“Father Christmas, give us some money

“Father Christmas, give us some moneyDon’t mess around with those silly toys

We’ll beat you up if you don’t hand it over

We want your bread so don’t make us annoyed

Don’t give my sister a cuddly toy

We don’t want a jigsaw or monopoly money

We only want the real mccoy” – Kinks

The Kinks were right, kids want CASH!!!

So, apparently do 68% of the Men and 86% of the Women surveyed – can you believe all that time we spent picking out jewelry? I have always been a trend-setter in that regard – as soon as my kids figured out there was no Santa we went to gift cards and then quickly to cash. Sure, I buy them something if I think they’ll really like it but they do seem to generally prefer the cash (given a week before so they can shop for their own friends).

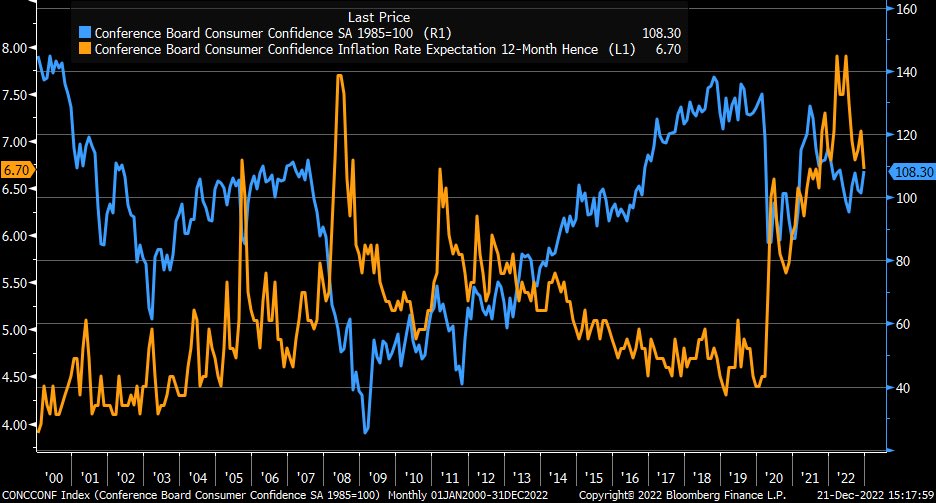

Yesterday we had a market rally because Consumers were much more confident than expected (108.3 vs 101.4 last month and 99.6 expected by Leading Economorons). And I will emphasize Economorons because, on December 9th, Michigan Sentiment was 59.1 vs 56.9 expected, which is +3.8% yet expectations were not raised for Consumer Confidence, which is a SYNONYM for positive Sentiment! MORONS!!!

Of course Confidence increases because Gasoline fell from $2.80 in November to just over $2 at the time of the survey and rates were coming off the highs and food prices were coming down while companies have been handing out raises and student loans were being forgiven.

Oil (/CL) is a good short here at $79.80 with a tight stop over the $80 line as $80 is ridiculously optimistic but we may spike into the holidays so either tight stops or the conviction to double down at $85 when there’s a $5,000 per contract loss. A catastrophic freezing storm is brewing that will shut down Transportation and kill demand over the holidays.

Of course, on news of Consumers being more confident (and China opening up), Gasoline is already back to $2.28 this morning and China re-opening will be a pull on the Global Supply Chain for months before it begins to help it. And that’s IF China can avoid a catastrophic Covid pandemic from the re-opening.

Notice in the chart that Inflation Rate EXPECTATIONS are down sharply and that’s pushing Confidence higher but when have their Consumers been accurate in their expectations? As we’ve noted, there’s been a blitz from our Corporate Media Masters TELLING us Inflation is under control and it may be slowing but slowing is not stopping.

As a person who lived through the 70s and 80s I can tell you that no one gives a damn about inflation as long as wages keep up (and you are employed) but if wages keep up, Corporate Profits will be squeezed and that’s not going to be good for the markets.

Meanwhile, all Volodymyr Zelensky wants for Christmas is Fighter Jets, Tanks and Long-Ranger Missiles and he sat on Biden’s lap yesterday and spoke to Congress where he told them that the aid provided by the U.S. wasn’t charity, but “an investment in the global security and democracy that we handle in the most responsible way.”

Meanwhile, all Volodymyr Zelensky wants for Christmas is Fighter Jets, Tanks and Long-Ranger Missiles and he sat on Biden’s lap yesterday and spoke to Congress where he told them that the aid provided by the U.S. wasn’t charity, but “an investment in the global security and democracy that we handle in the most responsible way.”

The Ukrainian leader thanked Washington policy makers for approving tens of billions of dollars in aid for Kyiv. “Your support is crucial,” he said. But he added, “Is it enough? Honestly, not really.” He said that he had discussed a 10-point peace formula with President Biden and that the President supports the peace initiative, including a potential summit.

During the meeting, the Biden administration announced a new roughly $1.8 billion security-aid package for Ukraine. It includes for the first time a Patriot antimissile battery, as well as equipment that converts unguided munitions into precision-guided missiles. Ukraine’s electrical grid and other infrastructure have been pummeled by ballistic missiles, cruise missiles and drones that Russia acquired from Iran.

House Republicans are set to take the majority in January and likely will be resistant to more Ukraine spending. Some in the GOP conference have called for a full audit of how Washington and Kyiv have spent the money, and Rep. Kevin McCarthy (R., Calif.), who is running for House speaker, has said his Comrades in the Republican Party won’t write a “blank check” for Ukraine nor will he allow Trillions of Dollars of tax breaks to his wealthy donors to expire.