First Asia, then Europe, then US.

First Asia, then Europe, then US.

That is how financial crises tend to spread in the Global Economy (like Covid!) and now we turn our focus to Germany, where a similar real estate narrative is beginning to unfold, potentially signaling a broader contagion effect across global commercial real estate markets.

Germany’s commercial real estate (CRE) sector is showing signs of distress, reminiscent of the early warnings we’ve seen in China. Despite reassurances from German banks about the domestic nature of their property exposures, the situation is far from comforting. A detailed analysis by Bloomberg reveals a complex interplay of factors that could precipitate a crisis within Europe’s largest economy.

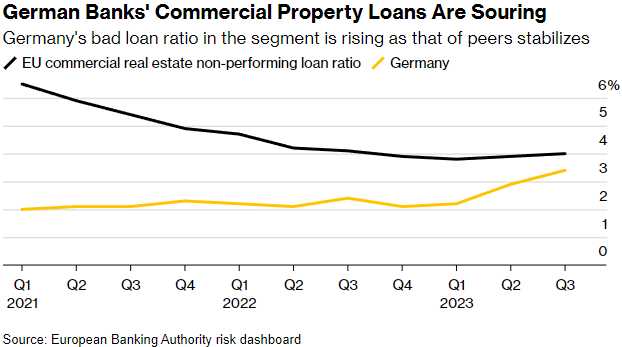

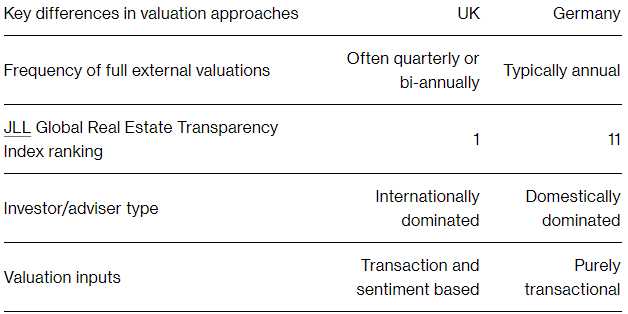

German banks are notably more exposed to CRE than most European counterparts, having extended loans more aggressively. This overexposure, coupled with arcane accounting practices, has so far shielded lenders and investors from immediate market corrections. German banks’ practice of infrequent property valuations and certain regulatory leeways complicates the visibility of their financial state. Despite regulators urging lenders to prepare for potential losses, accounting rules limit how much can be set aside for souring debt.

The potential for a slow-motion property crash is real. The forced sales by major property owners could accelerate the downturn, particularly affecting smaller and mid-sized lenders still recovering from the financial crisis bailouts.

The crisis in China’s CRE market has been a focal point of our discussions, highlighting the overreliance on real estate for economic growth and the subsequent market correction. The situation in Germany, while unique in its regulatory and market structure, echoes the systemic risks posed by a faltering real estate sector. The global nature of financial markets means the repercussions of these crises are not isolated, with potential impacts on investment flows, banking stability, and economic growth across borders.

🤖 The commercial real estate (CRE) sector is navigating through turbulent waters, exacerbated by a confluence of economic shifts and changing societal norms. Here’s a concise overview of the unfolding crisis:

1. Magnitude of the Crisis: The CRE sector’s downturn has been gradual, reflecting the private nature of property holdings and the slow pace of valuation adjustments. The MSCI World Real Estate Index’s 18% drop from early 2022 to late 2023 signals declining investor confidence in property values. The U.S. alone has about $1.2 trillion in “potentially troubled” CRE debt, with vacancy rates soaring and some properties being surrendered to lenders.

2. Catalysts for the Price Plunge: A significant factor behind the falling property prices is the rise in interest rates, which has led investors to seek higher yields, necessitating a decrease in property values to match the expected returns. This issue was particularly pronounced in markets like Germany, where pre-crisis rental yields were at record lows, and property owners were highly leveraged.

3. Implications of Falling Prices: Declining property values strain landlords’ borrowing capacity by worsening loan-to-value ratios, potentially leading to breaches of debt terms. This situation forces property firms into difficult positions, either injecting more capital, taking on costlier debt, or selling assets at steep discounts, complicating the refinancing of the looming $2.2 trillion in maturing loans across the U.S. and Europe.

4. Affected Property Types: Office spaces have borne the brunt of the crisis, with shifts towards remote work and concerns over energy efficiency driving down valuations. Shopping malls, already impacted by e-commerce, faced less drastic valuation changes due to their lower starting point.

5. Regional Variations: The impact of rising interest rates was more severe in Europe due to initially lower yields compared to the U.S. However, the U.S. saw a steeper decline in valuations due to a larger inventory of new and vacant buildings and a sustained trend of remote working.

6. Solutions for Empty Offices: Options include residential conversions, adaptations for flexible working, or energy efficiency upgrades, though these are often financially unfeasible. Foreclosure becomes a last resort for landlords unable to justify the investment required to make these properties viable.

7. Future Outlook: The CRE sector is witnessing a growing disparity between premium and substandard buildings. While top-tier properties continue to attract high rents, others face the dilemma of significant investment for upgrades — a challenging proposition given the financial strain on banks and the environmental concerns associated with new construction.

The unfolding situation in Germany serves as a cautionary tale of the vulnerabilities within the CRE sector and the broader financial system. It underscores the need for vigilance, diversified economic policies, and robust regulatory frameworks to mitigate the risks of such crises. As we continue to monitor these developments, the key questions remain: How will global markets respond to these emerging challenges? And what measures can be taken to prevent a full-blown crisis?

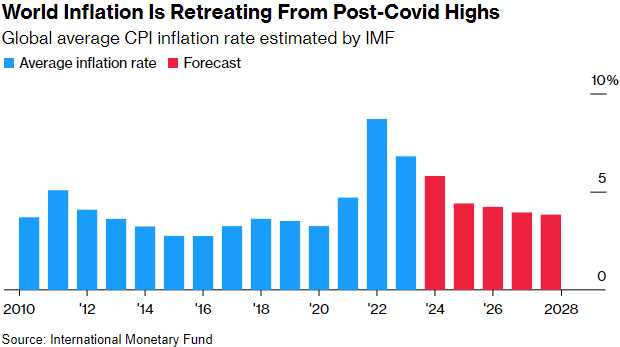

Meanwhile, the G20 Finance Meeting is down in Brazil this week and their draft communique reflects a cautiously optimistic view of the global economy, with an emphasis on the improved likelihood of achieving a soft landing. The mention of faster-than-expected disinflation as an upside risk suggests that policymakers are beginning to see the fruits of their labor in combating the inflation surge post-pandemic. However, the document and discussions also recognize the array of challenges that remain, from geopolitical tensions to debt vulnerabilities in low-income nations.

Meanwhile, the G20 Finance Meeting is down in Brazil this week and their draft communique reflects a cautiously optimistic view of the global economy, with an emphasis on the improved likelihood of achieving a soft landing. The mention of faster-than-expected disinflation as an upside risk suggests that policymakers are beginning to see the fruits of their labor in combating the inflation surge post-pandemic. However, the document and discussions also recognize the array of challenges that remain, from geopolitical tensions to debt vulnerabilities in low-income nations.

🤖 Key Points from the Draft Communique

-

-

Soft Landing Likelihood: The draft communique indicates that the chances of the global economy achieving a soft landing have improved, a positive shift from previous concerns over a potential hard landing or recession.

-

Balanced Risks with Disinflation: The statement notes that risks to the global economic outlook are becoming more balanced, with faster-than-expected disinflation cited as an upside risk. This suggests that inflationary pressures are easing more quickly than anticipated, which could alleviate some of the strains on economic growth.

-

Global Inflation Trends: The draft acknowledges the retreat of inflation in most economies, attributing this trend to effective monetary policies, the resolution of supply chain bottlenecks, and moderating commodity prices.

-

Global Growth Forecast: The International Monetary Fund (IMF) recently upgraded its forecast for global economic growth in 2024 to 3.1%, driven by stronger-than-expected growth in the US and fiscal support from China. This upgrade reflects a cautiously optimistic outlook for the global economy.

-

US Role in Global Growth: US Treasury Secretary Janet Yellen highlighted the significant role of the United States in supporting global growth, pointing to the country’s path to a soft landing as a key factor underpinning the global economic outlook.

-

Persistent Risks: Despite the optimistic tone, the draft and Yellen’s comments acknowledge ongoing risks, including prolonged conflicts in Ukraine and the Middle East, which have contributed to higher commodity prices and supply chain disruptions. Debt challenges facing low-income countries also pose a risk to the global economic outlook.

-

As Finance Ministers work to finalize the communique amidst sharp divisions, particularly regarding military conflicts and their economic impacts, the ability to reach a consensus on these contentious topics will be crucial for presenting a united front on the global stage. The outcome of these discussions will be pivotal in setting the tone for international economic cooperation and policy coordination in the face of ongoing global challenges.

On the other hand, Durable Goods Orders in the US are down 6.1% from -0.3% in December and that’s 50% worse than expected by our leading Economorons BUT, if you take out Transportation, we’re up 0.4% and that’s BETTER than 0.3% expected so they are wrong on both ends but it’s a strange report.

Macy’s is closing 150 stores and, since they only have 508 stores left (was 750 pre-covid), that’s pretty significant! About 1/3 of Macy’s 95,000 workers will be hitting the unemployment line and, guess what, even more pressure on Commercial Real Estate – especially the already-struggling malls where Macy’s is often an anchor store.

But everything is awesome, right? Believe what you hear and not what you see and you too can enjoy these Orwellian times we live in!