Wow, what a ride we are having!

Wow, what a ride we are having!

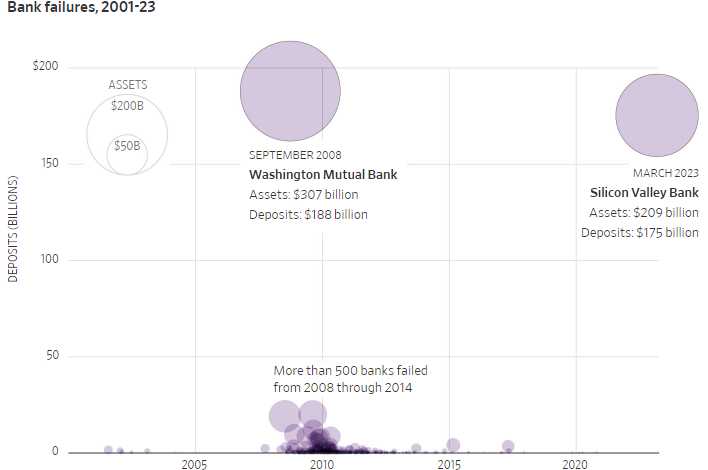

Thank God this happened over the weekend or we’d be in massive turmoil by now. Even as it is, there’s just so much uncertainty and things are coming apart at the scenes – even oil is collapsing. On Friday, there was widespread concern about the collapse of two banks, Silicon Valley Bank and Signature Bank. U.S. authorities took action to contain the fallout from Silicon Valley Bank’s collapse, which focused on business customers, including startups throughout the tech sector.

Over the weekend, officials announced that depositors with money at the California bank would be paid back in full, and depositors of Signature Bank, which had been shuttered by New York regulators, would also be made whole. The Fed announced an emergency lending program to funnel funding to eligible banks and help ensure that they are able to meet the needs of all their depositors. The turmoil was reflected in choppy trading in markets around the world, with US stocks poised to open down again this morning.

European shares are down across the board, with banks bearing the brunt of the losses. Investors were turning to bonds, dumping stocks and buying European government bonds, which are considered less risky. The Fed’s plan for interest rate increases may be reconsidered due to the turmoil in the banking system. Goldman Sachs analysts now believe that the Fed will keep rates unchanged next week, but expect increases at its meetings in May, June, and July. This is as opposed to a 0.5% hike expected as of Friday morning so THIS is what the market looks like with an effective 0.5% CUT – keep that in mind.

European shares are down across the board, with banks bearing the brunt of the losses. Investors were turning to bonds, dumping stocks and buying European government bonds, which are considered less risky. The Fed’s plan for interest rate increases may be reconsidered due to the turmoil in the banking system. Goldman Sachs analysts now believe that the Fed will keep rates unchanged next week, but expect increases at its meetings in May, June, and July. This is as opposed to a 0.5% hike expected as of Friday morning so THIS is what the market looks like with an effective 0.5% CUT – keep that in mind.

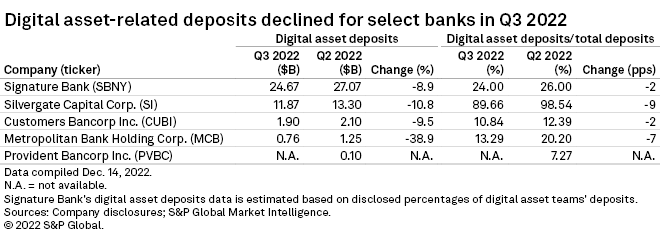

The sudden closure of Signature Bank, a New York-based bank with a large real estate lending business and a recent focus on cryptocurrency deposits, has left many of its customers and partners reeling. Signature’s decision to welcome cryptocurrency deposits came just before the overheated industry blew up last year.

As word about Silicon Valley Bank’s troubles began to spread last week, business customers of Signature began calling the bank, asking if their deposits were safe. Many were worried that their deposits could be at risk because, like business customers of Silicon Valley, most had more than $250,000 in their accounts. The FDIC insures deposits only up to $250,000. Despite assurances from regulators that customers of both banks would be made whole regardless of how much they held in their accounts, Signature saw a torrent of deposits leaving its coffers as well, which ultimately led to the bank’s closure.

The collapse of Silicon Valley Bank has led to investors seeking safer options such as government bonds and gold. US stock futures have been fluctuating, with losses in premarket trading for individual bank shares and European bank stocks. First Republic shares have plummeted by over 70%, despite an agreement with JPMorgan Chase for additional financing.

The collapse of Silicon Valley Bank has led to investors seeking safer options such as government bonds and gold. US stock futures have been fluctuating, with losses in premarket trading for individual bank shares and European bank stocks. First Republic shares have plummeted by over 70%, despite an agreement with JPMorgan Chase for additional financing.

Other regional bank shares have also seen significant losses, with Bank of America shares down by 5%. In the UK, HSBC has agreed to buy Silicon Valley Bank’s British arm for £1 (not a typo!) and continue to operate it for customers. First Republic Bank’s customers are businesses and wealthy individuals on the coasts, many of whom have been looking for higher interest alternatives to traditional bank accounts. Despite the collapse of Silicon Valley Bank, First Republic maintains that its “capital and liquidity positions are very strong” and that its “capital remains well above the regulatory threshold for well-capitalized banks.”

Other regional bank shares have also seen significant losses, with Bank of America shares down by 5%. In the UK, HSBC has agreed to buy Silicon Valley Bank’s British arm for £1 (not a typo!) and continue to operate it for customers. First Republic Bank’s customers are businesses and wealthy individuals on the coasts, many of whom have been looking for higher interest alternatives to traditional bank accounts. Despite the collapse of Silicon Valley Bank, First Republic maintains that its “capital and liquidity positions are very strong” and that its “capital remains well above the regulatory threshold for well-capitalized banks.”

Certainly, the situation with the banks and the government’s response does raise concerns about moral hazard and the potential consequences of the actions taken.

Firstly, regarding the government’s decision to insure all of SIVB’s depositors, even above the FDIC cap, it is true that this sets a dangerous precedent for moral hazard. When depositors know that their deposits are fully insured, regardless of the size of the bank or the riskiness of its investments, they have less incentive to be cautious about where they place their money. This can lead to a situation where banks take on riskier and riskier investments, knowing that they will not face the full consequences of their actions.

Additionally, the government’s actions in bailing out the banks can also have negative consequences for the economy as a whole. By stepping in and protecting the banks from the full consequences of their risky investments, the government may be encouraging more risk-taking behavior in the future. This can lead to a situation where the financial system becomes increasingly unstable, as banks take on ever riskier investments in an attempt to make higher profits.

There is also the issue of the government’s debt and ongoing debt ceiling battle. The government’s response to the banking crisis, particularly in terms of providing additional funding and insurance, will likely add to the already significant national debt. This can have negative consequences for the economy in the long term, as the government may be forced to cut spending or raise taxes in order to pay down the debt. Additionally, the ongoing debt ceiling battle only exacerbates these concerns, as the government may face significant difficulties in raising the funds necessary to pay for these additional expenses.

Finally, the actions of the Fed in providing additional funding to the banks can also raise concerns about their role in the economy. If the Fed is seen as simply printing money to cover up banks’ mistakes, it can erode confidence in the financial system and the government as a whole. This can have negative consequences for the economy, as individuals and businesses may be less willing to invest or spend if they do not believe that the government can effectively manage the financial system.

Overall, the situation with the banks and the government’s response raises significant concerns about moral hazard, the economy, and the role of the government and the Fed in the financial system. While it is important to take steps to protect depositors and prevent further instability in the financial system, it is also crucial to consider the potential long-term consequences of these actions and work to address the underlying issues that led to the crisis in the first place.

As the banking crisis continues to unfold, with the collapse of Signature Bank and Silicon Valley Bank (SVB), many are left wondering how we got here and what lies ahead. I was going to work on another book this weekend, warning about how this can happen due to massive concentrations of wealth, but I ended up writing this instead:

To fully understand the situation, we need to go back to the 2008 financial crisis, which was caused by a complex web of factors, including deregulation, irresponsible lending practices, and an over-reliance on complex financial instruments. The crisis resulted in the failure of many banks and the near-collapse of the global financial system.

Despite efforts to regulate the banking industry and prevent a repeat of 2008, it seems that we may be facing a similar crisis once again. The collapse of Signature Bank and SVB, both known for their exposure to the cryptocurrency market, highlights the risks of unregulated and volatile markets.

While the Biden administration has moved quickly to protect depositors and prevent further bank runs, questions remain about the long-term stability of the banking system. Some experts argue that more regulation and oversight are needed to prevent a repeat of this crisis, while others argue that the government should stay out of the banking industry altogether.

Regardless of the path forward, it is clear that the banking crisis is far from over. As businesses and individuals continue to grapple with the fallout, many are left wondering what the future holds for the banking industry and the economy as a whole. Only time will tell how this crisis will play out, but one thing is certain: the consequences of inaction could, once again, be dire.

Here’s a little primer on where we are and how we got here:

Part 1: The Road to Collapse

The collapse of Signature Bank and Silicon Valley Bank (SVB) has sent shockwaves through the financial world, but it didn’t happen overnight. The seeds of this crisis were sown years ago, as the two banks pursued vastly different strategies that ultimately led to their downfall.

Signature Bank was a rising star in the banking industry, with a laser focus on the growing world of cryptocurrency. The bank saw an opportunity to cater to the needs of crypto startups and investors, and it quickly became one of the leading banks in this space. Its bespoke payments system for crypto companies helped it double deposits in just two years, and by early 2022, a significant portion of its deposits came from digital-asset clients.

But Signature’s focus on crypto would also be its downfall. As the crypto market experienced a sharp downturn, following the collapse of Sam Bankman-Fried’s FTX exchange in November 2021, Signature’s deposits began to drain away. Its exposure to crypto left it vulnerable to the whims of the market, and when the market turned against it, the bank was left in a precarious position.

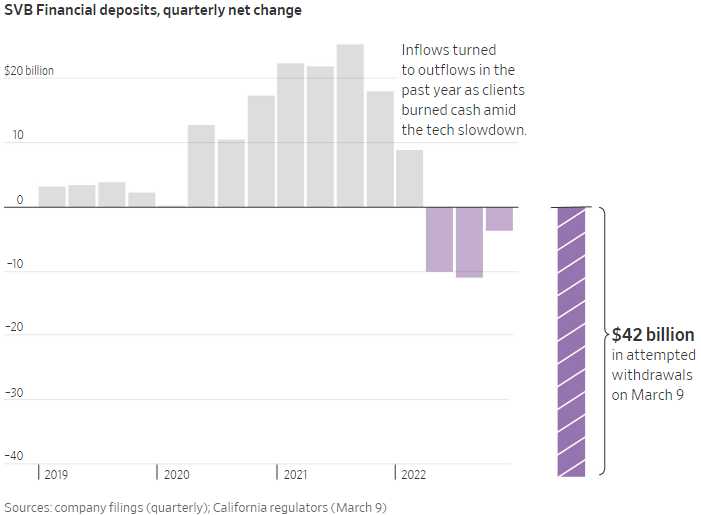

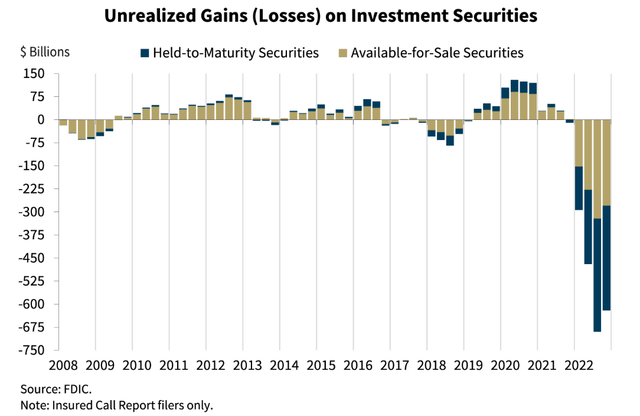

SVB, on the other hand, was a victim of its own success. The bank had seen its deposits surge in the wake of the pandemic, as federal policy responses left tech companies flush with cash. But rather than sitting on this cash, SVB invested it in longer-dated securities, which left it vulnerable to losses as interest rates began to rise. At the same time, SVB’s depositors were heavily concentrated in the world of startups and venture-capital firms, which made it uniquely vulnerable to a run.

As the tech industry began to slow down, and deposit costs began to rise, SVB’s venture-capital-backed customers began to pull their funds out of the bank. This sparked a classic bank run, with more and more customers withdrawing their funds to avoid potential losses on deposits in excess of the $250,000 limit insured by the federal government. The resulting collapse of SVB sent shockwaves through the financial world, as one of the industry’s most successful banks fell apart almost overnight.

These two very different paths to collapse demonstrate the diversity of the banking industry, and the unique challenges faced by banks in different sectors. But they also highlight a common thread running through the industry: the pursuit of profits at all costs, even if that means taking on excessive risk and leaving the bank vulnerable to collapse.

Part 2: A History of Banking Crises

The collapse of Signature Bank and SVB is just the latest in a long line of banking crises that have plagued the financial world for centuries. From the tulip mania of the 17th century to the subprime mortgage crisis of 2008, banking crises have been a recurrent theme throughout history.

One of the most famous banking crises in American history was the Panic of 1907, which was sparked by a failed attempt to corner the market on United Copper Company stock. The ensuing panic led to a run on banks, as depositors rushed to withdraw their funds before the banks could collapse. In response, a group of bankers led by J.P. Morgan stepped in to shore up the banking system, using their own money to prevent the collapse of the banks and stabilize the financial system.

One of the most famous banking crises in American history was the Panic of 1907, which was sparked by a failed attempt to corner the market on United Copper Company stock. The ensuing panic led to a run on banks, as depositors rushed to withdraw their funds before the banks could collapse. In response, a group of bankers led by J.P. Morgan stepped in to shore up the banking system, using their own money to prevent the collapse of the banks and stabilize the financial system.

The Great Depression of the 1930s was another major banking crisis, as banks collapsed en masse and depositors lost their life savings. The resulting economic hardship led to widespread unemployment and social unrest, and it took a massive government intervention to stabilize the banking system and restore confidence in the financial world.

In more recent times, the subprime mortgage crisis of 2008 led to a global financial crisis that rocked the world’s economies and left millions of people out of work. The crisis was sparked by a housing bubble,

Part 3: How We Got Here

To understand how we got here, we need to go back to the financial crisis of 2008. That crisis was caused by a combination of factors, including excessive risk-taking by banks, a housing bubble, and lax regulation. The collapse of Lehman Brothers in September 2008 triggered a global financial crisis, with banks across the world struggling to stay afloat.

:max_bytes(150000):strip_icc()/what-caused-2008-global-financial-crisis-3306176_FINAL-14548e14071e4bdb90ff985fac727225.jpg)

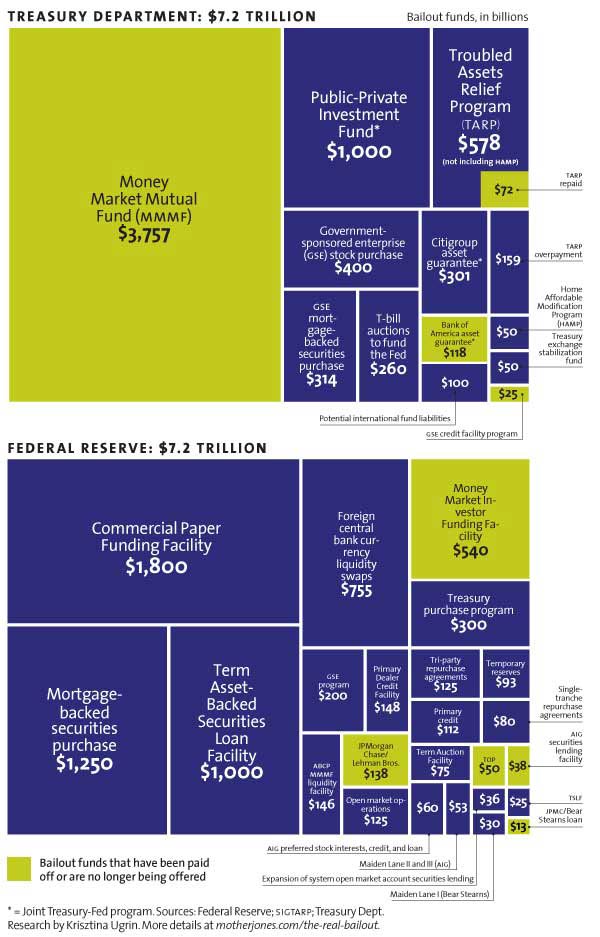

To prevent a complete collapse of the financial system, the US government injected trillions of dollars into the banking system, bailing out banks deemed “Too Big to Fail.” This rescue operation helped to stabilize the financial system, but it also set a dangerous precedent. Banks were essentially told that they could take on as much risk as they wanted, safe in the knowledge that the government would bail them out if things went wrong.

Fast forward to the present day, and we’re seeing the consequences of that policy. Banks have taken on more risk than ever before, and some of them are now facing the consequences. The collapse of Signature Bank and SVB Financial Group is just the tip of the iceberg, and there are likely to be more casualties in the coming weeks and months.

The problem is that the banking system is inherently fragile. Banks operate on a system of trust: we deposit our money with them, and we trust that they’ll keep it safe and return it to us when we need it. But if that trust is broken, then the entire system can collapse.

That’s what we saw in 2008, and that’s what we’re seeing a little of today as well. Banks have taken on too much risk, and now depositors are losing faith in the system. The run on SVB Financial Group last week, was the first salvo in a long war. If depositors start to withdraw their money from other banks, we could be facing a full-blown banking crisis. How the Government handles things in the next week, into the next Fed meeting, will be critical.

Part 4: What Comes Next?

So, what comes next? The Biden administration has already taken steps to shore up the banking system, but there’s only so much they can do. The fundamental problem is that banks have taken on too much risk, and that risk needs to be unwound.

There are two ways this can happen. The first is a controlled unwind, where banks gradually reduce their risk exposure over time. This is the best-case scenario, but it’s also the least likely. Banks are under pressure to generate profits, and reducing risk is likely to hurt their bottom line.

The second scenario is a sudden unwinding, where banks are forced to liquidate their assets quickly. This is the worst-case scenario, as it could trigger a full-blown banking crisis. If banks are forced to sell off their assets at fire-sale prices, then the entire financial system could collapse. The Fed can prevent this buy buying those assets (what’s another $600Bn?) so the banks don’t have to sell in a panic. That’s more likely than letting them collapse.

The key question is whether the government is prepared to step in again. In 2008, the government injected trillions of dollars into the banking system to prevent a collapse. But the political climate has changed since then, and there’s less appetite for government bailouts.

If we do face a banking crisis, then we could be facing a long period of economic turmoil. Banks are the lifeblood of the economy, and if they’re not functioning properly, then the entire system could grind to a halt. It’s a sobering thought, but it’s one that we need to consider. The collapse of Signature Bank and SVB Financial Group could just be the start of a much bigger problem.

https://press.princeton.edu/books/hardcover/9780691155241/fragile-by-designOne thing is clear: the events of the past week have highlighted the need for stronger oversight and regulation of the banking industry. While some may argue that government intervention is anathema to free market principles, the reality is that unchecked greed and a lack of accountability can have disastrous consequences for everyone involved.

https://press.princeton.edu/books/hardcover/9780691155241/fragile-by-designOne thing is clear: the events of the past week have highlighted the need for stronger oversight and regulation of the banking industry. While some may argue that government intervention is anathema to free market principles, the reality is that unchecked greed and a lack of accountability can have disastrous consequences for everyone involved.

As we move forward, we must remember that the health of our economy and the stability of our financial system depend on the responsible actions of those in power. Whether we like it or not, the fate of our country is tied to the decisions made by the wealthy elite who control our financial institutions.

So let us be vigilant in holding these institutions accountable, and let us work towards a future where the needs of all Americans are considered, not just those of the wealthy few. Only then can we truly call ourselves a Democracy that works for everyone.