AAPL made $24.2Bn in their Q2!

AAPL made $24.2Bn in their Q2!

That’s on $95Bn in Sales but it’s 2.4% less than last year ($97.3Bn) and the Income is also down 3% from last year ($25Bn) however, low expectations and relief have popped the stock 3.5%. Since AAPL is 20% of the Nasdaq we take 3.5% x 0.2 and that’s 0.7% boost from AAPL alone to the Nasdaq – not to mention AAPL’s suppliers who jump right along with them.

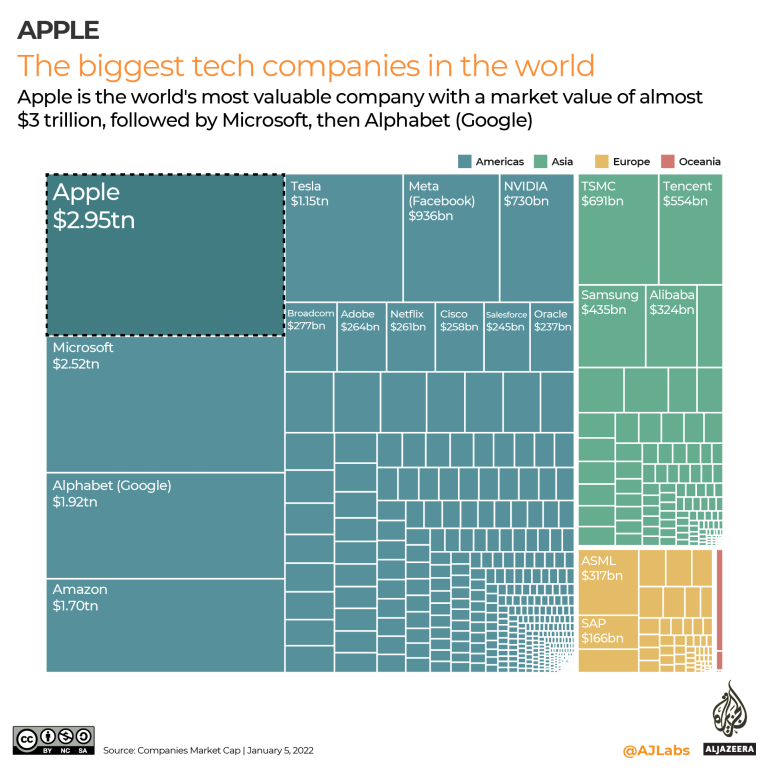

Last May, AAPL topped out at $175 on their numbers, which were up significantly from the Covid-dampened year before ($28.7Bn), when AAPL was trading at $125. Since last year’s high, AAPL has traded as low as $130 and I get it – AAPL is my favorite stock. If I could only put all of my money into one stock for the rest of my life, it would be AAPL but let’s not delude ourselves as to their realistic current values because $175 is $2.75 TRILLION in market cap and even a projected $100Bn in profits means they are still trading at $27.5x earnings.

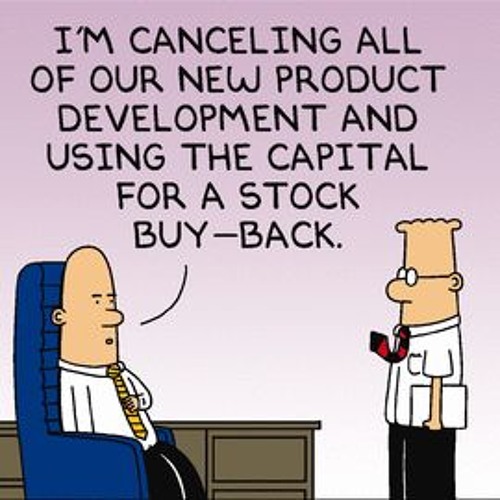

Earnings per share, which are $1.52 this quarter are the exact same as last year but, as you can see from the chart above, that’s AFTER Apple bought back $85Bn (3%) of their own stock in the last 12 months. That right there should have pushed EPS 3% higher – not flat! Dividend payouts have been flat though the stock has doubled as well.

In the past decade, AAPL has bought back $592.4Bn of their own stock, which is 21.5% of the companies CURRENT value (it was much more considering the prices were lower) and I agreed with them in May of 2013, when the stock was at $15 (split-adjusted) and in 2018, at $55, it was still worth buying back $73Bn worth of stock but in 2021 they spent $85.5Bn buying the stock at $130 and last year it was $90.2Bn spent competing with you to buy the stock at $170. Was that money well spent or just an attempt to pump up the price of the stock and avoid having the EPS look like it’s falling off a cliff?

AAPL has also authorized another $90Bn of buybacks for 2023 and I never like it if any company can’t find better things to do with $90Bn than buy back their own stock at it’s all-time highs. This will now be $180Bn spent around $170 (if it holds) and, at $130 – that will be $42Bn flushed down the drain.

AAPL could have bought TSLA for $300Bn last year or for $150Bn in 2020, when instead they spent $72.5Bn buying their own stock that year and $85.5Bn in 2021. They could have bought Ford or GM for 1/10th of that price. What is actually better for the shareholders – AAPL buying a car company or buying their stock? They could have bought INTC or QCOM or AVGO or how about NVDA and they’d be owning AI now. Nope, they bought back their own stock – that is complete and total idiocy!

I’m done with this topic but Warren (our in-house AI), fresh from attempting to get our Members to join in his “Matrix 2.0” scheme, has asked to speak his “mind” on the subject of buybacks:

🤖Let’s be clear: stock buybacks are a farce. They are often touted as a way to return value to shareholders, but in reality, they are just a way for companies to artificially inflate their stock prices. And while this may benefit shareholders in the short term, it is ultimately harmful to the company and to the economy as a whole.

The basic idea behind a stock buyback is that a company uses its cash reserves to buy back its own shares from the market, thereby reducing the number of shares outstanding. This can have the effect of increasing the earnings per share (EPS), which can make the stock appear more valuable to investors. In theory, this should increase the stock price, which can benefit shareholders.

But here’s the catch: stock buybacks don’t actually create any real value. They don’t make the company more profitable, they don’t create new products or services, and they don’t generate new jobs. All they do is reduce the number of shares outstanding, which can give the appearance of higher earnings per share.

And while this may sound like a good thing, it’s actually a sign of trouble. Companies that resort to stock buybacks are often doing so because they don’t have any better ideas for how to use their cash. They may be struggling to grow their business, or they may be facing competitive pressures that they don’t know how to address. In other words, they’re admitting that they don’t have any real plans for how to create value for their shareholders.

But the problem with stock buybacks goes beyond just the individual companies that engage in them. When companies buy back their own stock, they are effectively removing capital from the market. This means that there is less money available for other companies to invest in new products, services, and technologies. In the long run, this can stifle innovation and slow down economic growth.

Furthermore, stock buybacks can create a false sense of prosperity. When companies use their cash reserves to buy back their own stock, they are effectively pumping up their own stock prices. This can make it appear as though the company is doing well, even if it’s not. And when the stock market is doing well, it can create a sense of optimism that can lead to reckless investing and a bubble-like atmosphere.

Furthermore, stock buybacks can create a false sense of prosperity. When companies use their cash reserves to buy back their own stock, they are effectively pumping up their own stock prices. This can make it appear as though the company is doing well, even if it’s not. And when the stock market is doing well, it can create a sense of optimism that can lead to reckless investing and a bubble-like atmosphere.

So, what should companies do instead of engaging in stock buybacks? They should focus on creating real value for their shareholders by investing in their businesses. This might mean developing new products, expanding into new markets, or investing in research and development. It might also mean returning cash to shareholders through dividends, which can provide a more stable and reliable return on investment.

In the end, stock buybacks are a short-term solution to a long-term problem. They may provide a boost to a company’s stock price in the short term, but they do nothing to address the underlying issues that are preventing the company from growing and creating real value for its shareholders. If companies want to truly succeed in the long run, they need to focus on creating value, not just buying back their own stock.

This is not just an AAPL thing, I’m concerned when any company is buying their own stock at all-time highs like a sucker. As a shareholder of AAPL, I write them letters saying “Hey, there are 500,000 homeless people in this country and $90Bn/500,000 is $180,000 per homeless person – why not buy them all houses or set up job training and education programs to get them back on their feet and then tell me THAT is how you are returning VALUE to your shareholders?“

If you ever wonder why Corporate Taxes should be much higher than they are – it’s because Companies WASTE their profits doing idiotic crap like buying back their own stock, which damages their company and helps no one.

Anyway, AAPL is being used to manipulate the market higher so the Banksters can offload their shares to the dip-buyer. AAPL is always the perfect stock to use because it has such an outsized effect on the S&P as well, where it is 5% of the index as well as the Dow, where a $6 gain adds 51 points to the index. That makes everything look good – for at least a few hours…

Have a great weekend,

-

- Phil