Great (and unrealistic) expectations.

Great (and unrealistic) expectations.

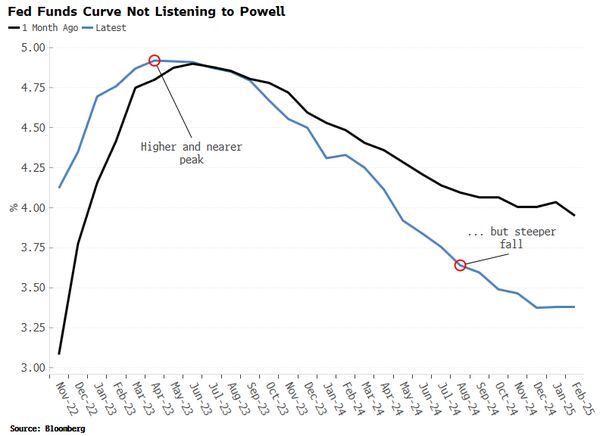

According to Bloomberg, our Leading Economorons generally predict that the Fed is about done hiking rates and they have done such a FANTASTIC job that they will, in fact, REVERSE and stat cutting rates dramatically towards the end of next year because, presumably, Inflation will have been completely defeated by Summer, much the way Covid was in the Summer of 2020, I suppose…

Covid is a good example of idiotic wishful thinking at every level of Government, Media and the Population – all wanting something to be true so badly they essentially weren’t willing to listen to alternatives. It’s like GOP voters.

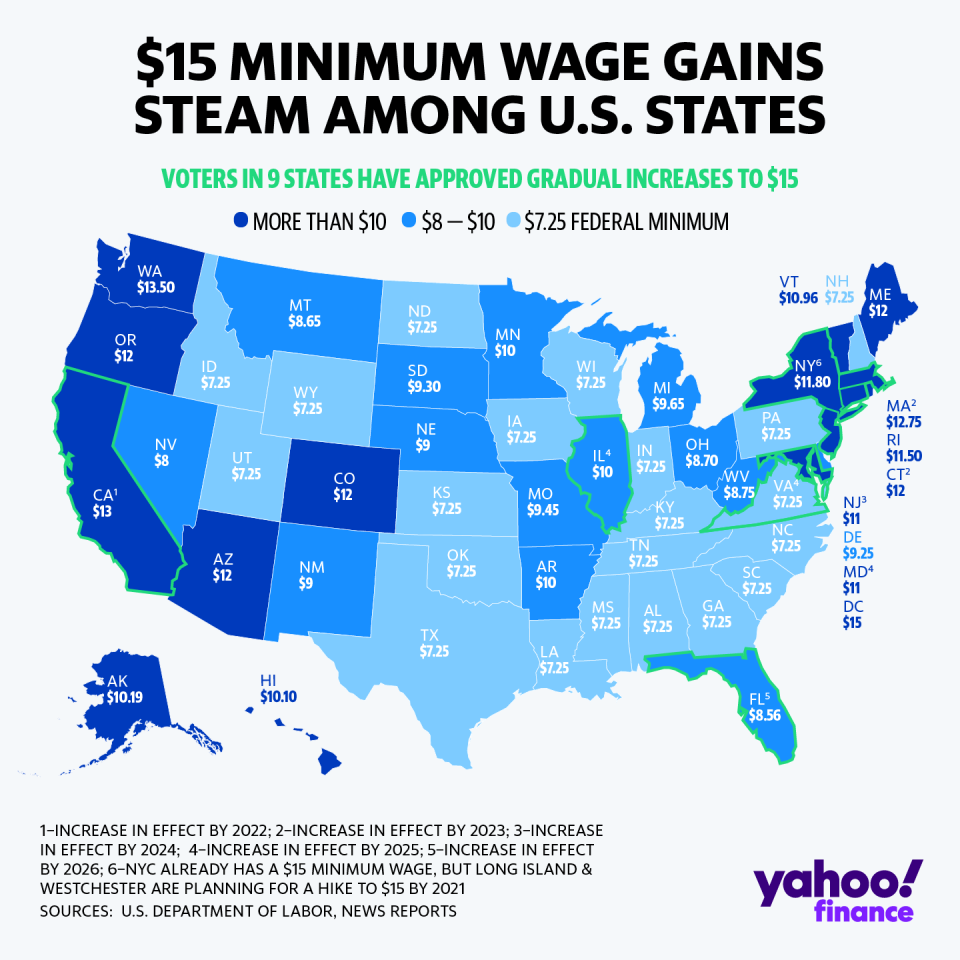

I’m not even going to get into it again but WAGES!!! Wages drive inflation and 3 states will be moving to $15 minimum wages this year and next while 13 more will increase wages to $15 by 2026 while we have 22 states still paying $8 or less per hour and 13 other states still paying less than $10 per hour.

40 hours at $7.25/hour is $290 and about $40 comes out for payroll tax, etc so call it $250 per week. Try living on $250 a week for a month. Try it when inflation is 8%. Try it when rents are climbing 30%, food 40%, etc. You can, like our Leading Economorons, put your head in the sand and pretend things will stay that way until your head is removed in the Revolution or you can imagine that, realistically, all wages will end up being $15 by the end of the decade.

If that is the case, however, inflation will be with us for a long, long time as we’ve done the math and Starbucks (SBUX), for example, has 402,000 employees generating $36Bn in revenues, which is a fantastic $89,552 per employee but Coffee costs money, and Cups cost money and Stores cost money as do advertising, Hazelnut, Milk, Cocoa, etc. and 402,000 Starbucks employees only MAKE $3.9Bn in profits and that’s just $9,701 per employee so, if you were to give those employees $2 more per hour and they worked 50 40-hour weeks, that would be $4,000 more per employee and POOF! goes half the profits…

If that is the case, however, inflation will be with us for a long, long time as we’ve done the math and Starbucks (SBUX), for example, has 402,000 employees generating $36Bn in revenues, which is a fantastic $89,552 per employee but Coffee costs money, and Cups cost money and Stores cost money as do advertising, Hazelnut, Milk, Cocoa, etc. and 402,000 Starbucks employees only MAKE $3.9Bn in profits and that’s just $9,701 per employee so, if you were to give those employees $2 more per hour and they worked 50 40-hour weeks, that would be $4,000 more per employee and POOF! goes half the profits…

Now SBUX can raise their price by 10% and make $3.9Bn more and give all the employees a 20% raise (yeah, right) but the cost of other things is going up too and, if they raise prices 10%, that’s 0.50 to you, the Consumer and suddenly you are spending 200×0.50 = $100 more per year on workdays for your coffee fix – not to mention the overall $1,000 coffee habit overall.

There is a breaking point for Consumers and SBUX is not looking to find out where that is but we are probably getting close when I can buy a Nespresso Machine ($150) and 200 capsules ($70) and 400 Hazelnut Creamers ($25) and even 200 disposable coffee cups ($50) if I don’t want to wash my own and that’s still just $325 and you’d be saving $675 a year and if you put $675/year into 6% bonds from the age of 40 until you retire at 65 – that would end up being $42,152 right there!

AND, keep in mind that, like SBUX, you only buy the equipment once so actually your subsequent years only cost you $145 and you are banking $855 per year after the initial investment. Many things in your life are like this (a pressure washer instead of a $20 car was, for instance) and you should think about them as you can put another $500,000 away pretty easily by being smart (see: “How to Get Rich Slowly“).

People don’t like to do the math but they do end up doing it in their heads and, at a certain point, the relationship with a vendor can break when the customer feels betrayed. You would think $5 per cup of coffee would have been that point but we’re past that now in the US and we’ll see how far it can go but 200% mark-up vs doing it yourself has got to be close to the breaking point.

SBUX is trading at about 30x earnings and I would not expect them to do well in a Recession – so I think a better short at $102 than a long. Most fast food places are franchises, so you don’t get to see the awful returns but SBUX owns their own stores and the returns per store ($115,000 per 34,000 stores) don’t make for an exciting franchise story – especially if they squeeze the franchisees for 20% of the take.

Anyway, you get the idea, times are tough and getting tougher and we’re not such good shape, economically, that we are going to be able to handle more than a very mild Recession but our Big Daddy Government just went into debt up to it’s neck bailing us out of the Covid Recession which means any market exuberance is likely to be irrational and I continue to urge caution in the quarter ahead.

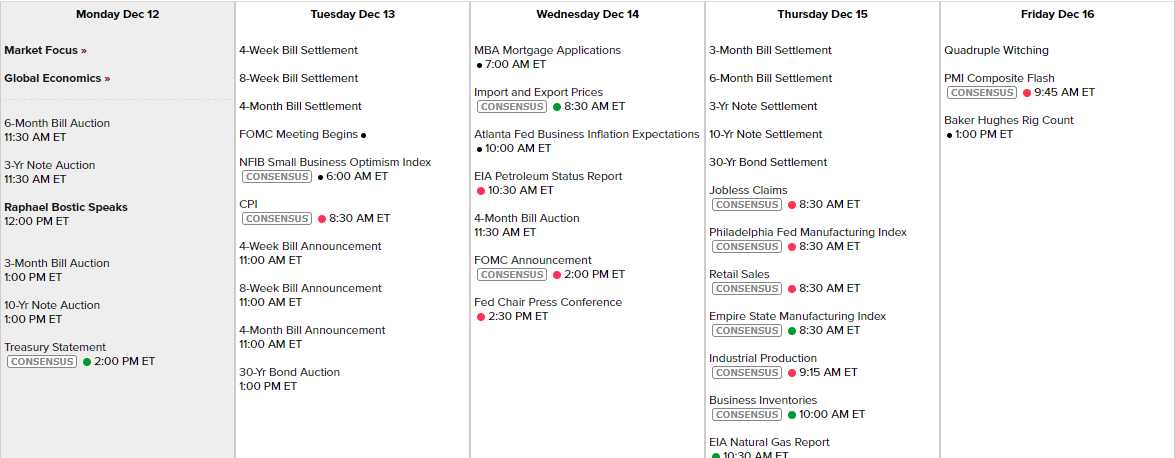

For some reason, Raphael Bostic is speaking at noon today as the Fed is supposed to be quiet ahead of their rate meeting. That means he’s likely to be hawkish ahead of the 10-Year Note Auction at 1pm as the Fed can’t afford to let the free market determine those rates. Tomorrow we’ll get the CPI Report, which was 0.4% last month, along with Small Business Optimism. Wednesday it’s the Fed at 2:30, followed by more nonsense from Powell. Thursday is Retail Sales, Philly & NY Feds and Industrial Production and Friday is more PMI from Europe and Options Expiration – fun, Fun, FUN!!!

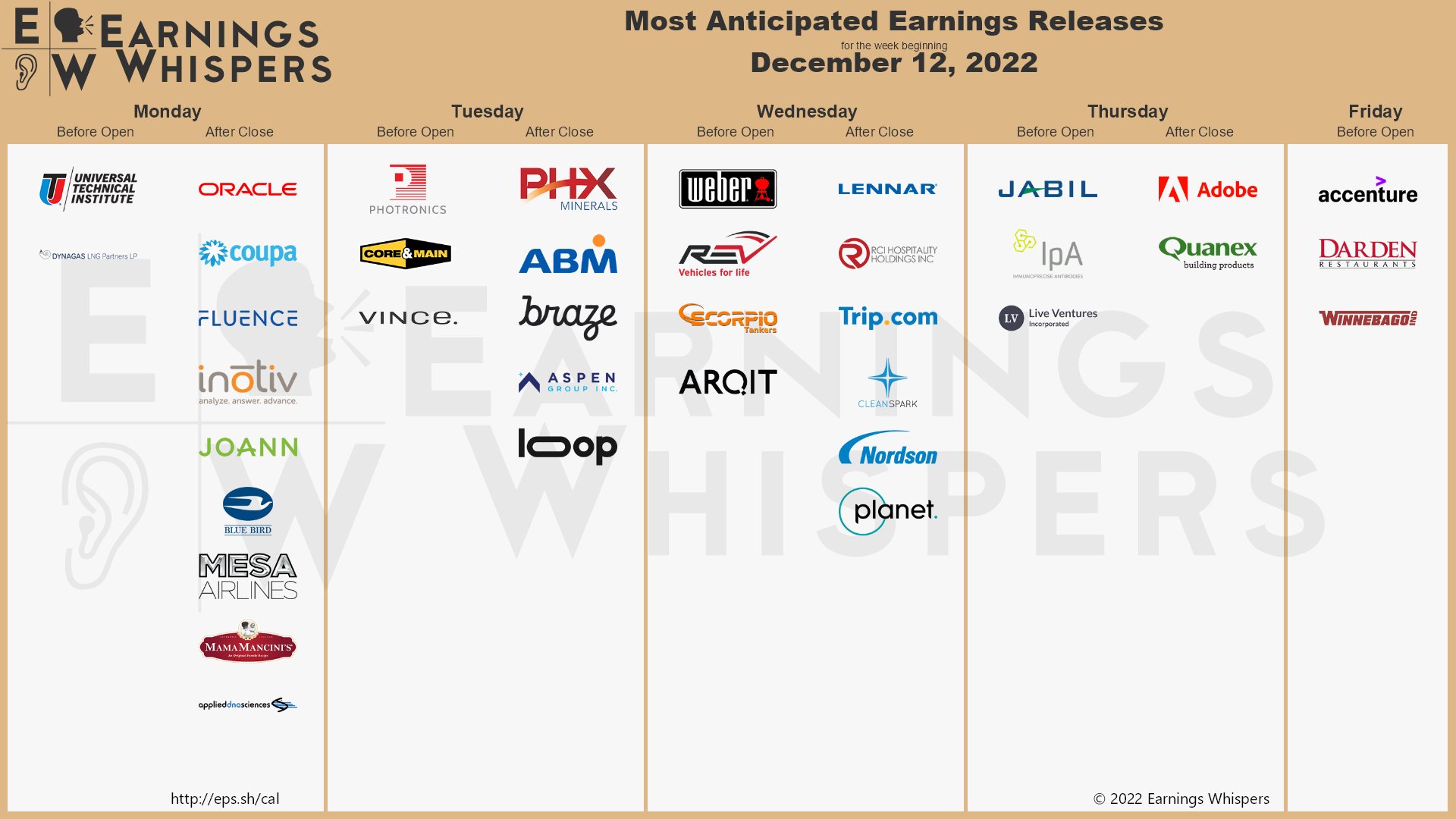

And there are STILL earnings! Good ones too, like ORCL, MMMB (well, I like them), WEBR, LEN, JBL, ADBE, ACN, DRI and WGO – lots of interesting stuff:

So, last week, I chose MOMO on Monday as a great stock to play and it gained 100% in the first week (you’re welcome!) so let’s talk about Mama Mancini’s (MMMB), which is a little Italian food distributor that makes excellent but expensive meatballs and sauces. In this company, there are only 6 employees as they outsource the cooking, packing and shipping. Like a Fabless Semi-Conductor Plant – they just have a recipe….

They do not make or lose money and they have $11M in debt but you can buy the entire company for $40M at $1.12 and sales are up from $47M last year trending towards $90M next year ($28M in 2019) and likely profits in 2024 around $5M. The company has no options but is a fun lay at $1.12/share for the long haul.

Pro Tip – If you have these in the freezer and Barilla’s Ready Pasta in the cabinet – you are never more than 5 minutes away from a decent fast lunch or dinner!