The Chinese real estate market is currently a hotbed of uncertainty, with two major players: Evergrande and Country Garden, facing severe financial crises.

The Chinese real estate market is currently a hotbed of uncertainty, with two major players: Evergrande and Country Garden, facing severe financial crises.

While Country Garden is struggling with debt restructuring and repayment deadlines, Evergrande is on the brink of the catastrophic event we have long been warning about: a winding-up hearing scheduled for October 30, 2023. This could have serious implications for the Global Markets.

Evergrande, once China’s top real estate developer, is facing a winding-up hearing on October 30, 2023. The base case scenario is that the company will be liquidated, which could trigger a series of unfortunate events not just in China but globally.

Evergrande, once China’s top real estate developer, is facing a winding-up hearing on October 30, 2023. The base case scenario is that the company will be liquidated, which could trigger a series of unfortunate events not just in China but globally.

The question on everyone’s mind is: Who will bear the brunt of this default? The immediate victims are likely to be local suppliers, employees, and homeowners waiting for their properties to be completed, who will lose their deposit money and, of course, the banks who lent money for development. However, the ripple effect could extend to global financial markets, affecting various asset classes and creating a credit crunch similar to the 2008 financial crisis.

-

-

Equity Markets: A default by Evergrande could lead to a sell-off in global equity markets. Investors may pull out of riskier assets, leading to a decline in stock prices worldwide.

-

Debt Markets: Evergrande’s default could make investors wary of high-yield bonds, especially those from emerging markets. This could lead to higher interest rates and tighter credit conditions.

-

Currency Markets: The Chinese Yuan could depreciate against other major currencies, affecting trade balances.

-

Commodity Markets: A slowdown in the Chinese real estate sector could reduce demand for commodities like steel and cement, affecting global prices.

-

Real Estate: Other real estate companies, like Country Garden, are also in hot water, which could lead to a broader real estate market collapse in China, affecting global real estate investments.

-

The October 30th deadline for Evergrande is more than just a company’s financial reckoning, it’s a litmus test for global financial stability. Investors and market analysts should keep a close eye on developments as the date approaches. The outcome could either be a sigh of relief or the beginning of a Global Financial Upheaval.

Meanwhile, the IMF has revised its Global Economic Growth Forecast for 2024, lowering it to 2.9% from the previously expected 3%. This comes amid a backdrop of higher interest rates, geopolitical tensions, including Russia’s invasion of Ukraine, and the ongoing conflict between Israel and Hamas. The IMF notes that the global economy has lost about $3.7 trillion in output over the past three years due to various shocks, including the pandemic and geopolitical conflicts. The U.S. Economy is somewhat of an outlier, with growth forecasts being upgraded. In contrast, the Eurozone and China face gloomier prospects – even without China’s looming Real Estate collapse.

The fragility in the global GDP forecasts could exacerbate the vulnerabilities in China’s Real Estate sector. A slowdown in Global Economic Growth could lead to reduced foreign investment in China, further straining the liquidity of companies like Evergrande and Country Garden. Additionally, geopolitical tensions could lead to more conservative investment strategies, making high-risk markets like China’s real estate less attractive.

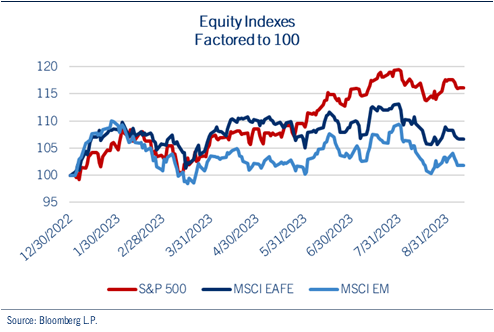

The interconnectedness of these issues suggests that a shock in one part of the global economy, such as a default by Evergrande, could have ripple effects that worsen the already fragile global economic outlook. We can already see money flowing back into US Equities as it panics out of the rest of the World (ROW) after the weekend attacks on Israel.

🤖 Why the U.S. Economy is an Outlier and Will It Last?

Current Factors Making the U.S. an Outlier:

-

-

Strong Services and Labor Markets: According to S&P Global, higher growth in the U.S. for 2023 reflects ongoing strength in services and labor markets.

-

Avoiding Recession: Swiss Re suggests that the U.S. is likely to avoid a recession this year, revising up GDP growth for 2023 and 2024.

-

Rate Hikes Ending: Morgan Stanley indicates that 2023 will see the end of rate hikes, which could stabilize the economy.

-

Headwinds and Global Demand: Despite being an outlier, the U.S. economy faces headwinds moving into the second half of 2023, mainly due to slowing global economic growth affecting demand, as per the U.S. Treasury.

-

Will It Last?

-

-

Global Economic Slowdown: The U.S. is not immune to the global economic slowdown, and its impact on demand could be a significant factor.

-

Geopolitical Risks: Ongoing geopolitical tensions could have an indirect impact on the U.S. economy.

-

Inflation and Interest Rates: While rate hikes are expected to end, the long-term impact of inflation and how well it’s managed will be crucial.

-

Domestic Policies: Future fiscal and monetary policies could either bolster or hinder the current economic resilience.

-

The resilience of the U.S. Economy will be tested if the Evergrande and Country Garden situations lead to a global financial crisis. While the U.S. is currently an outlier in a positive sense, the interconnectedness of global markets means that significant disruptions in China could have a ripple effect – just like they did in 2008 – we were the last to be affected back then as well but boy did we get hit by that wave!

Just this morning, former Walmart U.S. CEO, Bill Simon, has warned that consumers are starting to buckle for the first time in a decade. He attributes this to a variety of factors, including Inflation, Higher Interest Rates, Federal Budget Wrangling, Polarized Politics, and restarted Student Loan Repayments, which have been a $337 x 45M ($15Bn) per month stimulus for the past few years and now 45M people have to find $337/month and that money will come right out of Discretionary spending!

Simon notes that the timing of this consumer strain coincides with key sales weeks for major retailers like Amazon, Walmart, and Target. Interestingly, he observes that the bargains offered by these retailers are not as deep as they used to be, indicating inflationary pressures. Shares of Amazon, Walmart, and Target have been under pressure, with Target performing the worst, down 19% – a clear sign of broader market stress.

The strain on U.S. consumers adds another layer of complexity to the already fragile global economic situation. If the U.S. consumer, often considered the backbone of the economy, starts to buckle, it could have a domino effect. This is especially concerning when considered alongside the potential fallout from China’s Real Estate crisis and the lowered Global GDP forecasts.