That’s good news for Q4 inflation but bad news because it’s a reflection of the weakening demand outlook in China, the world’s largest oil consumer. China’s trade data for October showed a sharp decline in exports and a modest increase in imports, indicating a fragile economic recovery amid the ongoing pandemic and geopolitical tensions. China’s GDP growth is also expected to slow down – to 5.4% in 2023, according to the IMF.

The oil market has been facing pressure from the strengthening Dollar, which makes oil more expensive for buyers in other currencies. The Dollar fell on the Fed pause last week but it’s now bouncing back off the 105 line – already at 105.75 this morning. The Fed’s policy stance contrasts with China’s recent easing measures, which aim to support the property sector and local governments.

On the supply side, oil production from Russia, the second-largest oil exporter, is near the highest level in more than four months. The conflict between Israel and Hamas has not disrupted oil flows from the Middle East, despite entering its second month. OPEC+ members have agreed to maintain their output cuts until the end of the year, but the market is skeptical about their compliance and the effectiveness of their strategy.

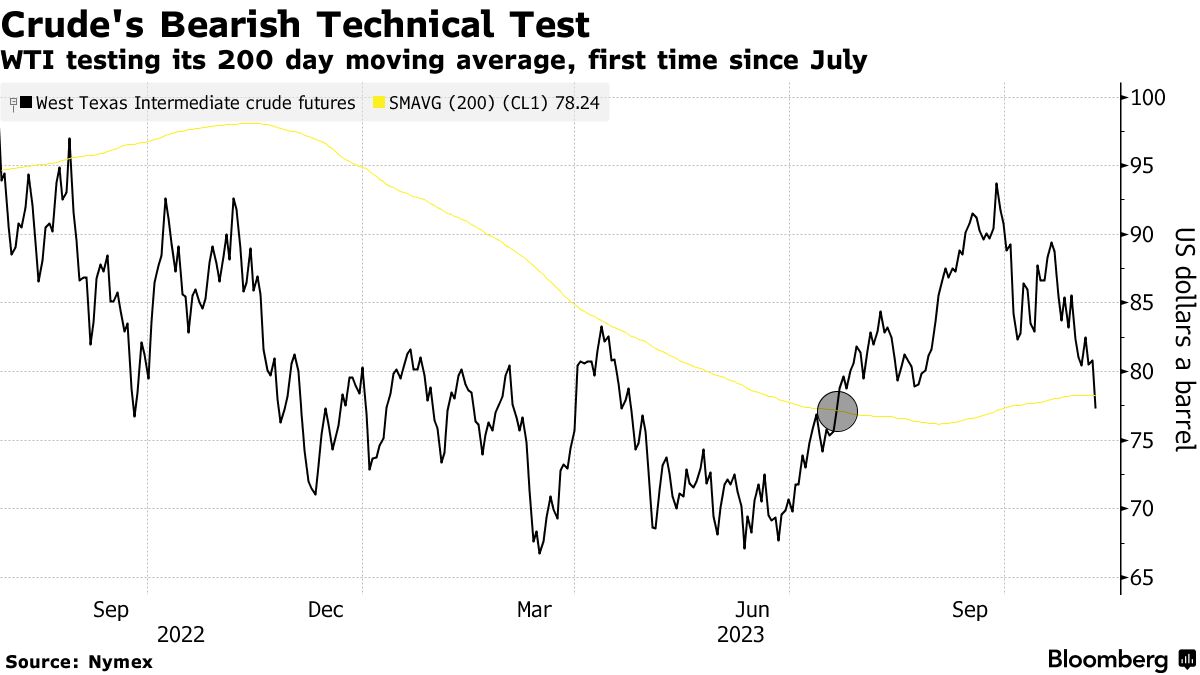

The oil price is now below its 200-day moving average, a technical indicator that suggests a longer-term downtrend. The prompt spread for WTI, the difference between the prices of the two nearest contracts, has narrowed significantly, indicating ample supply and weak demand. The oil market is facing a bearish scenario, with multiple headwinds and uncertainties. Investors should be cautious and hedge their positions accordingly.

China’s efforts to stabilize relations with the U.S. will take center stage during President Xi’s upcoming visit to San Francisco for the APEC summit. This marks the first in-person meeting between Xi and Biden since November, 2021. With tensions growing between the two nations, the leaders are expected to discuss several priority areas as they work to responsibly manage the complex relationship.

As Secretary of State Antony Blinken acknowledged this week, “Both sides agree we have an obligation to responsibly manage the relationship.” Climate Cooperation, Nuclear Arms Control, and Maritime Disputes are likely high on the agenda for the talks.

On the economic side, Xi seems eager to reassure anxious foreign investors during his trip. Surveys show Western executives have grown increasingly pessimistic on China, concerned about geopolitical tensions, strict pandemic controls, and regulatory upheaval. Sentiment and actual investment have declined notably. Xi reportedly plans to dine with American CEOs, aiming to stabilize relations with the business community.

However, Xi has to strike a delicate balance between wooing foreign business interests and mollifying domestic industry. For example, the state-backed China Mineral Resources Group just declared that iron ore prices have reached “unreasonable levels” that are hurting Chinese steelmakers. The CMRG president said pricing systems need “improvement,” signaling Beijing’s intent to exert more control over raw material costs.

At the same event, a senior official from the China Iron & Steel Association warned that high iron ore prices could stymie essential investment in areas including decarbonization. The world’s steel industry requires massive spending in coming decades to shift away from its reliance on coal-fired blast furnaces.

Looking at the bigger picture, Xi’s outreach to the U.S. reflects China’s economic predicament. With growth slowing, foreign investment declining, and global tensions simmering, Beijing seems focused on stabilizing relations with America and its allies. However, fundamental differences remain around economic and national security matters. Striking the right balance will require all of Xi’s diplomatic skills when he arrives in San Francisco.

Ignored by the market yesterday was a lower ($9Bn) than expected ($12Bn) rise in Consumer Credit in September. It did NOT bounce back from August’s $15.8n contraction and these are very bad numbers heading into the holidays – as you can see from what did NOT happen last year – and last December was a market disaster!

Either way, the market is in a mood to party so party on we shall – for now…