The Fed sets rates next Wednesday.

The Fed sets rates next Wednesday.

Until then, we wait patiently for the markets to calm down but cuts are already priced in – not next week but SOON! The only Fed head scheduled for the week is the Fed’s Bank Regulator, Michael Gibson – who we never hear from. He’s a hawk policy-wise but it’s just a speech on “Fostering Financial Innovation” so we shouldn’t expect fireworks. The rest of the Fed is quiet ahead of their decision next Wednesday, which will be followed by Powel’s press conference.

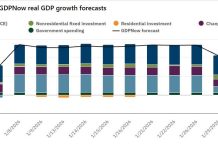

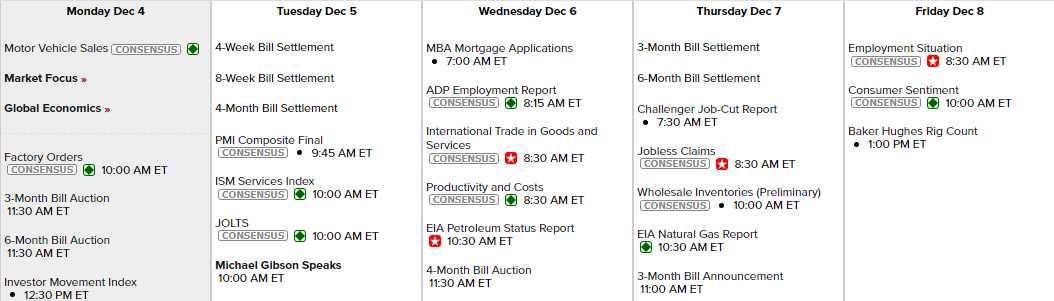

Other than that, it’s a pretty slow data week with Motor Vehicle Sales today, PMI & ISM tomorrow, Productivity on Wednesday is very, very important and Thursday we have Consumer Credit, followed by Consumer Sentiment on Friday along with Non-Farm Payrolls – big data points the Fed will pay attention to next week.

Earnings are still dribbling in but we’re generally down to Russell companies (small caps) but there’s also DG, AVGO, RH, GME, THO, MTN, LULU, DOCU and TOL. Finally LoveSac (LOVE) will be weighing in and they were a Top Trade Alert for our Members back in Sept of 2022 and again in June of this year – so you know we like them.

The September Trade was, fortunately, short-term and expired in April 100% in the money for the full 900% gain in 7 months, as planned so of course we couldn’t resist going back in when the stock took another dip below $25 and that spread is down a bit but the Jan $20s (we have the $17.50s now in the LTP from a roll) are still $3.20 and the $17.50s are $5 and the 10 short Jan $22.50 puts are $2.60 so we can roll those to 10 July $20 puts at $3.45 and roll the calls to 20 July $15 ($8.30)/22.50 ($4.50) bull call spread at net $3.80 and we’ll see how earnings go on Wednesday (and that’s good for a new trade – of course).

The Dollar has been flat but BitCoin ($41,000) and Gold ($2,100) have both flown higher over the weekend as US ships were attacked TWICE by Yemen and the USS Carney was responding to another ship (an oil tanker) that was under attack by Rent-A-Rebel. Yemin is controlled by Iranian-backed Houthi rebels – so escalation is in the air, my friends!

The Dollar has been flat but BitCoin ($41,000) and Gold ($2,100) have both flown higher over the weekend as US ships were attacked TWICE by Yemen and the USS Carney was responding to another ship (an oil tanker) that was under attack by Rent-A-Rebel. Yemin is controlled by Iranian-backed Houthi rebels – so escalation is in the air, my friends!

All that fuss and bother however, has barely gotten Oil (/CL) back to $73 with Brent (/BZ) well below $80 at $78. European crude markets, which help set benchmark prices, are facing a supply glut due to a combination of weak regional crude demand and an influx of cargoes from the US – which is EXPORTING 4Mb/d of petroleum products this year. The potential for Venezuelan oil to come online poses additional risks to the market. If Venezuela increases its oil exports, it could further contribute to the global supply, potentially putting downward pressure on prices.

Generally, it’s a waiting week ahead of the Fed – let’s have some fun!