Here we are again.

Here we are again.

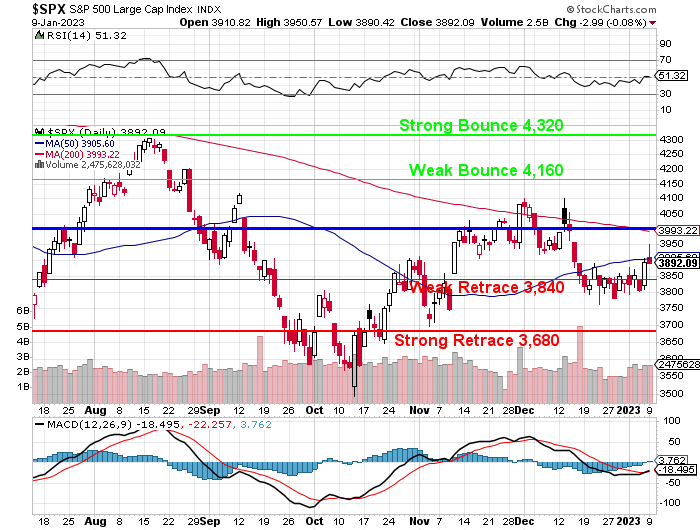

Back at the 50-Day Moving Average on the S&P 500 and 10 days into 2023 and already we’re all over the place – from 3,820 on Friday to 3,970 yesterday and back to 3,892 this morning.

This is why we went to CASH!!! starting in August (half cash) and again in November (80% cash) – there are just too many uncertainties out there and, if we aren’t sure, we don’t play. We can be sure and still be wrong but playing when you aren’t even sure which way things are heading – well that’s just silly…

Of course having all that cash on the sidelines makes us itchy to buy more positions but we’re being patient and next week we’ll start getting a handle on earnings which, hopefully, will give us a good idea of what we want to play in the new year. We already have our Watch List and, next week, we’ll be making adjustments on our existing positions for the new year.

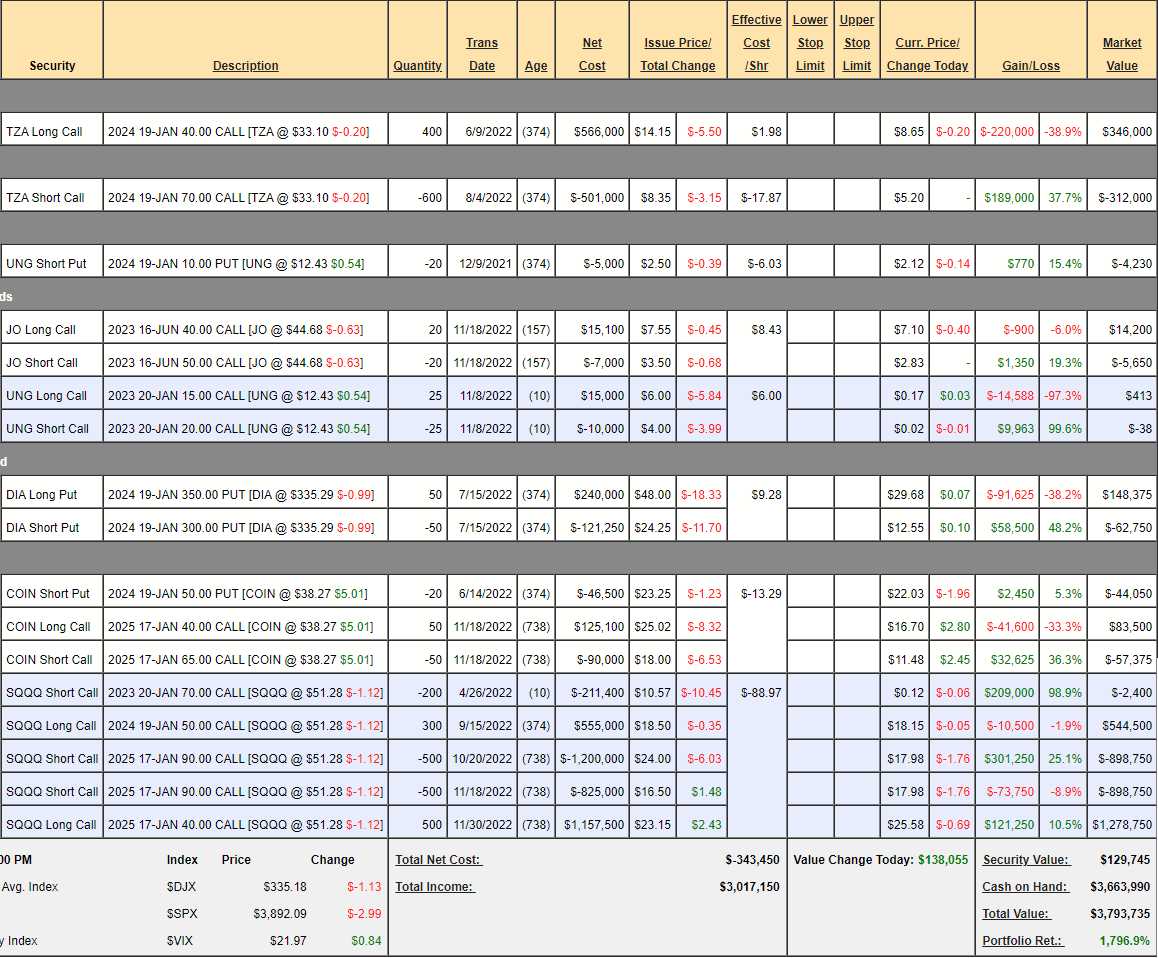

We have not touched our Short-Term Portfolio since the last review on Dec 13th but, in just under a month, we’ve gained $122,802 (3.3%) as the S&P has fallen from 4,000 to 3,895 (2.6%):

There’s still about $5M worth of downside protection here – only last month it was just net $6,943 in Securities and now you would have to fork over net $129,745 – the price of protection has gone up in these uncertain times…

Meanwhile, our Long-Term Portfolio has actually gone UP $14,000 (the power of Being the House – NOT the Gambler!) in the same period but the STP protects all of our portfolios, not just the LTP – we may need that money eventually.

- Natural Gas (UNG) has fallen a lot since last month, when that spread was $5.45/2.65. Now it’s 0.17/0.02 but rather than whine about it, we’re going to buy back the 25 short Jan $20 calls ($50) and we are going to buy 100 of the 2025 $10 calls for $6 ($60,000) and sell 100 of the 2025 $15 calls for $4.50 ($45,000) and sell 50 of the 2025 $10 puts for $3 ($15,000) and that will be net $0 on the $50,000 spread that’s $24,300 in the money to start.

We’ve lost $5,000 on the initial spread but it was a hedge for our hedges – in case the market was more bullish than we thought it would be. As it turned out, it was unusually warm in Europe so /NG priced plunged but the war is still on and we think it might get cold at some point between now and 2025 – so I like our odds on the bigger bet (with $0 cash outlay).

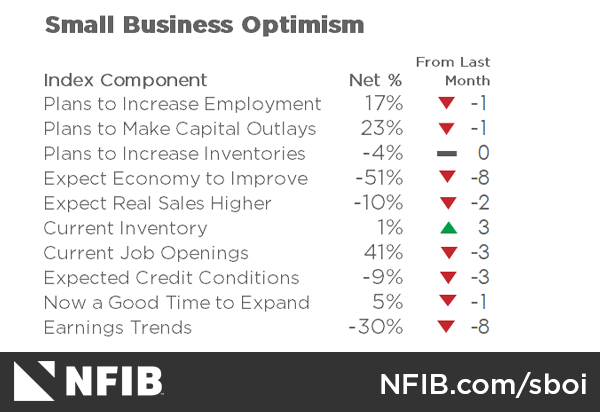

And, bad for the doves, still 41% have job openings and 17% plan to increase employment despite 51% LESS expecting the economy to improve – these are not good trends but also not the kind of thing the Fed is likely to fix by raising rates. Of course, when all you have is a hammer – every problem looks like a nail…

Speaking of hammers:

“In The Princeton Review’s ranking of the best public colleges and universities for “making an impact” — measured by things like student engagement, community service and sustainability efforts — New College comes in third.

“Naturally, Gov. Ron DeSantis of Florida wants to demolish it. On Friday, he announced six new appointments to New College’s 13-member board of trustees, including Chris Rufo, who orchestrated the right’s attack on critical race theory, and Matthew Spalding, a professor and dean at Hillsdale College, a conservative Christian school in Michigan with close ties to Donald Trump.

“The new majority’s plan, Rufo told me just after his appointment was announced, is to transform New College into a public version of Hillsdale. “We want to provide an alternative for conservative families in the state of Florida to say there is a public university that reflects your values,” he said.“

That’s how fast things can change, folks.