The Dollar is falling – again.

The Dollar is falling – again.

Our favorite currency is down is down 0.5% from yesterday and that SHOULD be boosting the indexes 1% – so anything less than that means the Dollar is just masking the weakness and that’s why the Banksters manipulate the Dollar to hide the fact that they are dumping equities, or oil – and today it’s both.

It’s like the old saying goes: “When the going gets tough, the tough start manipulating currency.” And these Banksters certainly know how to play the game. They can pull levers and push buttons to make the dollar rise or fall at will, all while merely mortal traders are left holding their breath and wondering what’s really going on. So I’ll tell you:

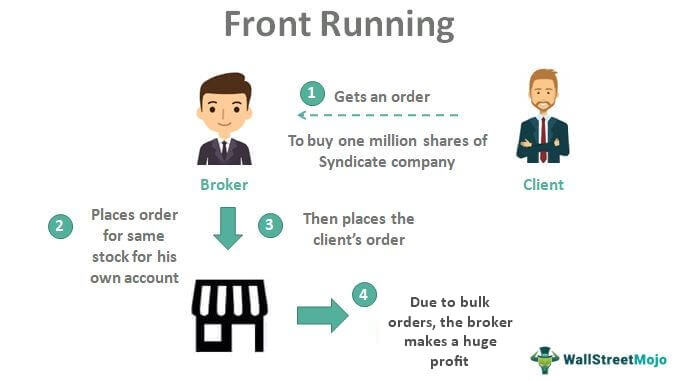

Hedge Funds and other financial institutions use various tactics to manipulate currency markets for profit. One method is through “Front Running” – this involves buying or selling a currency ahead of a large order in order to profit from the ensuing price movement. For example, if a Hedge Fund knows that a large order for Euros is coming in, it might buy Euros ahead of time to drive up the price before selling them at a profit once the large order hits the market.

Another tactic is called “Stop Hunting,” which involves intentionally triggering stop-loss orders placed by other traders. A stop-loss order is an instruction to sell a currency if its value drops to a certain level, and if enough traders have stop-loss orders at the same level, a large sell-off can occur. Hedge Funds can exploit this by pushing the currency down to trigger the stop-loss orders and then buying up the currency at a lower price.

In thinly-traded futures markets, Hedge Funds might use spoofing to manipulate prices. This involves placing fake orders to give the impression of market demand or supply. For example, a hedge fund might place a large buy order for a currency, only to cancel it at the last minute once the market moves in their favor.

These tactics can be difficult to detect and prosecute, and some Hedge Funds might argue that they are simply exploiting inefficiencies in the market. These tactics can have significant impacts on currency markets and can distort fair market value which, in cases like this, is their intention (to mask large-scale equity selling).

Let’s not forget that this game has consequences. Sure, the banks might be able to cover up their selling for a little while, but eventually, the truth will come out and, when it does, the markets will react accordingly. For now, we’ll just have to sit back and watch the Dance of the Dollar while we wait for reality to set in.

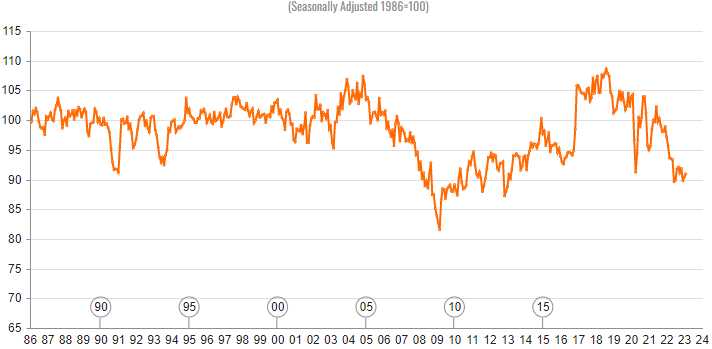

The Small Business Optimism Index came out this morning at 91 and it was 82 in 2009 so YAY – I guess. More to the point, we were at 108 before Covid and 82 was the all-time low so we’re 17 from the top and 9 from the bottom – to give it some perspective.

Why did 2020 not get a circle? This needs to be investigated! I do like how they assume we’re smart enough to understand the transition at the century mark without making the numbers bigger – this is how people should do long-term graphs – we do get it…

As noted above, 1986 was 100 so we are 9% less confident than we were in 1986 but 1986 was the year Chernobyl melted down (April 26) and the Challenger exploded (Jan 28th) and the Iran-Contra Affair became known (November) and we attacked Libya (April 15th) – not the best baseline year for business confidence, was it?

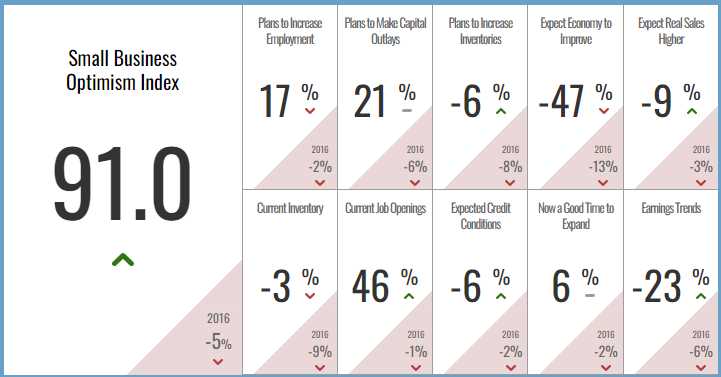

More to the point, 17% more small businesses plan to increase employment than last year and 21% more plan to make Capital Outlays. 6% less plan to increase inventories and a whopping 47% less than last year expect the economy to improve – that does not bode well for Consumer Sentiment. Oddly, 46% more than last year have job openings (bad if you want the Fed to pause) and 23% less expect Earnings to Increase – bad for upcoming Earnings Reports. On the whole – a troublesome report.

BitCoin is back over $30,000 and that’s less to do with a weaker Dollar and more to do with people panicking out of banks. Gold is also benefitting at $2,017 and Silver is at $25 which is great for GOLD and WPM – two stocks we have a lot of as this is pretty much what we expected would happen this year.

Speaking of commodities, we got a nice pop in Natural Gas this morning, which is great as it held our $2.15 line yesterday, as we discussed in our Live Member Chat Room. Congrats to all our Members who played along with us. If $2.25 fails again – we’ll stop out 1/2 at $2.20 and the other at $2.15 to lock in $3,000 in gains.

Speaking of commodities, we got a nice pop in Natural Gas this morning, which is great as it held our $2.15 line yesterday, as we discussed in our Live Member Chat Room. Congrats to all our Members who played along with us. If $2.25 fails again – we’ll stop out 1/2 at $2.20 and the other at $2.15 to lock in $3,000 in gains.

Speaking of gains – I was going to review our Top Trade Alerts from Q1 but March knocked back a lot of our profits so most of them are still available as new trades. We had SPWR on 1/27, UNG on 2/9, YETI on 2/23, SPWR again on 2/24 (because it was still cheap), CSCO on 3/8 and NYCB on 3/21 (great call). All in all, it was a slow quarter for Top Trades but that’s because we knew there were problems – so why buy into trouble?

Our Q4 Top Trades were up $100,465 when we reviewed them on Jan 27th and we’ll just see how Q1 was for them in charts:

Looks like our 9 Top Trades from Q4 held up pretty well in Q1 as we continue on the way to our next $100,000 in gains. BBAR was our only bank play but they were so stupidly cheap in October ($3), that we didn’t see any danger in taking a position. NYCB we added for good reasons after the crash and, if we can get past the next two weeks – we’ll probably pick another Bank and another REIT to play with.

For now, in all things – we remain a bit cautious ahead of Earnings, which start this week and the Fed, which is May 3rd.

Be careful out there!