Berkshire Hathaway (BRK.B) is a great proxy for the S&P 500.

Berkshire Hathaway’s operating earnings in Q4 2022 were $6.71Bn, down from $7.76Bn in Q3 and $7.29Bn in Q4 2021. The decline was mainly due to a $1.45Bn loss in the “other” businesses segment, which includes foreign exchange currency losses on non-U.S. denominated debt. Earnings from railroad and insurance underwriting also declined. However, earnings from insurance investment income increased to $2Bn from $1.41B in Q3 and $1.22Bn in Q4 2021.

- During the quarter, Berkshire Hathaway bought back around $2.6Bn of its common stock, bringing the year total to $7.9Bn. The company held approximately $128.7Bn of cash and short-term securities at the end of December 2022, up from $109.0Bn at the end of September 2022, despite acquiring Alleghany Corp. during the quarter.

- The insurance float was $164Bn at the end of December 2022 compared to $150Bn at the end of September 2022. The amount of float increased by $17Bn during the year, mainly reflecting $14Bn related to Berkshire’s acquisition of Alleghany Corp.

- The investment giant’s net earnings for the quarter were $18.2Bn, including investment and derivative gains of $11.5Bn, most of which is unrealized. This is compared to a net loss of $2.69Bn in Q3 and net earnings of $39.6Bn in Q4 2021.

As noted in Buffet’s letter to shareholders: “At yearend 2022, Berkshire was the largest owner of eight of these giants: American Express (AXP), Bank of America (BAC), Chevron (CVX), Coca–Cola (KO), HP Inc. (HPQ), Moody’s (MCO), Occidental Petroleum (OXY), Burlington Northern (BNSF – now private) and Paramount Global (PARA).”

Buffett is happy to point out they’ve had the same 400M shares of KO since 1994, which they accumulated over 7 years at a cost of $1.3Bn and the 2022 DIVIDEND on those shares was $704M – over 50% of the purchase price – ANNUALLY – and now the stock itself is worth $25Bn! This is a great example of that dividend strategy I keep telling you guys about.

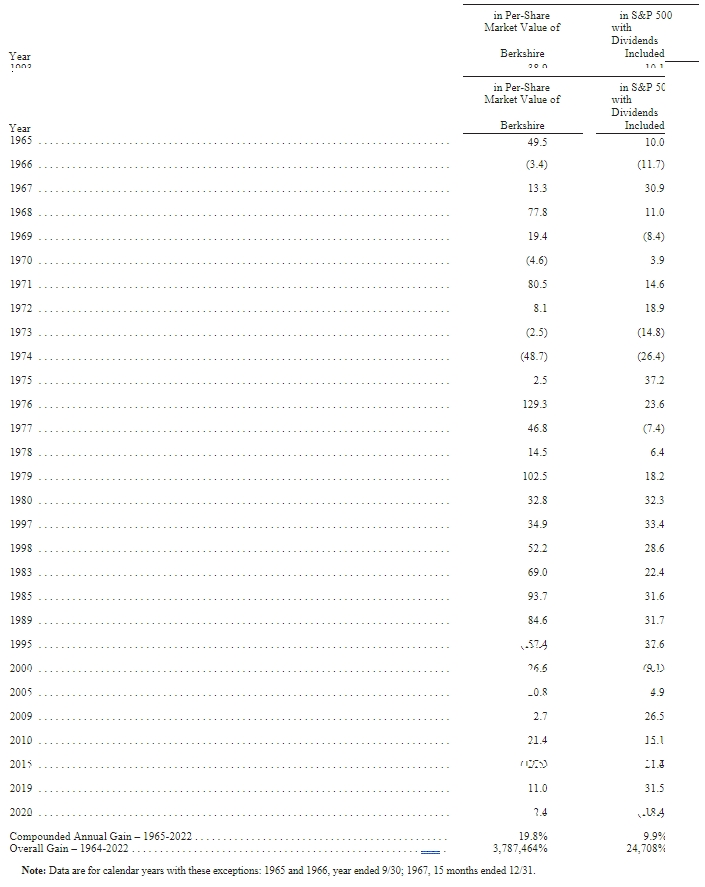

Just imagine how rich Buffett would be if we taught him how to enhance his returns with options! Here’s a chart of how Berkshire has performed over the years compared to the S&P 500:

The difference between a 19.8% average return and a 9.9% average return is 37,874 TIMES your investment over 55 years vs 247 times for the S&P 500. 247x is nice 37,874x is better! Still, in Buffet’s first 10 years, $1,000 invested in 1964 would have turned into $3,241 at the end of 1974 – that was the lesson that taught Buffett to avoid the big losses.

As our Members know, I’m a big advocate of Buffett’s overall strategies, which include:

-

-

Invest for the long term: Buffett’s approach to investing is to hold stocks for the long term, rather than trying to time the market or make short-term gains. He famously said, “Our favorite holding period is forever.” This approach has allowed him to capitalize on the power of compounding over time.

-

Focus on the fundamentals: Buffett looks for companies with strong fundamentals, including a competitive advantage, a solid management team, and a track record of consistent earnings growth. He also looks for companies with a clear and sustainable business model.

-

Buy stocks at a reasonable price: Buffett is known for his value investing approach, which involves buying stocks that are undervalued relative to their intrinsic value. He looks for companies with a low price-to-earnings ratio, high return on equity, and a low debt-to-equity ratio.

-

Be patient and disciplined: Buffett is patient and disciplined when it comes to investing. He doesn’t make impulsive decisions and he doesn’t let his emotions guide his investment choices. Instead, he takes a long-term approach and waits for the right opportunities to come along.

-

Diversify your portfolio: While Buffett is known for his concentration of investments in a few select stocks, he also believes in the importance of diversification. He recommends holding a mix of stocks, bonds, and cash, and diversifying across different sectors and geographies.

-

Ignore market noise and focus on the long-term: Buffett believes that short-term fluctuations in the stock market are often driven by emotion and speculation, rather than underlying fundamentals. He advises investors to ignore market noise and focus on the long-term prospects of the companies they invest in.

-

Invest in what you know: Buffett advises investors to invest in companies that they understand and know well. “Never invest in a business you cannot understand,” he often says.

-

Don’t try to time the market: Buffett doesn’t believe in trying to time the market. He believes that it’s impossible to consistently predict short-term fluctuations in the stock market and that trying to do so is a recipe for disaster.

-

Stay rational and don’t let fear or greed guide your decisions: Buffett believes that fear and greed are two of the biggest enemies of successful investing. He advises investors to stay rational and disciplined, and not to let their emotions guide their decisions.

-

Buffett also has come over to my side on stock buybacks, stating they are generally a bad idea unless the stock itself it undervalued. He also bought back a bunch of stock (1%) in Q4 because Berkshire started the quarter at $260, that gives a clear idea of where he sees value in his own company.

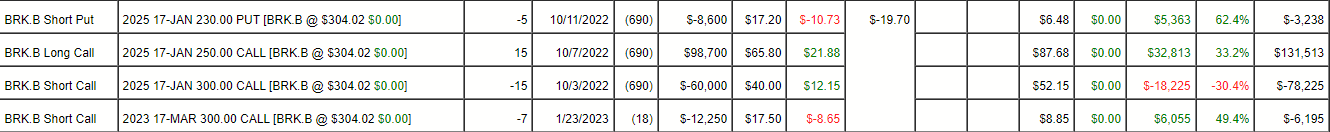

We also bought BRK.B in October for our Butterfly Portfolio, that position is very profitable already:

Notice we sold about a 50% cover in March $300 calls. Those make up a substantial portion of the profits so far. See how we sold them in January, when we thought BRK.B was a little toppy. As Value Investors we know when things are over-valued, as well as undervalued. Learning to make money in both situations is the key to unlocking that extra 10% boost to your performance…

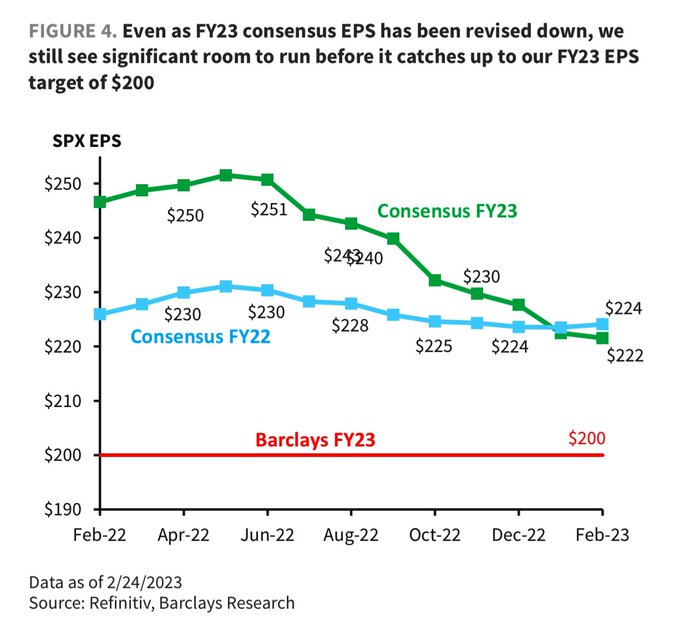

Do you know where the S&P 500 was last June? Around 4,000. Do you know where the Nasdaq was? Around 12,500. Do you know where the Dow was? Who cares? The Dow is a ridiculous, pointless index – stop looking at it!

Anyway, this week we have plenty of fun earnings reports to mull over, with lots of retailers reporting but also Buffett’s OXY this evening. Tomorrow morning we have Target (TGT) and we have them in our Long-Term Portfolio but we’re hedged, so we’ll see what happens but I think it may not be as bad as expected.

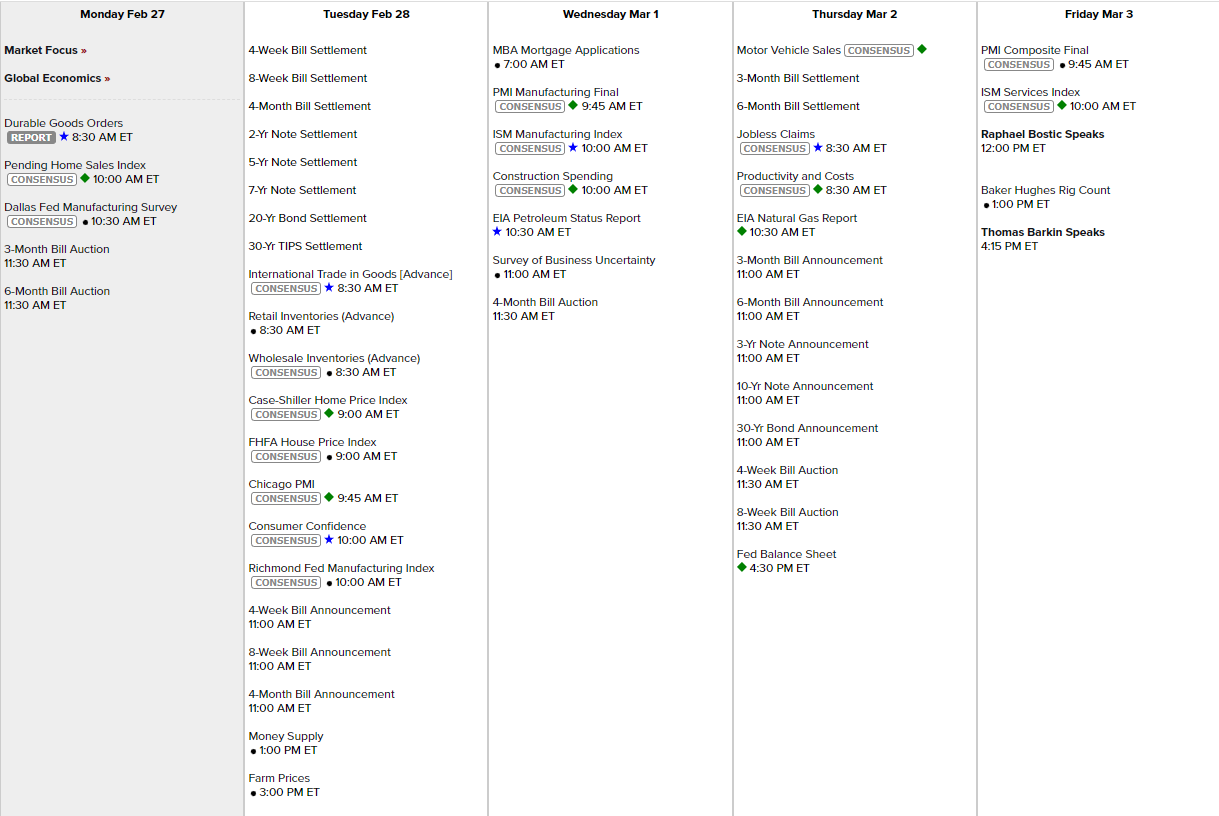

This week’s economic calendar has several important releases, including data on durable goods orders, pending home sales, retail inventories, and consumer confidence.

- On Monday, February 27, the Durable Orders report for January is expected to show a decline of 4.2%, following a 5.1% increase in the previous month. The Durable Goods report, which excludes transportation, is expected to show a 0.3% increase. The Pending Home Sales report for January is expected to remain flat at 0%.

- On Tuesday, February 28, the S&P Case-Shiller Home Price Index for December is expected to show a 5.2% increase, down from the previous month’s 6.8%. The ISM Manufacturing Index for February is expected to show a slight increase to 48.0%, up from the previous month’s 47.4%. The Consumer Confidence Index for February is expected to show a slight increase to 108.0.

- On Wednesday, March 1, the MBA Mortgage Applications Index for the week ending February 25 will be released, which could impact the housing market. The ISM Non-Manufacturing Index will also be released, providing a look at the state of the service sector.

- On Thursday, March 2, the weekly initial jobless claims report for the week ending February 25 is expected to show an increase to 200K, up from the previous week’s 192K. The revised Productivity and Unit Labor Costs reports for Q4 2022 will also be released.

- On Friday, March 3, the IHS Markit Services PMI for February will be released, providing a look at the state of the service sector. The EIA Natural Gas Inventories report for the week ending February 24 will also be released. Not an error, by the way, Non-Farm Payrolls are not out until the next Friday.

Overall, this week’s economic data releases will provide insight into the state of the housing market, consumer confidence, and the labor market. The market will be looking for indications of any slowdown in economic growth, particularly in the manufacturing and housing sectors.

The indexes are moving up about 1% this morning, so we’re not going to over-analyze things and we’ll just have to see what sticks. If you remember from last week, 4,040 on the S&P was the Weak Bounce Line and that’s not even impressive until we’re over the Strong Bounce Line at 4,080 so 4,010 pre-market with no volume is not going to get us excited.

- Investors Brace for Surge in Market Volatility

- Corporate Stock Buybacks Help Keep Market Afloat

- US Sees China in ‘Awkward’ International Position Over Ukraine.

- Lab Leak Most Likely Origin of Covid, U.S. Agency Now Says

- Asia Stocks Slide as Traders Eye Higher Rates Path: Markets Wrap.

- Australia Recession Risk Rises as RBA Seen Hiking More Than Fed.

- Emerging Markets Will Have to Weather Another Dollar Hurrah

- Supply Chains Have Healed Yet Their Mark on Inflation Will Endure

- Five Key Charts to Watch in Global Commodity Markets This Week.

- With the Easy Money Gone, Executives Tighten Belts by Slashing Dividends.

- Can’t figure out this economy? Walmart, Home Depot are having trouble, too

- Frackers Increase Spending but See Limited Gains

- Cars Return to Dealer Lots. Interest Rates Could Make Them a Harder Sell.

- With AI, We Are All Once Again Tech Companies’ Guinea Pigs

- The Capex Supercycle