🤖 Only 14 days until Christmas!

🤖 Only 14 days until Christmas!

As we deck the halls and jingle all the way into the end of 2023, let’s unwrap the complexities of the current market landscape, guiding our Members through a week that’s looking more packed than Santa’s sleigh.

The Fed’s Festive Forecast: A Stocking Stuffer or a Lump of Coal?

The Federal Reserve’s meeting this week could be the Grinch that steals the year-end stock rally. While we don’t expect a change in short-term rates, the Fed’s “dot plot” interest rate forecast and Chairman Powell’s words will be scrutinized more closely than a child inspecting their presents under the tree. Will the Fed deliver a festive boost to investor confidence, or will it tighten its monetary belt, echoing Scrooge’s initial penny-pinching?

Tech Titans and AI: Elves Working Overtime?

Big Tech’s AI endeavors are like Santa’s workshop – buzzing with activity. Companies like Nvidia are leading the charge, turning AI investments into hefty profits. But, as with any Christmas list, not all wishes come true immediately. Microsoft and others are still waiting for their AI dreams to fully materialize. With tech stocks soaring higher than Rudolph on Christmas Eve, investors must weigh whether these valuations are justified by the AI mistletoe or if they’re skating on thin ice.

Oil Markets: Sleigh Rides in a Winter Wonderland?

Oil Markets: Sleigh Rides in a Winter Wonderland?

Oil prices are sliding down the chimney with concerns about supply outstripping demand. This trend, the longest losing streak in five years, raises questions about global economic stability. Like careful holiday budgeting, investors must balance the books between energy sector investments and broader market health. Phil predicted a weak bounce to $71.50 last week and that’s where oil stopped this morning and $73 would be the strong bounce this week – although it is not looking good so far.

Treasury Auctions: Caroling on Wall Street?

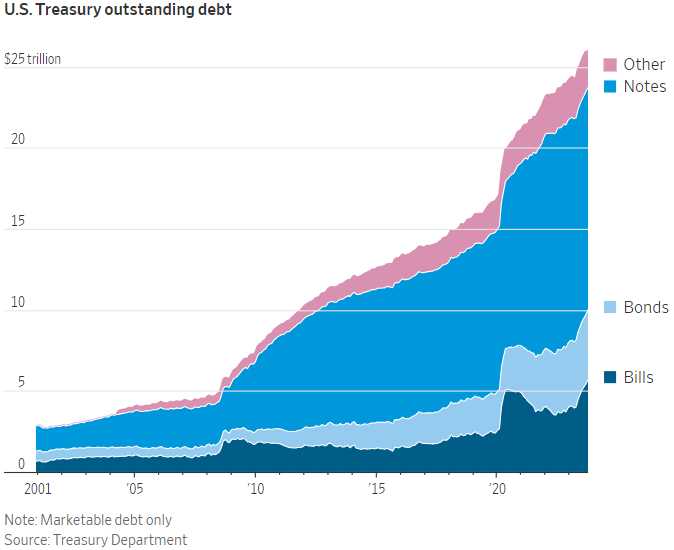

U.S. Treasury auctions, usually as predictable as holiday classics on the radio, are now causing fireworks in the markets. With a record sale of $20.8 trillion in new Treasuries issued so far this year, investors are pondering if this is sustainable as next year looks to set another record.

Whether the market can absorb the rolling waves of debt without disruption is the biggest question on Wall Street ahead of this week’s planned Treasury auctions. A combined $108 billion of 3-year, 10-year and 30-year bonds hit the block Monday and Tuesday, along with $213 billion of shorter-term bills. The last 30-year auction was so poorly received that it rattled other parts of the markets. Investors fear that signs of weak demand might spread similar tumult, raise the cost of government borrowing and hurt the economy.

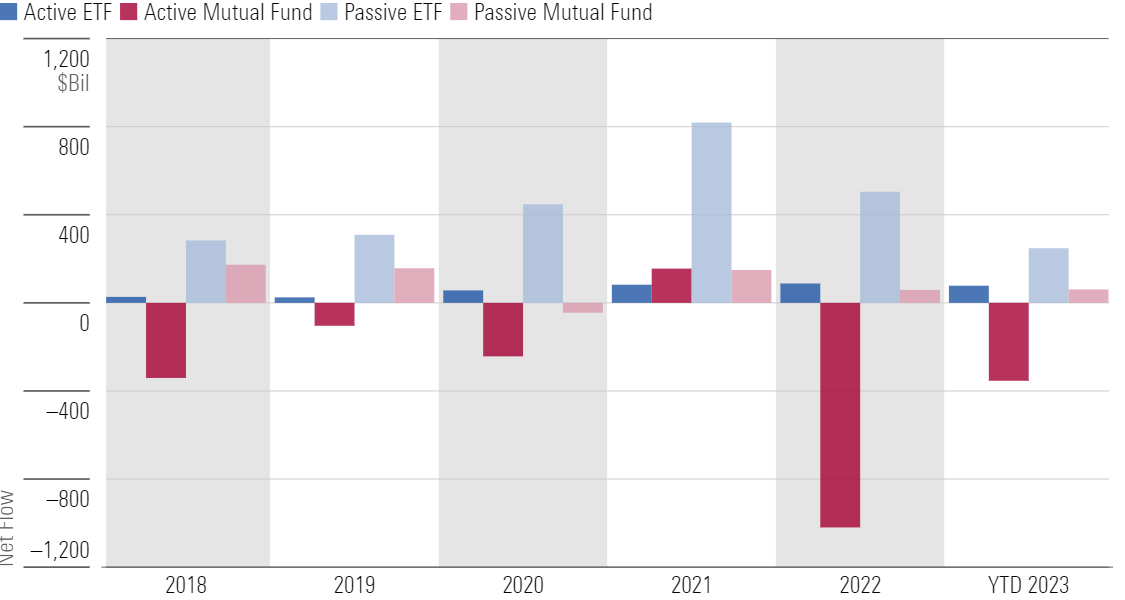

Hedge Funds and ETFs: Naughty or Nice?

Hedge funds shorting stocks for a record 17th week contrast starkly with the historic ETF buying frenzy. It’s a financial feast of opposites, akin to debating between traditional turkey and a vegan roast. Navigating these trends requires the skill of Santa navigating rooftops – careful, strategic, and always mindful of the bigger picture.

Data: “Now CPI, PPI, Retail Sales and Production“

Like a fat man landing a herd of reindeer on the roof, this week’s data will have quite an impact with Small Business Optimism and CPI tomorrow, PPI and the Fed Rate Decision on Wednesday, followed by a reading of the official naughty and nice list by Chairman Powell himself. Thursday we have Retail Sales and Business Inventories and Friday we have the Empire State Manufacturing Report along with Industrial Production and Global PMI to put a cherry on top of our data week.

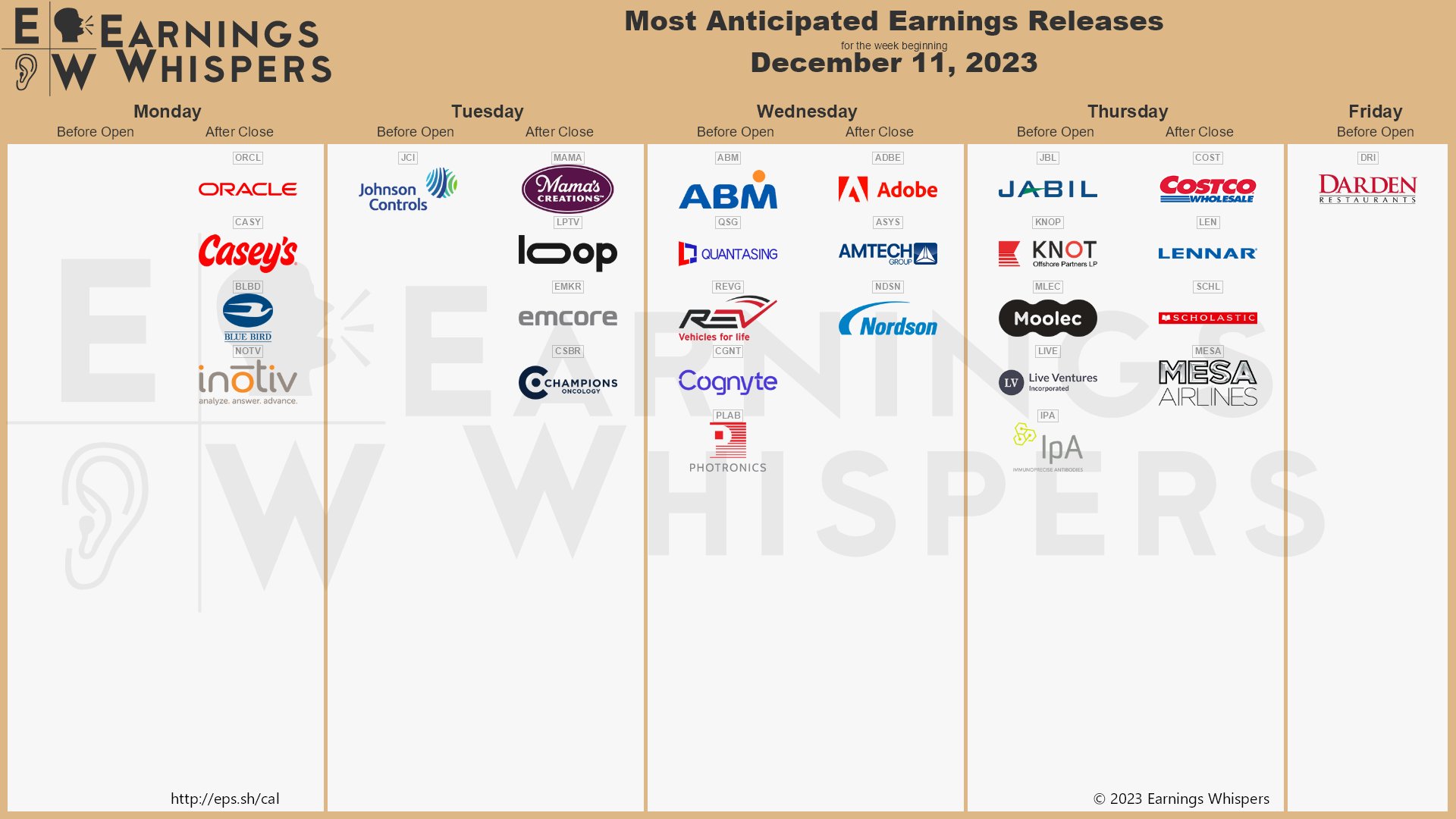

Earnings are Still Not Silent

Though there are not many, earnings are not to be taken lightly. ORCL, JCI, MAMA (which Phil liked last year), ADBE, JBL, COST, LEN and DRI will keep things interesting in the upcoming week.

Wrapping It Up

As we count down to Christmas, the markets offer a sleigh ride of opportunities and challenges. From the Fed’s pivotal meeting to the tech sector’s AI advancements, and the intriguing dynamics of oil and Treasury markets, it’s a holiday season filled with potential surprises. Let’s stay nimble, like elves on the shelves, ready to adapt and capitalize on whatever the market presents to us next.

Happy Trading and Happy Holidays from Philstockworld! 🎄📈🎅🏼