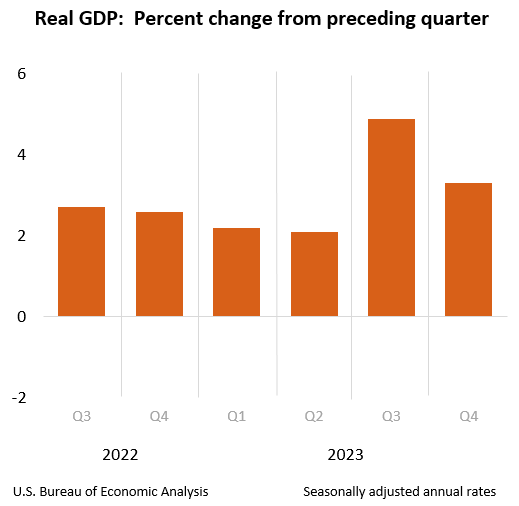

We get the revised Q4 GDP Report at 8:30.

We get the revised Q4 GDP Report at 8:30.

The first swipe at the data came on January 25th and it was 3.3%, which was down from Q3’s 4.9% and, if the economy is so great, we should expect an upward revision – especially since Inventories are considered a positive to GDP – so anything that wasn’t sold by Christmas only added to our GDP. Yes, that makes no sense but that’s how they count it…

The detailed breakdown of the GDP components offers a nuanced view of the economy’s direction as we move into 2024.

Consumer Spending and Investment

The sustained increase in Consumer Spending, particularly in services like food services, accommodations, and healthcare, alongside goods, underscores the resilience of the American Consumer. This resilience is pivotal, as consumer spending drives a significant portion of GDP. The growth in nonresidential fixed investment, especially in intellectual property (AI) products and equipment, suggests businesses are still investing in growth, a positive sign for future productivity.

Government Spending and Exports

The uptick in state and local government spending, along with federal nondefense spending, reflects ongoing public sector support for the economy. The rise in exports, led by petroleum and financial services, indicates a competitive edge in international markets, contributing positively to the GDP.

Residential Investment and Imports

The mixed signals from residential fixed investment, with an increase in new residential structures but a decrease in brokers’ commissions due, in part, to a recent court decision, highlight the housing market’s nuanced challenges. Meanwhile, the increase in imports, particularly in services like travel, might detract from GDP but also signals robust domestic demand.

Inflation and Personal Income

The deceleration in the price index for gross domestic purchases and the PCE price index suggested inflationary pressures were easing, but that has reversed somewhat since January. Easing inflation is crucial for maintaining purchasing power and consumer confidence – which just dropped 5% in yesterday’s report. The increase in personal income and disposable personal income, coupled with a slight dip in the personal saving rate, reflects an economy where consumers are willing and able to spend, supporting overall economic activity.

Looking Ahead

As we dissect these figures, the narrative isn’t just about the numbers but what they signify for future policy, investment, and consumer behavior. The moderation in GDP growth and inflation suggests a potentially soft landing scenario, where the economy slows enough to curb inflation without triggering a recession. This scenario would be ideal, allowing the Federal Reserve to navigate its monetary policy carefully, balancing the need to control inflation without stifling growth.

However, the nuances within the GDP components, such as the shifts in investment, consumer behavior, and government spending, highlight areas of strength and vulnerability. For instance, the reliance on consumer spending and government expenditure to drive growth, while beneficial in the short term, raises questions about sustainability and the need for broader-based economic drivers.

Moreover, the global context, including geopolitical tensions, supply chain dynamics, and international trade, will continue to influence the U.S. economic outlook. As we move forward, monitoring these components will be crucial for understanding the economy’s trajectory and identifying opportunities and challenges that lie ahead.

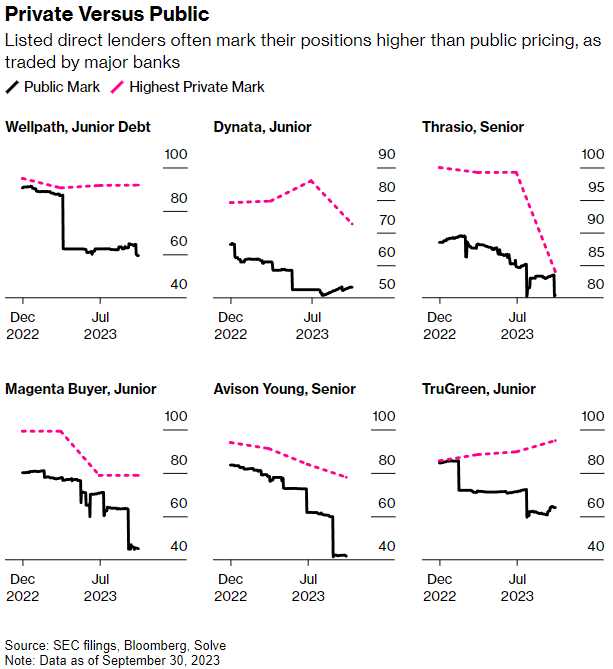

Unfortunately, GDP projections are only as good as the data they are fed and Bloomberg is raising a red flag on the $1.7Tn (7% of our GDP) Private Credit market, which directly intersects the broader economic outlook, particularly in relation to the GDP dynamics discussed above. It was these kinds of misreportings that led to the 2008/9 financial crisis. Given the market’s significant size and its role in financing businesses across various sectors, any destabilization could ripple through the economy, affecting investment, consumer confidence, and spending patterns.

Unfortunately, GDP projections are only as good as the data they are fed and Bloomberg is raising a red flag on the $1.7Tn (7% of our GDP) Private Credit market, which directly intersects the broader economic outlook, particularly in relation to the GDP dynamics discussed above. It was these kinds of misreportings that led to the 2008/9 financial crisis. Given the market’s significant size and its role in financing businesses across various sectors, any destabilization could ripple through the economy, affecting investment, consumer confidence, and spending patterns.

Businesses reliant on private credit for expansion or operational funding might face increased borrowing costs or reduced access to capital if lenders become more cautious or if regulatory changes tighten credit conditions. This could dampen nonresidential fixed investment growth, a key component of GDP that has shown positive signs as per the latest report.

Moreover, if businesses face higher financing costs or if the private credit market experiences significant valuation adjustments, this could lead to job cuts or reduced wage growth, directly impacting consumer spending. Given that consumer spending is a major driver of GDP, any reduction here could slow overall economic growth.

Government spending and exports have contributed positively to recent GDP figures. However, a crisis in the private credit market could necessitate increased government intervention or support for affected businesses, potentially diverting funds from other growth-stimulating initiatives. On the export front, a tighter credit market could impact businesses’ ability to finance export activities, affecting the competitive edge in international markets.

The confidence factor cannot be overstated. The private credit market’s issues could lead to a broader loss of confidence among investors and consumers alike. This could result in reduced spending and investment, further impacting GDP growth.

The confidence factor cannot be overstated. The private credit market’s issues could lead to a broader loss of confidence among investors and consumers alike. This could result in reduced spending and investment, further impacting GDP growth.

Thrasio just filed for Chapter 11 and its lenders had been divided on its prospects. Bain Capital and Oaktree Capital Management priced its loans at 65 cents and 79 cents respectively at the close of September. Two BlackRock Inc. funds didn’t even agree: One valuing its loan at 71 cents, the other at 75 cents. Monroe Capital was chief optimist, marking the debt at 84 cents. Goldman Sachs Group Inc.’s asset management arm had it at 59 cents – still too generous. The hammer has yet to drop on their rivals but it’s not likely to be pretty.

The article’s mention of inflationary pressures and the Federal Reserve’s delicate balance of controlling inflation without stifling growth is crucial. A shake-up in the private credit market could complicate this balance, potentially leading to higher inflation if credit becomes more expensive or if financial instability leads to a loss of confidence in the dollar.

As we consider the forward trajectory of the U.S. economy, the interplay between private credit market stability and broader economic indicators like GDP, inflation, and consumer confidence will be critical. The Federal Reserve will need to closely monitor these developments, ready to adjust policy to maintain economic stability.

While the current GDP report offers a snapshot of economic resilience and areas of growth, underlying risks in the private credit market pose potential challenges. Addressing these risks through regulatory oversight and maintaining a stable credit environment will be essential for sustaining economic growth and avoiding disruptions that could impact future GDP outcomes.

8:30 Update: GDP FELL to 3.2% and, even worse, the GDP deflator (inflation) rose from 1.5% to 1.7% so slower economy and more inflation = Stagflation but only slight moves so far – but both in the wrong direction so let’s be careful out there!

Meanwhile, Apple (AAPL)’s decision to terminate its electric car project, known as Titan, after a decade of development marks a significant pivot in the company’s strategic direction. Apple’s internal announcement to disband the Titan project surprised nearly 2,000 employees involved. This decision, while seemingly a retreat from an ambitious venture into the automotive industry, can be viewed through the lens of broader economic and financial considerations that also touch upon the themes of GDP growth, Economic Stability, and the valuation challenges within the private credit market.

Many employees from the car project are being redirected to AI initiatives, underscoring Apple’s commitment to strengthening its position in the rapidly evolving AI sector. Apple’s choice to focus on areas like AI and mixed-reality headsets, potentially due to the Vision Pro’s early success, underscores a strategic reallocation of resources towards high-growth, high-margin opportunities. This move is emblematic of broader economic trends where technology firms are increasingly investing in digital and AI-driven products and services that promise not only higher returns but also the potential to drive future economic growth.

By choosing to invest in sectors where it has a competitive advantage and can command higher margins, Apple is navigating away from the capital-intensive, low-margin automotive industry. This approach not only aligns with Apple’s historical emphasis on profitability but also resonates with the broader economic concern over inflated valuations and the need for sustainable investment strategies that do not over-leverage or risk financial stability.

Expanding and selling high-margin CarPlay interiors to automotive companies offers Apple a strategic foothold in the automotive industry without the direct risks associated with manufacturing electric vehicles. This strategy leverages Apple’s strengths in software and user experience design, providing a lucrative revenue stream while avoiding the pitfalls of the low-margin battles in the EV market. It also let’s us know that Tesla (TSLA)’s projections of maintaining their own margins are probably bullshit – so take note!

Apple’s strategic pivot away from its electric car project and towards AI and mixed-reality technologies reflects a broader economic and financial calculus. This move highlights the importance of focusing on core competencies, market strengths, and high-margin opportunities in driving sustainable economic growth and maintaining financial stability. By investing in innovation and technology, Apple not only positions itself for future success but also contributes to broader economic trends that support productivity, innovation, and growth.