I love a short week!

I love a short week!

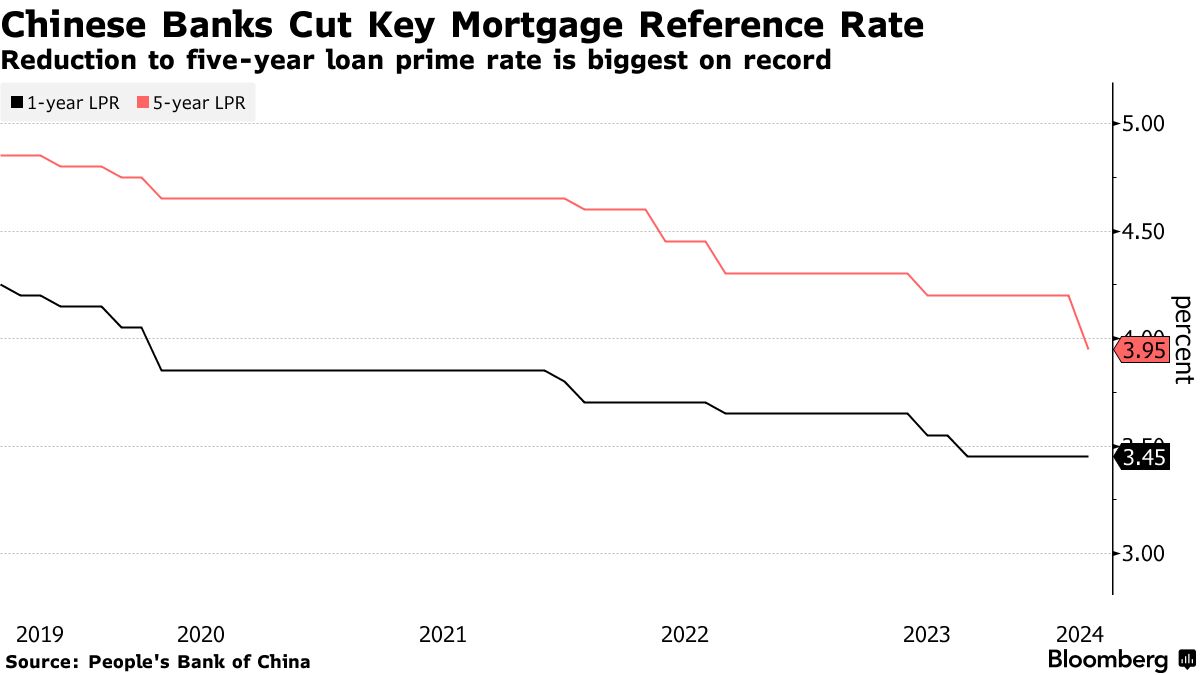

It’s like a present you get after having a long weekend. Hopefully all this productivity we get from AI can be plowed into making all Mondays a holiday. Not much happened over the weekend but this morning Bloomberg is matching my Friday observation to our stating: “Markets Start to Speculate If the Next Fed Move Is Up, Not Down” and China is back from their holiday with the PBOC cutting rates 0.25% to 3.95% – the largest reduction since 2019 and no, it’s not helping.

The move comes ahead of the National People’s Congress, which is set for early March. That annual legislative session is where the government is expected to unveil its official growth target for 2024, as well as detail of fiscal stimulus for the year. Until then, hope springs eternal that Beijing has a plan or something…

Capital One (COF) is buying Discover (DFS) for $35Bn but COF is only $52Bn so it’s more like a merger than an acquisition. Visa (V) is $572Bn and Mastercard (MA) is $436Bn so they are not exactly shaking in their boots. COF had been relying on Visa or Mastercard to issue it’s card but now, with DFS, which is all that’s left of Sears, they will have more control to directly negotiate with merchants. There will also be technology and advertising savings so, on the whole, it’s a good move for COF.

We still have lots of earnings reports this week including NVIDEA, the wonder stock, who report tomorrow (because it’s already Tuesday). Home Depot (HD) just reported their 5th consecutive quarter of declining revenues – a victim of high mortgage rates and the subsequent slowdown in home sales and construction. Sales were down 3.5% vs 1% originally forecast – not good!

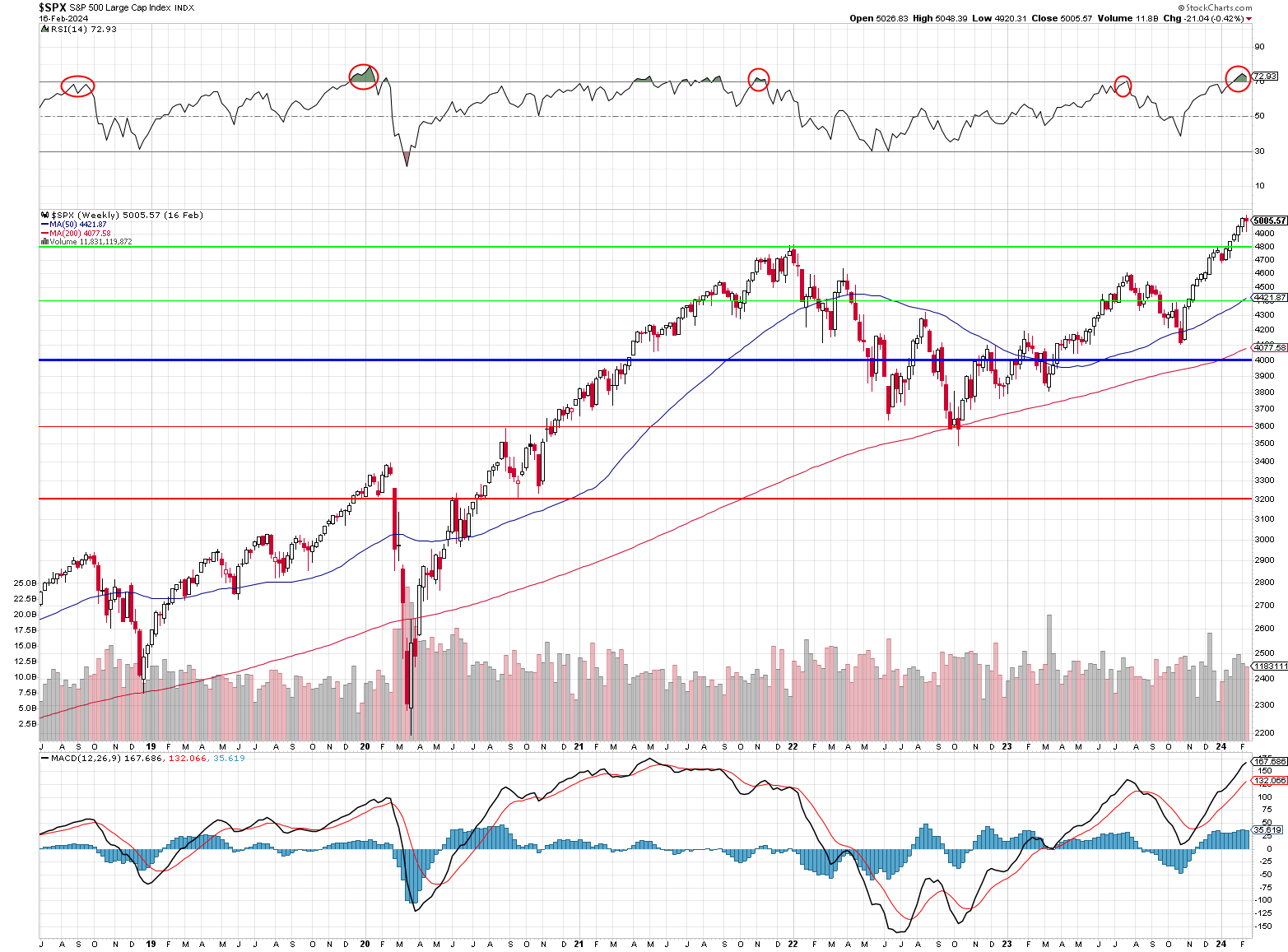

Should Home Depot be trading at all-time highs, 24 TIMES forward earnings when revenues are declining quarter after quarter after quarter? The company made $16.4Bn in 2022, trading at $320 and $17.1Bn last year, trading at $330 but 2024 looks more like $15Bn (barely) and they are trading at $362 but why not – the whole market is about 20% overprices – so why shouldn’t HD be as well?

The S&P 500 is testing 5,000 again, but not in a good way as it’s coming down from the top. As you can see, the RSI is still over 70 and correction isn’t off the table until we’re back to 50 so be very careful out there…

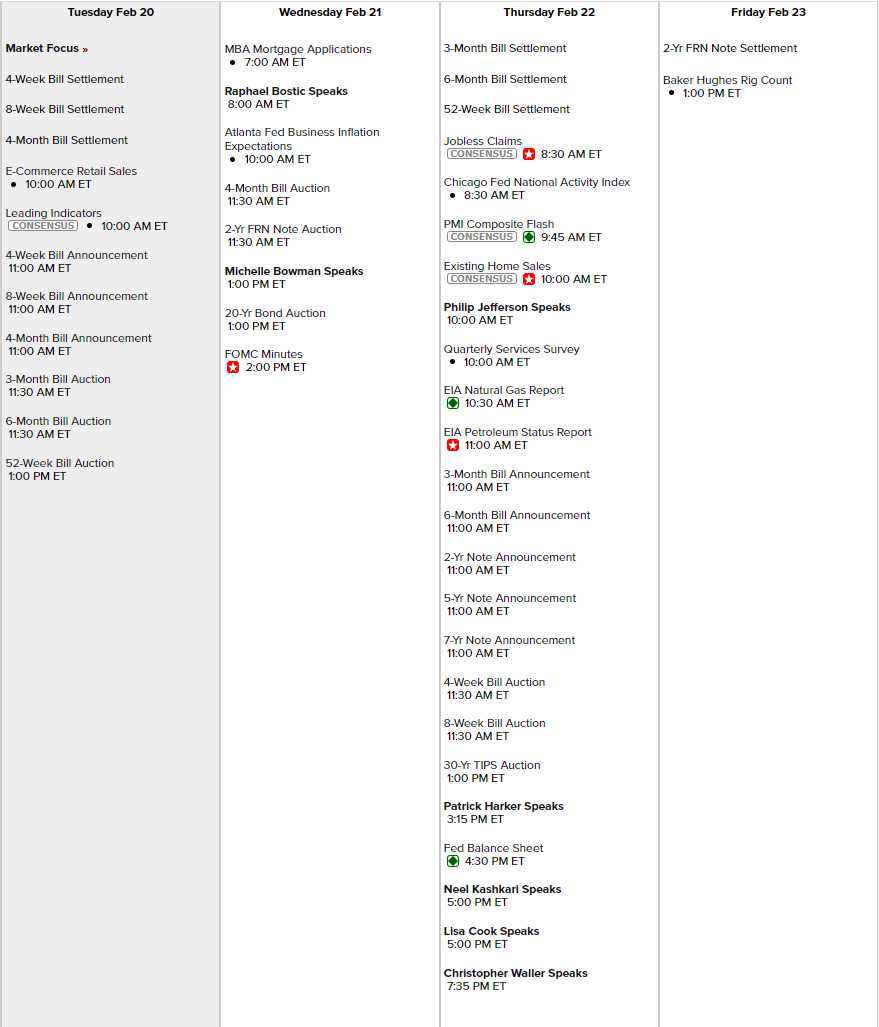

On the economic front, we have 7 Fed speeches in 2 days and the Fed Minutes tomorrow but first we have Leading Economic Indicators this morning (10) and the Atlanta Fed tomorrow morning and 2-year & 20-year notes and 30-year TIPS will be auctioned along with PMI on Thursday so look sharp in the short week.

Speaking of Government Stimulus, Global Foundries (GFS) got $1.5Bn form the CHIPS Act to build domestic manufacturing causing Intel (INTC) to say “Hey!” so the Government gave the $10Bn to build something too. Meanwhile, the World’s biggest EV manufacturer, Boyd (BYDDF), announced price cuts and that will put additional pressure on Tesla (TSLA) to explain to their investors why they should be trading at 62 times earnings ($200) – especially when those earnings are only theoretical.

But it’s all about NVDA this week – they should be making 4 times more than they made last year and that lets traders fantasize that their random stock can make 4 times more than they made last year – justifying their 30x purchases today.

“Dear Mister Fantasy play us a tune

Something to make us all happy

Do anything take us out of this gloom

Sing a song, play guitar

Make it snappy” – Traffic