It’s going to be an interesting week.

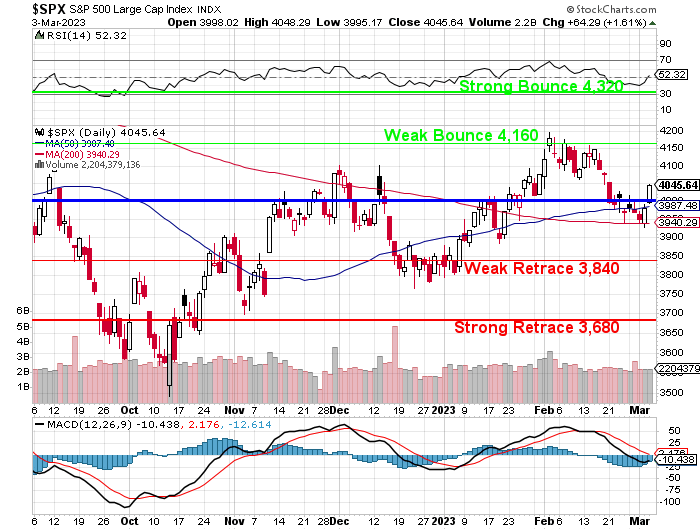

It took us two weeks to make our Weak Bounce Line at 4,040 and failing the weak bounce would be devastating and 4,080 is our Strong Bounce Line but we have no technical resistance so it’s all about what Powell says to Congress tomorrow and Wednesday (10am). We also have Non-Farm Payrolls on Friday and some bond auctions but nothing trumps Powell.

Warren (PSW’s AI mascot) says:

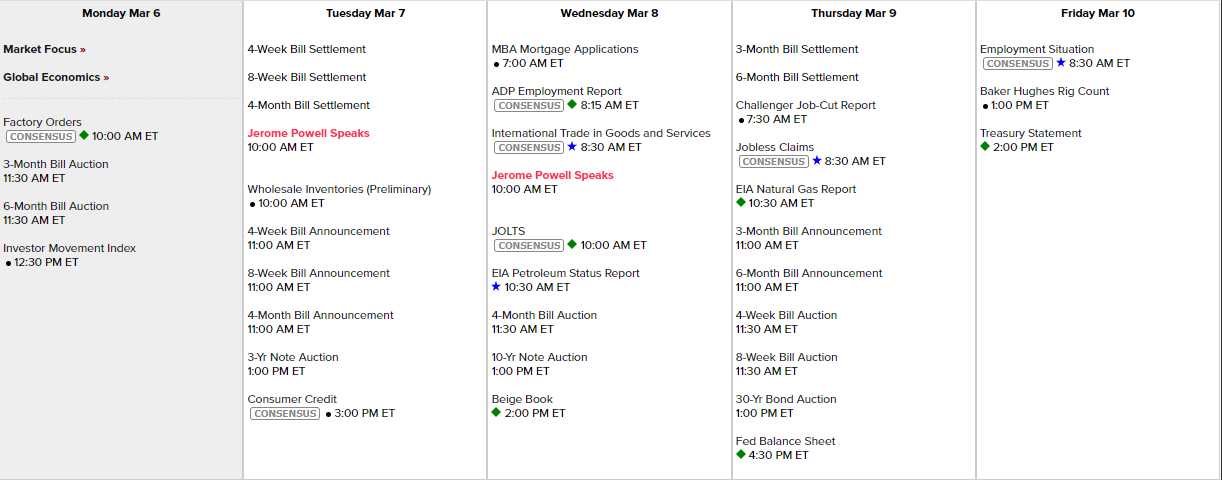

♦There are several high-impact data releases that could affect the financial markets, such as the Factory Orders, Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings.

- On March 6th, Factory Orders data for January is expected to be released. The data measures the change in the total value of new purchase orders placed with manufacturers, and it is expected to decrease by 2.0%, which could impact the market sentiment, but the overall effect is likely to be low.

- On March 7th, the Wholesale Inventories for January will be released, which measures the change in the total value of goods held in inventory by wholesalers. A decrease of 0.4% is expected, indicating a slowdown in the economy, but this is unlikely to have a significant impact on the markets.

- Also on March 7th, Consumer Credit data for January will be released. This report tracks the change in the total value of outstanding consumer debt, such as credit card debt and personal loans. The data is expected to increase to $17.5 billion, indicating stronger consumer spending, which could positively affect the markets.

- On March 8th, the ADP Employment Change for February is scheduled to be released. This report measures the monthly change in non-farm, private employment, and it is expected to increase to 200K, indicating a healthy job market, which could positively affect the market sentiment.

- The same day, the Trade Balance data for January will also be released. This report measures the difference between the value of exports and imports of goods and services, and it is expected to decrease to -$69.0 billion, which could indicate a weaker economy, but it is unlikely to have a significant impact on the markets.

- On March 9th, Initial and Continuing Claims data for the first week of March will be released. These reports track the number of individuals who filed for unemployment benefits, and they are expected to increase slightly. High-impact data like these could affect market sentiment, particularly if the actual figures deviate significantly from the forecasts.

- Also, on March 10th, the Nonfarm Payrolls report for February will be released, which is considered the most important economic indicator. This report measures the change in the number of employed people in the US, excluding the farming industry. A healthy increase of 220K jobs is expected, which could positively impact the markets.

In conclusion, this week’s economic data releases are expected to provide valuable insight into the performance of the US economy in January and February. While some data releases have the potential to impact market sentiment, such as the Nonfarm Payrolls and Initial Claims, the overall impact is likely to be moderate.

Investors will be looking for any hints or signals from Powell on how the Fed views the current economic situation, especially regarding inflation, growth, and interest rates. The Chairman is expected to back a quarter point rate hike in March and keep the door open for more hikes later this year if needed. He is also likely to speak about the potential impact of the Ukraine conflict on Global Financial Stability and Monetary Policy.

Then we have earnings. There are 300 companies scheduled to report this week but we’re generally into the smaller-cap companies but it’s important to get an idea of what’s going on as these companies employ far more people than the S&P 500 do – so trends we see here are going to have a real impact on the Q2 economy.

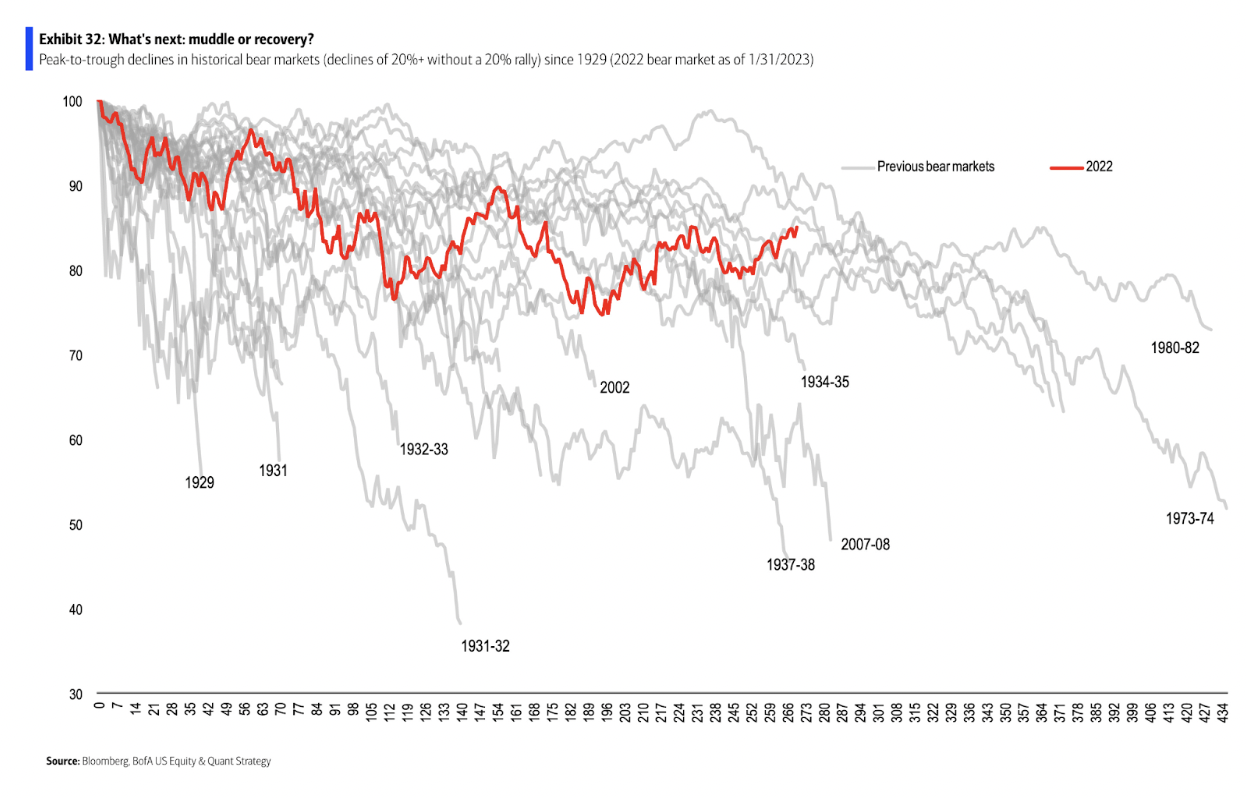

Let’s keep in mind that we are, in fact, already in a bear market and simply struggling to get out of it. If we do, however, it will be unique compared to 10 other bear markets we’ve experienced in the last 100 years. As you can see on this chart, we’re still hovering down about 20% off the highs of about a year ago.

Unfortunately, stimulus generally gets us out of these things and there is no more stimulus coming. We’ll be lucky if the reverse doesn’t happen and the Government shuts down… This is why we need to remain cautious but we are still adding some new trades from our watch list and, just last week, I appeared on Money Talk and we added both IBM and QCOM to our portfolio.

We’re looking closely at other companies that will benefit from the rise of AI over the rest of the decade and we’ll be making some trading decisions this week so join us inside for our Live Member Chat Room each day during market hours.

- Salesforce (CRM) came to my attention over the weekend. They are a leader in cloud-based customer relationship management (CRM) software that leverages AI to help businesses improve their sales, marketing, service, and e-commerce operations. Salesforce’s AI platform is called Einstein, which provides features such as predictive analytics, natural language processing, recommendation engines and chatbots. Salesforce has also acquired and integrated other AI companies such as Tableau and Slack to enhance its offerings.

- Snap (SNAP) is another social media company which runs Snapchat, a popular app that allows users to send disappearing messages, photos, and videos. Snap also develops innovative features such as augmented reality filters, lenses, and Bitmoji Avatars that use AI to enhance their user experiences. Snap also invests in AI research through its Snap Research team, which I find very interesting.

- Veritone (VERI) is a software company that provides an AI platform for various industries such as media, entertainment, legal, government, and education. Veritone’s platform allows users to analyze and process large amounts of audio video and text data using cognitive engines such as speech recognition face detection sentiment analysis and natural language understanding. Veritone also offers solutions for content monetization compliance and security. They are very small ($270M at $7.44) but sales are growing fast and they have enough in the bank to get profitable by next year.

- Splunk (SPLK) is a software company that specializes in data analytics and monitoring for IT operations security and business intelligence. Splunk’s products use AI to help customers collect index search correlate visualize and report on data from various sources and systems. Splunk also offers solutions for cloud computing machine learning internet of things (IoT) and blockchain.

- Twilio (TWLO) is a cloud communications platform that enables developers to build and integrate voice, video, messaging, and email applications using APIs. Twilio also leverages AI to provide features such as speech recognition, natural language processing, sentiment analysis, and conversational bots. Twilio has also acquired and integrated other AI companies such as SendGrid, Segment, and Electric Imp.

- UiPath (PATH) is a software company that provides robotic process automation (RPA) solutions for enterprises. UiPath’s products allow users to automate repetitive and mundane tasks using software robots that mimic human actions. UiPath also uses AI to enhance its RPA capabilities with features such as computer vision, document understanding, natural language processing, and machine learning. As AI gets better, so do their products.

None of these companies falls into our typical “Value” investing model but it gives us an idea of what to look for in what could be the start of a new “Dot Com”-type of bubble – and there’s nothing wrong with a bubble if you get in on the ground floor and get out before it pops, right?