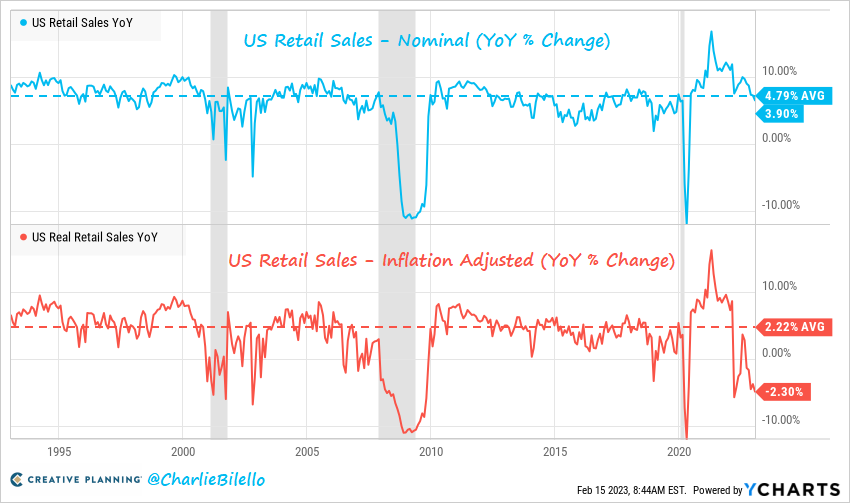

Retail Sales are expected to be up 2% for January.

Retail Sales are expected to be up 2% for January.

There were down 1.1% in December, so it might just be wishful thinking as they were down in November as well and haven’t been strong since June. Durable Goods and Furniture have been consistently awful but Gasoline really killed us in December, down 4.6% and Gasoline was down to almost $2 (wholesale) in December and hit $2.70 in January – so Retail Sales are probably saved – yay?!???

That’s right, you know and I know and anyone who’s taken Econ 101 (or has common sense) knows that Consumers spending more money on Gasoline is not a positive sign for the economy but it is a positive sign for Big Oil Companies and they own the Government and you don’t – so we will continue to act as if strong gasoline sales (which takes spending money away from other retailers) is somehow good for the economy.

Just look at that Retail Sales chart – it may as well be a Gasoline Sales Chart! What total BS this all is, right? That’s why I’m very concerned as the Retailers begin reporting Q4, when gasoline was pretty high in October and November – I’m not sure if the December pullback is going to be enough to have saved post-Christmas.

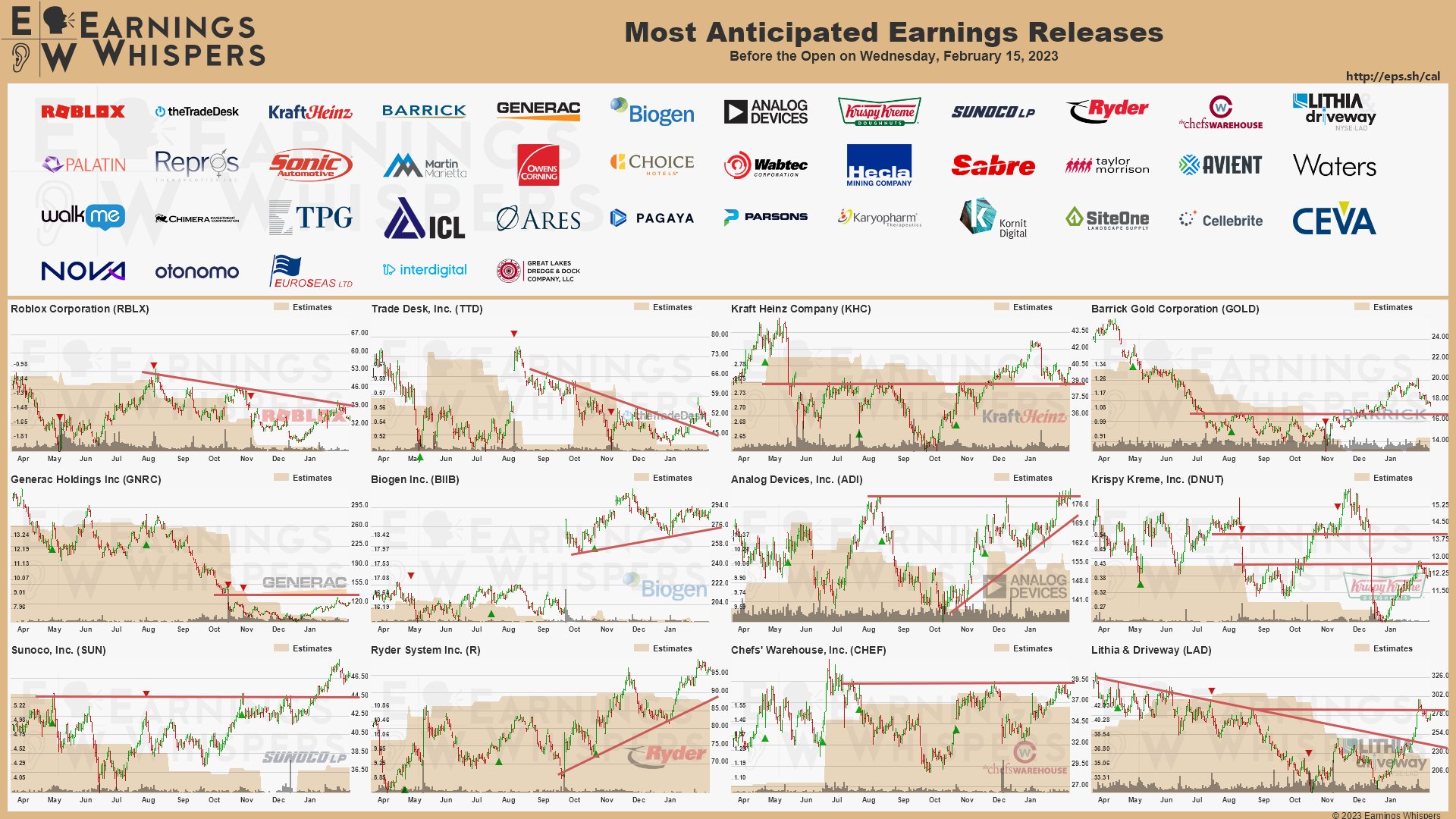

That’s who we have on deck for this morning. Now that the S&P 500s results are pretty much all in, we are turning to mid-cap and small-cap reports and those companies don’t have entire floors of accountants cooking their books – so we’ll get to some truth – hopefully…

Barrick beat by a penny, Biogen beat by more than 4 times what Barrick made in total (love them!), Generac is another one of our holdings and they beat too. KHC beat but guided down, Krispy Kreme guided down, Corning beat cleanly, Sonic had kick-ass earnings and Sunoco, of course, beat with record profits.

Bank of America said payments per household by its debit and credit-card customers rose 5.1% in January compared with the year before, up from a 2.2% increase in December but Social Security checks also increased 8.7% at the start of the year, the largest inflation-adjustment in decades, which gave roughly 70 million recipients more money to spend – so keep that in mind if we do get a positive number and people get all excited.

Bank of America said payments per household by its debit and credit-card customers rose 5.1% in January compared with the year before, up from a 2.2% increase in December but Social Security checks also increased 8.7% at the start of the year, the largest inflation-adjustment in decades, which gave roughly 70 million recipients more money to spend – so keep that in mind if we do get a positive number and people get all excited.

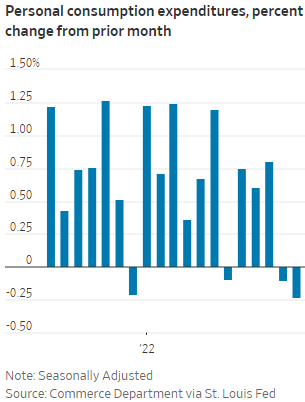

The retail-sales report is only a partial picture of spending as it doesn’t include many services such as travel, housing and utilities. The Commerce Department will release its monthly report that includes more complete spending figures later this month – it was down 0.2% in December and it was down 0.3% adjusted for inflation.

Looking at the above PCE chart, please keep in mind that we are supposedly entering a strong economy. Pay no attention to the fact that it LOOKS like it’s much weaker than last year… Now you are all caught up with the average media pundit!

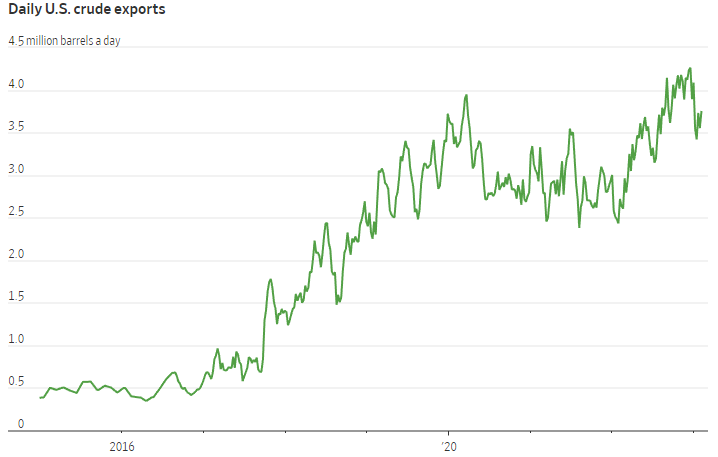

Speaking of things that make you go “Duh!” – Trump’s lasting legacy is his change in long-standing US policy in which he allowed the export of Petroleum Products to the point where we now export close to exporting 4M barrels per day, which is 25% of the US’s entire “consumption” of crude oil. This has, of course, been fantastic for oil companies and refiners but not so much for people who struggle to fill up their tanks:

What is the difference between $1.50 Gasoline and $2.50 Gasoline? Well, we drive 15,000 miles a year and get 30 miles to a gallon so call it 150 gallons so we’re contributing $150 x 200M cars is $30Bn a year taken directly out of Consumers’ pockets and then, indirectly, higher fuel costs is one of the root causes of all inflation, which is sucking 15% more out of your paycheck than it did in 2020.

Consumer Spending is $6Tn a year and 15% of that is $900Bn and let’s forget, Trump doesn’t call reaching into your pocket and extracting $1Tn to be a “tax” – it’s just Capitalism and the fact that the poor suffer and the rich make record profits off the arrangement – well, what part of “Capitalism” do you not understand?

You see the Government’s JOB is to PROTECT the people (who they supposedly represent) from overly greedy Capitalists, that’s how America has survived all this time. When you shrink the Government and pack the courts with “pro-Business” Judges, you erode those safety measures and things begin to get out of control – kind of like if you put ramps in the Colloseum that let the lions feast on the audience.

You see the Government’s JOB is to PROTECT the people (who they supposedly represent) from overly greedy Capitalists, that’s how America has survived all this time. When you shrink the Government and pack the courts with “pro-Business” Judges, you erode those safety measures and things begin to get out of control – kind of like if you put ramps in the Colloseum that let the lions feast on the audience.

8:30 Update: Retail Sales are up 3% but Mortgage Applications are down 7.7%, which is a disaster so not going to be able to celebrate the results. The Empire State Manufacturing Index is also down 5.8% so it’s kind of a Recession with Inflation as people spend more money on less stuff, which is called Stagflation. Stagflation makes people Depressed – which can lead to a Depression!

Strong Retail sales can also strengthen the Dollar (in demand to buy more goods) so watch out if it pops back over 104, which could push the markets lower all by itself! We’ve been stuck between 103 and 104 most of the month and I said in yesterday’s Live Member Chat Room that I thought we were consolidating for a move higher – we’ll see if that happens today.

Strong Retail sales can also strengthen the Dollar (in demand to buy more goods) so watch out if it pops back over 104, which could push the markets lower all by itself! We’ve been stuck between 103 and 104 most of the month and I said in yesterday’s Live Member Chat Room that I thought we were consolidating for a move higher – we’ll see if that happens today.

Still, let’s keep a little perspective on things as, adjusted for the 6% inflation, Retail Sales are actually LOWER than last year by 2.3% – but let’s not quibble over reality and try to enjoy the ride…