Biden spoke last night.

The President pledged that America needed to “finish the job,” on keeping Drug Prices low, increasing Taxes on the wealthy, making Child Care and Housing affordable… saying there was a lot more left to do to reshape Government programs on Health Care, Climate Change, Infrastructure and more.

He got booed for his troubles, from Republicans who shouted “liar” while he spoke, which made his calls for bi-partisanship kind of a joke. The President sparred with Republicans, depicting them not as normal, but extreme. The best example of this was on Medicare and Social Security, where he riled up House Republicans, accusing some of wanting to cut the popular entitlements. He was careful in that section to note that “some Republicans want Medicare and Social Security to sunset every five years.”

When Republicans took the bait and shouted that’s not true (it very much is), the President said “Good, we all agree, they are off the table” – a nice trick to put it out in front of the American people but it will never be off the table until we raise taxes to fund SS and Medicare properly or, God forbid, actually reform the system so it isn’t so expensive.

When Republicans took the bait and shouted that’s not true (it very much is), the President said “Good, we all agree, they are off the table” – a nice trick to put it out in front of the American people but it will never be off the table until we raise taxes to fund SS and Medicare properly or, God forbid, actually reform the system so it isn’t so expensive.

With 65M Americans (20%) depending on Social Security for a large (sometimes all) of their income and on Medicare for their Health Insurance, the Democrats WANT them to be a major campaign issue. Unfortunately for Republicans, the President looked sharp during the speech, making their “Senile Joe Biden” narrative harder to sell – even to their Fox-fed constituency.

We had a huge rally yesterday after Powell spoke at a conference but, as you can see from the volume lines, more people actually sold than bought and we expect that to follow-through today as most of these rallies seem to end up being nothing but “pump and dump” – as Fund Managers and Banksters stir up excitement so they can dump shares on the Retail dip buyers.

We had a huge rally yesterday after Powell spoke at a conference but, as you can see from the volume lines, more people actually sold than bought and we expect that to follow-through today as most of these rallies seem to end up being nothing but “pump and dump” – as Fund Managers and Banksters stir up excitement so they can dump shares on the Retail dip buyers.

Speaking of Retail Buyers – yesterday’s Consumer Credit Report showed a 50% REDUCTION in spending in December and that does not bode well as Retailers begin to report their earnings. As you can see from the chart, Savings are way down and Credit Card charging is way up and, apparently, we are reaching the limits Consumers can stand.

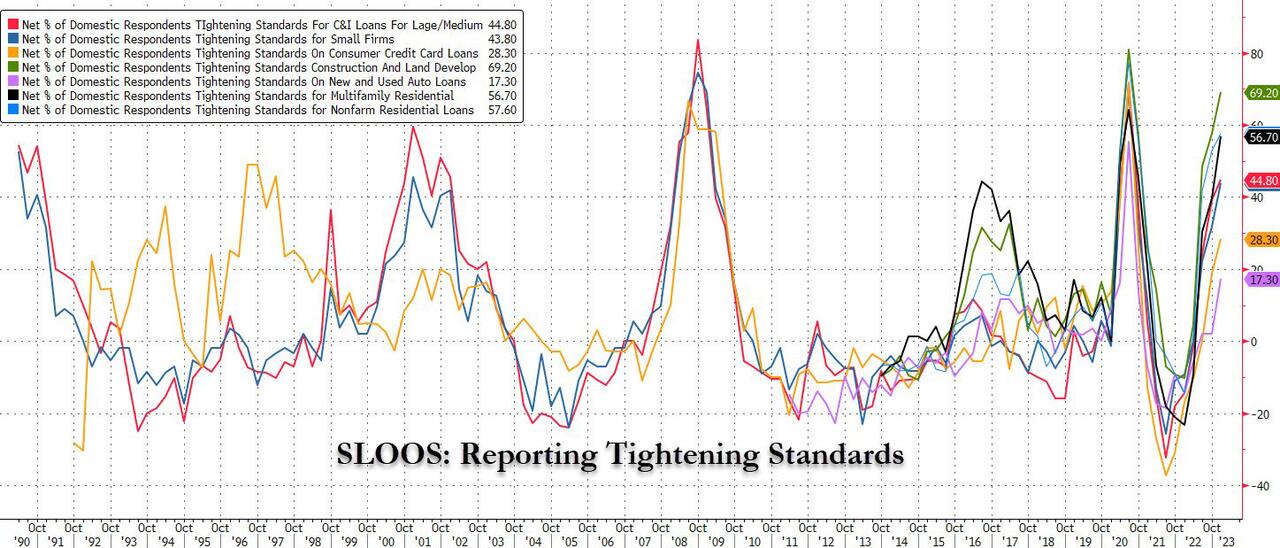

At the same time, Credit Opportunities are being taken away from people and businesses, as standards a tightening in a way that usually signals a Recession. Tightening standards indicate that the lenders don’t have confidence in the borrowers’ abilities to pay. It is also a reflection of the banks’ abilities to put their money to work in less-risky ways. With the riskless Fed Funds Rate now approaching 5%, why lend it to a consumer for 6.5%?

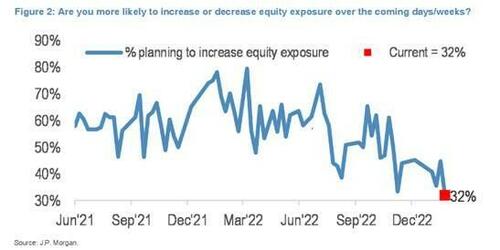

And on Wall Street, Investor Sentiment couldn’t be much lower, with only 32% of the clients surveyed by JP Morgan planning to increase their exposure in the near-term.

And on Wall Street, Investor Sentiment couldn’t be much lower, with only 32% of the clients surveyed by JP Morgan planning to increase their exposure in the near-term.

We made some bearish moves in our Short-Term Portfolio (STP) hedges yesterday, taking advantage of the move up to add some cheap protection. That puts us in a position to go shopping for some longs. Just because the overall market may be hard to invest in, doesn’t mean there aren’t a few hidden gems out there that are worth our attention.