WAR – What is it good for?

Well, Oil prices for one thing. Oil prices blasted back from $83 to $86.25 over the weekend as thousands of rocket were launched from Gaza at Israel, overwhelming their “Iron Dome” defense system – the same system that is protecting Ukraine from Russia – in case you are wondering who might be supplying and coordinating such an attack (possibly Iran as well).

Of course neither Israel or Gaza have any oil – this is just a fear tax we are paying – also of great benefit to the financially-strapped Putin in what could be the largest Rent-A-Rebel attack in history. Besides the rocket attack, Hamas militants broke through the boarders and went into dozens of Israeli towns and took hostages. On what is now day 3 of the crisis, Israel has responded with airstrikes and ground forces, trying to expel the Hamas gunmen from its soil and rescue the hostages. The Israeli Defense Forces (IDF) said they have killed hundreds of Hamas fighters, wounded thousands, and captured scores of others.

However, the IDF also admitted that they are not in full control of their territory along the border with Gaza and that they are still hunting down the last terrorists inside Israel. The fighting has caused heavy casualties and displacement on both sides. More than 700 people have been killed in Israel and more than 430 in Gaza, including dozens of children. Tens of thousands of people have been displaced in Gaza, where access to medical care and electricity has been severely disrupted.

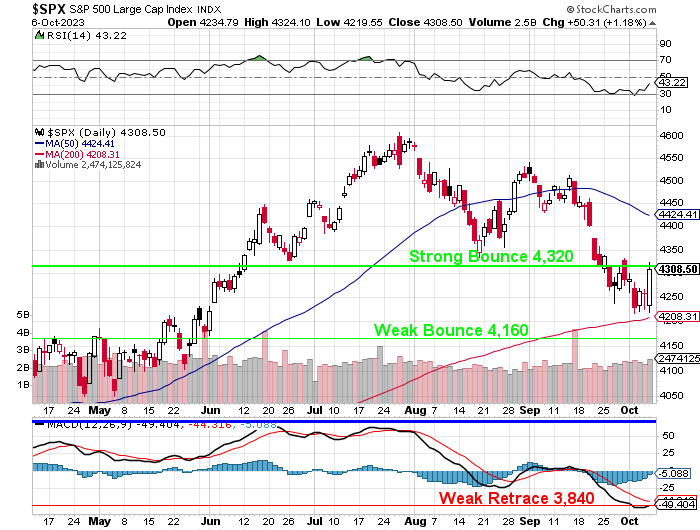

This all being the case, the indexes are giving up Friday’s silly gains and we’re back to Thursday’s close, in which the Futures (not the index) are back to the magical (and magnetic) 4,320 line on the S&P 500 – our “Strong Bounce” line we have long been discussing.

As noted last week, we’re not too worried until/unless the NYSE gives up 15,000 so we’ll see how much the broad market gives up this week. Energy stocks should be lifting the markets this morning, again, after XOM’s $60Bn purchase of PXD on Friday (great timing!). One Exxon executive was allegedly a little too happy and one of the women he was in his hotel room with left and called the police from the lobby – he’s now up on sexual harassment charges.

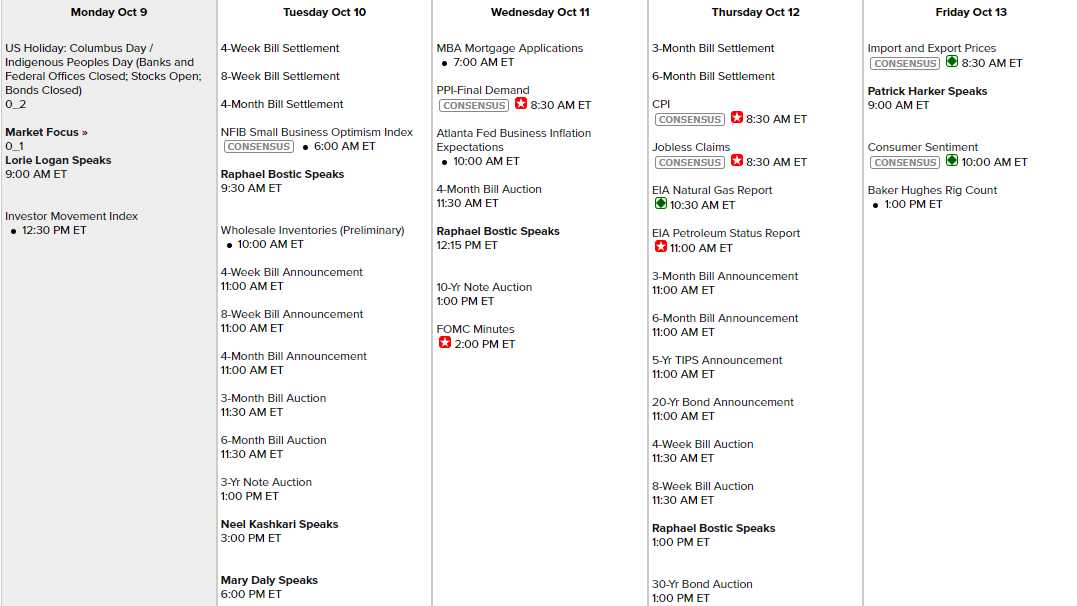

Meanwhile, it is a week that is flooded with Fed Speak – 7 Fed speakers have a go at shaping consensus in the week ahead, though 3 of them are Raphael Bostic, President of the Atlanta Fed. He’s a reliable Dove who has said rates are restrictive enough at 5% to eventually achieve the Fed’s 2% inflation target.

It’s interesting his speeches are wrapped around Wednesday’s release of the FOMC Minutes of the last meeting – I imagine that means they are giving off a Hawkish vibe that the Fed wishes to water down with Bostic’s commentary.

Tomorrow morning we have Small Business Optimism and there’s a 3-year note auction at 1pm. Wednesday we have PPI, the Atlanta Fed Inflation Index (maybe something else that’s troubling?) the 10-Year Auction and the Fed Minutes. Thursday we have CPI and the 30-Year Auction and Friday will be Import/Export Prices and Consumer Sentiment.

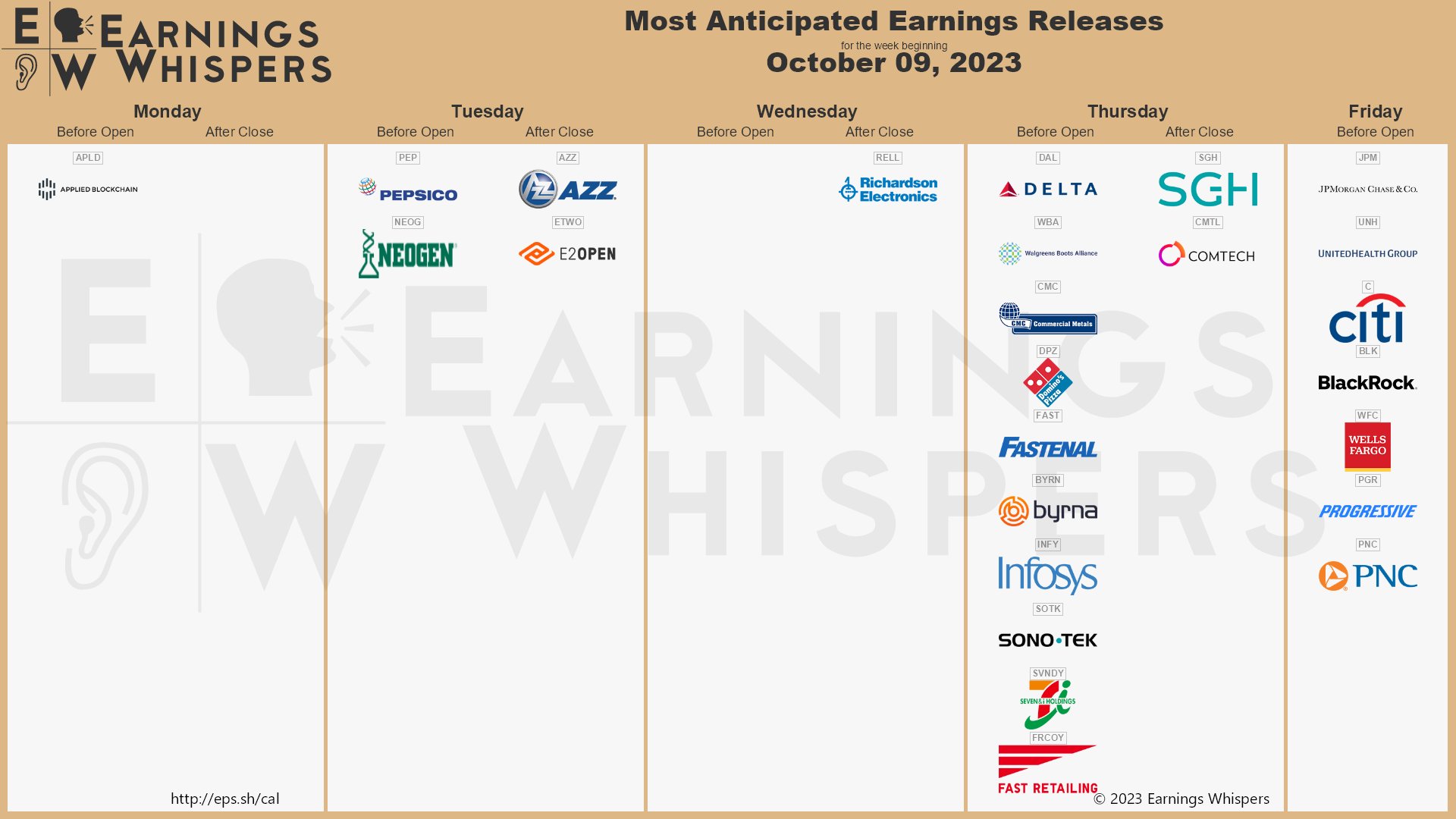

And next week is already Earnings Season again but the action picks up towards the end of the week with a flurry of activity on Thursday and Friday and, just like that – we’re back to getting some facts about Q3 earnings – we love FACTS! Keep in mind we reviewed our Watch List two weeks ago and those are the companies we are dying to take a look at as things have gotten pretty cheap again in the past month…

We already added a dozen positions to the Long-Term Portfolio (LTP) and Friday’s action bounced us back to $532,768 (up $38,533) from $494,235 in our Friday morning review while our Short-Term Portfolio (STP) fell back $34,355 – from $272,455 to $238,100. Now THAT is BALANCED!!!

When you are balanced, you have no fear of the market and that allows us to sit back and wait to make the smart adjustments – even when a war breaks out. We have all of this week to see how things shake out and then we’ll make adjustments and additions next week, with some earnings data under our belts.

Things should be interesting.