$14.1Bn, that would have made old JP Morgan Happy.

US Steel became America’s first Billion-Dollar corporation in 1901, after JP Morgan bought out Andrew Carnegie’s steel companies for $492M and then rolled up several other steel companies, including Charles Schwab’s steel company as well (this is where all that money came from – 100 year’s compound returns on $1Bn!).

$14.1Bn ($55/share) is a 60% premium to Friday’s close which was an 80% gain since rumors about a buyout of X began in August so good luck to Japan justifying that purchase! This should also be good for CLF because they WON’T be buying X and most people think they were biting off more than they could chew with their original offer.

At just $9.4Bn in market cap with almost $1Bn in profits on $21Bn in sales, CLF seems a bit undervalued as X only had $17Bn in sales with the same $1Bn in profits. For our Short-Term Portfolio (STP) I think a fun way to play CLF would be:

-

- Sell 15 CLF 2026 $17 puts for $3 ($4,500)

- Buy 20 CLF 2026 $15 calls for $7 ($14,000)

- Sell 20 CLF 2026 $20 calls for $4.60 ($9,200)

That’s net $300 on the $10,000 spread so there’s $9,700 (3,230%) of upside potential if X is over $20 in 2 years. If they do get bought, the options will trigger early and that will make us very happy! If they don’t get bought, our break-even is $17.03 – 9% below the current price.

It’s possible the purchase of X may be blocked as steel is a vital industry for the US but we still like CLF long-term, trading at just 10x earnings – so I don’t see a good reason not to make this trade.

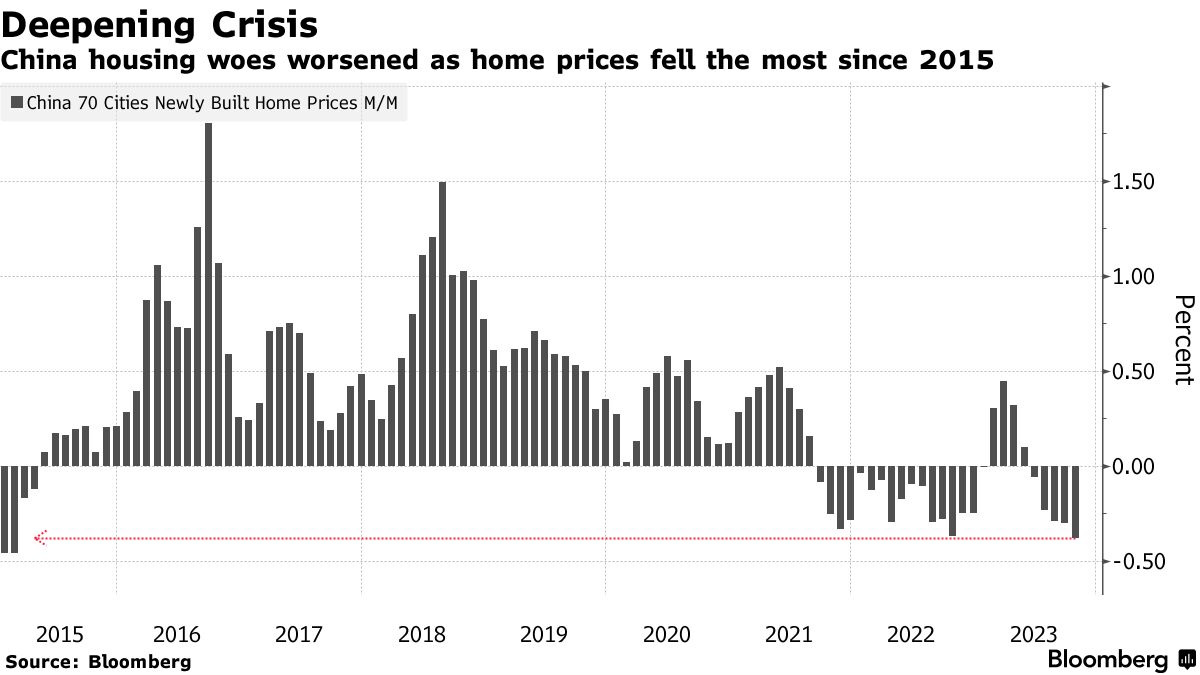

Meanwhile, on the other side of the World, real estate prices in China are still in freefall – after a brief pause as the end of last year that has not been repeated this year – something the Ministry of Truth calls “Double plus ungood.”

70% of China’s assets are tied up in housing – about $54Tn worth of them. Above are the official statistics – it is estimated that housing has actually declined at least 15% in major cities. The recent disbandment of Credit Suisse’s onshore wealth unit in China, as reported by Bloomberg, is another sign of the growing concerns in the Chinese financial sector.

The unraveling of the property market in China is akin to pulling a thread on an ugly Christmas sweater – the more you pull, the more the entire fabric unravels. The government’s pledge to introduce more policies to stabilize the market might seem like a good patch job, but it’s more like using a band-aid on a gaping wound. The underlying issues of over-leverage and speculative investments are systemic and deep-rooted.

The unraveling of the property market in China is akin to pulling a thread on an ugly Christmas sweater – the more you pull, the more the entire fabric unravels. The government’s pledge to introduce more policies to stabilize the market might seem like a good patch job, but it’s more like using a band-aid on a gaping wound. The underlying issues of over-leverage and speculative investments are systemic and deep-rooted.

China’s REITs, once a hot commodity, are now feeling the heat of the property slump. The demand for these investment vehicles has plummeted and we’ve discussed the ongoing issues with Evergrande and China Garden many times in the past. This slump isn’t just a reflection of declining property values; it’s indicative of waning investor confidence and a reevaluation of risk in Chinese real estate.

The case of Hywin, a wealth management firm in China, is particularly telling. As their shares took a nosedive, they vowed to fix defaults, a scenario that’s becoming all too common in the Chinese financial landscape. This situation is a stark reminder of the fragility of over-leveraged financial systems and the domino effect they can have.

What does this mean for the global economy and, more specifically, for investors? The Chinese real estate market, once a darling of investors seeking high returns, is now a cautionary tale of what happens when speculation and debt outpace fundamental value and sustainable growth. For those of us in the West, it’s a reminder to tread carefully in markets where growth is driven more by speculation than by underlying economic fundamentals.

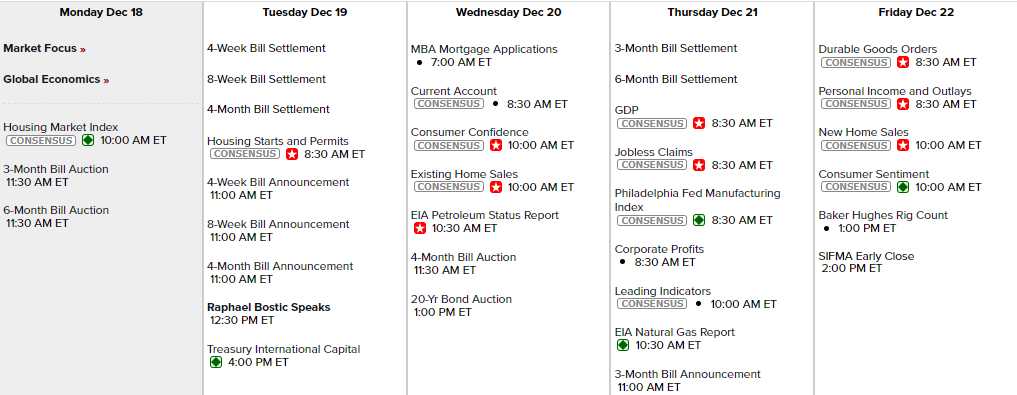

Speaking of fundamentals – it’s a strong data week but the Fed speakers are on vacation – other than Bostick, who is speaking at a lunch on Tuesday. Consumer Confidence, GDP, Corporate Profits, Leading Indicators, Durable Goods, Income and Outlays and Consumer Sentiment will keep us on our toes towards the end of the week.

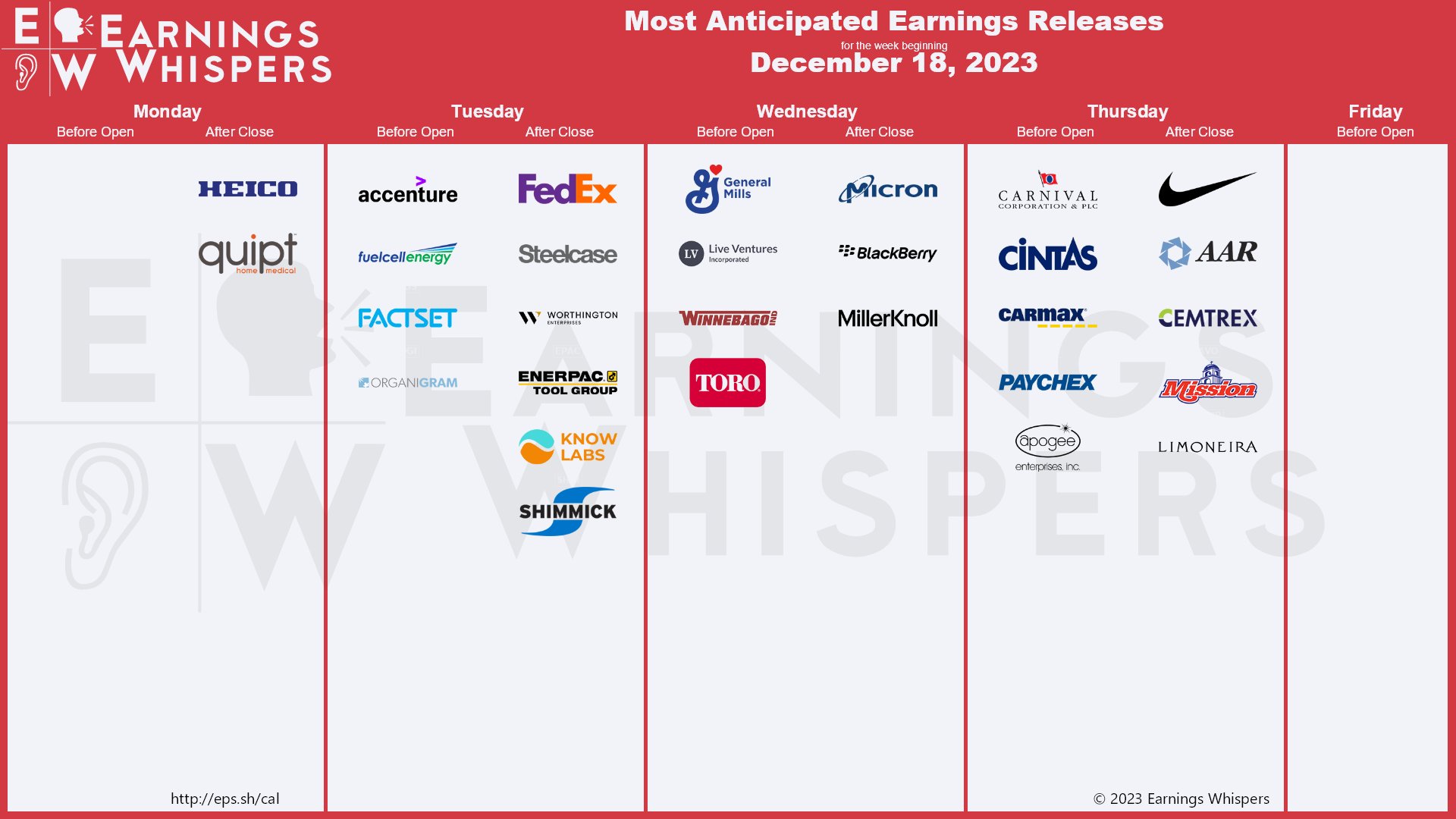

And, believe it or not – there are still earnings reports coming in – including FDX and NKE – so we can’t ignore those.

“You must have heard the cautionary tales

The dangers hidden on the cul-de-sac trails

From wiser men who’ve been through it all

And the ghosts of failures spray-canned up on the wall” – Townshend