Stuff is happening!

Stuff is happening!

Last night we heard from Alphabet (GOOG), Boston Properties (BXP), Chubb (CB), Juniper Networks (JNPR), Microsoft (MSFT), Mondelez Int’l (MDLZ), Mondelez Int’l (MDLZ) and Starbucks (SBUX) and this morning we got Boeing (BA), Boeing (BA), Brinker (EAT), GlaxoSmithKline (GSK) and Mastercard (MA) and the earnings are improving from a rough start (see Monday’s notes).

Still, CB, SBUX, BA and GSK are up and the others are down as traders are being very critical of companies that are already trading at all-time high valuations. Show us the earnings!

Microsoft could not have put up a better quarter but $408 is $3,000,000,000,000 in Market Cap and they are not making $100Bn this year ($84Bn) or next ($96Bn expected) so we’re well over 30x earnings though MSFT does have $46Bn in cash, which is nice. The other $3Tn company, AAPL, already makes $100Bn and expects $107Bn next year so either AAPL is $300Bn too cheap or MSFT is $300Bn too expensive or both of them should be at 24x and that would be down $1.2Tn between the two of them…

Speaking of drastically reduced valuations – poor Elon Musk will NOT be getting his $56Bn bonus as a judge said that is ridiculous and involved way too much self-dealing to be fair to shareholders. The Delaware judge voided Musk’s pay package, ruling that it was excessive and unfair to Tesla’s shareholders, and that the company’s board of directors (Muskovites?) failed to prove that the compensation plan was necessary or reasonable.

The judge agreed with the shareholder’s arguments, and found that the board did not act independently or in good faith, and that the shareholders did not receive adequate information or protection when they approved the pay package. The judge also criticized the pay package as an “unfathomable sum” that was “six times larger than the combined pay of the 200 highest-paid executives in 2021” and that “far exceeded the reasonable range of compensation for a CEO of a public company.” Of course, Elon Still has $205Bn – even after blowing $42Bn on Twitter – so there WILL be appeals.

Tesla (TSLA) is currently capped at $610Bn at $191.50 and they made $12.5Bn last year so that’s 48.8x earnings so it will take TSLA until late 2072 to pay you back the money you give them today. Stellantis, by comparison, made $18.6Bn last year and you can buy that whole company for $68.4Bn at $21.87 – that’s barely more than Elon Musk’s bonus for making half as much money at 10 times the price!

Why, you may wonder is STLA trading at 5 times earnings when TSLA is trading at 60 times earnings? Can moving just one letter in a stock symbol really make that much difference? No, it’s because traders are idiots and have no idea how to properly value companies and “analysts” are even bigger idiots – not because they are dumber than traders but because it’s their JOB not to be dumber than traders and they are clearly terrible at that and simply jump on whatever bandwagon gives them a paycheck… or a byline.

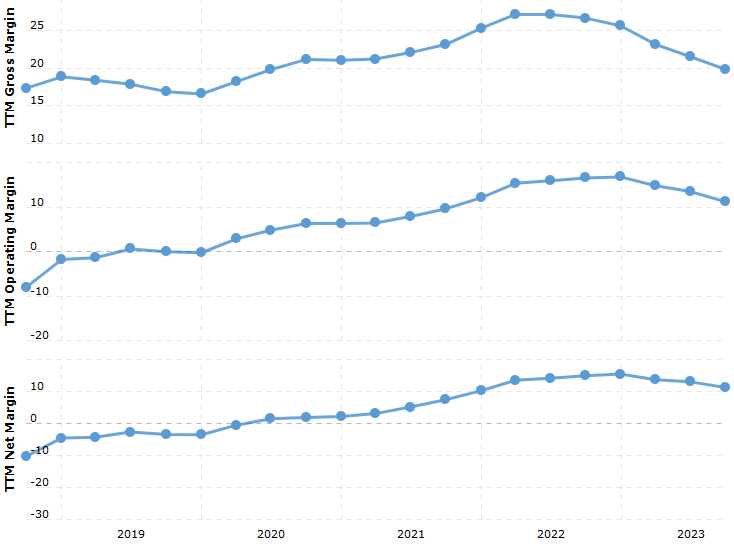

Wake up people, TSLA is not a biotech start-up – it’ a CAR COMPANY that makes CARS and has a 15% margin selling cars, which is much better than the industry average 7% but that’s because TSLA’s cars are SUBSIDIZED and there is very little competition – yet.

A lot of analysts point to the global market of $2.5Tn worth of cars that are sold and that puts TSLA’s $100Bn share (4%) into perspective but Elon Musk is not Henry Ford, competing against a bunch of guys who build cars in their garages. Toyota (TM), for example, sold 40 Trillion Yen worth of cars last year – close to $300Bn so 3x TSLA and, in 2024, they expect to make $25Bn – yet you can buy that whole company for $271Bn.

THAT is TSLA’s competition and they are not going to just roll over and cede Tesla the market but, in order for Tesla to get to 20x earnings, they need to TRIPLE sales AND maintain their margins while doing it (and not kill too many people with auto pilot). If you can’t say that’s a sure thing then why are you paying 60x now? Even if we assume steady 35% revenue growth from $100Bn, that’s $135Bn in 2025, $182Bn, $246Bn and $332Bn in 2028 – IF all goes amazingly well – and that only gets them to 20x earnings – IF they maintain their margin…

This is not just about Tesla but about all the stocks reporting earnings when the average P/E ration of the Nasdaq is now over 30 times earnings. Let’s try to have a realistic look at these companies at these prices. The stock market is essentially and auction and sometime people get too excited and bid each other up and end up overpaying. The smart traders hold onto their paddles and wait for the real masterpieces to go on sale and, if they leave the auction empty-handed – so be it – they will live to bid another day.

We will see what the Fed’s bid is this afternoon. Yesterday we had a big jump in Consumer Confidence – from 108 in December to 114.8 in January but the Case-Shiller Home Price Index was up an inflationary 5.4% and JOLTS (job openings) were up over 9M again – more than double the average and that pretty much means we’re short about 4M workers. With low birth rates and very little immigration – how do we expect to fill that gap?

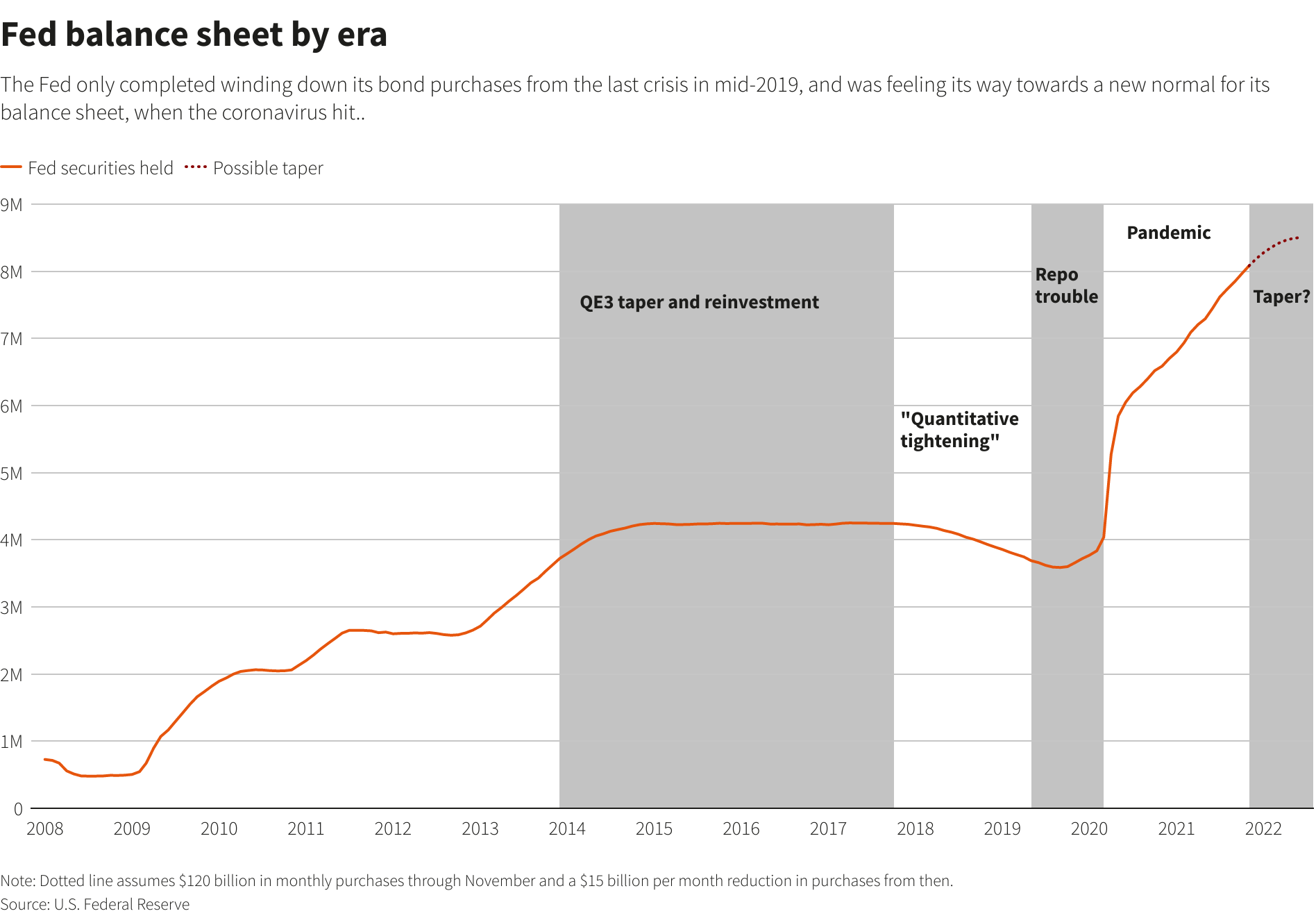

Not only do there not seem to be any Economic Data reasons for the Fed to lower rates but what about our debt? It’s all fine and dandy to say you want to see the Fed lower rates but rates are also an auction – it’s how much our government is offering to attract loans for the $500,000,000,000 worth of bonds and notes we issue and roll-over EVERY SINGLE MONTH. Over the course of the year, $1.7Tn (25%) of that is new borrowings to fund our annual deficit and the rest is old debt rolling over.

For the last decade, the number one buyer of those notes was our beloved Federal Reserve, who swelled their balance sheet from $1Tn in 2009 to $9Tn in 2023 and most of that was in the last 4 years so the Fed essentially purchased HALF of our Government’s debt for the last few years and that is like having a fake buyer at an auction, bidding everything up (or bidding rates down, in this case). What will happen when the Fed is no longer bidding?

You CAN just make up rates if your Central Bank is going to make sure every auction is sold out at the rates you advertise but you CAN’T just make up rates if your Central Bank isn’t willing to buy all the under-compensated loans and that’s the situation we’re in now – the Fed will not be able to simply cut rates at will – there has to be A LOT of genuine demand to pick up the slack if they follow-through on their plan to taper their purchases of US Debt.

THAT is what we’ll be paying attention to this afternoon as we get the FOMC Statement (2pm) followed by Powell’s press conference (2:30) – all during our Live Trading Webinar (1pm, EST)!