It’s been a crazy month.

It’s been a crazy month.

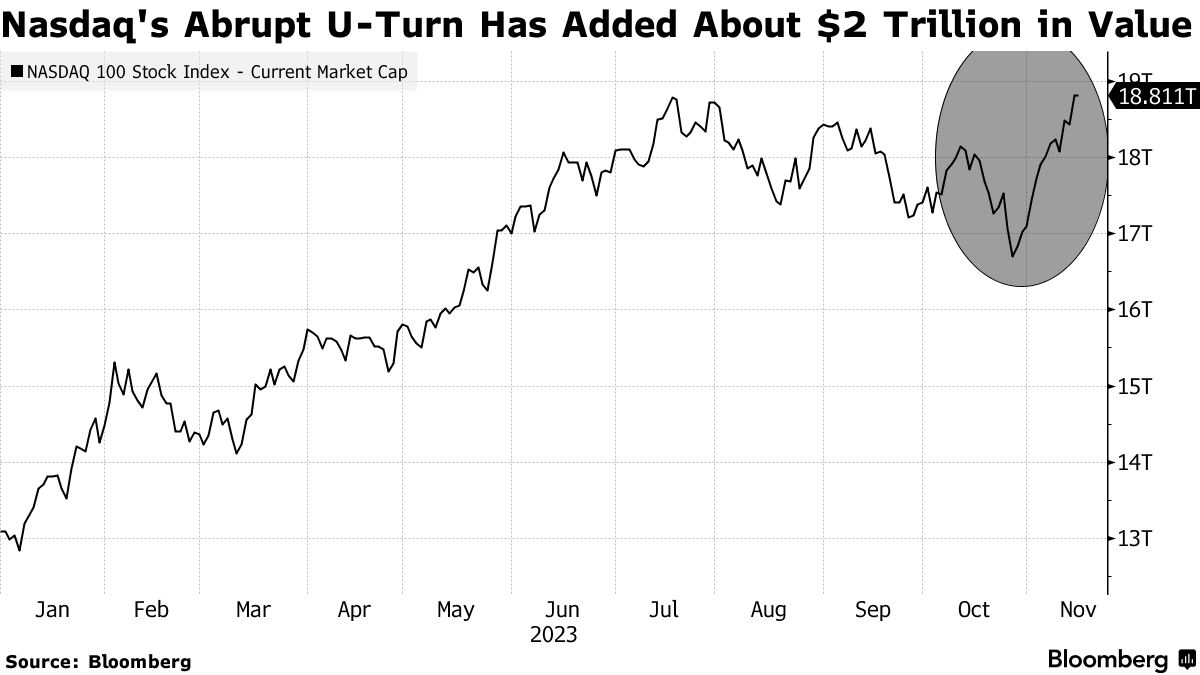

The S&P 500 has neatly risen from 4,200 to 4,500 (7%) and the Nasdaq, as you can see, jumped $2Tn, which is 11.7% in the past 3 weeks, which is an annualized pace of 200% – do you think we’ll keep that up?

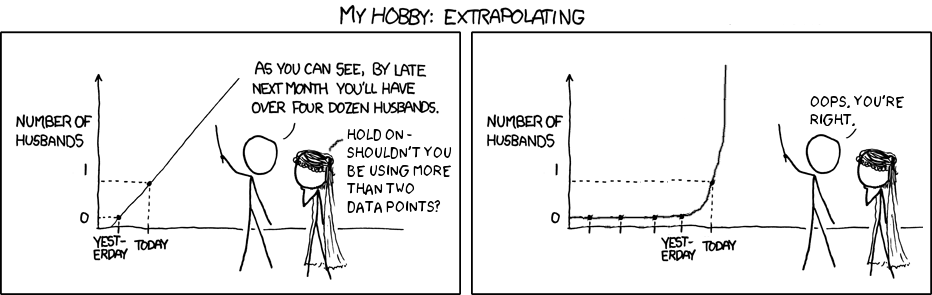

It’s not a silly question. In fact, it’s one of the most ignored concept by the average trader – understanding that trends are not always sustainable – whether to the upside or the downside and THAT is one of the leading causes of investing mistakes. Here’s a cartoon I often use for our Members to illustrate the point:

This is TA in a nutshell, extrapolating trendlines with no consideration for the underlying Fundamental dynamics that truly drive the markets. BECAUSE so many people use TA to make their decisions – we end up taking TA into account as a Fundamental factor but it’s only a factor because people believe in it the same way I would predict that, if a Preacher says “Amen” – a certain percentage of the congregation will also say “Amen” – it’s a behavioral reaction – not a physical one.

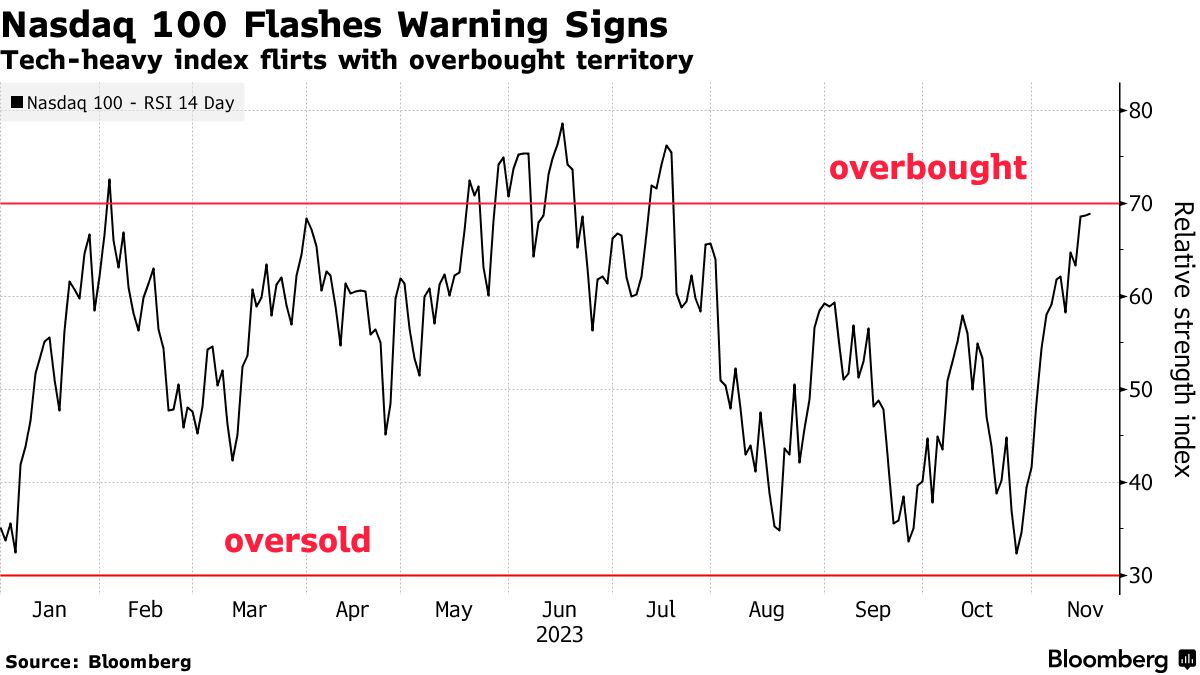

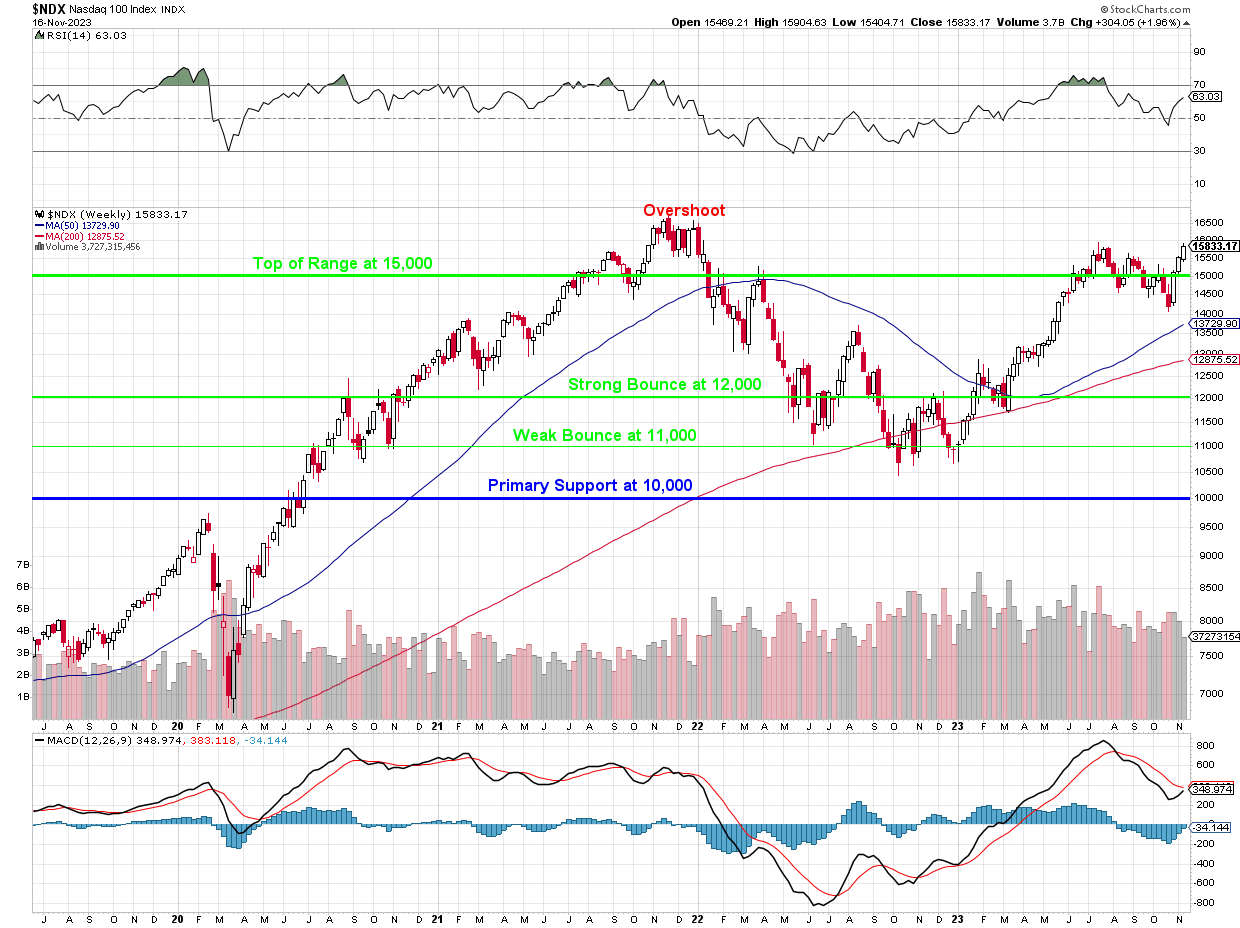

FUNDAMENTALLY, we’re quickly back to overbought territory on the Nasdaq on renewed expectations of Fed easing sooner, rather than later next year but the Nasdaq is already priced at 24 times PROJECTED earnings for next year and, without the money machine of the Magnificent 7, we’re well over 30x for the other 93 stocks in the 100.

This is all happening as we’re getting profit warnings in the tech sector so maybe next year isn’t going to be 24x but still the 27x we saw in July and, keep in mind that most of those earnings are simply a reflection of inflation and have nothing to do with any actual improvements in the profit-generating abilities of these companies. That means earnings are up on inflation and we’re getting more enthusiastic about the market because the Fed is taming inflation???????????

This enthusiasm might be overlooking some stark realities. Let’s not forget the Global Economic Pressures that are playing out in the background. The UK’s Retail Sales downturn and the entry of the oil market into a bear phase are not just isolated incidents – they are reflective of broader economic trends that could impact market dynamics.

The tech sector, despite its current euphoria, isn’t immune to these global pressures. The profit warnings should be raising a big red flag but we’re rallying like crazy. Are traders overestimating the sector’s resilience in a potentially turbulent economic environment? Tech’s performance has significant ramifications for the broader market, especially given its heavyweight status in major indices.

As we approach the end of the month and look towards the holiday season, it’s essential to maintain a balanced perspective. The current market rally, particularly in the tech sector, needs to be weighed against broader economic indicators and potential headwinds. It’s not just about the pace of growth, but the quality and sustainability of that growth.

According to a Bloomberg report, retail sales in the U.S. are expected to be robust this holiday season, despite inflationary pressures and higher interest rates. The National Retail Federation predicts a sales increase of 6-8% over last year. Additionally, Deloitte forecasts a 4-6% increase in holiday sales, with e-commerce sales growing by 12.8-14.3%.

According to a Bloomberg report, retail sales in the U.S. are expected to be robust this holiday season, despite inflationary pressures and higher interest rates. The National Retail Federation predicts a sales increase of 6-8% over last year. Additionally, Deloitte forecasts a 4-6% increase in holiday sales, with e-commerce sales growing by 12.8-14.3%.

Of course this is very much driven by Inflation – things cost more this year and Consumers are obviously stretched but not over-stretched yet so it will be interesting to see how much the sticker shock actually affects their buying habits beginning next (Black) Friday.

With Thanksgiving carving out a chunk next week (officially we’re open next Friday but who’s going to be here?), we’re looking at a low-volume market where anything can happen and probably will.

We have the Leading Economic Indicators on Monday, they were down 0.7% in September. Tuesday brings us Existing Home Sales along with the Fed Minutes, which is where we might see some market volatility, as investors attempt to read the tea leaves and I predict they are nowhere near as doveish as the market is currently expecting them to look.

Wednesday we’ll see Mortgage Applications, Jobless Claims, Durable Goods, and the Consumer Sentiment Index – which is critical ahead of the biggest shopping weekend of the year. Wednesday’s Oil Inventory needs to stave off the collapse in prices ($73.85 this morning, $78.36 on Brent) or that’s going to start putting a drag on the S&P 500.

Have a great weekend,

-

- Phil