Consumer Sentiment isn’t out until 10.

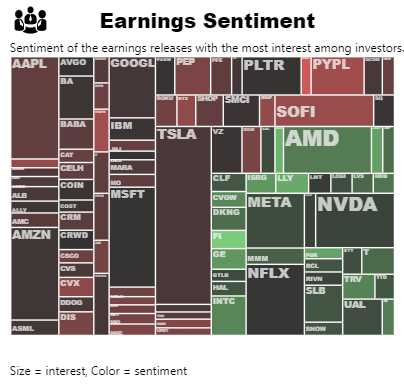

So, let’s move onto earnings, which got better today after a poor start to the week. Of 13 reports since yesterday’s close, only JBHT and RF missed while PPG guided down so 10 out of 13 (77%) is a good way to end the week on the earnings front ahead of next week’s Earningspalooza:

Expectations are very low overall with investors expecting misses from 2/3 of the S&P 500 and, since that’s not likely to happen – low expectations are likely to keep us rallying into February. Taiwan Semi-Conductor (TSM) had great earnings last night and great guidance and that’s lifting the tech sector – as is META’s announcement that they’ll be buying 350,000 of NVDA’s $25,000 AI Chips ($8.75Bn!) so Mark Zuckerberg can download himself and annoy us for Millenia to come.

Expectations are very low overall with investors expecting misses from 2/3 of the S&P 500 and, since that’s not likely to happen – low expectations are likely to keep us rallying into February. Taiwan Semi-Conductor (TSM) had great earnings last night and great guidance and that’s lifting the tech sector – as is META’s announcement that they’ll be buying 350,000 of NVDA’s $25,000 AI Chips ($8.75Bn!) so Mark Zuckerberg can download himself and annoy us for Millenia to come.

As far as evil Billionaire plots go – it’s still not as bad, or as crazy, as Elon Musk buying Twitter – we need a James Bond/Jason Bourne type to stop these guys, don’t we?

Anyway, earnings will be what they will be but China may not be at some point in the not too distant future. A series of complex challenges loom on the horizon, signaling potential turbulence that could ripple through global markets slowly or suddenly:

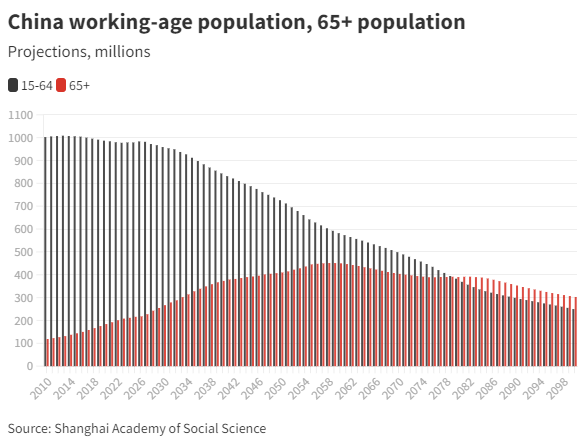

First of all, we’re witnessing a demographic collapse post the one-child policy era. China’s population decline is not just a number game; it’s a symptom of deeper societal shifts. With a plummeting birthrate and an aging workforce, the economic repercussions could be significant. The shrinking working-age population and a fertility rate well below the replacement level hint at a future where China might struggle to sustain its economic dynamism.

First of all, we’re witnessing a demographic collapse post the one-child policy era. China’s population decline is not just a number game; it’s a symptom of deeper societal shifts. With a plummeting birthrate and an aging workforce, the economic repercussions could be significant. The shrinking working-age population and a fertility rate well below the replacement level hint at a future where China might struggle to sustain its economic dynamism.

Adding to this complexity is the economic turmoil under President Xi’s leadership. The skepticism around China’s official GDP figures and the challenges of high youth unemployment and DEFLATION paint a picture of an economy grappling with internal pressures and a leadership style that may be more a hindrance than a help.

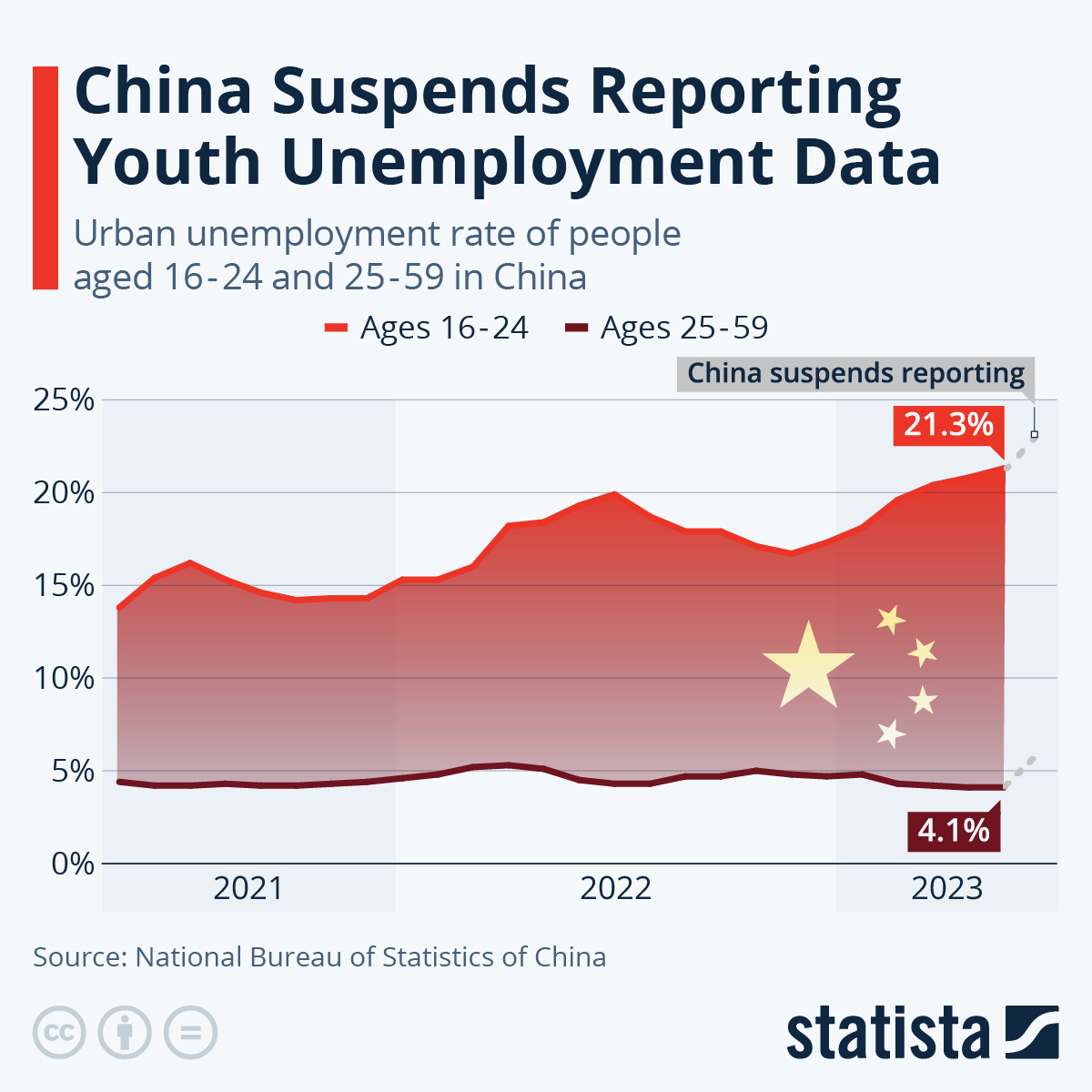

The issue of youth unemployment is particularly alarming. Despite a revised methodology presenting a lower unemployment rate, the reality on the ground remains grim for China’s youth. This is a ticking time bomb for social stability and a clear indicator of underlying economic distress.

The issue of youth unemployment is particularly alarming. Despite a revised methodology presenting a lower unemployment rate, the reality on the ground remains grim for China’s youth. This is a ticking time bomb for social stability and a clear indicator of underlying economic distress.

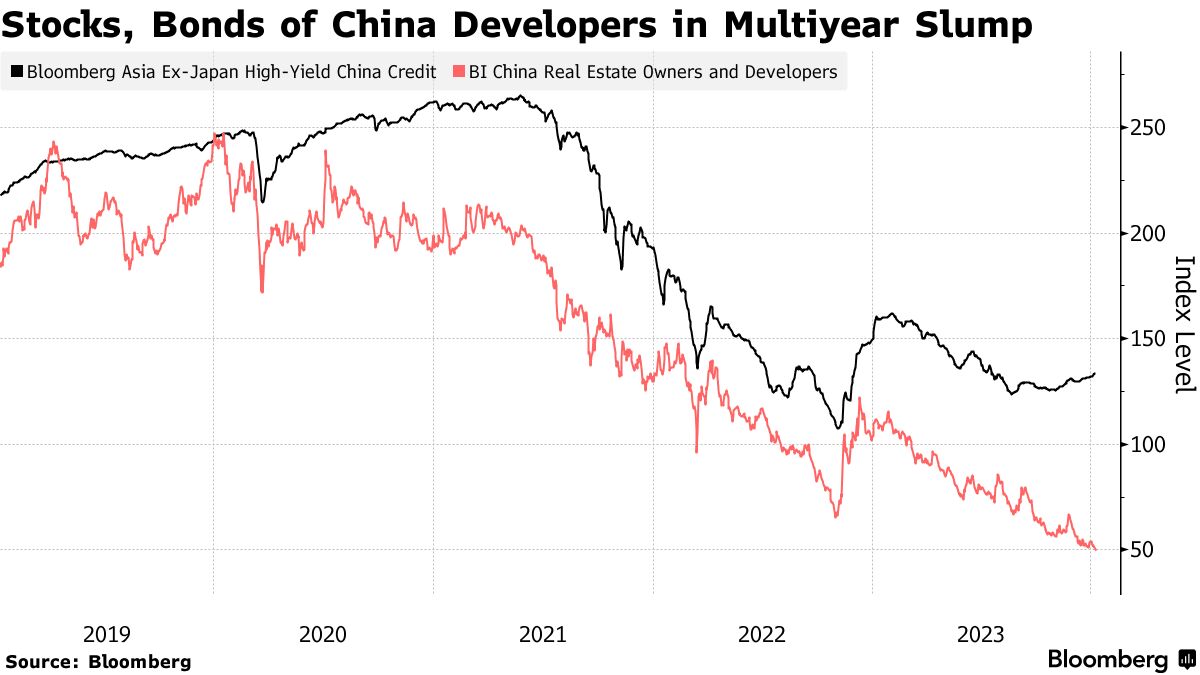

Moreover, the struggling property market remains a thorn in the side of China’s economic recovery. Despite various stimulus measures, the sector shows no signs of a turnaround, with falling property sales and a lack of fundamental recovery.

Lastly, the overall economic growth in China has slowed to a three-decade low, excluding the pandemic period. This slowdown, driven by a property-sector meltdown and weakened consumer confidence, signals deeper structural issues within the economy.

As investors and market analysts, we must keep a keen eye on these developments. The interplay of demographic shifts, economic policies, and market dynamics in China could have far-reaching implications, not just for the Asian markets but globally. The situation calls for a nuanced understanding and strategic foresight, as these factors could influence market trends and investment decisions – perhaps in the coming months but CERTAINLY in the coming years.

Have a great weekend,

-

- Phil