We’ve had quite a fall.

We’ve had quite a fall.

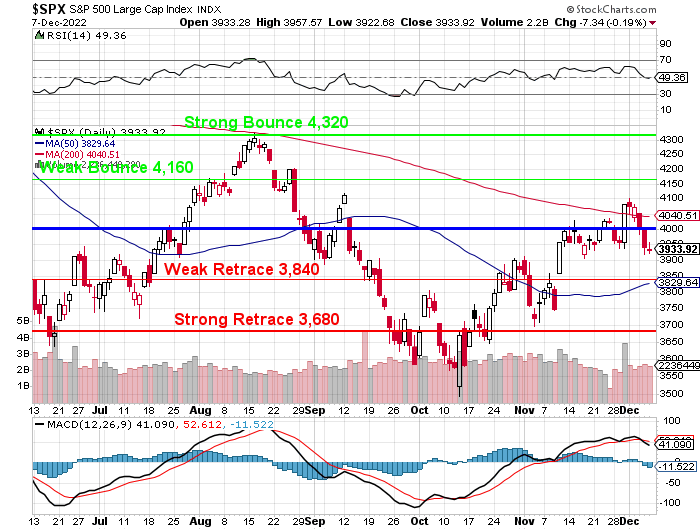

We began the month at 4,100 on the S&P 500 and we closed yesterday at 3,933, which is a 167 (4% drop) and usually we’ll look for 5% drops but, in this case, the Nasdaq already had a 5% drop from 12,100 to 11,500 (600 points) so that’s going to bounce, according to our 5% Rule™, in increments of 20% of the drop so 120 points will take the Nasdaq up to it’s -4% line at 11,620 (weak bounce) and, hopefully, 11,740 (strong bounce) at the -3% line.

In this case, for the S&P, we’re going to look at where it WOULD HAVE hit on a 5% drop, which is 3,895 and that’s down 205 from 4,100 but let’s call it 200 and call the bounces 40 points so 3,940 would have been the weak bounce and 3,980 is the strong bounce line:

Overall, it’s a good thing that the weak bounce line on /ES has been holding but the S&P needs to be over 4,000 for us to be at all happy and not even the Strong Bounce line gets us there. The Dollar is down a bit this morning – back at the 105 line – and that’s giving the indexes a small lift (0.5%) but the bounce lines are 1%, so we need a better response than we’re getting and 105 has been strong support on the Dollar as it’s the halfway point between 100 (too low) and 110 (too high) and that makes its bounces 106 (weak) and 107 (strong) but there’s nothing really preventing it from hitting 104 (weak retrace) either.

That then brings us to the Macros and today we had the usual 230,000 Jobless Claims with a small uptick in Continuing Claims from 1.61M to 1.67M and that is NOT what the Fed is looking for so there’s no reason the Dollar should fail 105 based on today’s data. Tomorrow we get PPI, which is expected to be 0.2% and the Dollar will bounce if it’s higher than that.

That then brings us to the Macros and today we had the usual 230,000 Jobless Claims with a small uptick in Continuing Claims from 1.61M to 1.67M and that is NOT what the Fed is looking for so there’s no reason the Dollar should fail 105 based on today’s data. Tomorrow we get PPI, which is expected to be 0.2% and the Dollar will bounce if it’s higher than that.

Logically (and that’s something my fellow analysts use sparingly), if China is opening back up won’t that cause inflation the way the US re-opening did last year? Won’t that put pressure on Commodities, Goods and Services and won’t 1.4Bn people being released just in time for Chinese New Year (Rabbit – which starts on Jan 22nd and goes on for 16 days) cause a massive spike in Global Q1 Inflation?

And then, when 10M people (0.7% of the population) get Covid and everyone freaks out in February – won’t that crash the markets again? Hence, LOGICALLY, the checkered flag remains on the field and we’re going to proceed with extreme caution into our own New Year.

Yesterday, in our Live Member Chat Room, we decided AAPL was going to determine what the market would do and I said:

“So AAPL is pretty much obeying the 5% Rule around the $140 line and playing stronger than the rest of the Nas (which are 80% of the index). RSI and MACD do not indicate that AAPL is particularly oversold here and they weren’t in our TotY finals because $2.3Tn is still 22.5x ($100-105Bn) and AAPL is usually lucky to get to 15x which would be a 33% contraction in AAPL and could easily be part of a 20% or more correction on the Nas.

“In other words, don’t look for AAPL to save us and, at the moment, we have the short-term $15 drop so $3 bounces to $143 and $146 will let us know if any recovery is serious down here while anything below $140 is likely to break 11,420 and then – DOOM!!!!”

That’s going to be more important than what the S&P or the Nasdaq do as AAPL is driving them both with it’s $2.3Tn market cap. We need to see AAPL get over that $143 line at minimum this morning and $146 is a tough nut to crack as we first run into that declining 50-day moving average at $145. Yesterday MS cut estimates for IPhone deliveries and that’s what got them down and we’ll see what manipulation today’s news cycle brings.