As I said yesterday – it’s just math.

As I said yesterday – it’s just math.

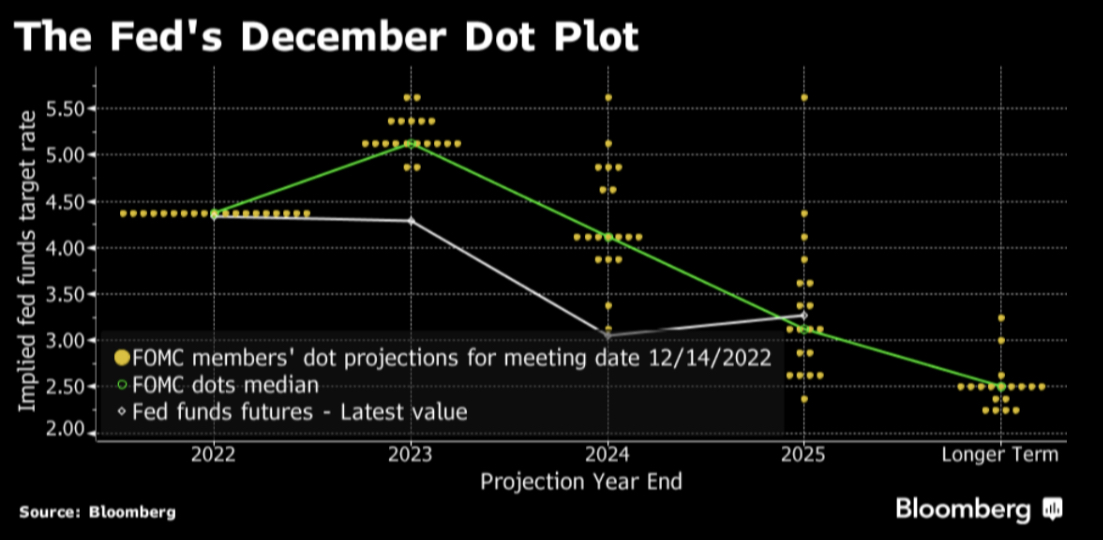

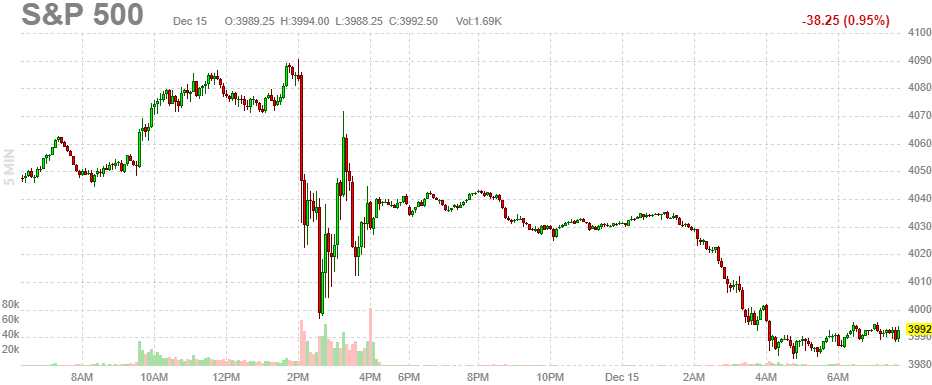

Despite “only” hiking rates 0.5%, once again Powell’s comments and the Fed Data we reviewed in our Live Trading Webinar got investors thinking the Fed was not done tightening and, also exactly as we predicted, overnight we got news that China is experiencing a rapidly advancing spread of Covid that looks like it will overwhelm Health Services.

We didn’t know about that yesterday afternoon but, after the Webinar (3:27pm),

I said to our Members in our Live Chat Room: “

During the Q&A, Powell said ongoing hikes would be appropriate. He also mentioned a peak rate “in the fives”. Given that, I expect more of a sell off than this once people digest.“

We had already determined our hedges would be more than sufficient to protect our portfolios so this is more of a buying opportunity for us but, on the whole, we are to remain “

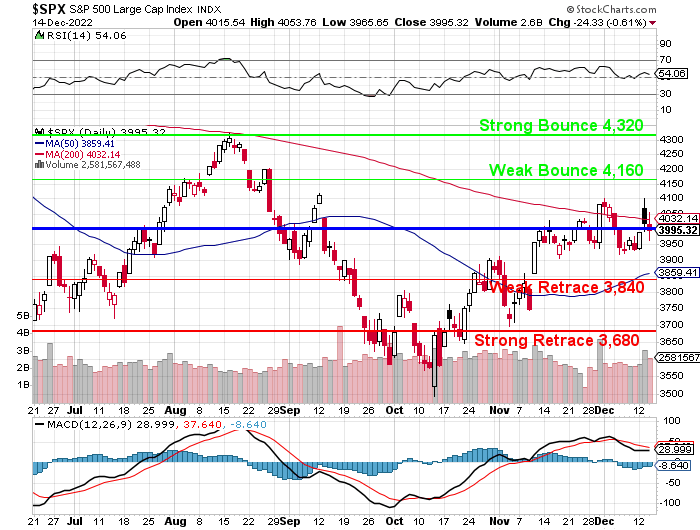

Cashy and Cautious” into January. 4,000 was our target for the S&P 500 at the end of 2022 and here we are – at 4,000 –

everything is proceeding as I have foreseen!

Technically, it’s not great to be rejected at the 200-day moving average and it’s very likely we’ll be retesting the 50-day moving average, now 3,860-ish. That will then create a 150-point gap causing the 200-dma to lose about 0.75 per day and we’re 32 points above 4,000 so we will cross below it in about 45 days – call it the end of January.

By then we’ll be getting some Bank Earnings (Friday the 13th, actually) so let’s pay very close attention to what those guys are saying about Q4 and we also have the next Fed meeting on Feb 1st – so wild times ahead. THEN we can discuss deploying more cash but doing so ahead of that is

MADNESS!!!

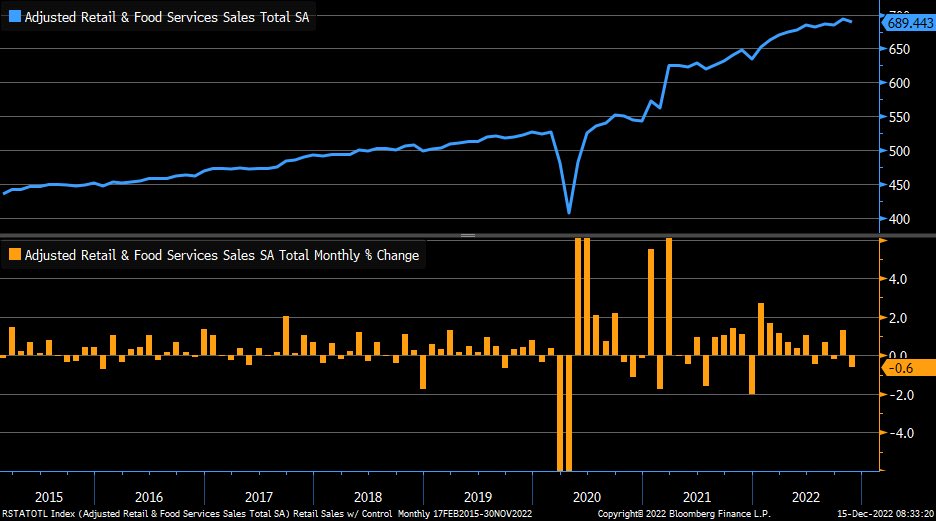

8:30 Update: Retail Sales were worse than expected, down 0.6% vs down 0.2% anticipated by leading Economorons and that, unfortunately, includes our early Thanksgiving, Black Friday and Cyber Monday (28th) numbers so holiday shopping is off to a disastrous start.

That’s OK, things could be worse and, oh look, they are: The Philly Fed Report is NEGATIVE 13.8 and the NY Fed Report is NEGATIVE 11.2 and we get Industrial Production and Cap Utilization at 9:15 but that’s not likely to be exciting either. Oddly enough, Unemployment is flat so no one is getting fired yet but that’s probably because all the Economorons have been predicting better conditions than we’re actually seeing and that will end up eating into Corporate Profits if they have all these workers standing around waiting for customers who never show up (like China).

That’s not the case in the UK, where everyone is on strike – even the nurses. And the trains are on strike and the mail is on strike – these are things that don’t exist in the US but they still use them in the UK.

That’s not the case in the UK, where everyone is on strike – even the nurses. And the trains are on strike and the mail is on strike – these are things that don’t exist in the US but they still use them in the UK.

Also, unlike US nurses, UK nurses don’t just strike when they are off-duty – they actually let the hospitals shut down to get their demands met. You don’t hear this reported on much in the US as they don’t want our workers getting any Commie ideas and thank goodness we can trust our Corporate Media to keep things Capitalist!

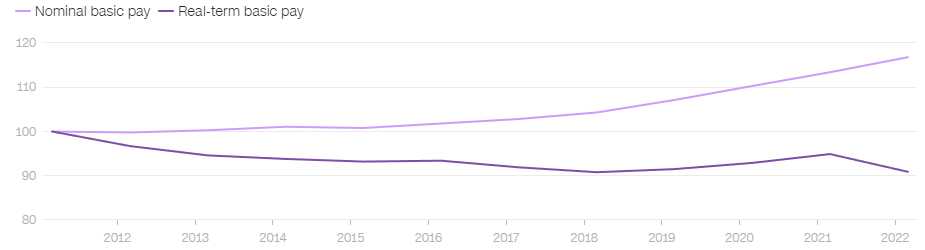

The RCN is calling for a pay rise of 5% above retail inflation, which on current figures amounts to a 19% hike, and for the government to fill a record number of staff vacancies that, it argues, is jeopardizing patient safety. Steve Barclay, the UK’s health secretary, told CNN in a statement earlier this week that their demand is “not affordable.”

This is why I keep saying inflation is not going away. Until we address these wage gaps, it will never be over and destroying demand by raising rates is not the answer – especially when the bottom 80% can barely afford the essentials that keep them alive. They’ve been cutting back – for over a decade and, whether the US media reports it or not – these protests will spread.

That’s not the case in the UK, where everyone is on strike – even the nurses. And the trains are on strike and the mail is on strike – these are things that don’t exist in the US but they still use them in the UK.

That’s not the case in the UK, where everyone is on strike – even the nurses. And the trains are on strike and the mail is on strike – these are things that don’t exist in the US but they still use them in the UK.