“Clowns to the left of me

Jokers to the right

Here I am stuck in the middle with you” – Stealers Wheel

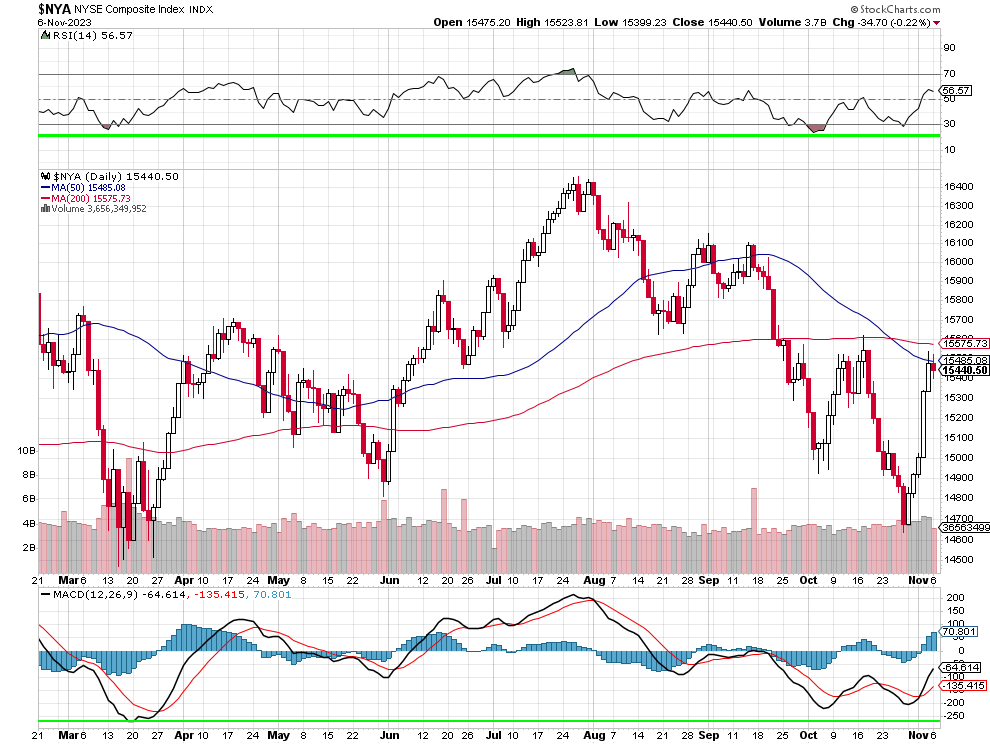

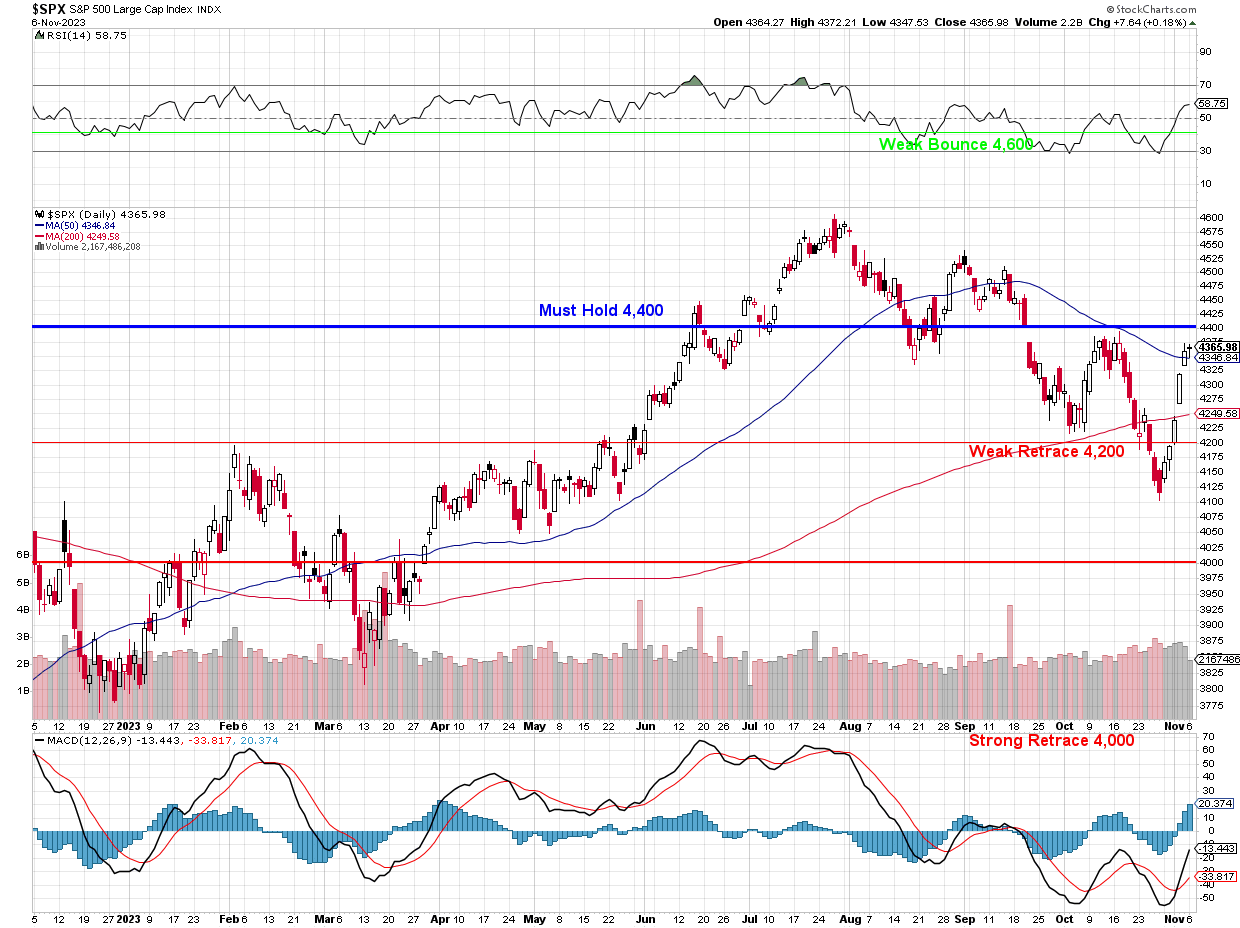

Last week it was all about hitting the dreaded “Death Cross” on the NYSE and we did, indeed have a tremendous drop in the NYSE (and other indexes) but it quickly reversed and now we’re back right where we started from a few weeks ago – still below the 50-day moving average and being rejected by that here is not a good sign.

What has really changed in the past few weeks? The Fed is supposedly done raising rates and, since the meeting (6 days ago), we haven’t had any data to contradict them. After a shaky start, earnings are turning out well with 81% of the S&P 500 now reporting.

Insight/2023/11.2023/11.03.2023_Earnings%20Insight/03-s%26p-500-earnings-growth-year-over-year-q3-2023.png?width=672&height=384&name=03-s%26p-500-earnings-growth-year-over-year-q3-2023.png)

Granted, expectations were very low – so they were easy to beat – but, that low bar is forgotten and people just remember it was a beat in the end. Overall, the S&P 500 was supposed to be down 0.3% in overall earnings and it’s up 3.7% instead. That is, of course, compared to last year, when we were still recovering from Covid BUT, the reality is thatthe net income of the S&P 500 for the trailing 12 months (TTM) as of June 30th was $1.64Tn. That was a -6.73% decrease from the net income of the S&P 500 as of June 30th, 2022, which was $1,75Tn.

Insight/2023/11.2023/11.03.2023_Earnings%20Insight/04-s%26p-500-revenue-growth-year-over-year-q3-2023.png?width=672&height=384&name=04-s%26p-500-revenue-growth-year-over-year-q3-2023.png)

Unfortunately, of 116 of 400 S&P 500 companies that have issued forward guidance, 74 (64%) have issued negative guidance. That has dropped Q4 estimates to 1.7% above Q4 of last year and the growth for all of 2023 is now estimated at 1.2%. Keep in mind we finished last year at S&P 3,850 so 4,365 is up 515 (13.3%) – 10 TIMES the actual gains in earnings.

We had a similar burst of enthusiasm towards the end of August as Q2 earnings weren’t so bad but then the market resumed it’s downturn so we’ll just have to wait and see how things go into the holidays (last December was not pretty either). We certainly don’t want to get complacent – especially when there’s no good reason for this rally.

Speaking of reasons, WeWork (WE) finally declared bankruptcy and that’s bad news for 200 landlords with 14.9M sq feet of Commercial Real Estate (0.5% of the US total) leased by the company. Overall, it’s about $10Bn of lease obligations between now and 2027 and another $15Bn for 2028 and beyond. That may send additional ripples through the CRE markets next year as much more inventory hits the streets.

SoftBank (SFTBY) and JPMorgan (JPM) are both large creditors of WE – so expect bad quarters from those two but it was SoftBank who stepped in and poured Billions into WE, trying to save it during Covid. Barclays (BSC) says CRE can fall even further – down to perhaps 40% off peak valuations (now 20% off). Barclays also noted that office availabilities currently exceed peak levels reached after the 2007 financial crisis, and “will likely remain elevated, as long-dated lease terms have delayed the timing for firms to right-size their spaces.”

As we come to the end of free money, interest rate normalization, and the return to fundamentals, opportunities in growth and value will lead the market, explained Chris Davis, chairman at Davis Advisors. The long-time Berkshire Hathaway (BRK.B) investor said the price of money was distorted and manipulated for over a decade. “We’re just in the early innings of this unwinding,” he said, noting that investors should focus on characteristics like durability and resiliency.

Davis also explained that the repricing of money is a return to normalcy, forecasting a “hangover” from popping the bubble of the fixed-income markets. This was already seen during the regional bank (KRE) crisis, and it will affect private equity and venture capital, as well as certain parts of commercial real estate.

THAT is the story for 2024!