What a week!

Amazon (AMZN) and Intel (INTC) both had good reports last night AMZN reported better-than-expected results for the third quarter, with revenue up 13% year-over-year to $143 Bn and earnings per share of $0.94, beating the consensus estimates of $141Bn and $0.58, respectively. The company also issued a strong revenue guidance for the fourth quarter, ranging from $146Bn to $153Bn. Amazon attributed its performance to the strength of its cloud computing business, AWS, which grew 27% year-over-year to $23.2 Bn.

The company cried “generative AI“, which whipped investors into a buying frenzy, now well over 50x forward earnings at about $1.5Tn in market cap with $23Bn in profits for 2023. Amazon actually LOWERED guidance but no one seems to care because – AI!!!

The takeaway from the earnings reports of AMZN, META, GOOG/L and MSFT is that AI is becoming a key differentiator and growth driver for the tech giants, as they compete for market share and customer loyalty.

On the chippy side of AI, Intel (INTC) also reported Earnings yesterday, and it surprised the market with a beat on both Revenue and Earnings. Revenue was down 8% year-over-year to $14.2Bn, but still above the consensus estimate of $13.5Bn. Earnings per share was $0.41, adjusted, versus $0.21 expected. Intel’s results were driven by strong demand for its PC chips, as well as its foundry services, which offer chip manufacturing to other companies. Intel also raised its revenue guidance for the full year to $62 billion.

Intel’s earnings should provide some relief to the tech sector and our Stock of the Year runner-up has been lagging behind its rivals in chipmaking technology, but it has ambitious plans to catch up by 2025 (so it’s still a contender for next year!). The company also announced a new partnership with Qualcomm (QCOM) to produce chips using its advanced 20A process technology. Intel is betting on its IDM 2.0 strategy, which combines internal manufacturing with external foundries and partnerships.

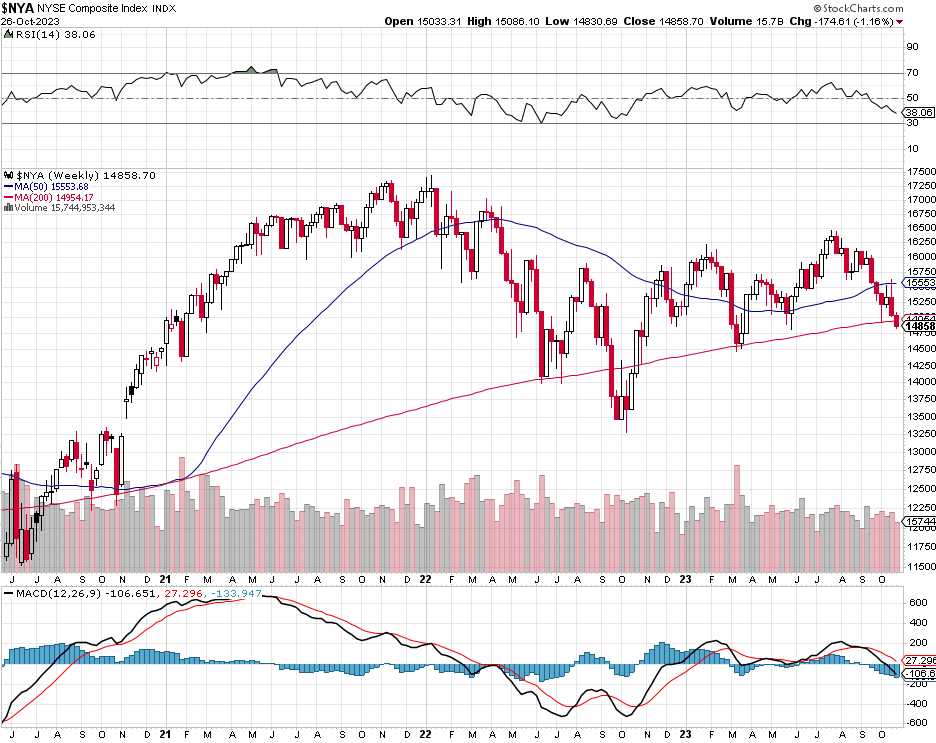

Heading into next week, however, some extreme technical damage has been done to the indexes and, after a blowout 4.9% GDP Report yesterday, I don’t know that the Fed is going to be any help next Wednesday. Most concerning is the NYSE, which has fallen below 15,000 for the first time since the March Financial Crisis. That’s down 10% from 16,500 in late July and, if 14,800 fails – there won’t be much technical support for another 10% (13,500):

Keep in mind that stocks are listed on either the NYSE or the Nasdaq, depending on their size, sector, and listing requirements. The Russell and the Dow are just indices that track the performance of a subset of stocks that are already listed on one or the other exchange so, when push comes to shove, the NYSE and the Nasdaq are all that really matter with the NYSE at about $25Tn in market cap while the Nasdaq’s components are at $11Tn (and most of that in just the top 7 companies!).

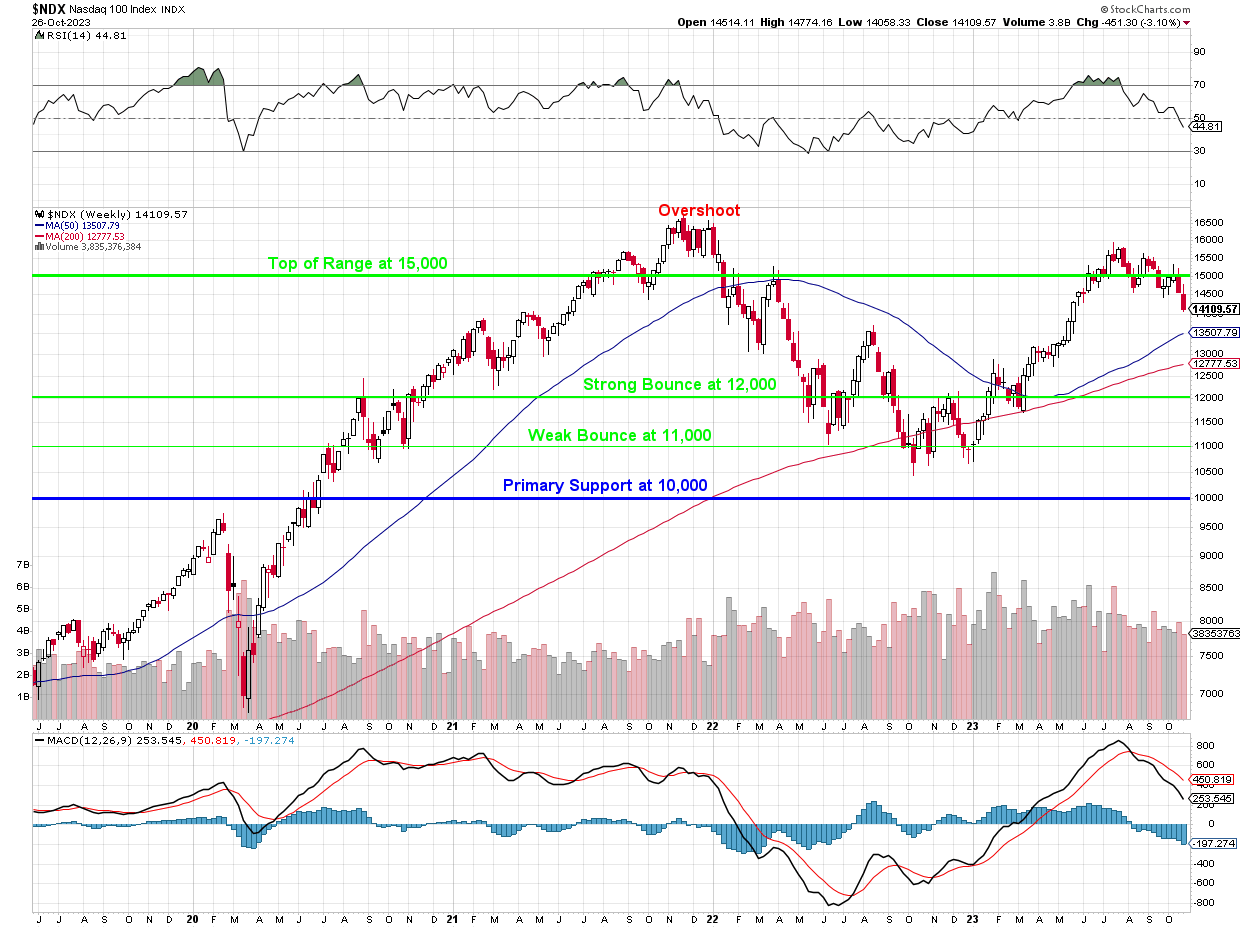

14,000 will complete a 20% ($5Tn!) correction on the NYSE from the beginning of 2022 but we were below that already last fall so really – there’s not much to complain about at 14,850 – is there? Still, there is plenty to worry about as the Nasdaq 100 (the ones that matter) topped out at 16,500 at the start of 2022 and a 10% correction there is 14,850 but we blew past that and now 14,109 – on the way to -20% at 13,200 – which is pretty much the 50-week (250-day) moving average.

Essentially the NYSE’s chart breakdown is just a preview of the Nasdaq breakdown that is to come and the Fed can put the nail in the coffin next week with another hike (and how can they not with a 4.9% GDP?) as 10-year notes already popped 5% this week and that means ANY company with a P/E ration higher than 20x is giving you less of a return on your money than a 10-year note – that is NOT a good situation for a market that is generally trading at around 30x!

As we head into the weekend, we’ll be watching how the market reacts to these earnings reports and how they affect the sentiment and expectations for the tech sector in particular. We’ll also be keeping an eye on the economic data and the Fed’s signals ahead of next week’s rate decision.

Have a great weekend,

-

- Phil