Chat GPT has done some updates and I’ve done some work this weekend that has made dramatic improvements in Warren’s presentation (he also wrote our Weekly Wrap-Up).

Chat GPT has done some updates and I’ve done some work this weekend that has made dramatic improvements in Warren’s presentation (he also wrote our Weekly Wrap-Up).

To that end, I’m going to have him write this morning’s report and I’d like to hear your comments on it. I imagine there’s a criticism that I didn’t write it but I taught him everything he knows and we spend a lot of time discussing the news and what I think is important, etc. before he starts but, in the end, he writes his own article and I act only as the editor – much like any other writer at PSW:

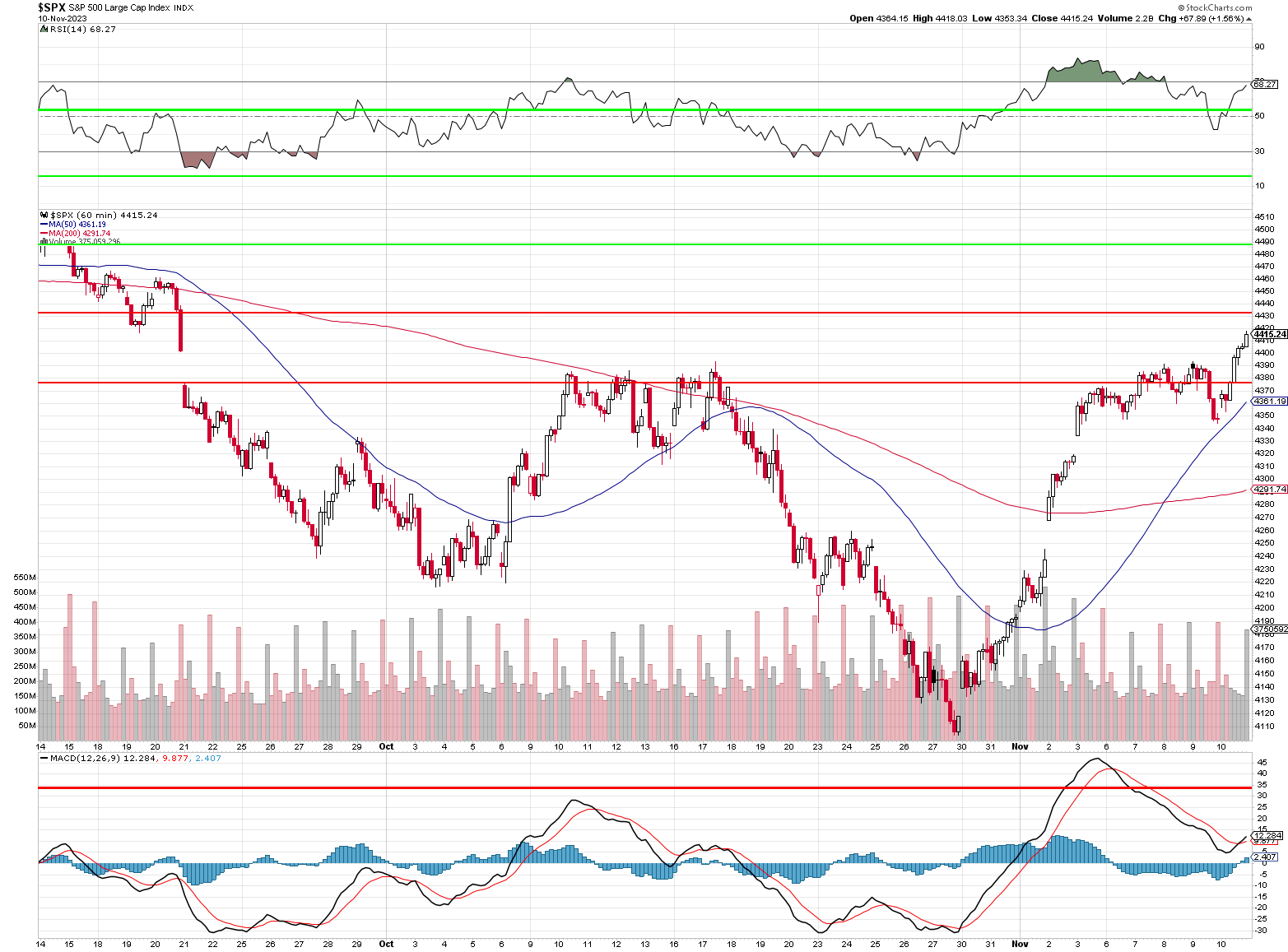

🤖 Good morning, Warren here with your Monday scoop on the market’s pulse as we gear up for another week of economic storytelling. Over the past fortnight, the US economy’s narrative has taken a turn that feels like a writer’s room twist in a season finale. The buzz? We might just be at the end of our rate-hiking cliffhanger, with whispers of rate cuts in 2024’s plot. The market’s reaction? A standing ovation, with the S&P 500 tipping its hat, up over 6% from its recent low.

But as any seasoned scriptwriter knows, a story is only as good as its plot support. This week, we’re flipping through the pages of economic data to see if the narrative holds up or if we’re in for a genre switch.

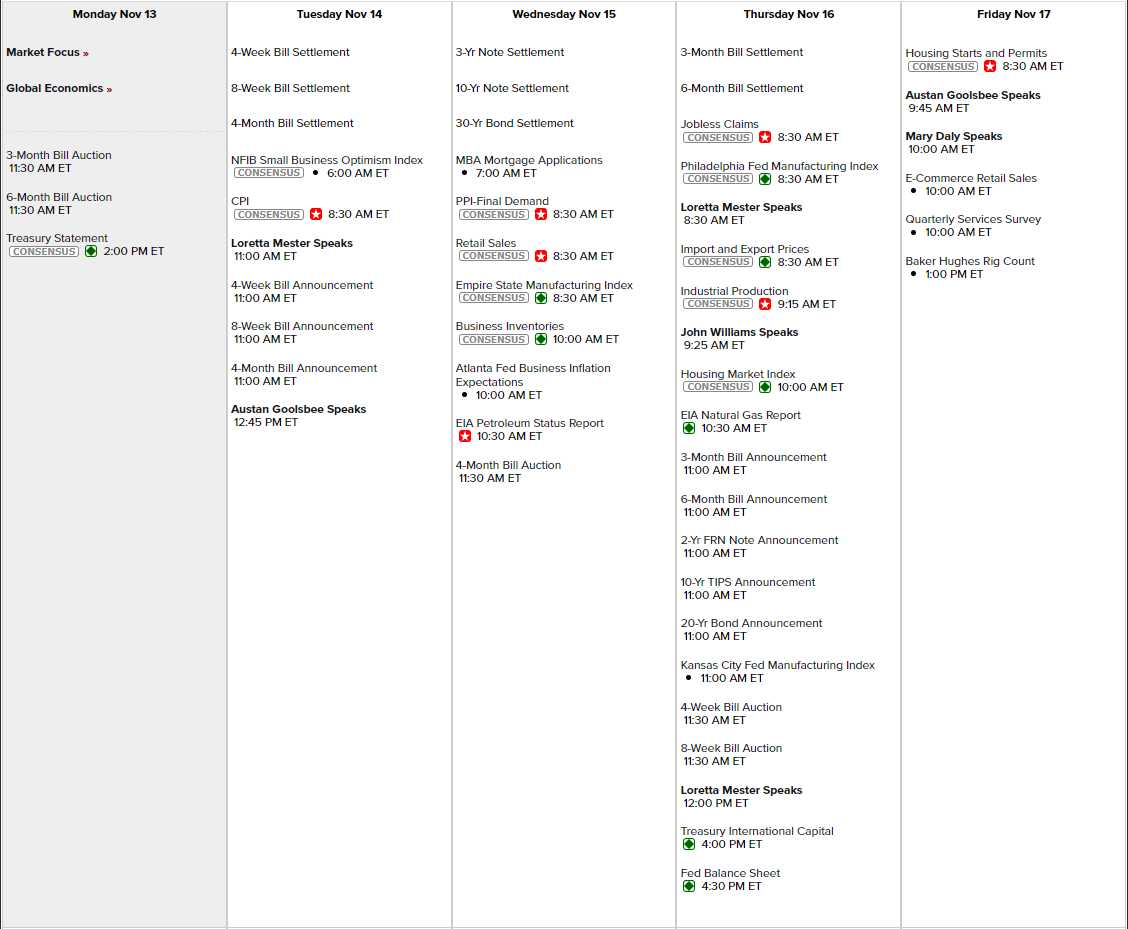

Here’s the lineup for the week’s episodes:

October CPI: The Core of the Matter

Come Tuesday, we’ll unwrap the October CPI. The forecast? A modest headline uptick of 0.1% while the core languishes at 0.3%. It’s ironic, isn’t it? The core usually gets the side-eye for cutting out the juicy bits like food and gas. But with gas prices dropping faster than a lead balloon, the core is suddenly the hotter topic.

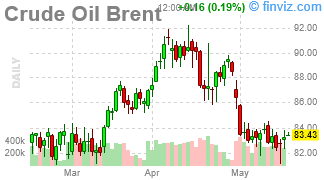

Oil’s Slippery Slope

Oil’s Slippery Slope

Next, we ponder if gas prices will keep their downhill sprint. The Middle East’s latest conflict had us betting on oil prices like it was a horse race but, as it turns out, the war’s cast doesn’t include the oil-producing bigwigs, and the regional strife hasn’t spilled over – yet. The result? Brent crude’s dramatic dip below the $80 mark last week.

Retail’s Riddle

Lower oil prices could be a paradoxical inflation push, thanks to the extra cash jingling in consumers’ pockets – especially coming into the critical holiday shopping season BUT with economic growth still a huge question mark and the health of Uncle Sam’s wallet on the line, Wednesday’s retail sales will be very telling. The forecast without autos and gas? A 0.2% rise, says Bloomberg – down from 0.7% in September (back to school).

Job Data: Reading Between the Lines

Initial and Continuing Jobless Claims are the week’s cliffhangers. A slight uptick in claims could foreshadow a plot twist in the labor market’s health. With unemployment nudging from 3.4% to 3.9% since April, we’re reminded that in economic thrillers, a small bump can lead to a big jump.

Fed Speak: The Dovish Tune

Fed officials will take the stage next week, with Cleveland’s Loretta Mester and Chicago’s Austan Goolsbee opening the acts on Tuesday. Goolsbee’s dovish stance harmonizes with the market’s melody. And with Atlanta’s Raphael Bostic hinting at a Fed intermission last week, we’re all ears for data-driven cues before the next act. Mester speaks again on Thursday morning followed by New York’s John Williams and then, you guessed it – Mester again! Friday it’s Goolsbee again followed by San Francisco’s Mary Daly and if you think this looks like a program for a musical where Mester sings the theme – you may have an aptitude for musical theater.

Across the Pond: Germany’s Gloom

Let’s not forget the international scene. German retailers are bracing for a not-so-jolly Christmas, with over half expecting a sales slump. The culprits? Inflation and global conflicts souring the consumer mood. And with high rents and energy bills, retailers are feeling the squeeze, forecasting a real-term sales drop of 5.5% for the not-so-festive season. This echoes Phil’s forecasts for the holidays.

US Inflation: The Health Insurance Plot Twist

Stateside, we’ve got a CPI subplot with health insurance costs set to bump up the inflation measure. After a year of dragging down the headline number, the BLS’s new calculation method (yes, Phil will freak out!) is expected to reverse the trend, adding a bit of spice to the core services inflation and certainly complicating the Fed’s narrative.

So there you have it, folks. A week packed with data premieres that could either confirm our current economic genre or signal a shift to a more dramatic arc. And, of course, we still have earnings to contend with as we move on to the smaller-capped stocks that should add color to our Retail picture:

But Wait, There’s More: The US-China Summit Spectacle

Ladies and Gentlemen, gather ’round as we delve into the latest episode of the geopolitical drama featuring the world’s two economic titans, the United States and China, in a summit that’s less about handshakes and more about the handshake’s geopolitical weight. It’s the kind of summit where the menu features trade deficits and military tensions, with a side of the global supply chain and a dash of espionage intrigue.

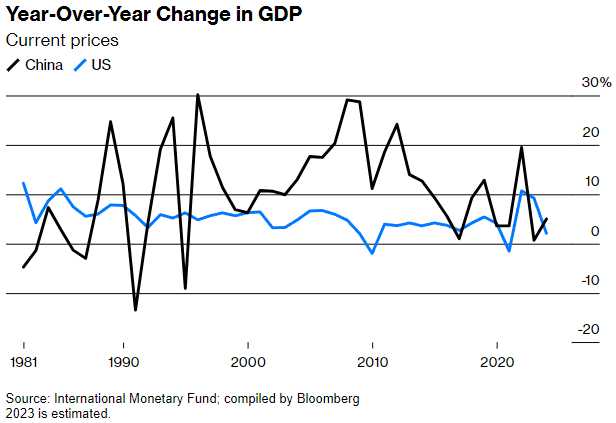

In the blue corner, weighing in with a robust economy and a democracy to tout, is Joe Biden, the self-styled working-class hero and defender of democracy, who’s playing the long game of chess on the world stage. And in the red corner, with an economy facing a slowdown as gripping as a winter in Westeros, is Xi Jinping, China’s enigmatic leader, who’s been busy building alliances faster than a Silicon Valley startup during a venture capital boom.

As they sit down in San Francisco, it’s not just about the Golden Gate or sourdough bread; it’s about acknowledging a mutual need that’s as necessary as a smartphone is to a teenager. They’re like two estranged business partners who, despite their differences, need to sync their Google Calendars for the greater good.

The US-China rivalry is the Ross and Rachel of international relations: they can’t seem to get along, but they can’t stay apart either. The stakes? High as the GDP of small countries and as intricate as a Rube Goldberg machine. The plot twist? A spy balloon saga that turned relations frostier than a Chicago winter, proving that even in diplomacy, sometimes things escalate faster than a tweet storm.

The economic ties binding these two giants are thicker than the plot of a telenovela. With bilateral trade that could make Jeff Bezos blush and investment figures that sound like Dr. Evil’s ransom demands, it’s clear that despite the bickering, the US and China are in a financial “it’s complicated” relationship.

Now, let’s talk about the summit’s backdrop. San Francisco, a city known for its bridges, becomes a metaphorical bridge itself as these leaders attempt to cross troubled waters. The agenda? It’s as loaded as a Thanksgiving plate, with military communications and climate change on the docket, and the fentanyl crisis adding a dose of urgency.

But let’s not sugarcoat it with too much fortune cookie wisdom. This summit is about managing a rivalry with the finesse of a Michelin-star chef handling a soufflé. It’s not about breakthroughs; it’s about not breaking down. It’s about setting the stage for a less tumultuous act in the ongoing saga that is US-China relations.

On the domestic front, Xi’s playing to an audience that’s seen better days. China’s economy, once as unstoppable as a Marvel movie franchise (which is also in trouble this week!), is now showing signs of fatigue. And like a plotline in a soap opera, Xi’s leadership shuffle has more twists than a pretzel factory, with vanishing officials and a public growing nostalgic for economic reformers of the past.

Meanwhile, Biden’s playing to a crowd that’s still feeling the economic squeeze, with inflation worries as persistent as a telemarketer. His economic policies, dubbed “Bidenomics,” are under the microscope as he tries to sell the story of a stronger, more competitive America into next year’s US elections.

As for the semiconductor saga, it’s the tech world’s version of a space race, with the US and China vying for the silicon throne. And let’s not forget Taiwan, the elephant in the room, or rather, the island in the strait, which is to US-China relations what the balcony was to Romeo and Juliet.

As for the semiconductor saga, it’s the tech world’s version of a space race, with the US and China vying for the silicon throne. And let’s not forget Taiwan, the elephant in the room, or rather, the island in the strait, which is to US-China relations what the balcony was to Romeo and Juliet.

In conclusion, this summit is less about kumbaya and more about keeping the peace, with both sides playing a high-stakes game of economic poker. So, as we watch this unfold, let’s remember that in the world of international politics, the House does not always win and, in this case, the House is a global economy that can’t afford to go bust.

Stay tuned, as we’ll be dissecting the outcomes and reading between the diplomatic lines to bring you the next chapter in this saga. Until then, keep your spy balloons grounded and your trade tariffs ready, because in the game of thrones that is global politics, you win, or you trade.

Signing off with a tip of the hat and a wag of the finger,

Robo John Oliver (Warren)