10 Fed speeches this week!

10 Fed speeches this week!

Chairman Powell got the ball rolling last night (Wednesday, really) with a full interview on 60 Minutes, his third interview on that show. This time, he’s walking the rhetorical tightrope between “We’ve got inflation on the run!” and “We’re not putting our interest rate bazookas back in the closet just yet.”

Like Mohammed Ali, Powell danced and weaved through Scott Pelley’s questions. “Is inflation dead?” to which Powell replied, “I wouldn’t go quite so far as that.” Powell, in his infinite wisdom, reassured us that the Fed’s eagle eyes are on the prize, with inflation having “come down really over the past year, and fairly sharply over the past six months.” Powell fancies himself the action star of a financial thriller where the hero disarms a ticking inflation bomb… one percentage point at a time.

When Pelley pressed on why the Fed isn’t cutting rates now that inflation has been falling steadily for 11 months, Powell declared, “With the economy strong like that, we feel like we can approach the question of when to begin to reduce interest rates carefully.” Translation: We’re not popping the champagne and slashing rates just because the economic party hasn’t burned down the house yet – a lesson many of us learned in college (Powell went to UCLA)!

When Pelley pressed on why the Fed isn’t cutting rates now that inflation has been falling steadily for 11 months, Powell declared, “With the economy strong like that, we feel like we can approach the question of when to begin to reduce interest rates carefully.” Translation: We’re not popping the champagne and slashing rates just because the economic party hasn’t burned down the house yet – a lesson many of us learned in college (Powell went to UCLA)!

The highlight was, of course, Powell’s commitment to the Fed’s 2% Inflation target. “Why isn’t it zero?” Pelley inquired, to which Powell might as well have said, “Did you take Econ 101, Scott?” Instead, he nicely explained that a 2% target gives them “more ammunition, more power to fight a downturn.” Good old Fed, always keeping some powder dry for the next economic catastrophe – which is often right around the next corner.

So, as we brace ourselves for a week filled with Fed speeches, let’s remember that Jerome Powell, our monetary maestro, has already set the tone. It’s a symphony of cautious optimism, with a hint of “We’ve got this, but let’s not get ahead of ourselves.” As for the markets, they hang on every word, every pause, every carefully chosen phrase, because in the world of finance, sometimes the music of monetary policy is all we have to dance to.

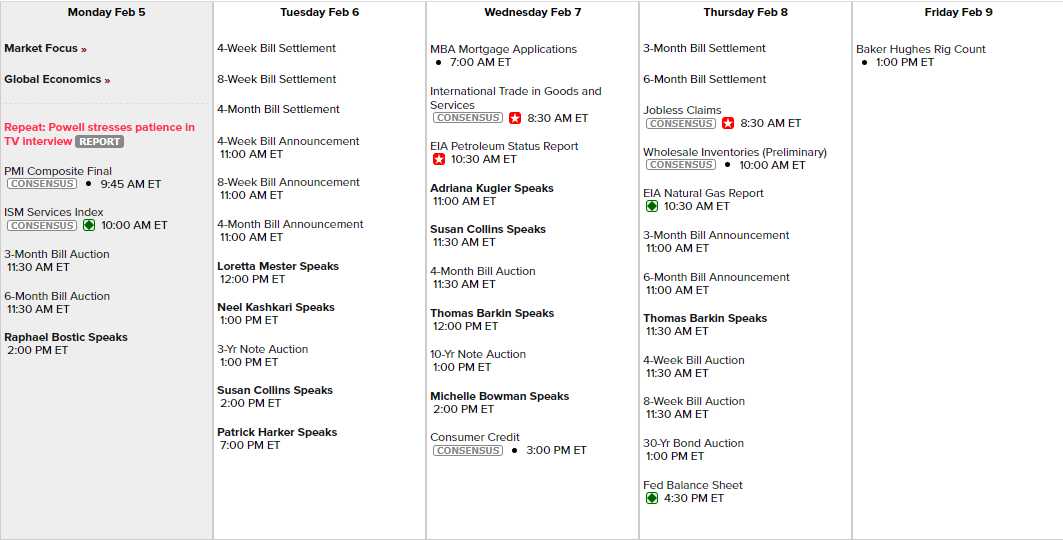

Speaking of economic catastrophes around the corner: We have 10-Year and 30-Year Note auctions this week and we’ll see whose lending the US money at 4% for the long-term. PMI and ISM this morning and Consumer Credit on Wednesday but, other than that, it’s a slow data week so the focus is going to be on earnings:

Monday the 19th is Presidents Day, so the markets are closed then and, of course, they will be closed for my Birthday in March as well. This week, earnings turn towards the Retail and Restaurant Sectors but we still have over 100 S&P 500 companies reporting this week so busy, busy – we’re going to have to earn that day off!

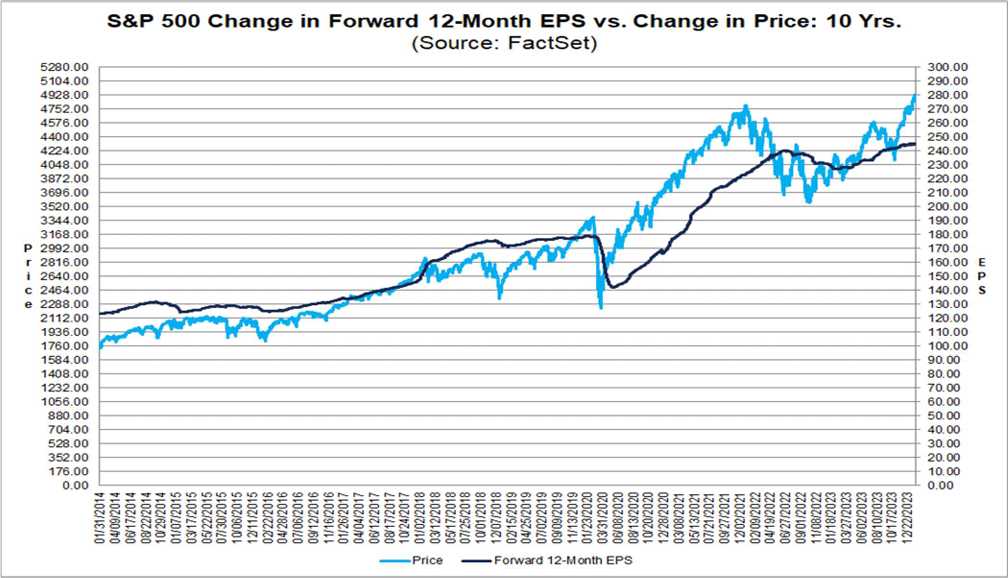

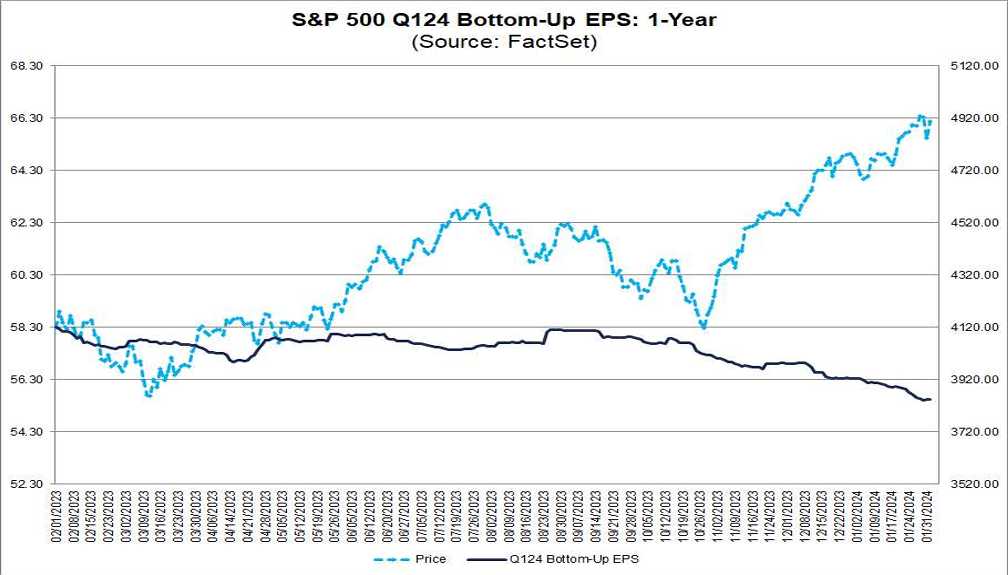

So far, 46% of the S&P 500 companies have reported and 72% of those have beat on earnings but only 65% beat on revenues. That’s 1/3 of the S&P 500 missing on Revenues! 31 companies have issued negative guidance vs only 17 upgrading their guidance and the FORWARD P/E ratio is now above 20 – about 15% higher than normal (17) for the S&P 500.

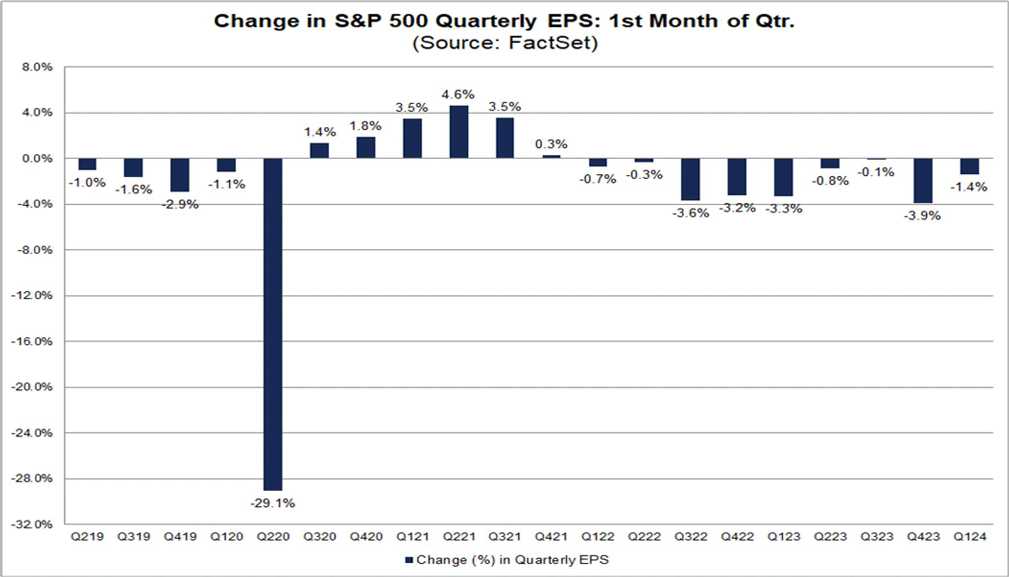

There is still a dangerous combination of expectations of rapid rate cuts and lack of expectations of a Recession in these forward numbers and the S&P 500 hasn’t put up positive overall earnings numbers since the first quarter of 2021, when the SPX was at 3,800 – now we’re just under 5,000 – up 31.5% on lower earnings but the market seems to be as oblivious as it was in 1999, when the economy slowed down but the indexes did not.

SOMETHING is going to happen to sober these markets up and, when that does happen – try not to be the last one out the door when reality shows up. We’ll be doing our Member Portfolio Reviews next week with the goal if taking a bit off the table as S&P 5,000 is going to be a tough nut to crack, especially when 20x earnings is a 5% return and 10-year notes are paying 4% – is it really worth the risk?