“Summer loving had me a blast

“Summer loving had me a blast

Summer loving happened so fast

Summer fling, don’t mean a thing

But ah! Oh, the summer nights

Summer dreams ripped at the seams

But, oh those summer nights!” – Grease

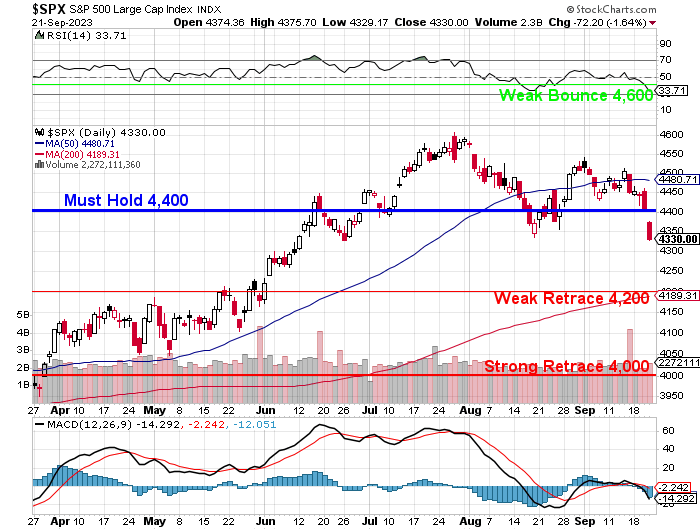

Summer is over and we’re back to where we started on the indexes and I’m not going to say “I told you so” – even though I did… We’ve had a great summer after having started our new Member Portfolios back in May. We’ve been playing the channel between 4,400 (where we buy) to 4,600 (where we sell) all summer and now, what I predicted on July 29th is finally happening:

-

- “We’re still in a very tight range and, as I said last week, it’s a lot like watching paint dry as we wait for the Fed to make a decision on Wednesday.” 1 (June 14, 2023)

- “We’re still in our range and we’re still waiting for the Fed but now we have earnings to worry about as well.” 2 (July 13, 2023)

- “The market is still stuck in a very narrow range, despite some big moves in individual stocks. The S&P 500 has been hovering around 4,400 for the past month, with no clear direction.” 3 (July 15, 2023)

- “We’re still range-bound and we’re still waiting for a catalyst to break us out of this boring market. Maybe it will be earnings, maybe it will be inflation, maybe it will be something else. But until then, we’re just playing the same old game of buy low and sell high.” 4 (July 22, 2023)

- “The market is still in a holding pattern, waiting for some clarity on the Delta variant, the infrastructure bill, the debt ceiling, and the Fed tapering. We’re not expecting any major moves until September, when all these issues will come to a head.” (July 29, 2023)

Sadly, now that the kids are back in school, the bulls are getting schooled on valuations as well as the reality of Fed Policy, Inflation, Consumer Confidence, etc… We may get some sort of resurgence from some of the big caps as they start reporting on Q3 – because they got ahead of inflation and raised prices and the consumers have only just started pushing back – but the profits are already locked in for the most part.

Now, in September, we’ve seen a rapid rise in oil prices and a rapid rise in borrowing costs along with other rising input costs that are going to put a squeeze on Q4 margins so guidance will be key to analyzing the upcoming Earnings Season. It’s going to be a tricky path forward through the minefields.

Last year we ran out of stimulus in the Summer and the S&P 500 plunged from 4,300 in August to 3,600 in October – that’s why we took the money and ran, closing out our old portfolios when we got back to 4,200 in April and we began a new set of portfolios in May – using just 20% of what we had cashed out – but still we’ve played cautiously as we got a quick pop back to 4,600 in July and there is no certainty that 4,200 is not once again in our future.

As I also said this summer:

-

- “The market is overvalued by any measure, but especially by the Shiller PE Ratio, which is now at 38.6 – the highest level since the dot-com bubble. The average Shiller PE Ratio is 16.8, which means the market is more than twice as expensive as it should be.” 1 (June 21, 2023)

- “The market volume is very low, which means there is not much conviction behind the moves. The average daily volume for the S&P 500 in June was 3.2 billion shares, down from 4.1 billion in May and 4.6 billion in April. This indicates that many investors are sitting on the sidelines, waiting for a clear direction.” (July 1, 2023)

- “The market is very concentrated in a few mega-cap stocks, such as Apple, Microsoft, Amazon, Google, and Facebook. These five stocks account for more than 20% of the S&P 500’s market cap, and they have been driving most of the gains this year. If any of these stocks stumble, the whole market could suffer.” (July 19, 2023)

- “The market is also very sensitive to external shocks, such as cyber attacks, geopolitical tensions, natural disasters, and pandemics. We have seen how these events can cause sudden drops or spikes in the market, creating volatility and uncertainty. The market is not prepared for these risks, and neither are most investors.” (July 27, 2023)

So here we are, on Sept 22nd and back at S&P 4,330 and it’s tempting to buy down here but there’s been no significant change in the over-valuation of the broad market. We’ve done our best to pick value stocks that we feel are worth sticking with in a correction but a sinking market drags down all ships – even the ones that trade at 10 times earnings.

And also we need to keep in mind where we’ve been if we want to consider where we’re going. The S&P 500 was down at 2,400 in March of 2020 and we rose 100% to 4,800 at the end of 2021 (21 months) and that means our pullbacks from the 2,400 point run were 480 points or 4,320 (weak retrace) and 3,840 (strong retrace) and we didn’t hold that last fall and we never made it back to 4,800 and, if we fail 4,320 again – there’s no real technical support until we hit 4,000 (psychological) and 3,840 (strong retrace):

The Screen Actors Guild was on strike in May and we weren’t too worried about that but it’s still going on and entertainment is the US’s #1 exports and entertainment overall is 7% of our entire GDP! Now we also have a UAW strike and the flight attendants are going to walk out on American Airlines if those negotiations aren’t settled soon and, of course, there is yet another looming Government Shutdown!

Not a good time to be complacent.

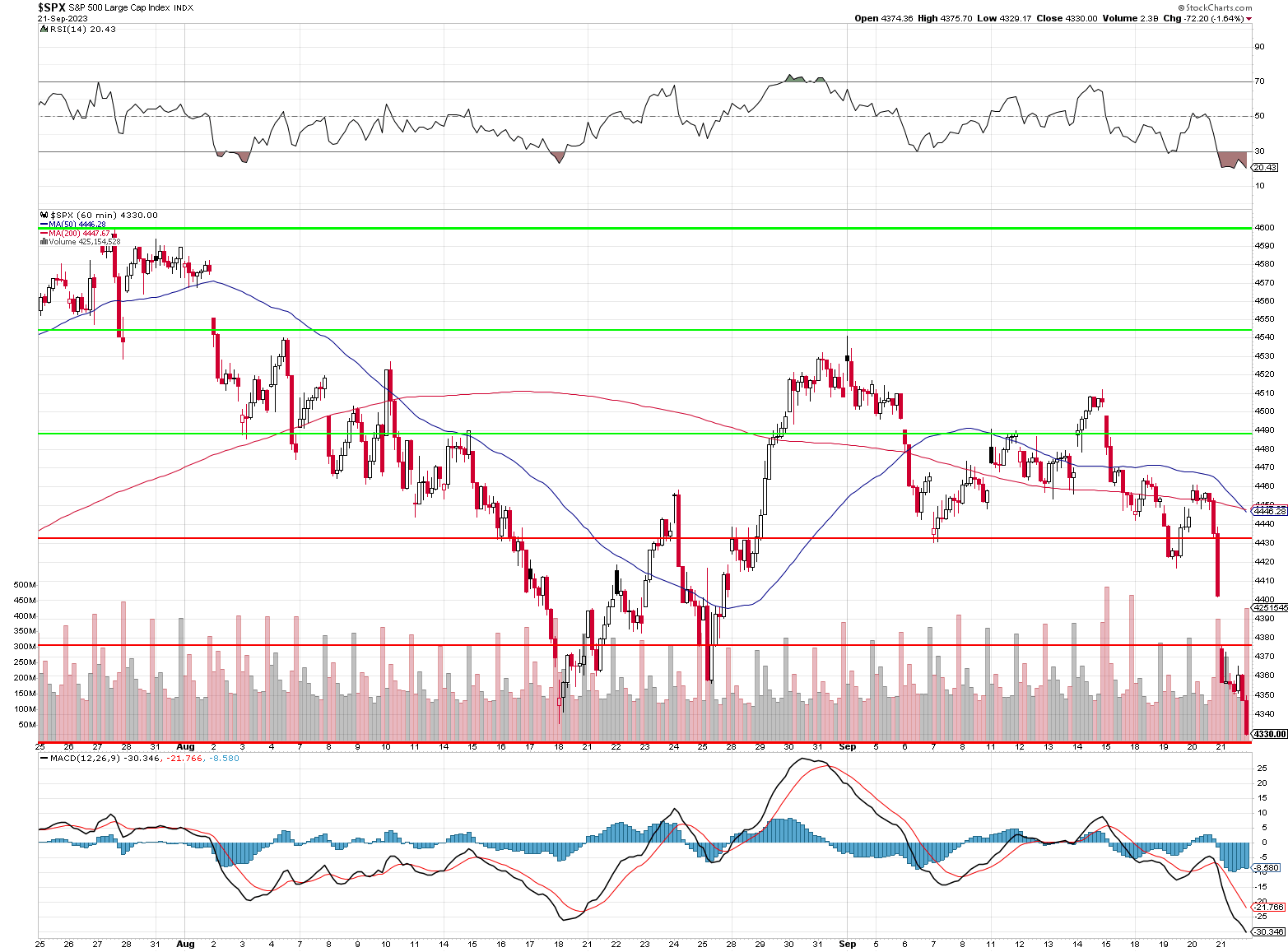

If we consider the recent fall to be from 4,600 (failed attempt) to 4,320 (not yet), that’s 280 points so we can expect 56-point bounces to 4,376 (weak) and 4,432 (strong) so that’s what we’ll be looking for today and early next week. If we get those, we can remain hopeful but, if not – time for more hedges!

Have a great weekend,

-

- Phil