The Monday after a holiday should always be a holiday.

The Monday after a holiday should always be a holiday.

Wouldn’t that make you happier? Then why don’t we vote for it? I thought this is a Democracy but nobody I know wants to work today so why are we all doing it? Technically, I don’t work Monday’s anyway, but I end up in the chat room anyway as it’s a lot more interesting than Florida – which is usually my alternative…

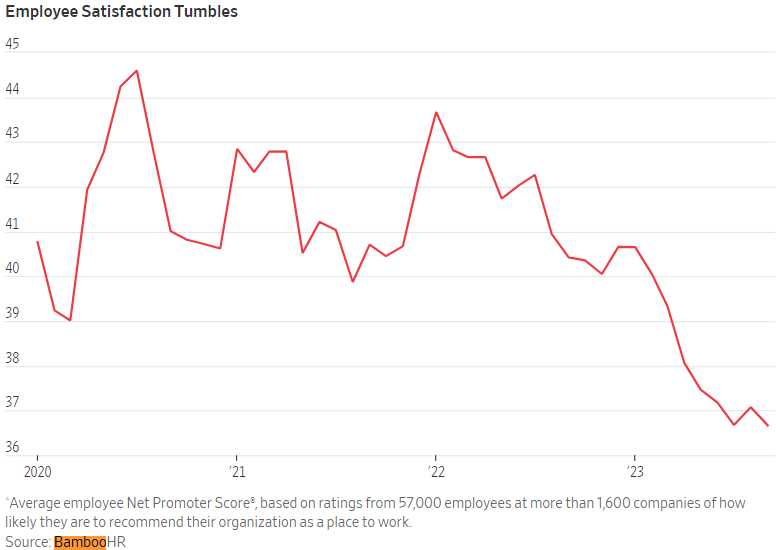

It’s not just me. There is apparently growing dissatisfaction among U.S. employees, despite improvements in wages, paid time off, and work flexibility. This discontent is highlighted by Gallup’s 2023 Workplace Report and a BambooHR analysis, both showing a decline in job satisfaction and an increase in negative emotions like stress and anger among workers.

-

Rethinking Work Post-Pandemic: The dissatisfaction stems from a reevaluation of work life that began in 2020. Factors contributing to this include inflation eroding recent pay gains and the unsettled nature of the workday, with issues arising from both in-office and remote work environments.

-

Company Responses and Worker Expectations: Companies have shifted back to a focus on productivity and cost-cutting post-pandemic, leading to a disconnect with workers. Despite increased spending on employee benefits, this has not translated into higher job satisfaction.

-

Changing Employee Experiences: A WSJ article shares personal stories, like that of Lindsey Leesmann, who felt her professionalism was doubted when asked to return to the office. This reflects a broader sentiment where employees feel their needs and expectations are not being met, despite superficial improvements in working conditions.

-

Mental Health and Employee Turnover: There’s an increase in mental health claims and costs due to employee turnover. The disconnect between employers and employees is also evident in the experiences of new hires, who often feel adrift in their roles.

-

Remote Work and Managerial Challenges: The increase in remote work has led to weakened ties among coworkers and heightened conflicts. This is exacerbated by the physical distance between employees and managers, leading to a lack of trust and increased transactional relationships.

-

Mixed Data on Job Satisfaction: While some surveys, like the Conference Board Survey, indicated higher job satisfaction among certain groups, recent layoffs and job market declines have likely impacted these perceptions.

-

Backlash Against Policy Changes: Some companies reversing flexible remote-work policies have faced backlash from employees who feel betrayed by these changes.

The pandemic has fundamentally altered employee expectations and perceptions of work. While companies have made efforts to adapt, these have often been insufficient or misaligned with what employees truly value. The shift in focus from pandemic-era flexibility and support back to traditional productivity metrics appears to be a significant factor in the growing dissatisfaction.

The pandemic has fundamentally altered employee expectations and perceptions of work. While companies have made efforts to adapt, these have often been insufficient or misaligned with what employees truly value. The shift in focus from pandemic-era flexibility and support back to traditional productivity metrics appears to be a significant factor in the growing dissatisfaction.

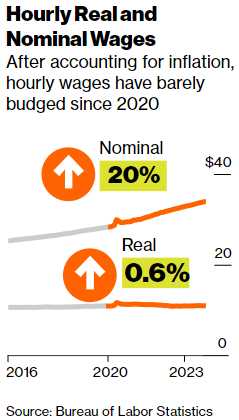

Of course, workers are willing to put up with really, really terrible jobs and working conditions if they are being paid well but that’s the problem – they’re not! Wages are not even close to keeping up with inflation and that’s the root of the dissatisfaction that’s causing Consumer Confidence to be below Recession-levels – along with Biden’s polling numbers because, in the end, people are happy if they don’t have to worry about money all the time.

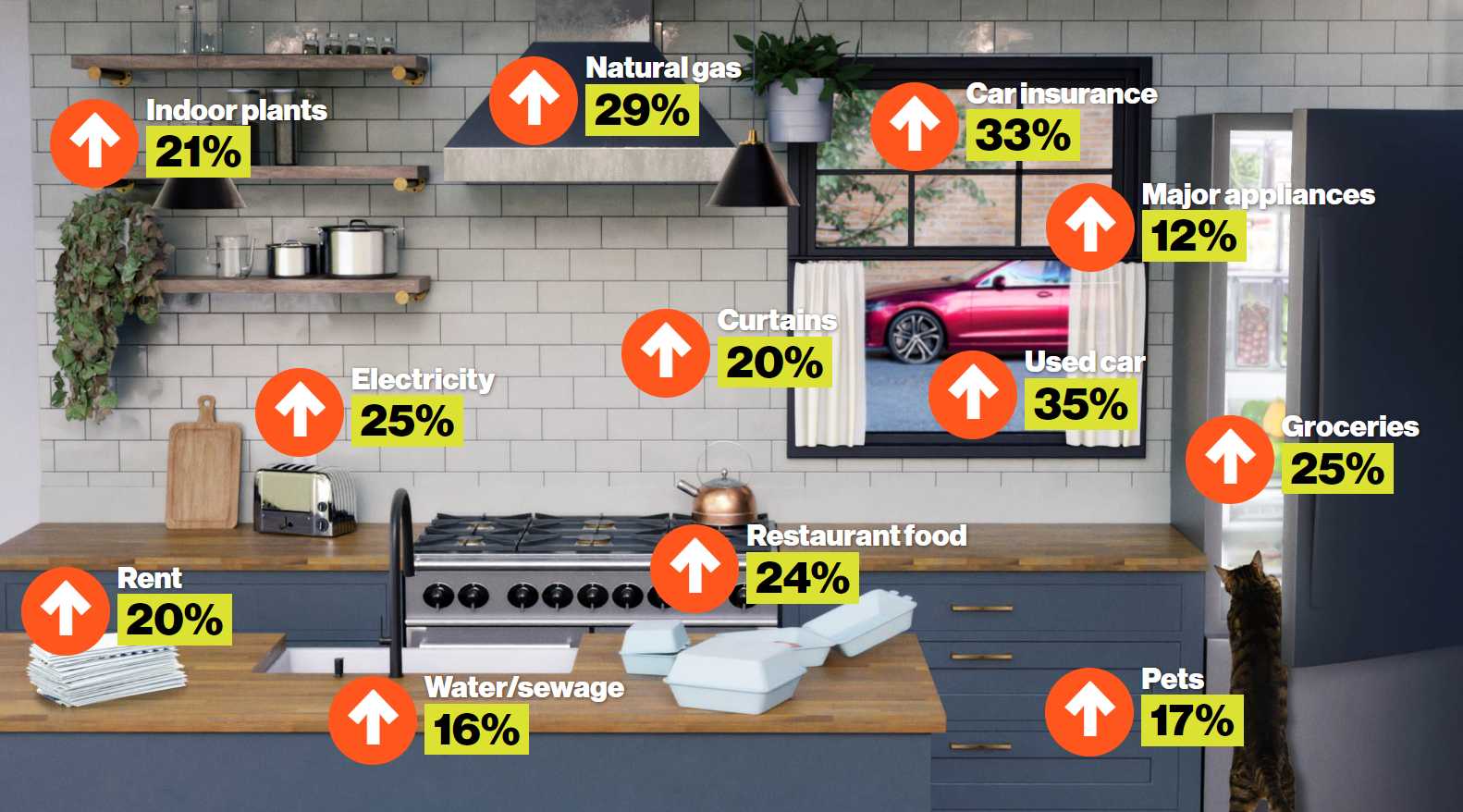

The cost of living in the U.S. has significantly increased since the pandemic. It now takes $119.27 to purchase what $100 could buy before the pandemic (and those are just the BS, official numbers). This rise is more than the total inflation of the ENTIRE previous decade:

The cost of living in the U.S. has significantly increased since the pandemic. It now takes $119.27 to purchase what $100 could buy before the pandemic (and those are just the BS, official numbers). This rise is more than the total inflation of the ENTIRE previous decade:

-

- Groceries: Up by 25% since January 2020.

- Electricity and used-car prices: Increased by 25% and 35%, respectively.

- Rent: Roughly 20% higher.

Despite rapid wage increases, inflation has largely offset these gains, leaving the average American’s purchasing power stagnant. Housing costs have soared, with mortgage rates at a 23-year high and home values up by 42% since 2020. This has made both renting and homeownership more challenging.

Essential services like electricity, natural gas, and car insurance have seen significant price hikes. As of 2022, the average annual cost of child care nationally was $10,853, according to data from Child Care Aware of America, with prices varying by state. And as of September, average monthly child care payments were 32% higher than the 2019 average. Health Care is causing similar pain for working families – nearly 40% of Americans have delayed or skipped needed health care in the past year because they couldn’t afford it.

Savings accumulated during the pandemic are dwindling, and debt levels are rising, partly due to higher borrowing costs. Costs for non-essential items and services like travel (hotels up 15%) and dining out (up 24%) have also increased, further squeezing budgets. Meanwhile, restaurant prices are up 24% since January 2020 – a figure that doesn’t even include the “optional” tips that touchscreen checkout systems often nudge diners to add these days.

High Inflation and Cost of Living are key concerns for voters that are likely to influence the 2024 Presidential Election. While there might be some relief in certain areas, like grocery inflation (mostly due to Consumers “swapping” for less-expensive items), overall financial pressures are likely to persist for quite a while:

-

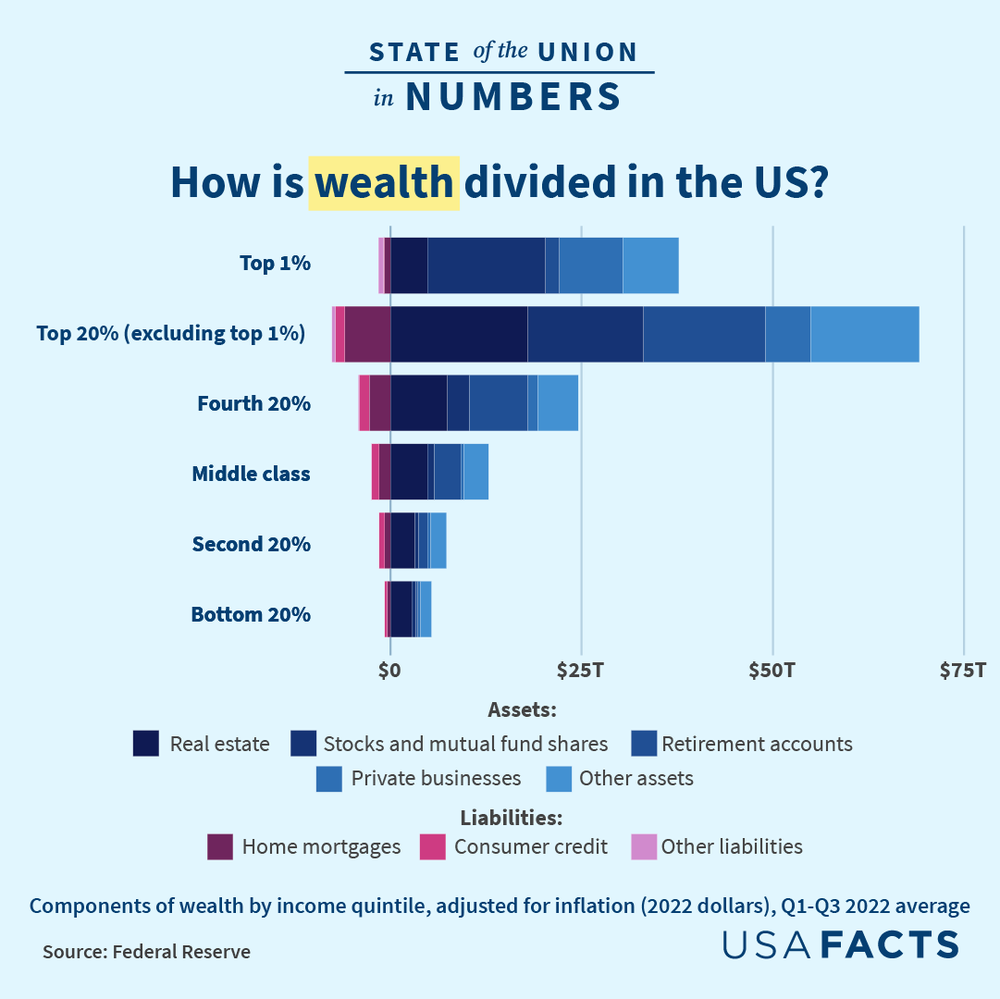

Economic Disparity: There is growing economic disparity, where the cost-of-living increases are disproportionately affecting middle and lower-income families. This is evident in the struggle to afford basic necessities like food and housing.

-

Policy Implications: The situation poses significant challenges for Policymakers. While wage growth is a positive sign, it’s insufficient to counteract the inflationary pressures. This could necessitate more nuanced Economic Policies to address both Inflation and Wage Stagnation.

Policy Implications: The situation poses significant challenges for Policymakers. While wage growth is a positive sign, it’s insufficient to counteract the inflationary pressures. This could necessitate more nuanced Economic Policies to address both Inflation and Wage Stagnation. -

Market Sentiment: The article underscores a general sentiment of economic frustration among consumers, which could have broader implications for Market Confidence and Consumer Spending Patterns.

-

Investment Perspective: From an investment standpoint, sectors like Real Estate and Essential Services might continue to see growth due to their inelastic demand. However, Consumer Discretionary sectors could face headwinds if the squeeze on disposable income continues.

-

Long-term Outlook: While there might be some leveling off of prices, the high Cost of Living and Inflation are likely to remain key features of the economic landscape in the near term. This could have implications for long-term investment strategies, particularly in sectors sensitive to consumer spending and borrowing costs.

Meanwhile, in the short run, Black Friday went “well” with in-store and on-line sales up 2.5% but that’s less than inflation. Mastercard, which measures retail sales across all forms of payment, said e-commerce sales rose 8.5% on Black Friday ($16.4Bn US, $70.9Bn Globally), while in-store sales rose 1%. Discounts, however, were averaging 30% this year so consider that it’s one thing for Retailers to make sales and quite another thing to make profits on those sales…

Meanwhile, in the short run, Black Friday went “well” with in-store and on-line sales up 2.5% but that’s less than inflation. Mastercard, which measures retail sales across all forms of payment, said e-commerce sales rose 8.5% on Black Friday ($16.4Bn US, $70.9Bn Globally), while in-store sales rose 1%. Discounts, however, were averaging 30% this year so consider that it’s one thing for Retailers to make sales and quite another thing to make profits on those sales…

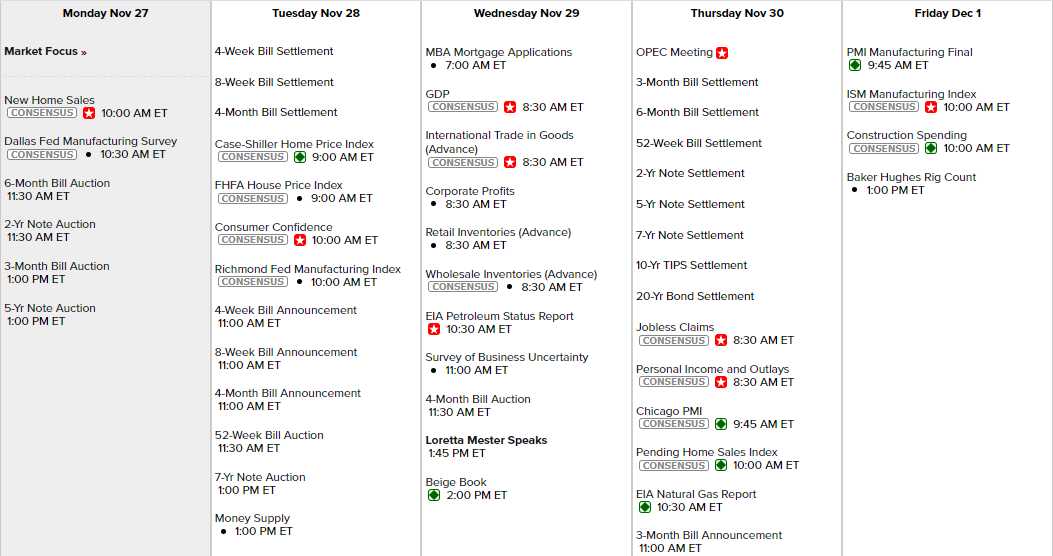

We’re back to a kind of normal week in the markets, led by Housing Data with the Dallas Fed this morning and some note auctions this afternoon. Tomorrow is Consumer Confidence and the Richmond Fed and Wednesday we’ll see GDP numbers, Inventories and Business Uncertainty with Loretta Mester speaking ahead of the Beige Book at 2pm. OPEC finally has their meeting on Thursday and we also get Personal Income, and the Chicage PMI with Friday giving us Manufacturing PMI, ISM and Construction Spending so we should have a pretty good grasp on the Data by Friday.

And there are still PLENTY of earnings reports dribbling in with a few significant players. One of them is Foot Locker (FL) who we just got more aggressive with them in our Long-Term Portfolio Review on the 14th and they’ve begun to show signs of life so we’ll cross our fingers on that one as it could be a huge win for our LTP.

TD Bank (TD) is cheap at $61.50 ahead of their earnings as well – especially when you consider that, for the past year, they have been lending out money at less than 75 CAD to the Dollar and, assuming Canada’s currency doesn’t completely collapse – the are likely to get paid back in stronger loonies in the Future and THAT will be a very nice bonus boost to profits down the road.

I asked Shelbot to check my math and he has this to say:

🤓 To illustrate the potential impact of a stronger CAD on TD Bank’s earnings, we can use a hypothetical scenario where the CAD/USD rate increases from 1.36 to 1.30 by the end of 2023. Assuming that TD Bank’s US operations have the same level of profitability and growth as in the third quarter of 2023, and that the average exchange rate for the fourth quarter of 2023 is 1.33, we can estimate the following effects:

-

- When the CAD is weak relative to the USD, TD Bank’s US earnings are worth more in CAD terms, and vice versa. This is called the translation effect1. The translation effect would be negative, meaning that TD Bank’s US net income would be worth less in CAD terms. Based on the third quarter net income of $1,590 million CAD, we can estimate that the fourth quarter net income would be $1,557 million CAD, using the average exchange rate of 1.33. This would be a decrease of $33 million CAD, or 2%, compared to the third quarter.

- The revaluation effect would be positive, meaning that TD Bank’s US net asset position would increase in value in CAD terms. Based on the net asset position of $77,491 million CAD as of November 24, 2023, we can estimate that the net asset position as of December 31, 2023 would be $83,333 million CAD, using the spot exchange rate of 1.30. This would be an increase of $5,842 million CAD, or 8%, compared to November 24, 2023.

- The net effect of these two effects would be positive, meaning that TD Bank’s earnings would increase in CAD terms. The increase in the net asset position would more than offset the decrease in the net income, resulting in a net gain of $5,809 million CAD, or 7%, compared to the third quarter.

Now, we’re not saying it’s going to happen that soon but, eventually, the Dollar will weaken and it’s a good hedge if we are playing the Fed to stay tight and they get loose instead – that will weaken the Dollar, strengthen CAD and TD is off to the races – see how easy it is? A nice play to make on TD for our Butterfly Portfolio is:

-

- Sell 5 TD 2026 $60 puts for $6 ($3,000)

- Buy 15 TD 2026 $60 calls for $8 ($12,000)

- Sell 10 TD 2026 $70 calls for4 $4 ($4,000)

- Sell 5 TD April $60 calls for $3.75 ($1,875)

That’s net $3,125 on the $15,000 spread so we have $11,875 (380%) upside potential at $70 but notice we sold $1,875 in premium using our first 144 days out of the 781 we have to sell. So, if TD is down or flat, we’ll have 4 more sales like that and make about $7,500, which would turn our spread into a net credit. If TD is up then we roll the short calls to higher strikes and we’ll have our $15,000 in 2 years. Aren’t options fun?