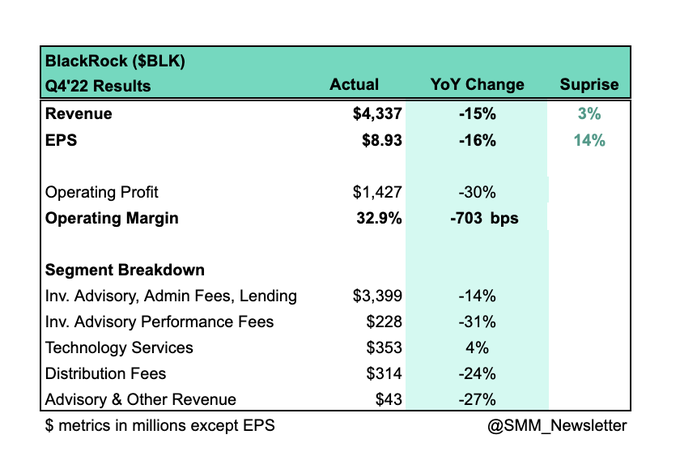

BAC, BLK, DAL and JPM all had 10% beats while BK, FRC and UNH were pretty much in-line and we’re waiting for C and, of course, WFC missed – but that’s only because they got caught and had to take a $3.3Bn charge for fines for a total of $5.3Bn against $140Bn in earnings since the scandal broke in 2016 and hundreds of Billions more from the illegal practices they engaged in – not to mention whatever their peers have gotten away with…

As President Trump says, “It’s not a crime if no one catches you.” I wonder if people still want their children to grow up and become Presidents? Did people want their children to grow up and become Al Capone or John Gotti?

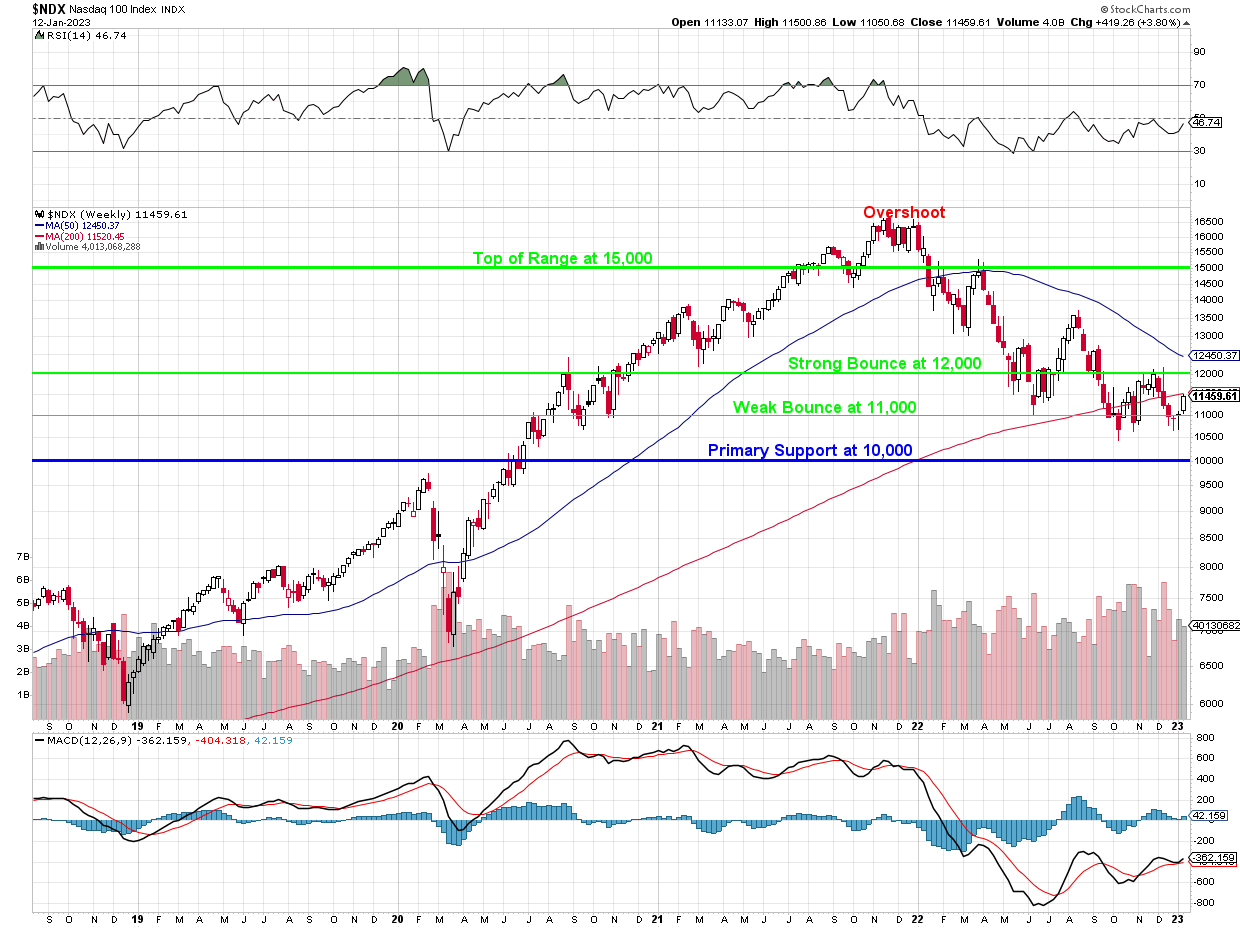

And by highs, I mean highs for the year, of course (4,020 on the S&P yesterday) – you can forget about 4,800 on the S&P 500 the same way we had to forget about Nasdaq 5,000 for 16 years after the 2,000 high. Nasdaq 16,500 was our high last year and we’re not likely to see that again this decade either – especially as we struggle to hold 11,000 at the moment.

The real race on the Nasdaq Weekly Chart is that the 50-week moving average does not cross below the Strong Bounce Line at 12,000. It’s at 12,450 and it’s dropping 25 points per week if the Nasdaq is under the 200 wma so we have 18 weeks to improve – either these earnings or the next. Otherwise the bearish technicals will dominate the charts into the end of the year.

None of this matters to long-term, value investors. We are thrilled to once again be able to buy stocks for realistic prices (16,000 and 4,800 were NOT realistic) and the main reasons the Economy is having trouble are artificial:

- We have the Fed tinkering to keep Inflation down.

- Inflation is up over supply chain issues caused by Covid and the War.

- Inflation is also up due to a strong demand for workers – an indication of a healthy economy.

- Wages are finally rising, which will give our economy a stronger base to build on.

- A lot of the slowdown we see is due to the end of stimulus and the end of QE – don’t expect the economy to come off life support and run a marathon. Like Damar Hamlin, we’re going to need a little time to recover, please.

So let us pray for 2023 and what lies ahead – you never know when you are going to take a brutal hit, so it’s best to be prepared. Like Dmar’s medical support – our cash is on the sidelines, ready to come to our rescue if this earnings season is unkind and, if it turns out to be strong and healthy – we can always join the game!

Have a great weekend,

-

- Phil