Oil is only $85 this morning!

Although Iran directly attacked Israel over the weekend, they did it in such a way that Israel was able to knock out 99% of 300 missile and drone attacks with their “Iron Dome” defense – mainly because the attack was telegraphed well in advance (by Iran) and Israel was extremely ready for it.

So, overall, the whole thing was for show. Israel did attack (with jets) the Iranian Embassy in Damascus on April 1st because Iran has been training proxy Hezbollah fighters in Syria and Iran could not let that action go without a response but what happened this weekend was extremely measured and a grave disappointment to all the War Hawks who had been spouting alarmist BS all week long.

Can things escalate? Sure they can but that didn’t help Oil (/CL) traders who jacked the price up to $87.50 on Friday and are now down $2,500 per contract as “there was supposed to be an Earth-shattering kaboom” that never came.

So that’s over with (for now) and we can turn our focus back to Earnings and Data and we’ll have plenty of that during this options expiration week.

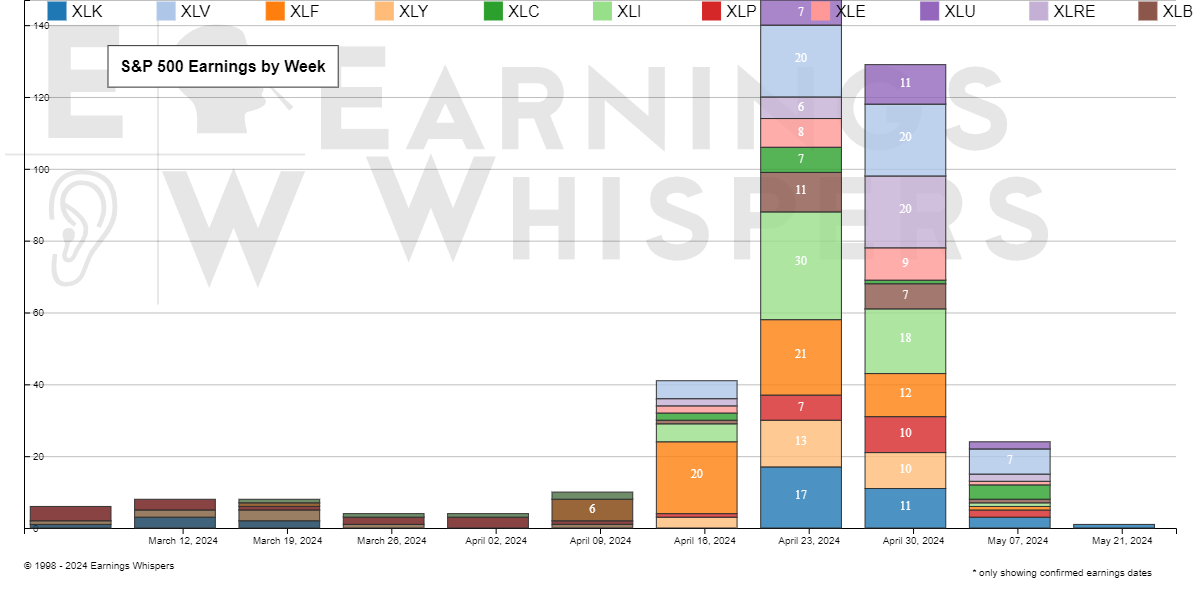

So many big reports that we’ll just have to ride the wave and see where it takes us. We finished Friday with the Russell 2000 at 2,003 and the Nasdaq 100 was at 18,003 so those are going to be our up or down indicators this week as we digest these early earnings reports but this is nothing compared to the EarningsPalooza we’ll be hit with in the next two weeks and then, suddenly, it will be over and we’ll see if traders “Sell in May” or decide to stay.

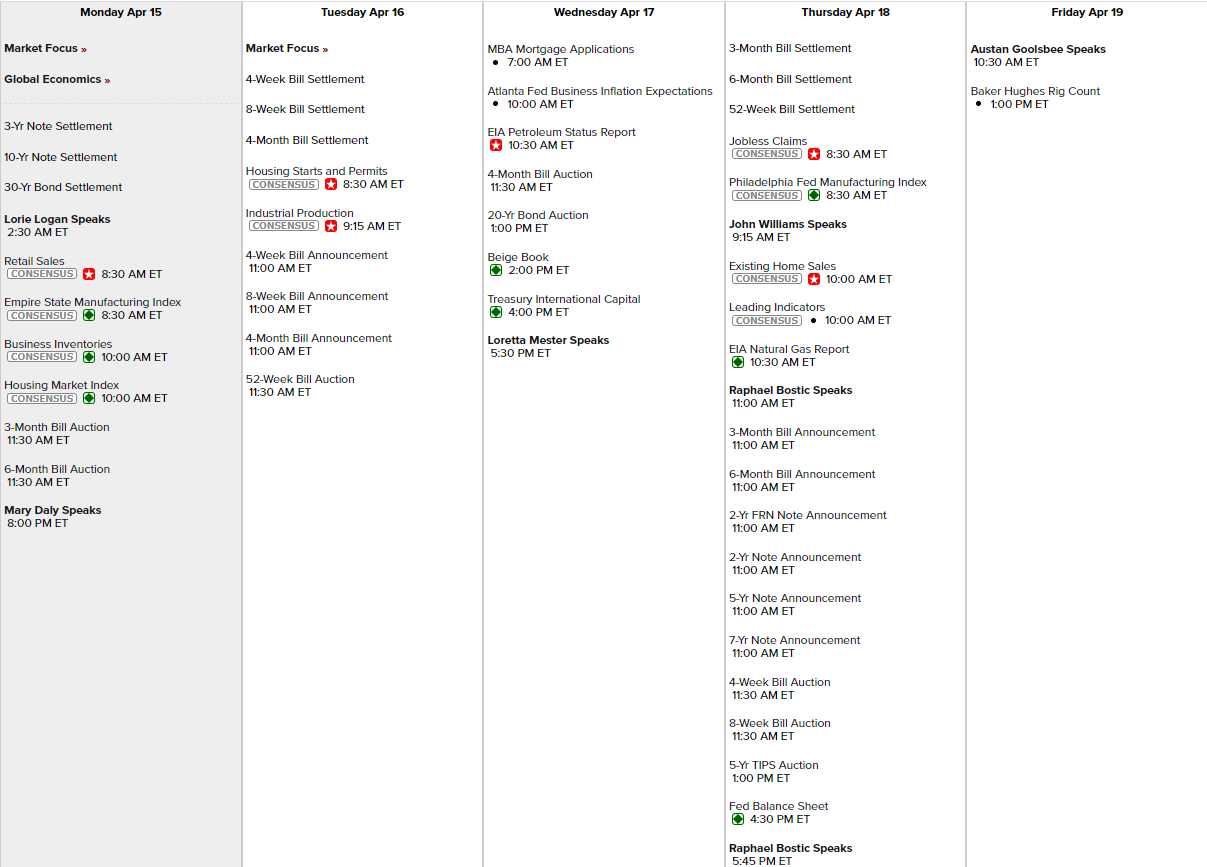

Meanwhile, “There WILL be Data,” including Retail Sales this morning (8:30) along with Empire State Manufacturing. Tomorrow we have Industrial Production, Inflation Expectations and the Beige Book on Wednesday, the Philly Fed and Leading Economic Indicators on Thursday – along with some note auctions – and nothing on Friday so let’s plan to take the day off!

I know the calendar says Lorie Logan was speaking this morning but I see no news about it anywhere so far. Daly is scheduled later, Mester Wednesday after the close, Williams and Bostic (twice) on Thursday and Goolsbee wraps things up on Friday. Bostic is hawkish (so he speaks around the auctions to chase people into bonds) and Williams is Doveish (to fix any damage done by Williams) and the rest are centrists – so it looks like the Fed is rooting for a flat week – which would be much better than last week’s debacle in the indexes.

What else is happening?

- What the Middle East Now Implies for the Global Economy, Markets

- US Seeks UN Response to Iran Attacks; Markets on Edge

- ‘Not Looking For A Significant Escalation’ – Israel Threatens Imminent Response To Iranian Attack, Then Walks It Back

- Investor reaction to Iran’s unprecedented attack on Israel has been muted so far on hopes that the conflict will remain contained.

- America’s Bonds Are Getting Harder to Sell

- Morgan Stanley: 10-Year Yields Have “Decisively” Broken Through The Risk Level For Stocks

- ‘Cuts This Year Are Optional Not Necessary’ – Goldman Warns Long-End Rates More Likely Going Higher

- Surging inflation fears sent markets tumbling and Fed officials scrambling

- Alleged Rent-Fixing of Apartments Nationwide Draws More Legal Scrutiny

- Ugly Macro: Debtflation nation

- It’s Official: Reflation Is Here

- Let’s Be Honest: The Economy Is NOT Doing Well

- Weekend News Round Up – Newsquawk Asia-Pac Market Open

- Ukraine’s attacks on Russian oil refineries show the growing threat AI drones pose to energy markets

- Oil Shrugs Off Iranian Assault on Israel as Brent Holds Steady

- US, UK Ban Deliveries Of Russian Copper, Nickel And Aluminum To Western Metals Exchanges: Here’s What This Means

- This Next Bean Is Hyperinflating, And It’s Not Cocoa

- Why Car Insurance Keeps Getting More Expensive

- Hybrids Extend Lead Over EVs in Green Vehicle Race

- The Lawsuits That Could Shape the Future of AI and Copyright Law

- Samsung Electronics Gets $6.4 Billion for Texas Chip Plants

- Apple Faces Worst iPhone Slump Since Covid as Rivals Rise

- Apple’s iPhone Shipments Plunge 10% as Android Rivals Rise

Be careful out there!