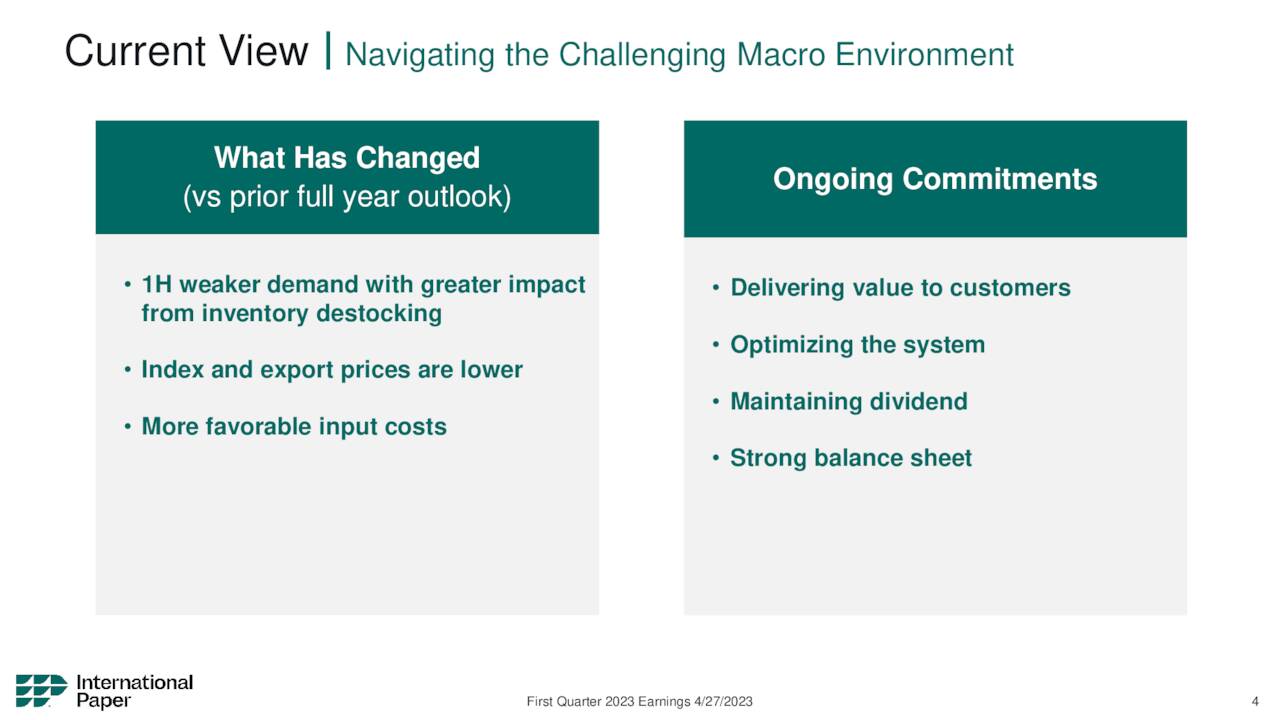

🤓According to the web search results, International Paper (IP) is a global manufacturer of renewable fiber-based packaging and pulp products1. It has a 6% dividend yield but weak long-term performance, making it a value stock1. The company faced headwinds in Q1 2023 due to inventory destocking and adverse market conditions, but expects improvement in the second half of the year1. The stock is fairly valued, but the risk/reward is favorable, and improved economic growth could lead to a higher stock price, making it suitable for a high-yield portfolio1.

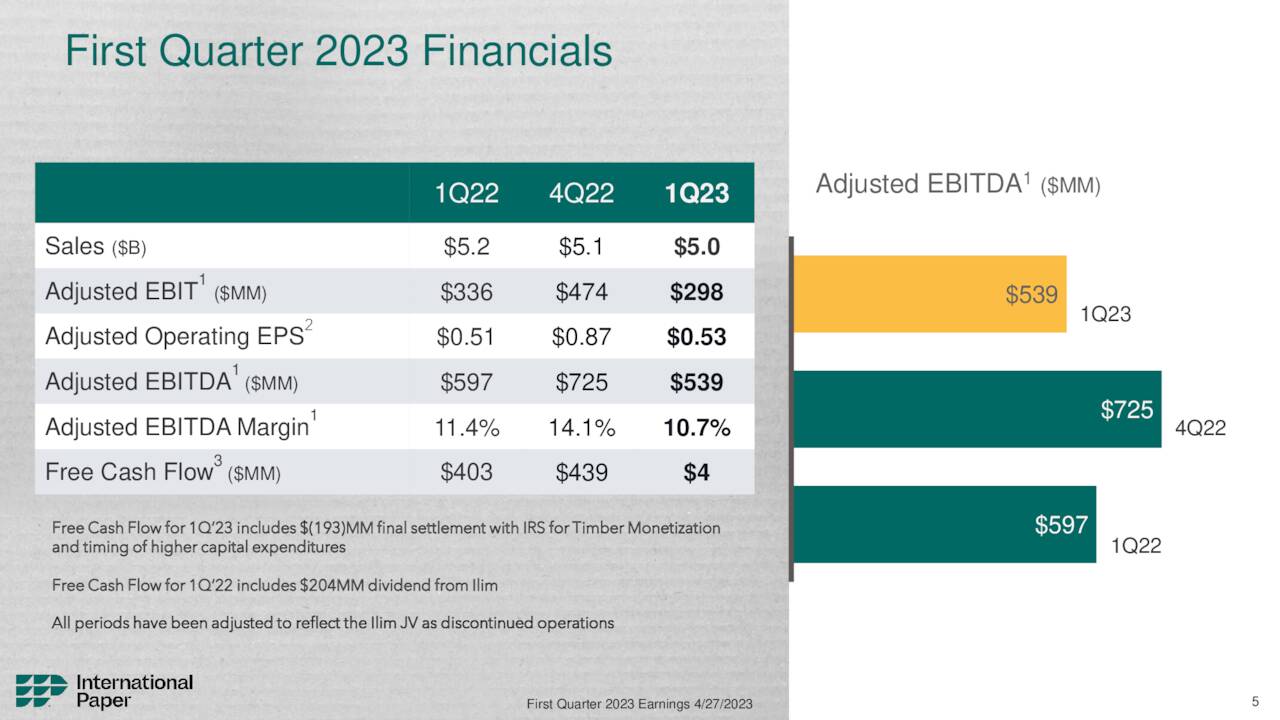

However, IP’s stock price is extremely cyclical and depends on consumer demand and input costs1. It has declined by roughly 50% from its 2021 highs and is trading at the lower boundary of its long-term trading range1. The company reported a 39% year-over-year decline in adjusted earnings per share for Q1 2023, although it beat the consensus estimate by a margin of 8.2%2. The company’s revenue also fell 9.4% year-over-year to $5.02 billion in Q1 20233.

Therefore, playing the stock going forward may depend on your risk appetite and time horizon. If you are looking for a stable income stream and believe in the company’s long-term prospects, you may consider holding or buying the stock at its current low price. However, if you are looking for capital appreciation and growth, you may want to look elsewhere or wait for signs of recovery in the company’s performance and outlook.

IP is on our watch list and it's back to where we liked it in November ($29.26).

EPS was 0.53 vs 0.51 a year ago, so not tragic and people thought they were worth $45 last year.

See, there's another trick, they made less money but they bought back shares so EPS looks better than it really is!