No major data today, no major earnings.

No major data today, no major earnings.

Just a brief pause before tomorrow’s CPI Report surrounded by 3 Fed speakers ahead of Friday’s Consumer Sentiment Report along with Earnings Reports from UNH, DAL, WIT and 7 major banks – THAT is when things begin to matter. Trading volume continues to be anemic but that’s good, as volume has certainly not done us any favors recently.

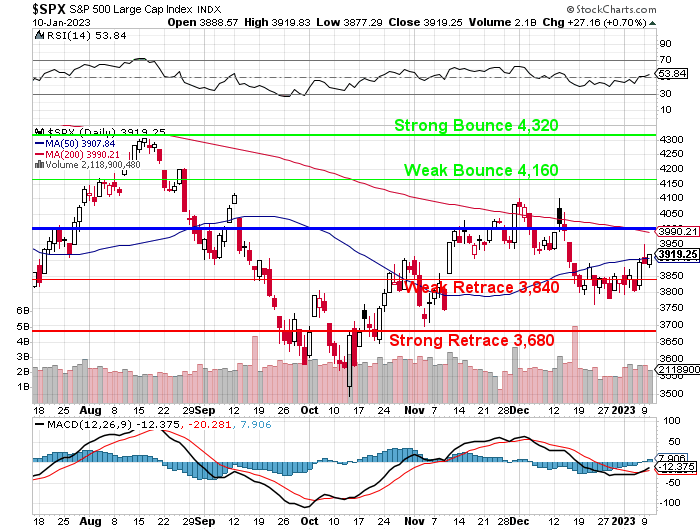

We finished just above the 50-day moving average (3,908) on the S&P 500 and this morning (on virtually no volume), we’ve gained even more ground – so holding it would be the goal for the bulls for the rest of the week. NOT holding it means all this was a BS prop job to sucker in the rubes – we’ll have to wait and see.

Waiting and seeing has been pretty boring so far this year but earnings start on Friday and next week we’ll be back to picking stocks again – so I think we can hang on for a few more days as we wait for clarity.

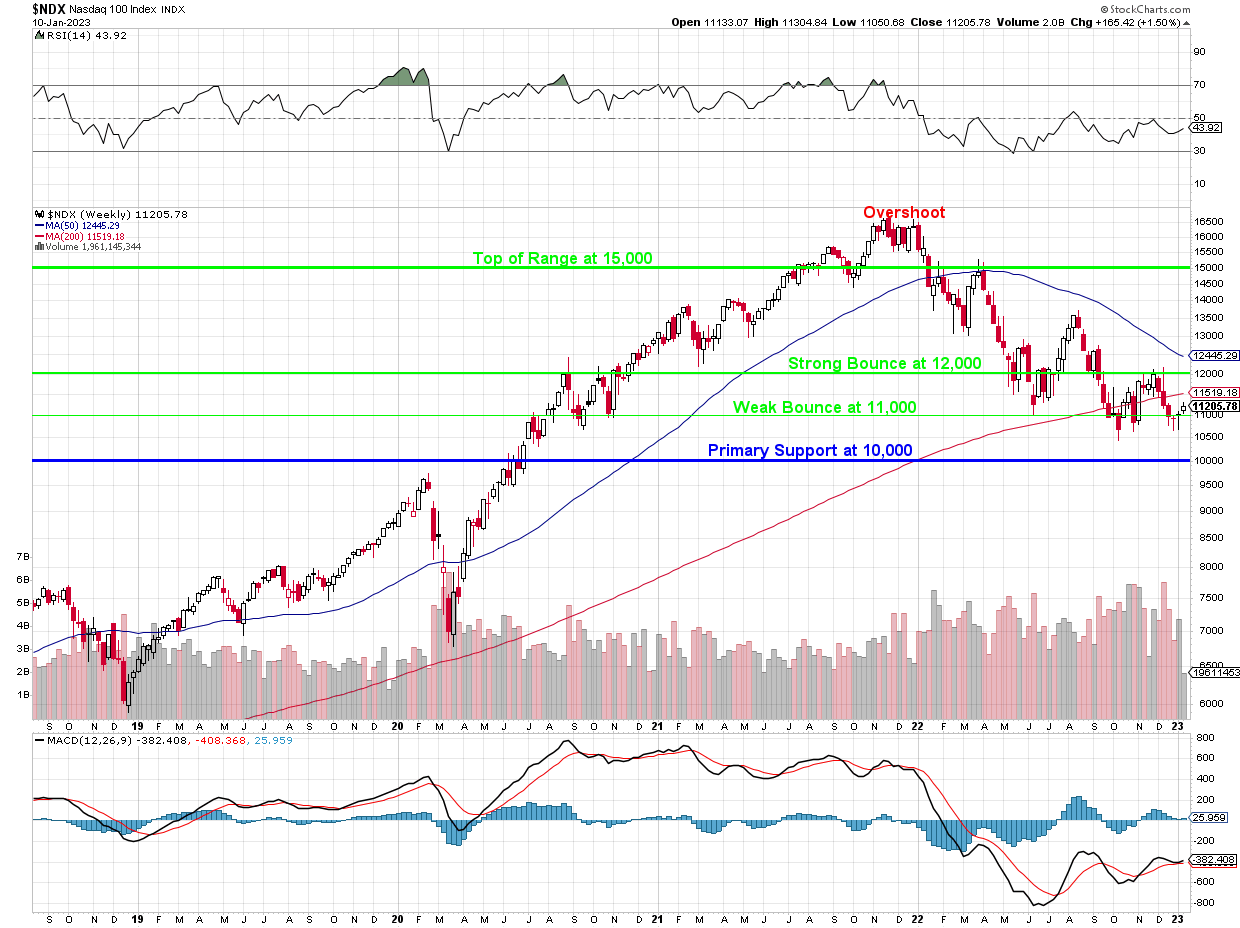

As a sanity check, the Nasdaq weekly chart reminds us things have not really improved at all and we’re still on a path towards a Death Cross with the 50-week moving average falling 25 points per week at 925 points above the 200-week moving average so we are just 8 months away from a technical catastrophe if we don’t mend our ways.

In reality, we have 2 chances – the current earnings that are upon us and then one more chance in April/May to bust over that 12,000 line – otherwise our market fate is going to be pretty much etched in stone unless a miracle occurs in July/Aug. There is, however, enough big tech now on our Watch List that I do have hope we’re closer to a bottom than a top – as long as the economy doesn’t take a turn for the worse.

I do wish I was certain but I’m not – hence the waiting….

• Wall Street Sets Low Bar for Corporate Earnings Season: Analysts expect S&P 500 companies to report first year-over-year decline in quarterly earnings since height of pandemic. (Wall Street Journal) see also Value Stocks to Lure Investors During Grim Earnings Season: Majority of investors expect ugly earnings reports to drive S&P 500 lower. (Bloomberg)

• The Most Important New Inflation Indicator: Introducing the New Tenant Repeat Rent Index—A New Way of Measuring Housing Inflation. (Apricitas Economics)

• Something big is happening in the U.S. housing market—here’s where 27 leading research firms think it’ll take home prices in 2023. For the first time in over a decade, residential real estate across the world has entered into a period of falling home prices. (Fortune)

• 50 Companies to Watch in 2023: From EBay to Porsche, keep an eye on these global stocks this year. (Businessweek) see also CES 2023’s Wildest Highlights: Flying Cars, Flying Boats and Folding Screens The world’s biggest consumer electronics show has brought plenty of TV, laptops and gaming gadgets to gawk at — plus some big surprises. (CNET)

• December 2022 jobs report: Why the Fed is probably happy about it: Wages and employment grew, but probably not at a pace that would panic the Fed. (Grid) see also Where is the minimum wage increasing in the U.S.? Here are the 23 places enacting a pay bump in 2023. With a stagnant federal minimum wage, states and localities are picking up the slack. (Grid)

• ‘87,000 IRS agents’ is the zombie falsehood setting the House agenda: We call these “zombie claims” because they keep rising from the dead no matter how often they have been fact-checked. But we haven’t before witnessed such a roundly criticized claim set the agenda for a new Congress. (Washington Post)