The Fed has certainly done a good job of resetting expectations.

The Fed has certainly done a good job of resetting expectations.

👬 (Gemini) Timeline: Late 2023 – Early 2024

-

-

Late 2023: Market widely anticipates rate cuts by the Fed beginning in late 2023 and continuing through 2024, in response to slowing inflation.

-

January 2024: Strong jobs report and resilient inflation data fuel a shift in sentiment.

-

February-March 2024: Fed officials emphasize that they remain data-dependent and that the fight against inflation is ongoing. Higher-than-expected inflation readings harden this stance.

-

The Result:

-

- Market Adjustment: Traders now begin to price in a scenario where the Fed holds interest rates higher for longer, potentially with no rate cuts in 2024.

- Increased Volatility: This shift creates uncertainty in the markets leading to fluctuations in stock and bond prices.

Key Points:

-

- The Fed’s data-dependent approach means expectations can continue to evolve based on economic indicators.

- Market pricing often reflects a “best-case scenario”, while the Fed tends to focus on potential risks, leading to potential disconnect in expectations.

We can tell the resetting of expectations is coming to an end as, just yesterday, Powell said there’s no evidence in the data to support rate cuts and the markets went higher anyway. So NOW we have a situation in which NO rate cuts are priced in and any news to the contrary can spur a nice little rally.

Of course it is POSSIBLE that we could get inflation data that is SO BAD that rate hikes are back on the table – but let’s not speculate… We do get the Fed’s Beige Book today, which is generally the Regional Fed heads calling their industry buddies on the phone and asking them how things are going. It’s not very scientific but it does give us a clue as to how the Fed is seeing the economy. That comes out at 2pm.

Of course Powell’s hawkish comments came out ahead of today’s 20-year Bond Auction (1pm) and we’ll see what the demand is for $13Bn worth of notes at 4.52%. Yesterday we sold $205Bn worth of 4-week, 8-week and 17-week notes as Powell worked his magic to steer traders into those securities and tomorrow they are selling 13-week, 26-week, 2-year and 5-year notes – could be a $500Bn week of borrowing!

As you can see, the 5-year notes are barely keeping up with inflation so the Fed CAN’T lower rates if it means no one will buy our debt (as it becomes a money-losing proposition). This is where the whole thing can start to unravel because we need to roll over another $500Bn+ next month, and the month after that…

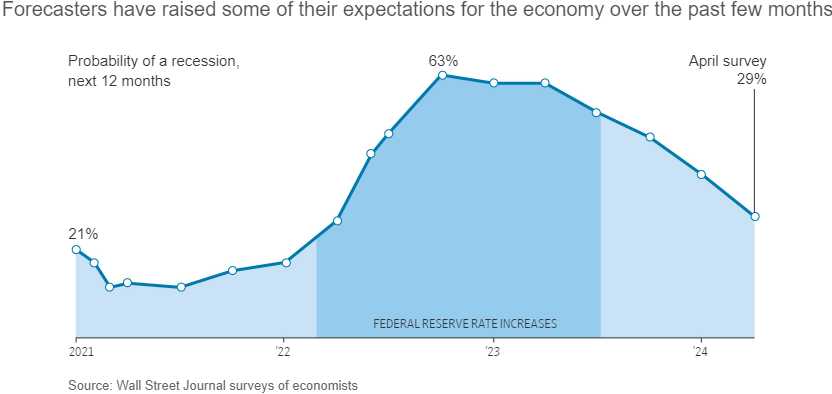

Meanwhile, some good news: The Wall Street Journal’s latest quarterly survey reveals that economists are adjusting their forecasts upwards. The data shows a surprisingly resilient U.S. Economy with growth outstripping expectations, primarily driven by robust Government Spending, increased Immigration, and strong Consumer Demand. Despite initial concerns that the Federal Reserve’s aggressive interest rate hikes would significantly dampen economic activity, the economy has remained robust, with reduced fears of a near-term recession.

The labor market has exceeded expectations, with job gains surpassing forecasts. This has been boosted by a rise in the working-age population due to immigration (which the GOP is trying to end). Economists predict an imminent slowdown in job growth, mainly because the current pace is unsustainable given the finite pool of available workers and the anti-immigration tone in Congress.

The survey highlights a notable shift in economic forecasts, underscoring a more robust economic outlook than previously anticipated. This resilience suggests that the U.S. economy, while facing challenges from higher inflation and interest rates, is more adaptable to policy changes than Leading Economorons had forecasted. The adjustments in economic projections reflect an environment where previous pessimism may give way to cautious optimism and the markets could be back off to the races if we get a nice batch of earnings reports this quarter.