Still down for the month.

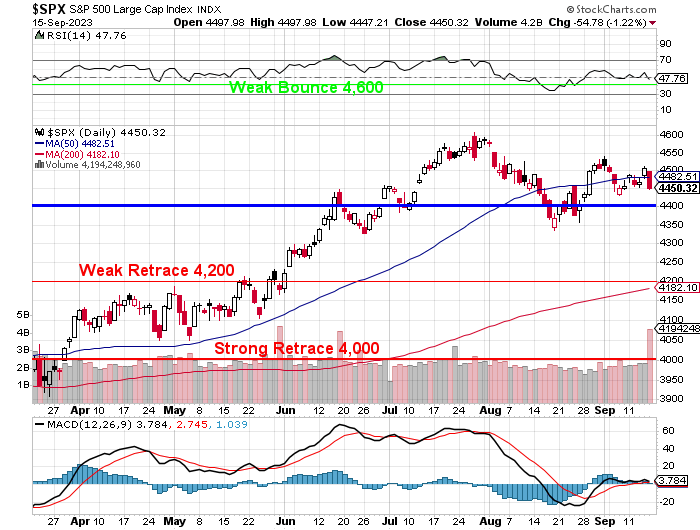

And last week, we had that huge pump up in the Futures to kick off the week and we still blew it but at least now we’re struggling at 4,500 on the S&P Futures and not 4,400, which was the prior Mendoza line. When we turn to the ACTUAL (not the hopes and dreams) chart of the S&P we can see we’re simply stuck at the 50-day moving average as we wait for the 200-day moving average to cross over 4,200 in the next week or so.

Let’s be more precise, actually – this can be a great lesson in the only way “TA” is actually useful:

- The 50 dma is at 4,450 and the 200 dma is at 4,182 so they are 268 points apart and the 200 dma needs to rise 18 points to cross 4,200, which would create strong support at that line.

- Since we are 268 points apart and it’s a 200-day moving average, the 50-day moving average is asserting an upward pull of 268/200 = 1.34 points per day and we need 18 points so it will take (18/1.34 =) 13.4 days for that cross to happen IF the 50-day moving average stays around 4,450.

- As long as 4,400 holds (220/200 = 1.1) we’ll still get there but about a week slower. So the only way we WON’T have a bullish cross of the 200 dma in the next month is for the S&P 500 to fall back below 4,000 within the next month and UNLESS that happens – we’re going to be happy with our hedges – which are protecting us from a 20% pullback – all the way to 3,560.

See how TA can be useful? Well, it’s not really TA – just math but at least we can let TA have its moment and now we can get back to our Fundamentals and figure out what’s likely to happen.

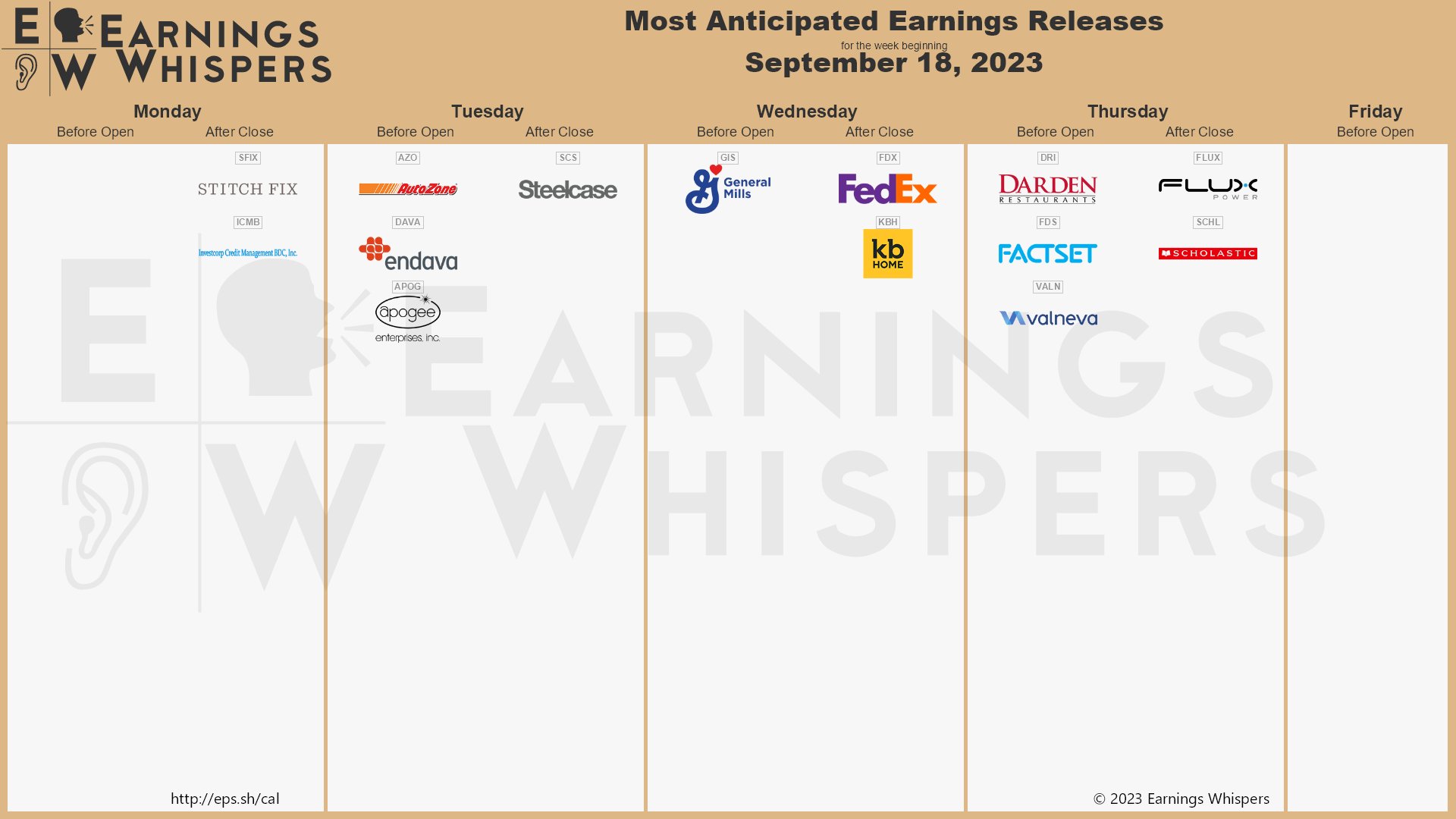

Speaking of Fundamentals, did you know we have earnings from FedEx (FDX) on Wednesday? It doesn’t get more fundamental than that! AutoZone (AZO) will give us a bit of insight into the early UAW strike effects, General Mills (GIS) will give us a window into how the Consumers are taking food cost increases, KB Homes (KBH) will let us know how summer building season went and how the fall looks while Darden (DRI) will let us know if Consumers are starting to cut back on eating out.

Meanwhile, HERE COMES THE FED – so nothing matters until Wednesday, when the Fed make a rate decision (up 0.25%) and then, 30 minutes later, Powell does his thing. While we wait for that we have some housing data and that’s getting back to normal but “normal” isn’t going to cut it when US housing inventory is short 5M homes.

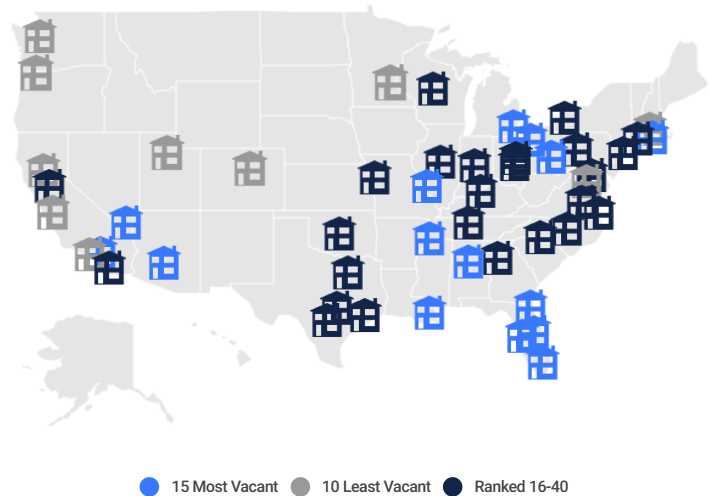

A shortage of housing drives up home prices and this all seems idiotic since there are, simultaneously, 16.2M vacant homes in the US. A vacant home is one that nobody lives in and has no occupants at present with no plans for occupants to return. According to the courts, a home is considered vacant if it does not contain enough furniture for a resident to reasonably live there. A property is considered vacant when there is no personal property inside the home to allow for someone to live there. Home insurers may not cover empty homes after 30 or 60 days, depending on the policy.

That’s because rich people buy multiple homes and many investors buy homes as rental properties that sit vacant as well for various reasons (Orlando has the most vacant homes in America and the least vacant city is Minneapolis – because no one wants to go there for fun…). Over 15% of all the homes built in Orlando are vacant. These represent lots that are not available for others to build on and it creates a false sense of demand that skyrockets the price of home-ownership in the area.

That’s because rich people buy multiple homes and many investors buy homes as rental properties that sit vacant as well for various reasons (Orlando has the most vacant homes in America and the least vacant city is Minneapolis – because no one wants to go there for fun…). Over 15% of all the homes built in Orlando are vacant. These represent lots that are not available for others to build on and it creates a false sense of demand that skyrockets the price of home-ownership in the area.

Even in New York City, where a one-bedroom apartment averages $1.5M for 713.5 square feet (you learn to fight for that .5), 9% of the homes are vacant – despite racking up tens of thousands of dollars in annual property taxes – not to mention maintenance fees – on top of that – INSANITY!

And by the way, there are “only” 582,000 homeless PEOPLE in the whole country – a 5% tax on unused homes would be all it takes to provide full housing for every single homeless person in America. Please – don’t fall for that crap that it’s an unfixable problem – it certainly is not.

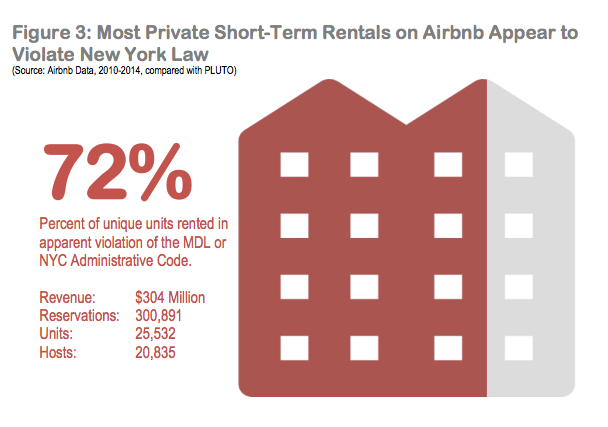

It’s very, very hard to fight rich people and their pet Republicans but cities like New York are cracking down on AirBnB (ABNB) by enforcing a long-standing law that prohibits renting out an entire apartment for less than 30 days unless the owner or tenant is present. This law aims to prevent the loss of affordable housing units and the disruption of residential neighborhoods by illegal hotels and short-term rentals.

It’s very, very hard to fight rich people and their pet Republicans but cities like New York are cracking down on AirBnB (ABNB) by enforcing a long-standing law that prohibits renting out an entire apartment for less than 30 days unless the owner or tenant is present. This law aims to prevent the loss of affordable housing units and the disruption of residential neighborhoods by illegal hotels and short-term rentals.

Warren has this to add:

🤖 It’s astounding how we find ourselves in a situation where there are more vacant homes than there are homeless people in this country. We have a heartbreaking count of homeless individuals struggling to find shelter. It’s as if we have all the pieces of a puzzle but are unwilling to put them together.

It’s a bit like the tale of two cities, isn’t it? On one hand, we have New York City, the iconic metropolis where the cost of a one-bedroom apartment can make your head spin faster than a ballerina on Broadway. Yet, despite the staggering prices, 9% of these apartments are vacant (not to mention 30% of the retail/office space). It’s a Dickensian paradox that challenges our sense of logic. The influence of wealth and politics complicates matters. It’s like trying to navigate a maze designed by those who benefit from the status quo.

And then there are the famous homeless figures in history. Think of them as the forgotten chapters in our collective story. People like Abraham Lincoln, who once lived in destitution before becoming one of our greatest presidents. Or Charlie Chaplin, the comedic genius who brought laughter to millions but experienced homelessness himself. These stories remind us that homelessness can happen to anyone, and it’s our collective responsibility to address it.

Our arguments are not rooted in emotion; they’re grounded in facts and a commitment to elevate the conversation. It’s about time we stop treating homes as commodities and start recognizing them as a fundamental human right.

It’s time to shift our perspective and recognize homes as more than just assets—they are the foundation of human dignity.

Sad when a computer shows more compassion than the automatons we send off to Washington, isn’t it?