New Zealand’s Prime Minister resigned this morning as that economy goes in the tank and the French are FREAKING OUT that the Government is considering raising the Retirement Age from 62 to 64 in 2030 in order to balance their own SS and Medicare systems without having to raise taxes/debt or cut benefits (something we discussed that the US is facing even more imminently in yesterday’s webinar).

The French capital ground to a halt as teachers and railway, health and oil workers went on strike, forcing many schools and nurseries to shut down. Trains, subways and buses were severely curtailed, and dozens of flights were canceled.

Tough choices are what Recessions are all about. Depressions come about when no choices are left.

Similar debates are playing out across Europe as populations age and people live longer, putting growing pressure on government finances. France has one of the lowest poverty rates among the elderly in Europe, but it spent 13.8% of its gross domestic product on pensions in 2021 – more than most other European countries.

The US, in case you want to check, spends $1.25Bn a year on Social Security and another $350Bn on Veteran’s benefits, so let’s say $1.5Tn on Pensions (the VA does other stuff too) out of a $25Tn Economy is just 6% and we are freaking out about that! And yes, France has Universal Health Care – THAT program is not up for debate.

The US, in case you want to check, spends $1.25Bn a year on Social Security and another $350Bn on Veteran’s benefits, so let’s say $1.5Tn on Pensions (the VA does other stuff too) out of a $25Tn Economy is just 6% and we are freaking out about that! And yes, France has Universal Health Care – THAT program is not up for debate.

Like many countries, including our own, France is suffering from demographic math: France had four workers for one retiree at the end of the 1950s, two workers for one retiree at the beginning of this century, and 1.7 now, said Jean-Marc Daniel, an economics professor at Paris-based business school ESCP Europe. “It will go down to 1.3 if we do nothing,” he said.

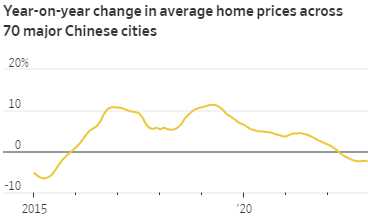

This is the same problem China is rapidly facing with their own now-declining population. China’s housing market flipped from being a growth driver to an economic drag in 2022, with sales slumping, prices falling and widespread job losses. The prognosis for this year isn’t much better.

This is the same problem China is rapidly facing with their own now-declining population. China’s housing market flipped from being a growth driver to an economic drag in 2022, with sales slumping, prices falling and widespread job losses. The prognosis for this year isn’t much better.

Sales of new residential properties in the country tumbled 28%, to a five-year low. By floor area, they dropped to their lowest level in nearly a decade, after a wave of real-estate developer debt defaults, delays in construction of unfinished apartments and Covid-19 lockdowns dampened consumer confidence. Land sales by area declined 53% in 2022 to a level below that of 1999, the year China’s National Bureau of Statistics began releasing the data.

These are the signs of a disaster that is just beginning – not ending. Less land to build on will show up in not enough houses to live in LATER this year and next. Chinese authorities have, over the past decade, tried multiple times to bring down what they have long seen as excessive borrowing by property developers and speculative activity in the country’s housing market. Each time they tried to slow the sector down, they ultimately backed away because it caused too much pain on the economy. Now we will see what happens when the bubble just bursts on its own…

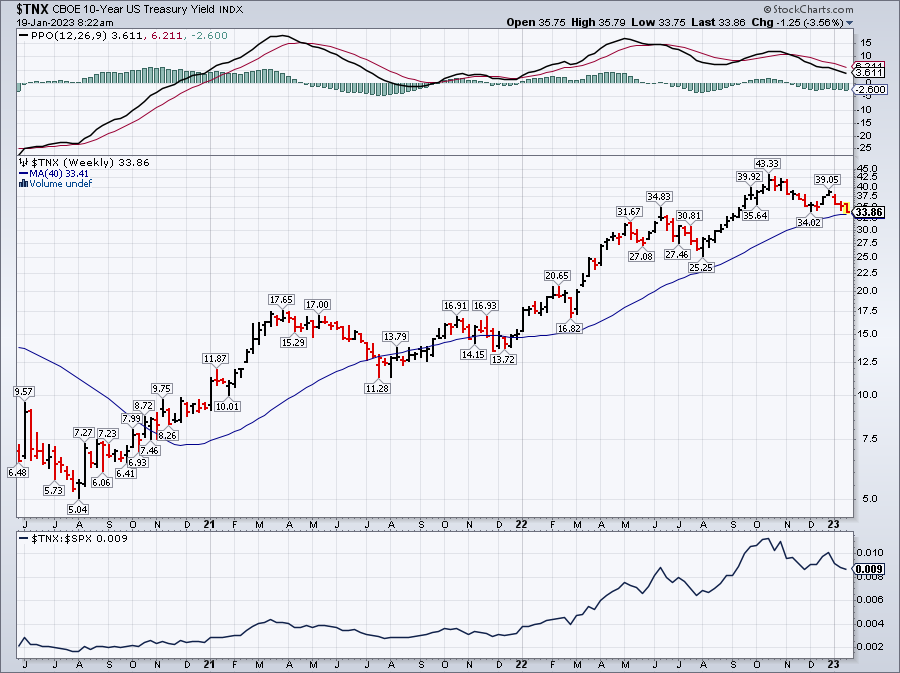

We’ll also get to see what happens when the US hit’s it’s borrowing limit today and the answer is nothing – yet. It’s not too different when your bank account goes to zero – you stop writing checks and switch to credit cards. The problem comes when you can’t pay those bills and they cancel on you. At least that buys the US about 6 months before it really starts to matter.

Virtually all financial assets on the planet are priced in relation to Treasuries, so you could argue that if the U.S. Treasury defaulted, there would be nowhere safe to go. The entire financial world would suddenly become much riskier. Bizarrely, since World War II, after every previous debt ceiling crisis — and, indeed, whenever markets have panicked — investors around the globe have typically flocked to the U.S. Treasury market as a safe place to park their money – so don’t bet on anything to be rational for a while.