Things are looking up!

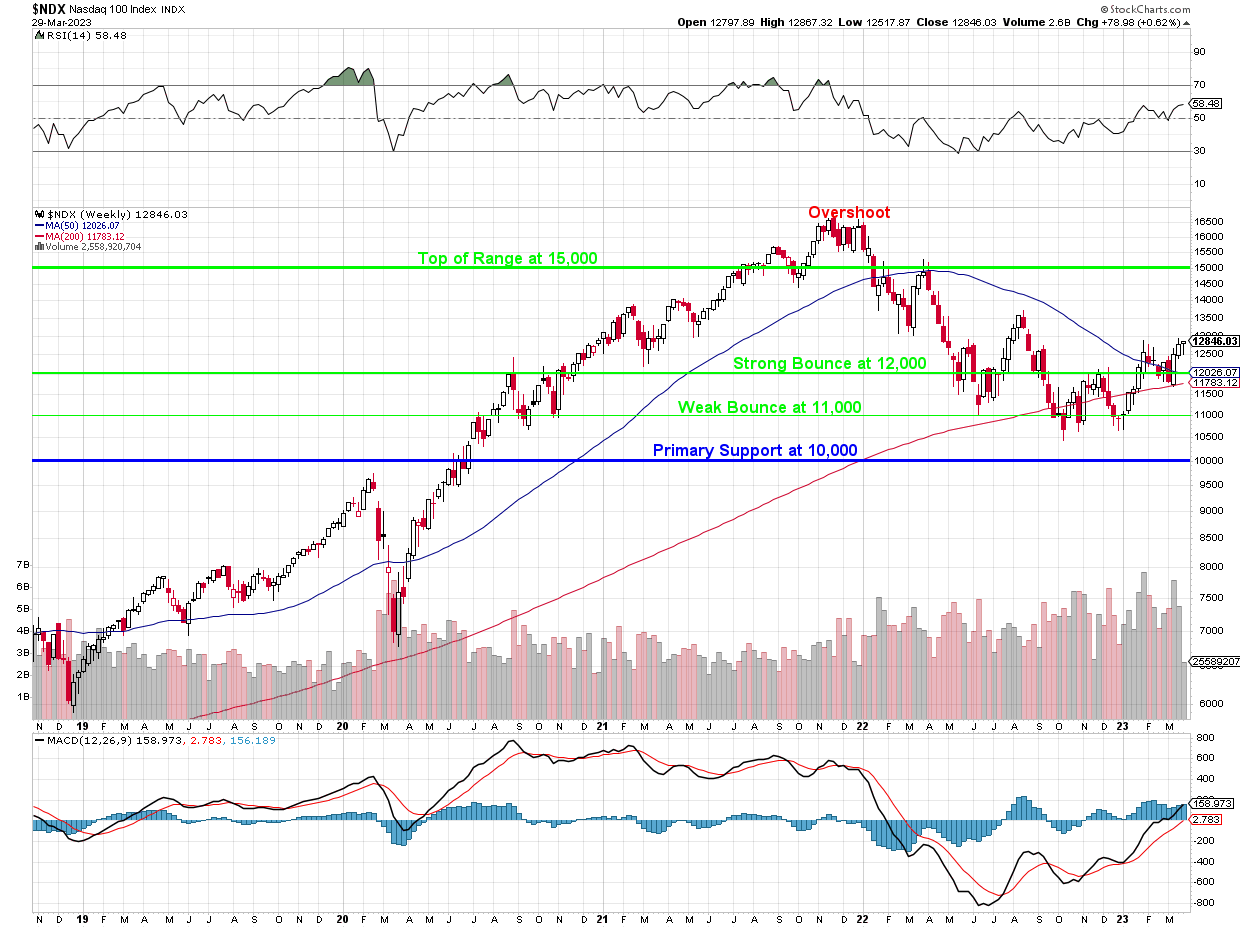

In what is looking like the shortest banking crisis ever, it’s been nothing but up for the Nasdaq since our March 10th low – just a bit below 11,700. Now we’re back over 13,000 this morning and that’s up 11% so we’ll see how it goes. An overshoot would take us to 12% (13,104) so we’re not cleared for 14,000 until we break that barrier.

In the grander scheme of things, we fell from 16,500 to 10,500 and that’s a 6,000-point drop during 2022 and now, in 2023, we’re looking at a 2,400-point rise, which is what we call a “Strong Bounce” using our 5% Rule™. No one is impressed by a strong bounce that takes 3 months and we’ll be watching this area very closely to see if there’s any sort of rejection tomorrow, when we get Personal Income, PCE and Consumer Sentiment data.

For today, however, think of it like a roller-coaster clicking up the hill and enjoy the view.

For today, however, think of it like a roller-coaster clicking up the hill and enjoy the view.

We discussed the upcoming data in yesterday’s Live Member Chat Room and we’re concerned that inflation will come in hotter than expected (0.4%) in tomorrow’s PCE Report. That and the lower Dollar are what is keeping us from adjusting more bullish but we did buy a ton of longs last week – it’s just our hedges that we are still a bit too aggressive on, perhaps.

We also have 1,800 on the Russell to contend with and the Russell is down from 2,400 last summer to 1,700 and that was just under a 30% drop and the bounces should be 20% of 700 (140) to 1,840 (weak) and 1,980 (strong) but we’ll call it 1,850 and 2,000 as the Russell has a tendency to hit the round numbers.

So we have our goals and that means we can take the emotion out of our observations and let the facts guide us at this potential turning point (for good or ill). The Nasdaq is attempting to hold it’s strong bounce but it’s on the WEEKLY chart, so it has to hold it for 2 weeks before we believe it. With the Russell – a few days over 1,850 would impress us enough to pull back our hedges – despite our misgivings.

Tomorrow is shaping up to be a very important day and Investors will be paying close attention to the numbers, which will provide clues about the state of the economy and whether inflation is under control – our out of it. The Dollar has dived back to 102 and that is supporting the indexes based on the idea that our Fed is about done tightening but, what if they are wrong?

See – Dollar down 2.5%, S&P up 4.5% – nothing at all impressive about that as a 2:1 relationship is standard….

Of particular interest tomorrow will be the PCE Prices report, which measures inflation at the consumer level. Analysts are expecting a 0.4% increase for February, which would be down from the previous month’s 0.6% increase but still MUCH higher than the Fed’s target of 2% annual. If inflation comes in hotter than expected, it could signal that the Fed might need to raise interest rates again to keep prices in check.

Meanwhile, Personal Income and Spending are expecting to show modest gains for both measures, with Personal Income forecasted to rise by 0.2% and Personal Spending by 0.3%. If the numbers come in higher than expected, it could be a sign that consumers are feeling more confident about the economy and are opening up their wallets but too much income signals more inflation and, again – the Fed has to act.

Then we have the Consumer Sentiment report, which measures consumers’ attitudes about the economy. Analysts are expecting a modest increase to 63.6, up slightly from the previous month’s reading of 63.4 but it’s going to greatly depend on WHEN they took the poll in light of our recent melt-down. Investors will be watching closely to see if there are any surprises, and how the markets will react.

So buckle up, it could be an interesting ride!