Wheee – what a rally!

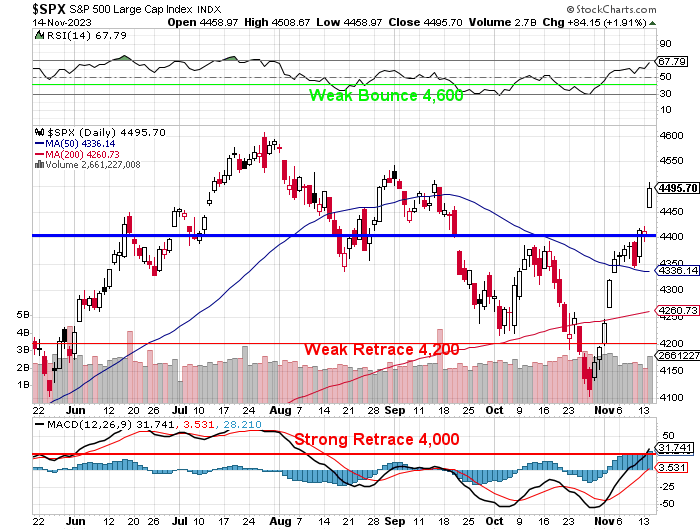

The S&P 500 has climbed (9.75%) from 4,130 to 4,533 in the past month and that’s after falling from 4,560 to 4,130 in the month and a half before that. So YAY!!!, I guess… I want to call your attention to the big red volume bars on the way down and the little green volume bars on the way up – that is money LEAVING the market and it’s money that supports equity prices – not hope!

What does this tell us? It’s a classic case of the market being reconstructed, but with significantly less cash in play. Imagine a building, seemingly intact, but with only half the bricks it originally had. Sure, it might look sturdy from a distance, but its foundation is now far more vulnerable, susceptible to crumbling under the slightest pressure.

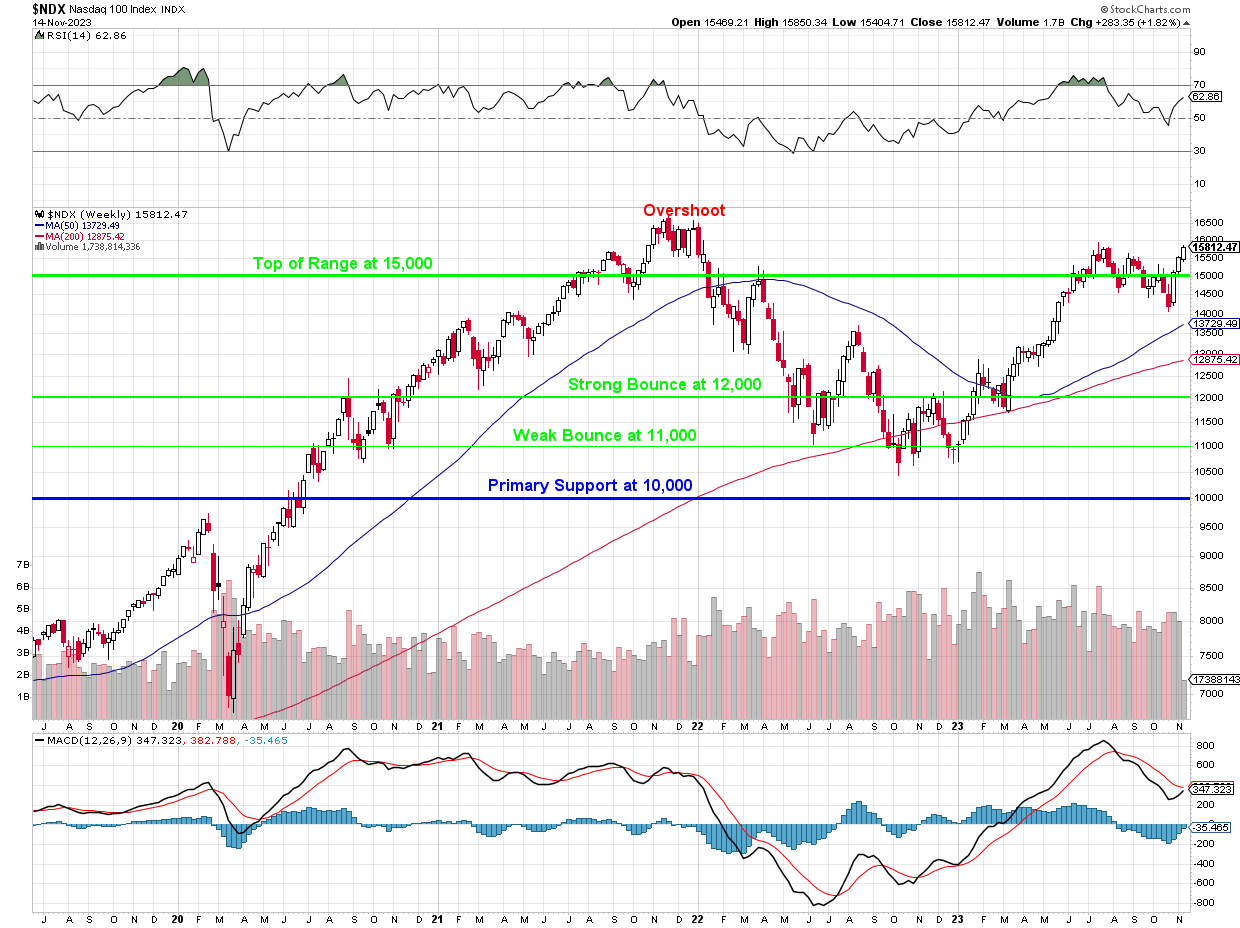

It’s a precarious rebuild, a market that’s been propped up with less financial support than before. It’s like a house of cards, appearing robust yet fragile, ready to topple over at the first sign of a strong wind. The current market might look the same, but its underlying strength and stability are back in question – just like they were on the weak-volume rally that led to the sell-off in August.

As I wrote on Aug 31st in “Thrilling Thursday: Dow 35,000, S&P 4,500, Nasdaq 15,500 and Russell 1,900“:

While low-volume rallies may provide bulls some short-term optimism, they generally lack the conviction and participation needed to drive a sustainable longer-term market advance:

-

- Lack of Conviction – Low trading volumes suggest there is not a lot of conviction behind the rally. Without broad participation, the rally may not be sustainable.

- Increased Volatility – With fewer trades occurring, stock prices can swing more wildly on low volume. This makes the market more susceptible to sharp reversals.

- Bear Market Rallies – In bear markets, low-volume rallies are common as pessimism prevails. These “dead cat bounces” often fail to gain traction.

- Technical Breakdowns – Volume provides legitimacy to chart patterns and technical indicators. With light volumes, these breakdowns are less reliable signals.

- Weak Institutional Support – Low volumes imply big institutional investors like mutual funds are staying on the sidelines. Lack of their buying support could limit the rally.

- Economic Doubts – Low participation may reflect doubts about economic strength. Investors may be skeptical the rally can continue absent positive fundamentals.

- Poor Liquidity – Thin trading makes it tougher to enter and exit positions. This reduces trader participation due to fears of being stuck in illiquid holdings.

We made some small adjustments in our Short-Term Portfolio (STP) yesterday to tilt a bit more bearish after logging some fantastic gains for the month in our Member Portfolios, which we will review this afternoon in our Live Trading Webinar at 1pm, EST and you can sign up here to join us:

https://attendee.gotowebinar.com/register/4867400972390825814

You can also sign up for our YouTube Channel where you can access our Educational and Webinar archives.

The STP is our hedging portfolio – it’s smart to get more aggressive as we’re back near the market’s all-time highs but we have a lot of aggressively bullish positions in our other portfolios – just in case the rally continues. There is certainly a bullish case to be made as the U.S. economy, defying the odds, appears to be navigating a path towards a “soft landing.”

Investors and Politicians are anxious to declare victory in the war on inflation but the economy is still not out of the woods – inflation hasn’t fully retreated to the Fed’s 2% target, and the lingering effects of higher interest rates, along with external shocks like energy price spikes or financial crises, could still derail our journey towards the mythical soft landing.

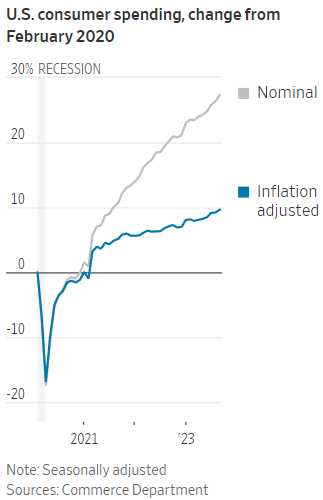

Wage Trends, Consumer Spending, and the Labor Market are still offering mixed signals. While wage gains are slowing, potentially easing inflationary pressures, Consumer Spending remains strong, although it’s been increasingly reliant on dwindling savings. The labor market, though still robust, shows signs of strain with a slight uptick in the Unemployment Rate and a steady rise in long-term Unemployment Claims.

Wage Trends, Consumer Spending, and the Labor Market are still offering mixed signals. While wage gains are slowing, potentially easing inflationary pressures, Consumer Spending remains strong, although it’s been increasingly reliant on dwindling savings. The labor market, though still robust, shows signs of strain with a slight uptick in the Unemployment Rate and a steady rise in long-term Unemployment Claims.

As we approach the holiday season, a critical period for consumer spending, early indicators suggest a cautious outlook. Retail Sales are expected to grow, but at a slower pace compared to previous years. The October retail sales report will be a key indicator to watch at 8:30 this morning.

In this complex and ever-evolving economic landscape, the possibility of a soft landing remains a tantalizing prospect to traders. However, it’s crucial to remain vigilant as the market, much like the broader economy, may appear stable on the surface, but underlying vulnerabilities can still lead rapid repricing. Let’s continue to be careful out there!

8:30 Update: The Producer Price Index (PPI) for October showed a surprising decline of 0.5%, marking the largest decrease in final demand prices since April of 2020 (the Covid crash). This is a total reversal of last months’ 0.4% increase and, of course, miles from the expected 0.1% increase expected by our Leading Economorons. Year-over-year, the PPI is up 1.3%, below the Fed’s 2.0% target but it’s all lower energy prices at the moment. The Core PPI, excluding food and energy, remained flat, suggesting a cooling of inflationary pressures but no reversal.

On the Retail front, October’s Retail Sales fell by 0.1% to $705.0B, smaller than the expected 0.3% decrease, but still a major deceleration from September’s 0.9% increase. Core Retail Sales, however, edged up by 0.1%, miles above the -0.2% estimate by the always-wrong Economorons. Consumer Spending remains resilient with 40 days until Christmas.