We’re back at S&P 4,000!

Of course it’s a low-volume, BS rally but we’ll take it as it certainly gives us plenty of time to cash out ahead of the holiday uncertainty. As I said earlier in the week, we need to see EuroStoxx over 4,000 to confirm this madness in the US and, this morning, it’s at 3,934 – nowhere near as excited as the US exchanges got yesterday.

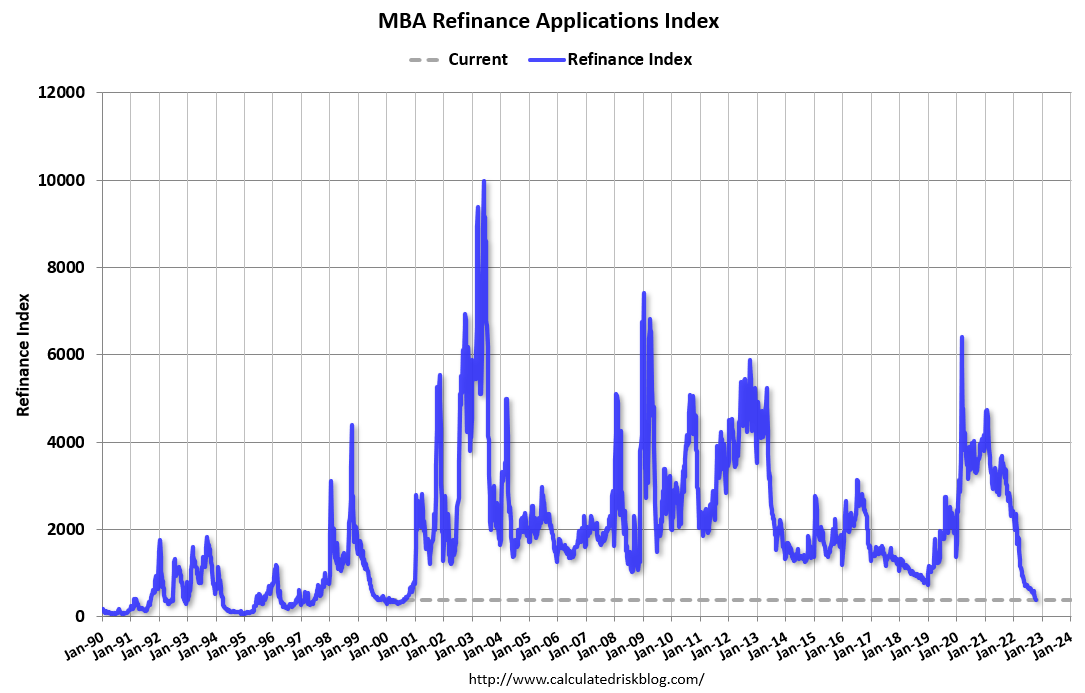

This is one of my market worry points as it indicates home equity can’t be used by consumers to offset their spending and that’s because it doesn’t make sense to refinance a 3% mortgage at 7% so, essentially, NO ONE who bought a home in the past 20 years has the ability to unlock the equity and that won’t change until rates are back below 4% – which is probably not in this decade.

There were violent protests outside a Foxconn factory in Zhengzhou as workers, who have been under lockdown for weeks became furious about the bonuses that were being paid to new workers who showed up to replace the quarantined workers – quite a mess. If the Government puts the protesters in jail – then they company has to hire more workers to replace them and the cycle continues. All I know is I’d better get my new IPhone for Christmas! 😉

In other Human Tragedy News: Virginia celebrated the Holidays with their 2nd mass shooting this month, this time leaving 6 dead at a Walmart in Chesapeake. Last Sunday, 3 people were killed at the University of Virginia and, of course, on Saturday, 5 people were killed at a club in Colorado. 4 people were killed by lightning in November so you have a much better chance of being shot in America than you do of being hit by lightning.

In other Human Tragedy News: Virginia celebrated the Holidays with their 2nd mass shooting this month, this time leaving 6 dead at a Walmart in Chesapeake. Last Sunday, 3 people were killed at the University of Virginia and, of course, on Saturday, 5 people were killed at a club in Colorado. 4 people were killed by lightning in November so you have a much better chance of being shot in America than you do of being hit by lightning.

Just this past July 4th, my daughter and her friend were sitting in a park in Philadelphia watching the fireworks when the crowd stampeded towards them as someone shot a couple of policemen. “Hearts and minds” but nothing ever changes. There have been 13 mass shootings in the US since Oct 1st – 2 per week! It happens so often we hardly even mention it – that’s crazy!

That is from “Bowling for Columbine” 20 years ago. 13 kids were killed along with the two shooters and 21 more were shot, which is nothing compared to Las Vegas in 2017, when 61 people were killed and another 413 were shot in a single incident. The Uvalde, Texas school shooting was this year with 22 dead and 18 more injured – “hearts and minds”… Rather than doing something about it – we’ve had constant escalation with more and more powerful weapons available to the human hunters.

So keep your head down and have a happy Thanksgiving,

– Phil