From the top this time.

From the top this time.

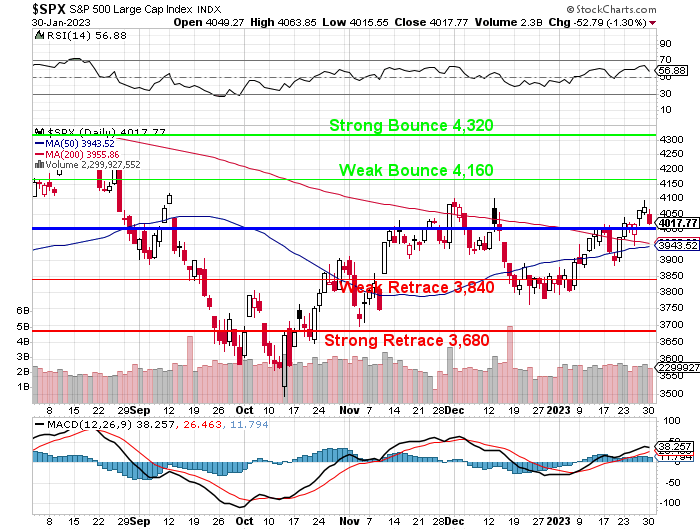

That’s right we tested the S&P 500’s 4,000 line from the bottom for most of January and finally we’re testing it from the top and, hopefully it holds as we’ve got a very critical test of the 50-Day Moving Average about to (hopefully) cross over the 200 dma at about 3,950.

As long as we are able to stay over 3,960 long enough for that to happen, we’ll have a bullish signal for the TA crowd. So, let’s do the math: The 50 dma is at 3,943 and 4,000 is 57 points over that so it’s rising at about 1 point per day! The 200 dma is at 3,956 and 4,000 is 44 points over so rising at 0.25 per day. So, the 50 dma is closing the gap at 0.75/day while we’re over 4,000, which means we need to stay up here for 17 more days to close the deal – not quite as easy as the chart makes it look, right?

So, it’s very much up to earnings and, of course, the Fed tomorrow. This morning we’re down 125 on the Dow at the moment (8am) and 10 point on the S&P 500 but that’s 4,027 – a relief after 4,007 when I started this article. Misses were once again about 50/50 last night, with three winners (CFLT, HLIT and WHR) dropping guidance but WHR (got ’em) had a huge beat and we’re still proud of them.

This morning, AQUA, CAT, CVLT, MAN, MDC, MPLX, OSK, PSX, PBI and SPOT have missed so far with guide-downs from UPS, PFE & GLW while AOS, ALGM, DOV, XOM, GM, HUBB, IMO, IP, KEX, LII, MCD, MCO, MSCI, NYCB, PNR, PHM & ST gave us clean beats. That’s 17 out of 30 for 56.66% winners – not a good sign….

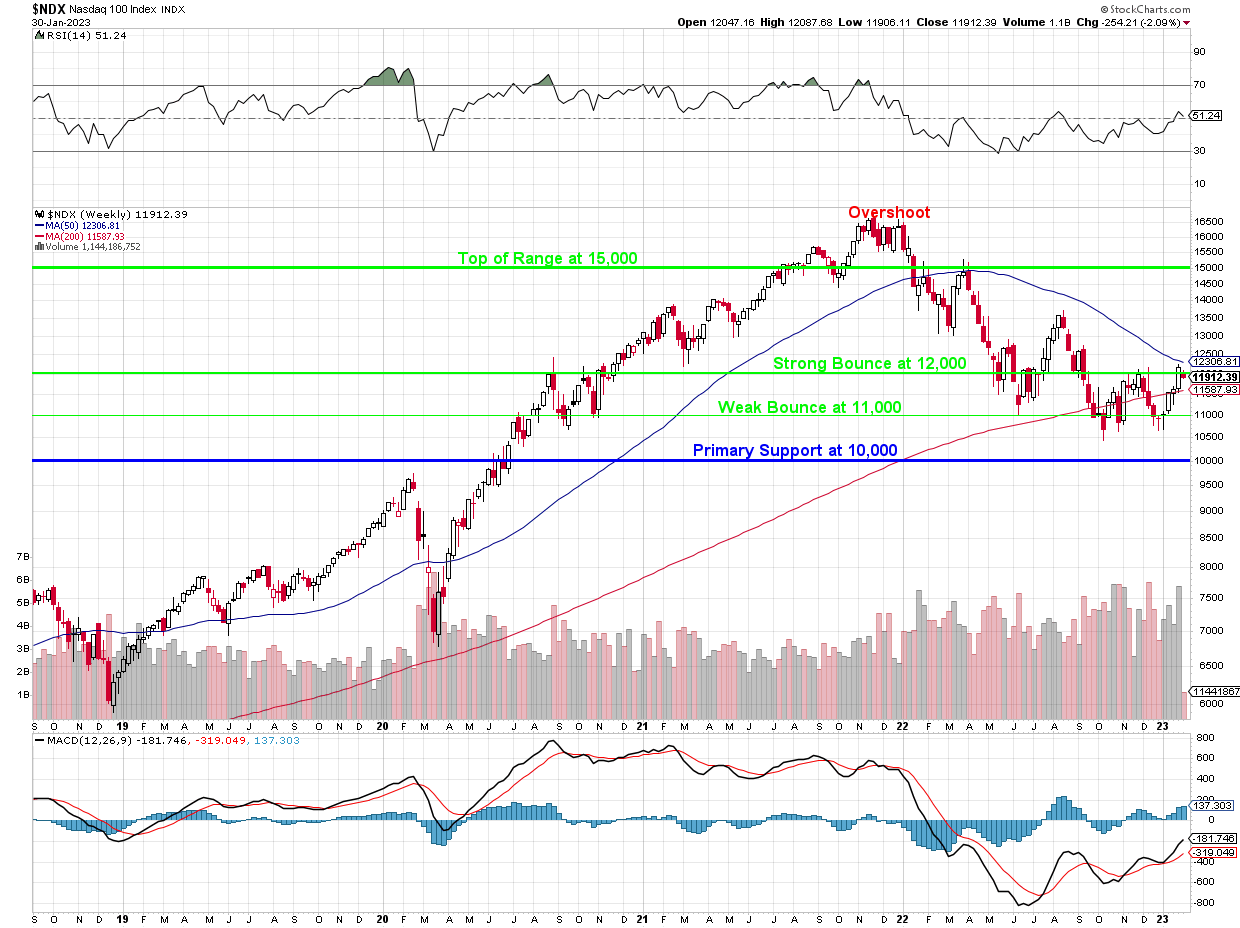

Like the S&P 500, the Nasdaq 100 also has something to prove but, in this case, it needs to stop the 50-WEEK Moving Average at 12,306 from falling below the 200-Week Moving Average at 11,587. They are 719 points apart and are currently being drawn together so this math is like those 2 trains approaching each other problem but the answer is in the Fall so nothing to see here if we stay inside the range. What it really means is the S&P 500 will decide our technical fate, not the Nasdaq.

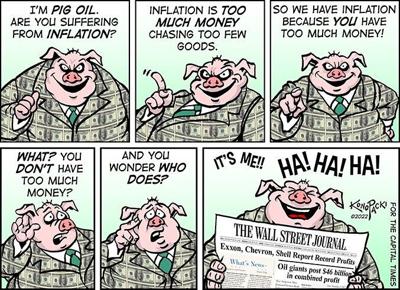

XOM made $55.7Bn last year, well over CVX’s $35Bn and that’s $90Bn between them and there’s 330M of us so that’s $272 each we contributed at pump, about $800 per family – and we didn’t even get a free mug! Now, XOM, in a typical good year prior to this, made about $20Bn so, when they say $55Bn is “EXCESS PROFITS”, now you know that their excess profits were the ENTIRE profits of CVX.

So we put 500 gallons of gas in our cars in a typical year and it’s not just XOM and CVX who make money, of course but the Excess Profits for those two companies alone last year came to about $1 per gallon (2 cars) and if you factor in the rest of the sector – well over $1 per gallon. It’s interesting then, how they can testify to Congress and tell us they have no control over these prices, when over 1/3 of what we pay at the pump tend to slip its way right into their pockets, OVER AND ABOVE WHAT IS CUSTOMARY, isn’t it?

So we put 500 gallons of gas in our cars in a typical year and it’s not just XOM and CVX who make money, of course but the Excess Profits for those two companies alone last year came to about $1 per gallon (2 cars) and if you factor in the rest of the sector – well over $1 per gallon. It’s interesting then, how they can testify to Congress and tell us they have no control over these prices, when over 1/3 of what we pay at the pump tend to slip its way right into their pockets, OVER AND ABOVE WHAT IS CUSTOMARY, isn’t it?

They know they are doing it, these aren’t “accidental” profits! XOM made their usual $5.9Bn in Q1, before the war started and in Q2, they were suddenly making $20.7Bn and another $20Bn in Q2 before calming down to $10Bn in Q4. Sometime during Q1 or Q2 they might have said “Do you think we’re charging people a bit too much for gas?” – Nah!

And why is wholesale gas $2.50 but we’re still paying over $3.50 at the pump? When gas was $2 just two years ago were they marking it up $1? No, gas was, in fact, wholesaling at $1.50 and we paid $2 at the pump until it jumped to $2 in early 2021. Now XOM, CVX, etc can pretend all they want but 200M cars using 500M gallons of gas is 100Bn gallons of gas and x $0.50 is – HEY!!! – we just found out where the extra $50Bn came from!

Be sure to tell your Congressmen we figured it out – they seem to have been stumped…

In other news, the Futures have turned around and gone positive. The Employment Cost Index came down from 1.2% to 1% for Q4 but that doesn’t actually put a dent in the gain for the year of (1.4%+1.3%+1.2%+1% =) 4.9% but anything that seems like an excuse for the Fed to pause is good for a rally these days.

In other news, the Futures have turned around and gone positive. The Employment Cost Index came down from 1.2% to 1% for Q4 but that doesn’t actually put a dent in the gain for the year of (1.4%+1.3%+1.2%+1% =) 4.9% but anything that seems like an excuse for the Fed to pause is good for a rally these days.

The IMF upgraded their expectations for Global Growth from 2.7% in October to 2.9% today – making it more likely we will avoid a recession. Several developments in the past few months contributed to the shift in the IMF’s views, its economists explained. Economic growth proved surprisingly resilient in the third quarter of last year, helped by tight labor markets, stronger-than-expected spending by households and businesses, and Europe’s swift adaptation to the energy crisis caused by the war in Ukraine.

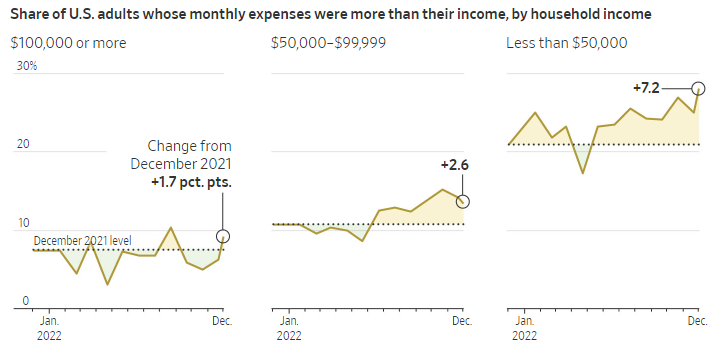

For contrast, the WSJ says US Consumers are starting to “Freak Out” as their bank accounts are drained and their credit cards are maxed and inflation is not falling, nor are salaries rising enough to fix this in a timely manner.

For contrast, the WSJ says US Consumers are starting to “Freak Out” as their bank accounts are drained and their credit cards are maxed and inflation is not falling, nor are salaries rising enough to fix this in a timely manner.

That is 30% folks, 30% of the people who make less than $50,000 (half the households in this country) are falling further and further behind on a monthly basis. We’ll get the Personal Income and Spending Report on Friday and we’ll see if it’s getting better or worse but almost 50% of the Earnings Reports coming in negative indicates it is, in fact, getting worse.

From the WSJ:

“Jazzlyn Millberry, 33, has been looking for big ways to make cuts. One day last fall, her banking app informed her that the cost of one month’s groceries and household goods for her family of four had risen to $900, from about $600 or $700.

“I find myself now going to three or four different grocery stores just to get the best deals on things to save on costs,” said Ms. Millberry, a health-insurance claims analyst in Pickerington, Ohio.

On one recent outing, she stopped at Kroger for eggs and meat, Aldi for produce, Sam’s Club for her children’s snacks, and Target for toilet paper.

Even as she has cut back on groceries, restaurants, hairstyling and facials, her credit-card balances have grown in the past several months. She said she started making only the minimum required payment on her credit cards.”

That’s what’s going on in Middle America, people are sacrificing and scrambling to hold on but it’s still not enough and raising minimum wages from $12 to $13 to one day $15 isn’t really going to help all that much, is it? We have done a great job brain-washing people into believing that falling behind economically is their own personal failure and not Society’s or the Government’s and by making people ashamed of their situation, they tend to complain less and protest less – BRILLIANT!