$2,000,000,000,000!

$2,000,000,000,000!

That’s the magic number for the Fed’s Bank Term Funding Program (BTFP – get used to saying it), which is aimed at injecting funds into the US banking system and easing the liquidity crunch. But as JPM warns, this program is likely to be big, indicating that we may have massive problems that are still unseen by the public.

This massive bailout follows a series of events that have hit the markets one after the other; from the collapse of three lenders to the liquidity crunch caused by the Fed’s quantitative tightening and rate hikes – the banking sector has been facing significant challenges.

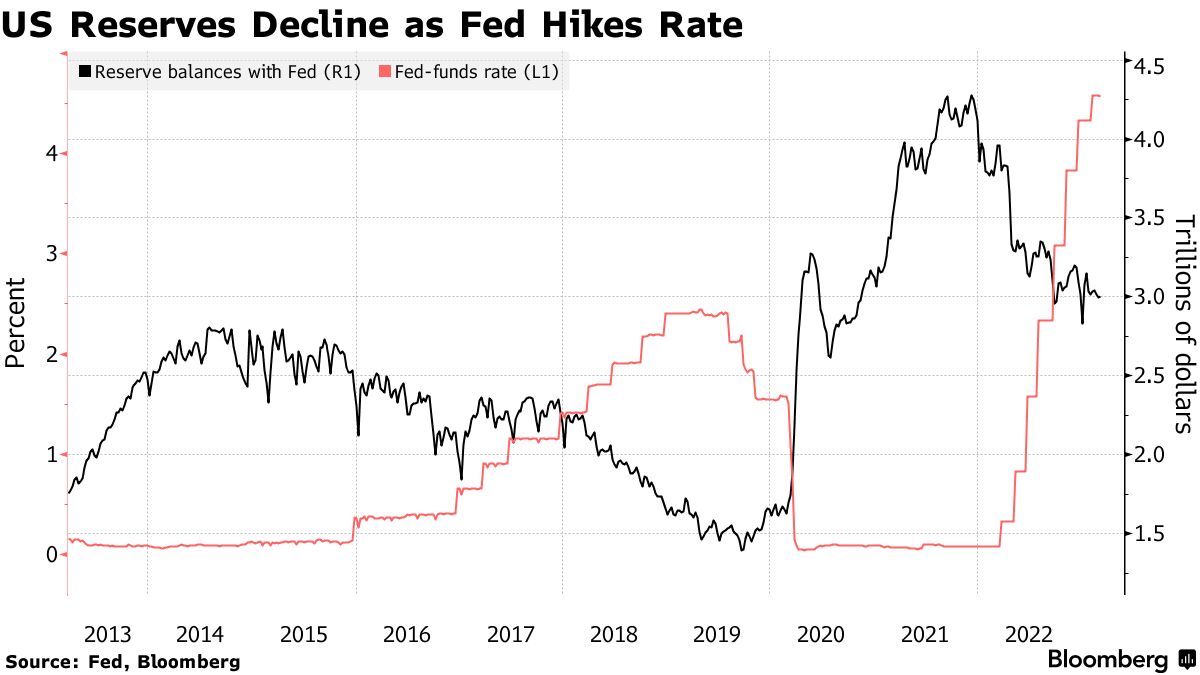

It’s no wonder that Treasury 2-year yields have tumbled more than 60 basis points this week amid speculation that the Fed will skip the interest-rate hike next week as it seeks to stabilize the banking sector (since those two things appear to by dynamically opposed). The fact that the Fed feels that $3Tn of reserves remaining in the US banking system (see chart above) is NOT ENOUGH to address the tightening that has taken place over the past year has got to be a little bit concerning, right?

It’s clear that the Fed is taking drastic measures to prevent a fire sale of sovereign debt to obtain funding, and the BTFP (see, comes in handy already!) is just one of them. BUT, as we watch this massive bailout sweep bank issues under a huge rug, it’s hard not to wonder what other problems are still lurking beneath the surface?

It’s clear that the Fed is taking drastic measures to prevent a fire sale of sovereign debt to obtain funding, and the BTFP (see, comes in handy already!) is just one of them. BUT, as we watch this massive bailout sweep bank issues under a huge rug, it’s hard not to wonder what other problems are still lurking beneath the surface?

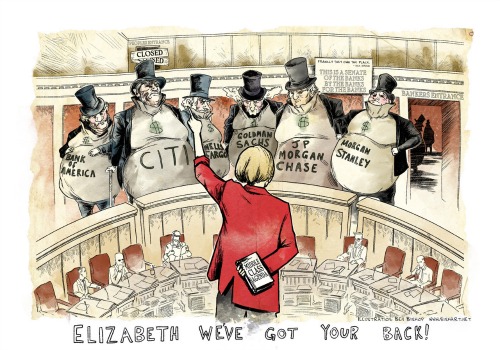

It’s hard not to question the ethics of a system that requires such massive bailouts to keep it afloat. Perhaps it’s time for the banking sector to take a long, hard look at its practices and start prioritizing the needs of the people it serves over its own self-interest?

Elizabeth Warren, writing in the New York Times, argues that recent bank failures in the United States are a direct result of the weakening of financial regulations in Washington. She points out that, in 2018, big banks lobbied Congress to roll back critical parts of the Dodd-Frank Act, which was put in place after the 2008 financial crisis to protect consumers and prevent banks from causing economic disaster.

The loosening of these regulations allowed banks to take on more risk and make decisions that threatened their stability. Warren asserts that this is what led to the recent collapse of Silicon Valley Bank and Signature Bank.

The loosening of these regulations allowed banks to take on more risk and make decisions that threatened their stability. Warren asserts that this is what led to the recent collapse of Silicon Valley Bank and Signature Bank.

She correctly argues that Congress, the White House, and banking regulators should reverse the deregulation of the Trump era and reform deposit insurance to ensure that businesses are fully covered, while the cost of protecting large depositors is borne by the institutions that pose the greatest risk. She also urges elected officials to demand stronger oversight rather than the weaker oversight the Banksters have been enjoying.

Greg Becker, CEO of Silicon Valley Bank, lobbied Congress to weaken the law in 2018 and the big banks won. With support from both parties, Trump signed a law to roll back critical parts of Dodd-Frank, which were enacted to protect us after the last crisis. Regulators, including Fed Chair Powell, then made a bad situation worse, letting financial institutions load up on risk.

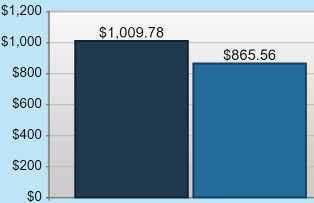

In fact, Becker took home $9.9 million in compensation last year, including a $1.5 million BONUS for boosting bank profitability — AND its riskiness! Joseph DePaolo of Signature Bank got $8.6 million as a reward for taking more risk with his bank’s money. That’s the way the incentives run – make money at all costs and losses will be borne by the taxpayers…

By taking on all the low interest-paying notes the banks have, the Fed gets to pretend all is well because they don’t have to redeem them so, even though the redemption value of a note may be 15% below the face value, the banks are being allowed to sell them to the Fed at full price.

By taking on all the low interest-paying notes the banks have, the Fed gets to pretend all is well because they don’t have to redeem them so, even though the redemption value of a note may be 15% below the face value, the banks are being allowed to sell them to the Fed at full price.

TECHNICALLY, since the Fed doesn’t have to re-sell the notes, they will collect the 1.25% (or whatever) interest until maturity and then they get back their $1,000 so – not only do they not show a loss – but they show a profit on the interest! It’s the perfect crime because the Fed’s magic checkbook allows them to first claim the note as an asset and then use that asset to back the money the Fed creates to buy the note from the bank.

It seems victimless but that same obligation could have been taken on by the Fed to wipe out 100% of all student loans ($1.7Tn) or to build a $300,000 home for all of this countries 500,000 homeless people ($150Bn – I don’t know why we don’t do this anyway in our $6.8Tn budget). Or, the Fed could just become a bank that lends money to ordinary citizens when they want to buy a home and they could take your home as an asset and you can pay them back whenever – that’s what banks do!

But Noooooo! We just sit back and let the banking sector continue to prioritize its own self-interest over the needs of the people it supposedly serves. We just accept the fact that the Fed is bailing out banks to the tune of Trillions of dollars while Millions of Americans struggle with Student Loan Debt, Homelessness, and lack of access to Affordable Housing and Affordable Health Care.

But Noooooo! We just sit back and let the banking sector continue to prioritize its own self-interest over the needs of the people it supposedly serves. We just accept the fact that the Fed is bailing out banks to the tune of Trillions of dollars while Millions of Americans struggle with Student Loan Debt, Homelessness, and lack of access to Affordable Housing and Affordable Health Care.

We need to DEMAND stronger oversight of the banking sector and a reversal of the deregulation that has allowed banks to take on more risk and make decisions that threaten their stability BEFORE the next crisis is upon us. We need to ensure that Deposit Insurance is reformed to protect businesses and depositors, and that the cost of protecting large depositors is borne by the institutions that pose the greatest risk.

We need to hold the CEOs of these banks accountable for their actions and demand that they prioritize the needs of their customers over their own profits. And we need to demand that the Fed uses its magic checkbook to invest in the people and the future of this country, not just in propping up a broken banking system – over and over again.

So let’s not just accept another massive bailout as business as usual. Let’s use this moment to demand real change, to demand a system that works for everyone, not just the wealthy few. Why should we accept anything less?