Blame the regulator!

China is getting very Republican as they toss out poor Yi Hyiman as the head of China’s Securities Regulatory Commission (CSRC) and they are replacing him with with Wu Qing in a series of dramatic moves aimed at stabilizing its faltering stock market and economy, China has also replaced other key market regulators, and intensified efforts to buoy investor confidence.

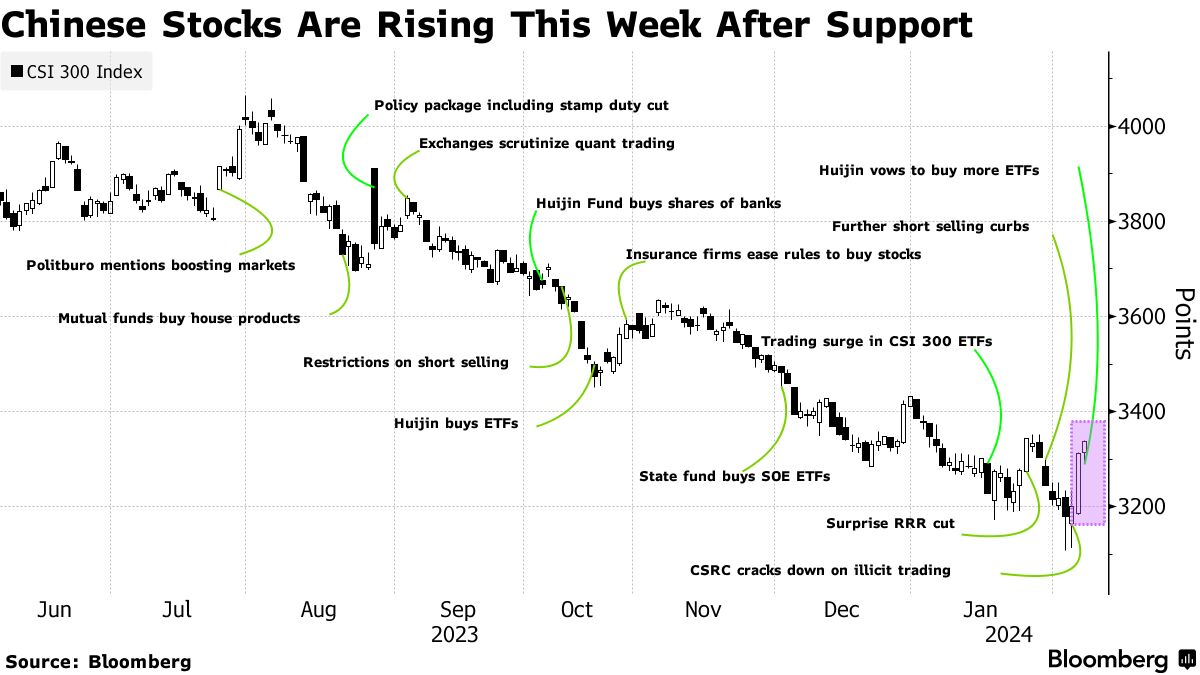

China’s decision to replace the head of its securities regulator the day before a two-week holiday marks a significant shift in its approach to managing the ongoing crisis in its $8 Trillion stock market (1/8th the size of US Markets, down from $14Tn in 2021). The appointment of Wu Qing, known as “the broker butcher” for his rigorous crackdown on traders in the mid-2000s (when he shut down 31 firms for breaching regulations), signals Beijing’s readiness to adopt more forceful measures to stem the market rout – or else! This move, unexpected by many, could herald a new era of stringent market regulation and oversight, aiming to restore investor confidence and stabilize the market.

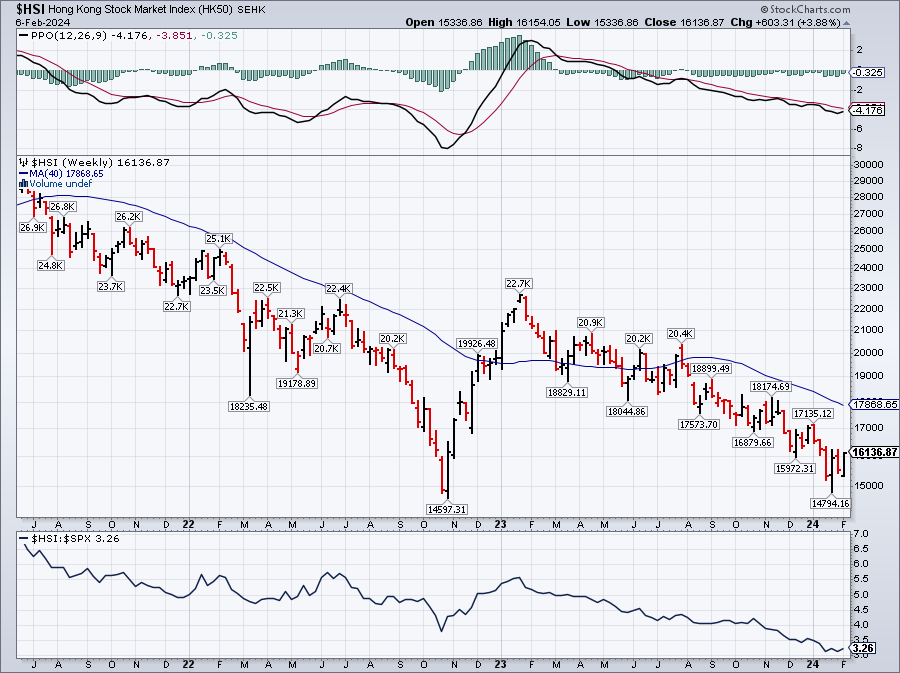

The once-celebrated onshore funds, which had previously weathered the storm in China’s stock market, are now facing severe losses. This downturn underscores the volatile nature of the Chinese market, where investment trends can swiftly reverse, leaving even the most seasoned investors struggling with the unpredictability. The significant losses experienced by these funds highlight the challenges of navigating China’s complex investment landscape, especially amid a broader market downturn.

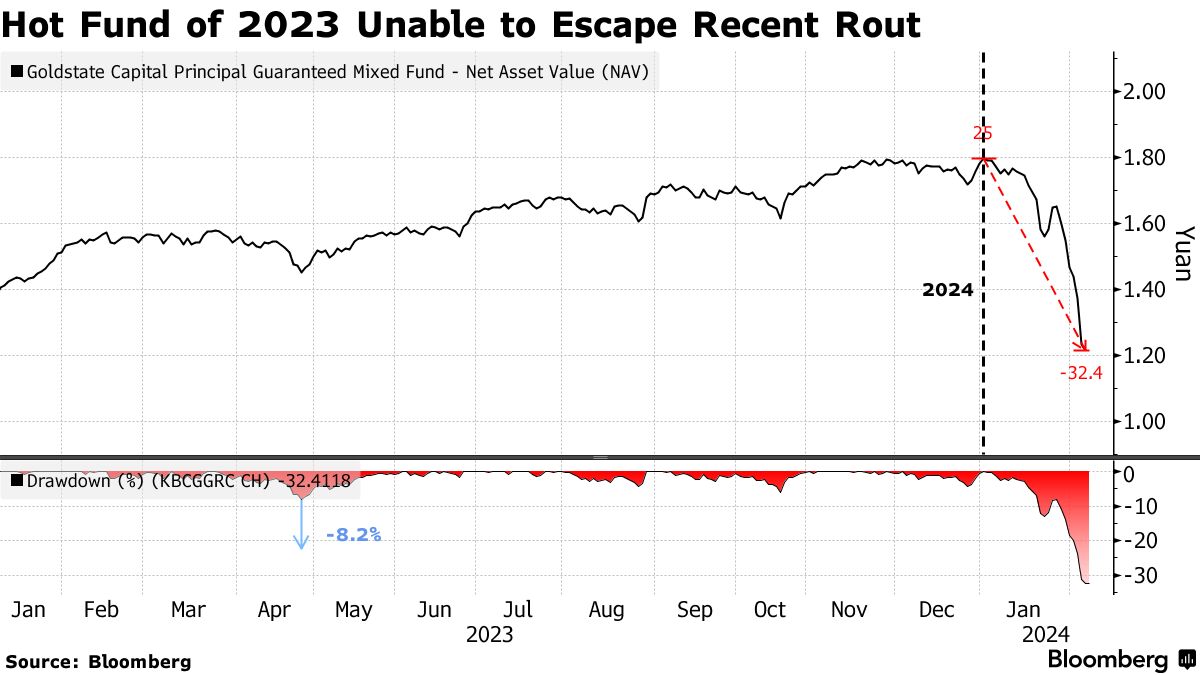

In response to the market’s decline, Chinese authorities have launched a comprehensive rescue operation, employing a range of policy tools from wider trading curbs to direct state intervention in buying major bank stocks. These efforts, coupled with the sovereign wealth fund’s pledge to increase equity holdings, aim to prevent a fourth consecutive year of market slump.

So far, bouts of stock gains spurred by stimulus hopes have only lasted a few days as weak economic data soon poured cold water on optimism. The swoon in Chinese equities is playing out against the backdrop of a rally in global stocks, with the US market trading near a record.

The benchmark CSI 300 Index has gained 5.2% so far this week. The rebound came after a quickening drumbeat of policy support, ranging from wider trading curbs to the sovereign wealth fund’s pledge to boost equities holdings, as well as state buying of major bank stocks. News that regulators plan to brief President Xi Jinping on markets also fueled optimism.

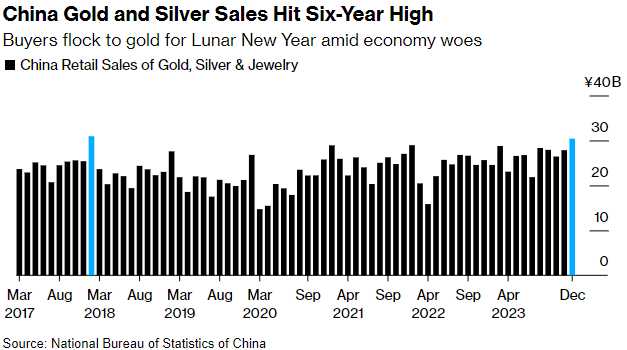

Amidst the stock and property market turmoil, Chinese consumers are increasingly turning to gold as a safe haven. Despite gold reaching record high prices in China, demand for the precious metal has surged, driven by its perceived stability and value preservation qualities. This trend is particularly notable as it coincides with the Lunar New Year, a period traditionally associated with increased spending on luxury items like jewelry. The pivot towards gold reflects broader concerns about the economy and the search for secure investment avenues.

These developments paint a picture of a nation at a critical juncture, grappling with economic challenges while striving to restore stability and confidence in its financial markets. For investors and market watchers, these moves offer a glimpse into China’s strategic priorities and the potential trajectory of its economy and stock market in the coming months.

Keep in mind that, if Xi and Wu do manage to instill confidence in Chinese markets again, that $6Tn that has flowed out of China into US Equities may turn around and start to flow the other way. $6Tn is “only” 10% of US markets – but that can kick off our own crisis of confidence – especially when the average Chinese stock trades below 10 times earnings vs 28 times earnings in the US.

“Are you with me Doctor Wu

Are you really just a shadow

Of the man that I once knew

Are you crazy are you high

Or just an ordinary guy

Have you done all you can do

Are you with me Doctor” – Steely Dan