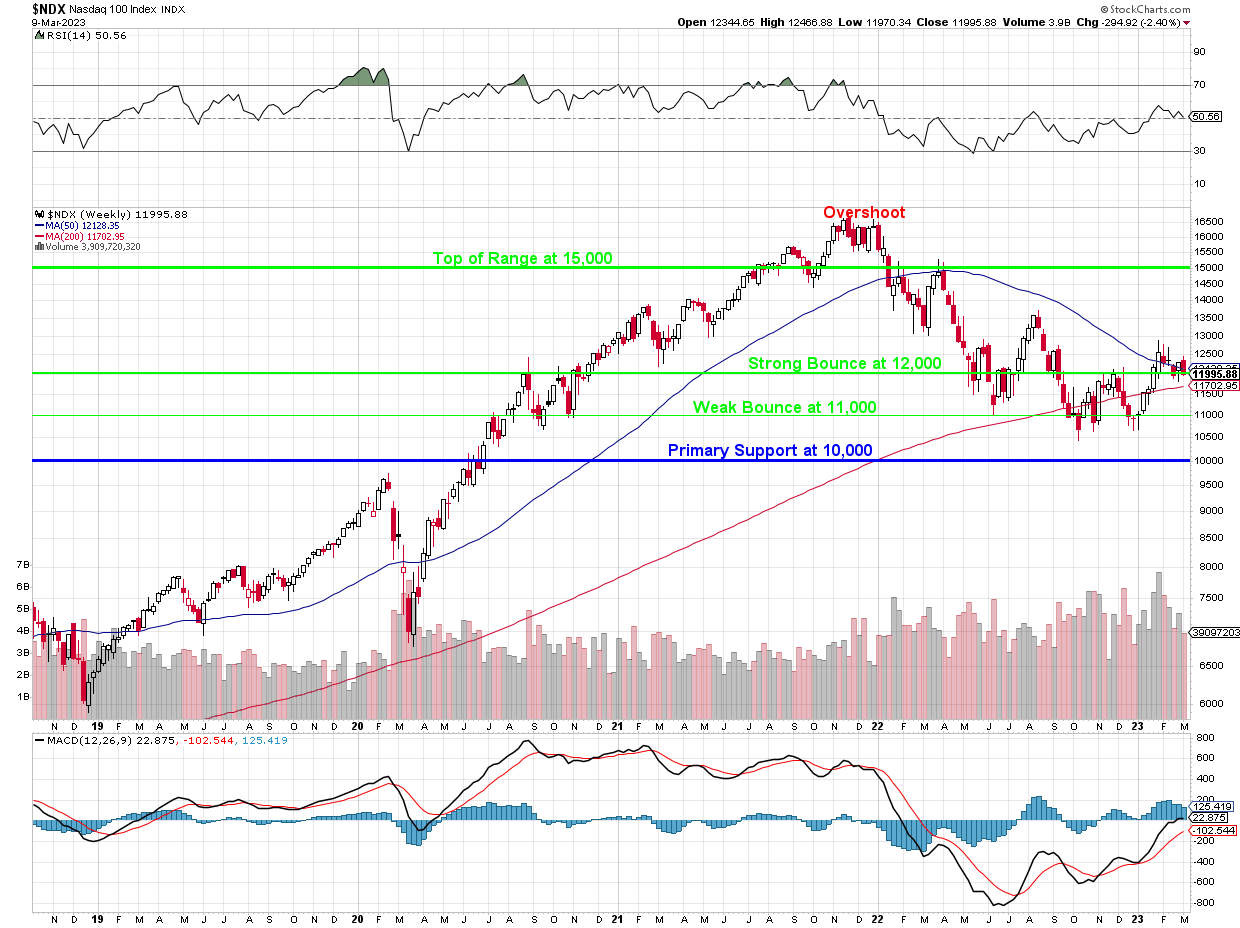

Here we are again:

We had HOPED (not a valid investing strategy) that the Nasdaq was safely over the Strong Bounce Line at 12,000 and we could go on to a constructive Q2 but here, in the last 3 weeks of Q1, we are faltering but most of the market sell-off is over Powell’s comments on Tuesday – which we saw coming a mile away – and now the collapse of Silicon Valley Bank (SIVB), which shows my age, as it’s now called SVB Financial Group.

SIVB is a prominent bank that primarily serves the technology and startup industries. However, recent market turbulence has hit the bank hard, leading to a significant drop in its stock price and raising concerns among investors. According to reports, SIVB needed to raise $2.25 billion in fresh capital to address the cash burn of its clients, many of whom are technology startups that have been struggling in the current market environment. However, concerns over the bank’s ability to cover its losses and liabilities have led to panic selling by investors, resulting in a steep decline in the stock price.

SIVB has issued an equity share raise of $1.75bn, after it sold its $21bn bond portfolio, which mostly consisted of US Treasuries. The portfolio was yielding an average return of 1.79%, which was far lower than the current 10-year Treasury yield of 3.9%. Despite the equity share raise, investors in SVB’s stock have expressed concerns over its sufficiency, following the loss-making bond portfolio sale. As a result, SVB’s shares fell 60%, resulting in over $80bn in value wiped out from bank shares. SIVB’s CEO, Gregory Becker, has been calling clients to assure them that their money is safe.

Yesterday, the stock reached its lowest level since 2016 but this was quickly followed by a further 26% drop after hours and again this morning, leaving the stock trading at $35.83 in the futures market, down 86% from its 52-week high of $597.16. The sharp decline in SIVB’s stock price has also triggered a sell-off in other bank stocks that have exposure to Treasury bonds, which have suffered from rising yields and inflation expectations.

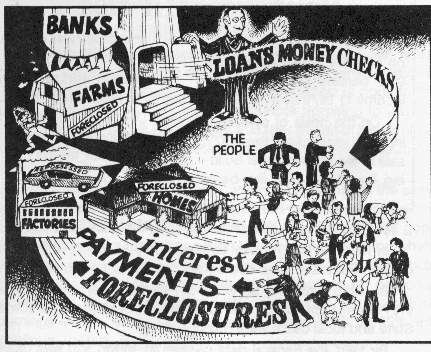

From the perspective of mark-to-market accounting, the pain that SIVB is experiencing is due to the decline in the fair value of its Investment Portfolio, which includes investments in Treasuries and Loans to Small and Large Cap Companies. The mark-to-market accounting method requires financial institutions to value their assets at current market prices, which can result in significant fluctuations in Reported Earnings and Balance Sheets – something that we were concerned would show up in Q1 when we went to mostly CASH!!! in our PSW Portfolios last November.

From the perspective of mark-to-market accounting, the pain that SIVB is experiencing is due to the decline in the fair value of its Investment Portfolio, which includes investments in Treasuries and Loans to Small and Large Cap Companies. The mark-to-market accounting method requires financial institutions to value their assets at current market prices, which can result in significant fluctuations in Reported Earnings and Balance Sheets – something that we were concerned would show up in Q1 when we went to mostly CASH!!! in our PSW Portfolios last November.

In the case of SIVB, the decline in Treasury prices has led to significant losses in its investment Portfolio, which have not been fully reflected in its Financial Statements. In addition, loans to small and large cap companies that have lost value during the Covid pandemic may not be fully reflected in the bank’s Financial Statements, as the bank may be holding these loans at historical cost rather than marking them to market.

Triggered by Powell’s more aggressive comments on Tuesday, Investors are now taking a long, hard look at all bank stocks that have steep Treasury losses to deal with, as well as outstanding loans to small and even large cap companies that have lost a lot of value during the pandemic. This is because the losses may not have been fully reflected in the banks’ Financial Statements, which could lead to further Write-Downs and Losses in the future.

Triggered by Powell’s more aggressive comments on Tuesday, Investors are now taking a long, hard look at all bank stocks that have steep Treasury losses to deal with, as well as outstanding loans to small and even large cap companies that have lost a lot of value during the pandemic. This is because the losses may not have been fully reflected in the banks’ Financial Statements, which could lead to further Write-Downs and Losses in the future.

Investors may also be concerned about the overall health of the banking sector, given the long-term impact of the pandemic on borrowers and the potential for increased loan defaults and bankruptcies. This could lead to further losses for banks and a challenging operating environment for the Financial Iindustry as a whole.

The current situation facing SIVB is a stark reminder of the risks that come with investing in the technology and startup sectors. While these industries can offer significant growth opportunities, they can also be highly volatile, particularly during times of economic uncertainty.

8:30 Update: Jobs are still coming in very strong with 311,000 jobs added in February – and it was a short month AND it had a holiday – so it could have easily been closer to 350,000 in a 31-day month. Leading Economorons were expecting 220,000 so off by about 50% but at least it wasn’t a complete blow-out like January’s 504,000 new jobs.

The unemployment rate actually ticked up from 3.4% to 3.6% as more people entered the work-force and that allowed earnings growth to slow from 0.3% to 0.2% and even hours per employee slipped from 34.6 to 34.5 (less overtime) so wage pressures are easing somewhat despite continued growth – that’s a good thing!

Will that be enough to turn the markets back up? It should be for the Nasdaq, as it doesn’t have a lot of Finance stocks in it but a lot of damage has been done this week – mostly to Investor Confidence.