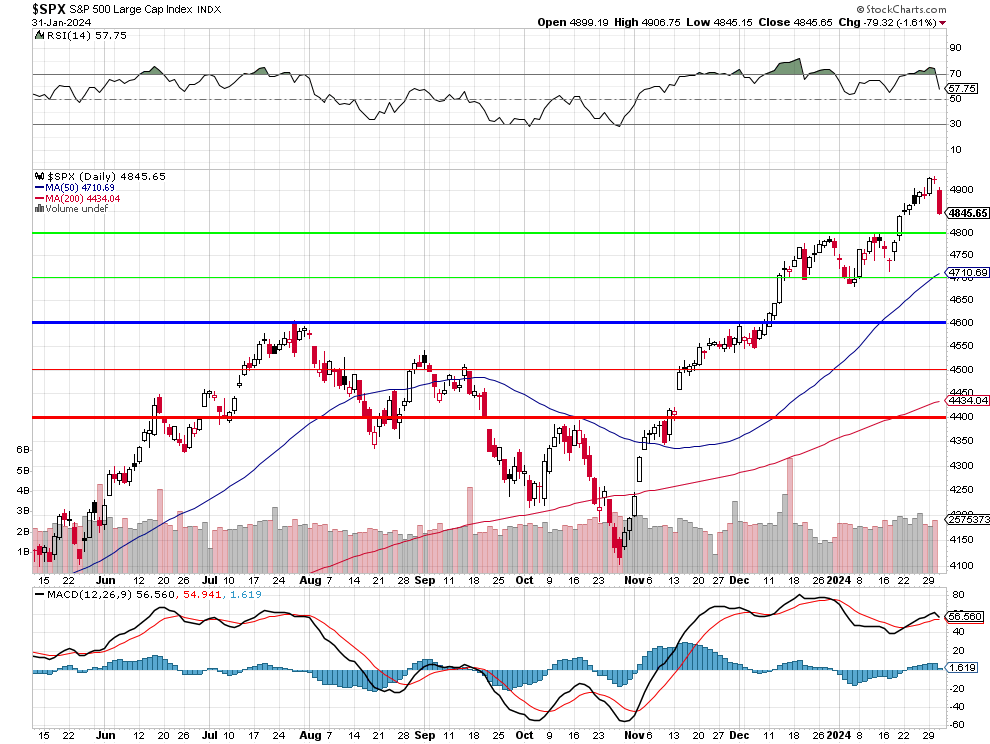

The market was disappointed yesterday, to say the least!

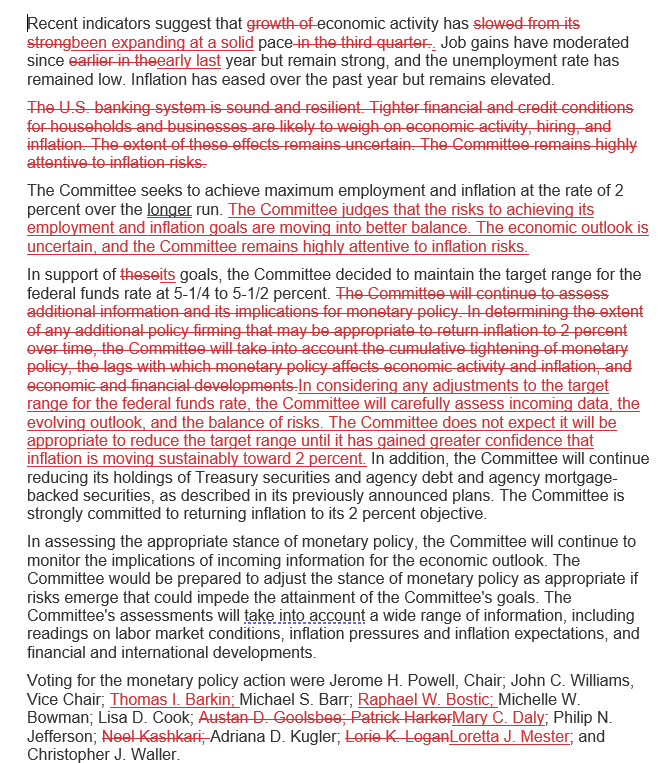

Yesterday’s more hawkish Fed comments paint a picture of a Fed that’s not just holding the line but actively pushing back against market expectations. The FOMC unanimously voted to keep rates steady, with a clear message: no rate cuts until there’s greater confidence in inflation moving sustainably towards 2 percent and we just had our CPI Report and it looked like this:

The Fed’s statement was a master class in saying a lot without saying much at all. They’ve removed references to “tighter financial conditions” and “growth slowing,” which is like saying, “Everything is fine, but don’t quote us on that.” The most intriguing part? The omission of the usual “U.S. banking system is sound and resilient” comment. It’s like removing “I’m fine” from a teenager’s vocabulary – it speaks volumes.

So, what does this all mean for the future landscape of rates in 2024? The Fed is playing a long game. They’re not just looking at current economic indicators; they’re peering into their crystal balls, trying to predict where the economy will be months, even years, down the line. The Fed’s latest move is a juggling act of maintaining economic stability, managing inflation expectations, and navigating the choppy waters of election-year politics. For investors and market watchers, it’s a signal to buckle up – 2024 is going to be an interesting ride. And as for rate cuts? Don’t hold your breath…

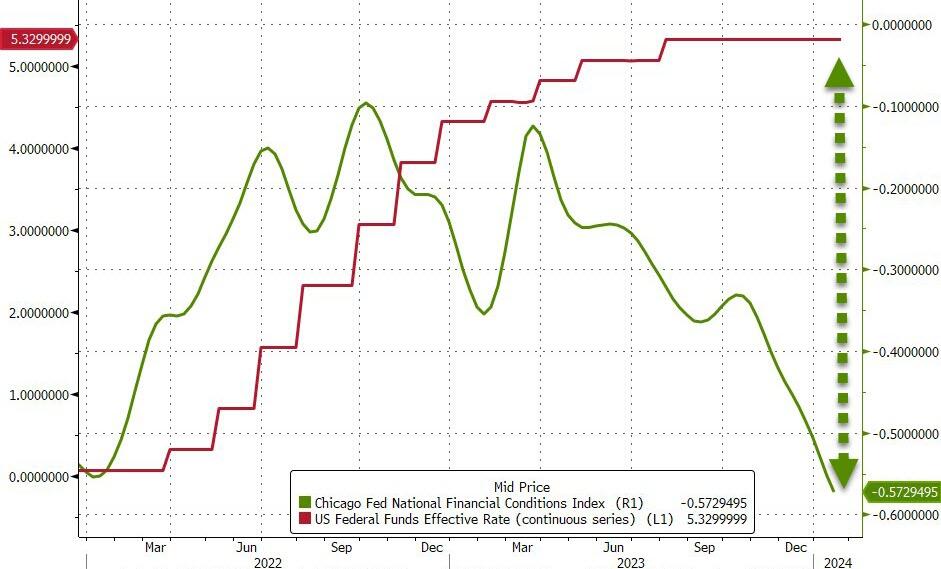

The NFCI aims to give a comprehensive weekly overview of U.S. Financial Conditions, covering aspects like money markets, debt and equity markets, and both traditional and “shadow” banking systems. It includes three categories of financial indicators: Risk, Credit, and Leverage. The NFCI is constructed to have an average value of zero and a standard deviation of one over a sample period extending back to 1971. Positive values indicate tighter-than-average financial conditions, while negative values indicate looser-than-average conditions.

As you can see from the chart, it’s taken this long just to get financial conditions back to normal and yes, higher rates make lenders happier to loan money so of course conditions are now “looser” and this is all part of the Fed’s plan to engineer a “soft landing” and, so far – it looks like it’s working, with the index implying easier access to credit, lower risk premiums, and generally more accommodative financial conditions.

HOWEVER – Looser financial conditions can also contribute to higher inflation. Easier credit and lower borrowing costs can increase demand in the economy, potentially pushing prices up, especially if the economy is near or at full employment, as ours is. The Fed is rightly aiming to “watch and wait” – no matter how impatient investors and politicians are getting.

HOWEVER – Looser financial conditions can also contribute to higher inflation. Easier credit and lower borrowing costs can increase demand in the economy, potentially pushing prices up, especially if the economy is near or at full employment, as ours is. The Fed is rightly aiming to “watch and wait” – no matter how impatient investors and politicians are getting.

Now, let’s talk about PIRATES! Yes, you read that right. In a world where we thought swashbuckling buccaneers were confined to the pages of Robert Louis Stevenson’s novels or the silver screen antics of Captain Jack Sparrow, modern piracy is making a rather unwelcome comeback.

According to the WSJ article “On the High Seas, a Pillar of Global Trade Is Under Attack,” the age-old rule that ships of any nation may freely sail the high seas is being challenged. This isn’t just about eye patches and parrots; it’s a serious issue that’s rocking the boat of international trade.

According to the WSJ article “On the High Seas, a Pillar of Global Trade Is Under Attack,” the age-old rule that ships of any nation may freely sail the high seas is being challenged. This isn’t just about eye patches and parrots; it’s a serious issue that’s rocking the boat of international trade.

The resurgence of piracy and security crises in key maritime regions like the Red Sea and the Black Sea isn’t just a throwback to the days of Blackbeard; it’s a real threat to the smooth sailing of global trade. With ships carrying everything from crude oil to consumer goods, any disruption in these waters can rip through the economy like a cannonball through the side of a ship.

While the idea of pirates might conjure images of adventure and buried treasure, the reality is far less romantic. The resurgence of piracy is a stark reminder of the vulnerabilities in our global trade system. It’s a wake-up call to secure our seas, not just for the sake of trade, but for the stability of our global economy. So, next time you think of pirates, remember, it’s not all about walking the plank; it’s about keeping the wheels (or rather, the rudders) of commerce running smoothly.

Keep in mind – we’re the red-coats now!