Let’s talk about poverty.

Let’s talk about poverty.

It’s spreading and it’s capable of undermining the entire economy and it’s about to explode when millions of people who are already on the edge of poverty have to start paying their student loans again. It’s not the loan payments themselves that are the problem but that the pause on payments has put off those borrowers having to deal with the full force of the damage inflation has done to their spending power in the past two years.

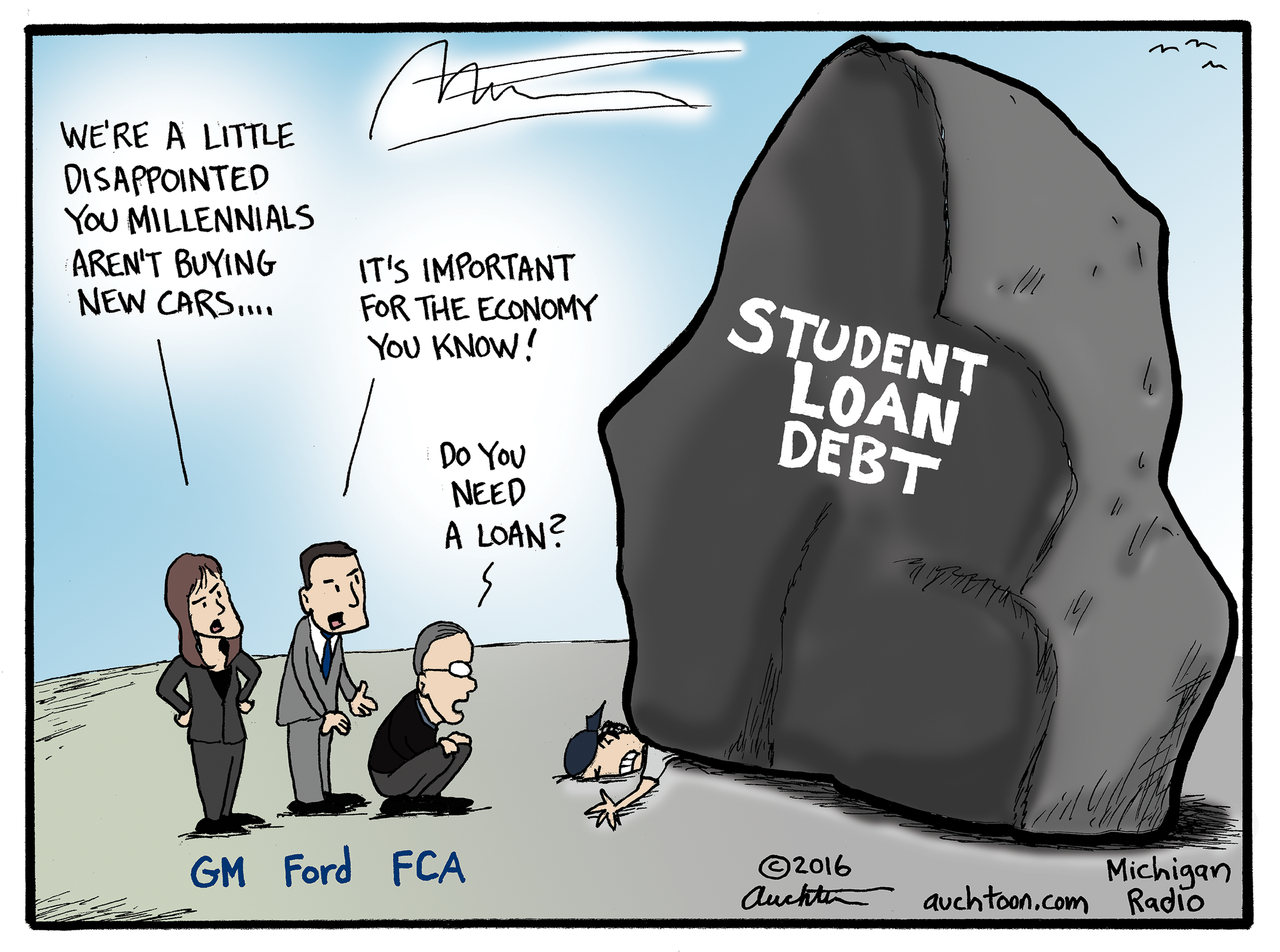

Student debt is a huge burden for Millions of Americans who pursued higher education in hopes of improving their lives and careers. According to the Federal Reserve Bank of New York, Americans owed more than $1.75 TRILLION in student loans at the end of last year, making it the second-largest source of household debt after mortgages. That’s an average of $28,950 per borrower, which is more than enough to buy a new car or make a down payment on a house.

Unlike cars or houses, student loans are extremely difficult to get out of. Most Borrowers cannot discharge their student loans, even in bankruptcy, and many have struggled to keep up with their monthly payments, especially during the pandemic. According to the National Center for Education Statistics, 11% of Borrowers who entered repayment in 2015 had defaulted on their loans within three years. Defaulting can have serious consequences, such as damaging credit scores, losing eligibility for federal benefits or programs, and facing wage garnishment or seizure of tax refunds.

Student debt also has broader implications for the economy and society. It limits the choices and opportunities of Borrowers who have to delay or forego major life decisions such as starting a family, buying a home, saving for retirement, or starting a business. It also exacerbates inequality and injustice by disproportionately affecting low-income students and students of color who may have less access to financial aid or family support. And it undermines the value and quality of higher education by forcing students to choose between affordability and excellence.

Student debt also has broader implications for the economy and society. It limits the choices and opportunities of Borrowers who have to delay or forego major life decisions such as starting a family, buying a home, saving for retirement, or starting a business. It also exacerbates inequality and injustice by disproportionately affecting low-income students and students of color who may have less access to financial aid or family support. And it undermines the value and quality of higher education by forcing students to choose between affordability and excellence.

Student debt is not just a personal problem but a national crisis that requires urgent action.

Bing Says:

The status of the student loan battle between Biden and the GOP is uncertain and contentious. President Biden announced a plan last year to forgive $400 billion in student loan debt for more than 40 million Americans who were affected by the pandemic12. He said he had the authority to do so under the Higher Education Act of 1965, which gives him discretion over federal student loans3.

However, his plan faced immediate opposition and legal challenges from Republican lawmakers and state officials who argued that he was overstepping his constitutional powers and that he needed congressional approval to cancel such a large amount of debt45. They also claimed that his plan was unfair to taxpayers, borrowers who paid off their loans, and students who chose cheaper or alternative education options65.

The Supreme Court agreed to hear two cases challenging Biden’s plan: one filed by six Republican-led states4, and another filed by a group of Republican senators led by Ted Cruz6. The oral arguments took place on Tuesday, February 28th, 2023, and the court is expected to issue its ruling by June63.

The outcome of these cases could have a significant impact on millions of borrowers who are hoping for debt relief, as well as on Biden’s political agenda and legacy. Some analysts believe that Justice Amy Coney Barrett could be the swing vote on the court, as she has shown some sympathy for borrowers in previous cases involving student loans1. Others say that the court could avoid ruling on the merits of Biden’s plan and instead focus on procedural issues such as standing or mootness3.

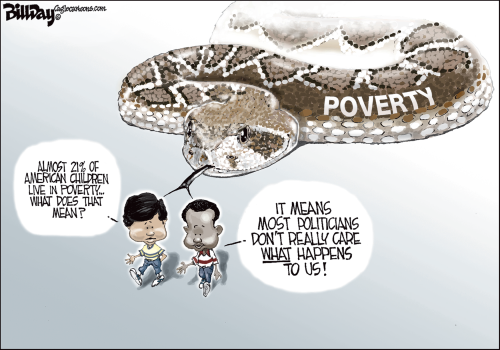

Poverty is a multifaceted phenomenon that goes beyond a lack of income. The World Bank defines poverty as “pronounced deprivation in well-being,” which encompasses not only low income but also limited access to Education, Healthcare, Housing, and Social Participation (World Bank, 2022). In the US, poverty is typically measured by the Federal Poverty Line, which is based on household income and family size. According to the US Census Bureau, the poverty line for a family of four in 2022 was $27,750 – though how you are supposed to live with a family on $27,750 I can’t possibly imagine…

Despite being one of the wealthiest nations in the World, poverty remains a pressing issue in the US. According to the latest data from the US Census Bureau, 9.2% of the population, or 30.1 Million people lived in poverty in 2020. The poverty rate varies significantly by race and ethnicity, with Black and Hispanic individuals experiencing higher poverty rates than White and Asian. In 2020, the Poverty Rate was 18.8% for Black individuals, 15.3% for Hispanic individuals, 6.6% for White individuals, and 6.7% for Asian individuals per the Census that year.

Poverty has a profound impact on individuals, families, and communities. Individuals living in poverty are more likely to experience Food Insecurity, Housing Instability, and limited access to Healthcare, Education, and Employment Opportunities. Children living in poverty are more likely to have Developmental Delays, Lower Academic Achievement, and higher rates of Chronic Health Conditions. Poverty also has intergenerational effects, as children who grow up in poverty are more likely to live in poverty as adults.

Poverty has a profound impact on individuals, families, and communities. Individuals living in poverty are more likely to experience Food Insecurity, Housing Instability, and limited access to Healthcare, Education, and Employment Opportunities. Children living in poverty are more likely to have Developmental Delays, Lower Academic Achievement, and higher rates of Chronic Health Conditions. Poverty also has intergenerational effects, as children who grow up in poverty are more likely to live in poverty as adults.

Moreover, poverty is linked to Social Exclusion and Marginalization, as individuals living in poverty often face Stigma and Discrimination. They may also have limited social networks and community resources, which can exacerbate their Isolation and Vulnerability.

The causes of poverty are complex and multifaceted, but they often stem from Systemic Inequalities and Structural Barriers, such as Discrimination, Lack of Access to Quality Education and Healthcare, Low Wages, and Inadequate Social Safety Nets. Poverty also intersects with other social issues, such as Race, Gender, and Immigration status, which can further compound its effects.

Addressing poverty requires a comprehensive and multi-dimensional approach that tackles its root causes and provides support to individuals and communities. This can include policies that increase access to Education and Training, improve the affordability and availability of Housing and Healthcare, and provide a robust Social Safety Net. It also requires addressing Systemic Inequalities and dismantling barriers to Opportunity, such as Discrimination and Prejudice.

Poverty is a pervasive issue in the US that affects individuals, families, and communities across multiple dimensions. Addressing poverty requires a holistic approach that tackles its root causes and provides support to those in need. By investing in policies and programs that prioritize Equity and Opportunity, we can create a more just and inclusive Society for all.

I asked Bing to summarize the NYTimes article on Poverty, by America – you should all read it in full and please, get others to read it as well.

Poverty, by America, is a new book by Matthew Desmond, the author of the Pulitzer Prize-winning Evicted12. The book is a study of how the wealthy harm the poor in the United States, both intentionally and unintentionally12. The NYTimes praises Desmond’s book as a “powerful indictment” of American capitalism and inequality, and highlights some of his findings and arguments, such as:

-

- How tax policies favor the rich and deprive the poor of essential services3.

- How predatory lending practices trap low-income borrowers in debt cycles3.

- How environmental racism exposes poor communities to pollution and health risks3.

- How mass incarceration disrupts families and communities3.

- How corporate lobbying influences policies that affect workers’ rights and wages3.

The article also compares Desmond’s book to other works on poverty, such as Nickel and Dimed by Barbara Ehrenreich and The New Jim Crow by Michelle Alexander, and argues that Desmond’s book is more comprehensive and systemic in its analysis3. The article concludes by calling Desmond’s book a “must-read” for anyone who cares about social justice and democracy3.

My comment on this article is that it is an informative and persuasive review that summarizes the main points of Desmond’s book and provides some context and critique. It also raises some important questions about the causes and consequences of poverty in America, such as:

-

- Why does poverty persist in such a wealthy country?

- What are the moral implications of exploiting or ignoring the poor?

- How can we create more equitable and humane policies for all?

With 10% of the people in our country already living below the poverty line, the Government is cutting SNAP Benefits and reinstating Student Loan Payments at the worst possible time. As much as we like to ignore them, the 30M Americans below the poverty line still spend $360Bn a year of their own money and another $360Bn in Government assistance that they receive goes right back into the economy with a 3x multiplier and, IN FACT, ends up right back in the hands of the very people who complain about the taxes used to support them.

There’s another 60M people with student loan debt who aren’t considered poor because they can still move back in with their parents but let’s see what happens when we cut their disposable income back below zero.

That’s the Social Experiment we’re about to engage in!