This time is NOT different:

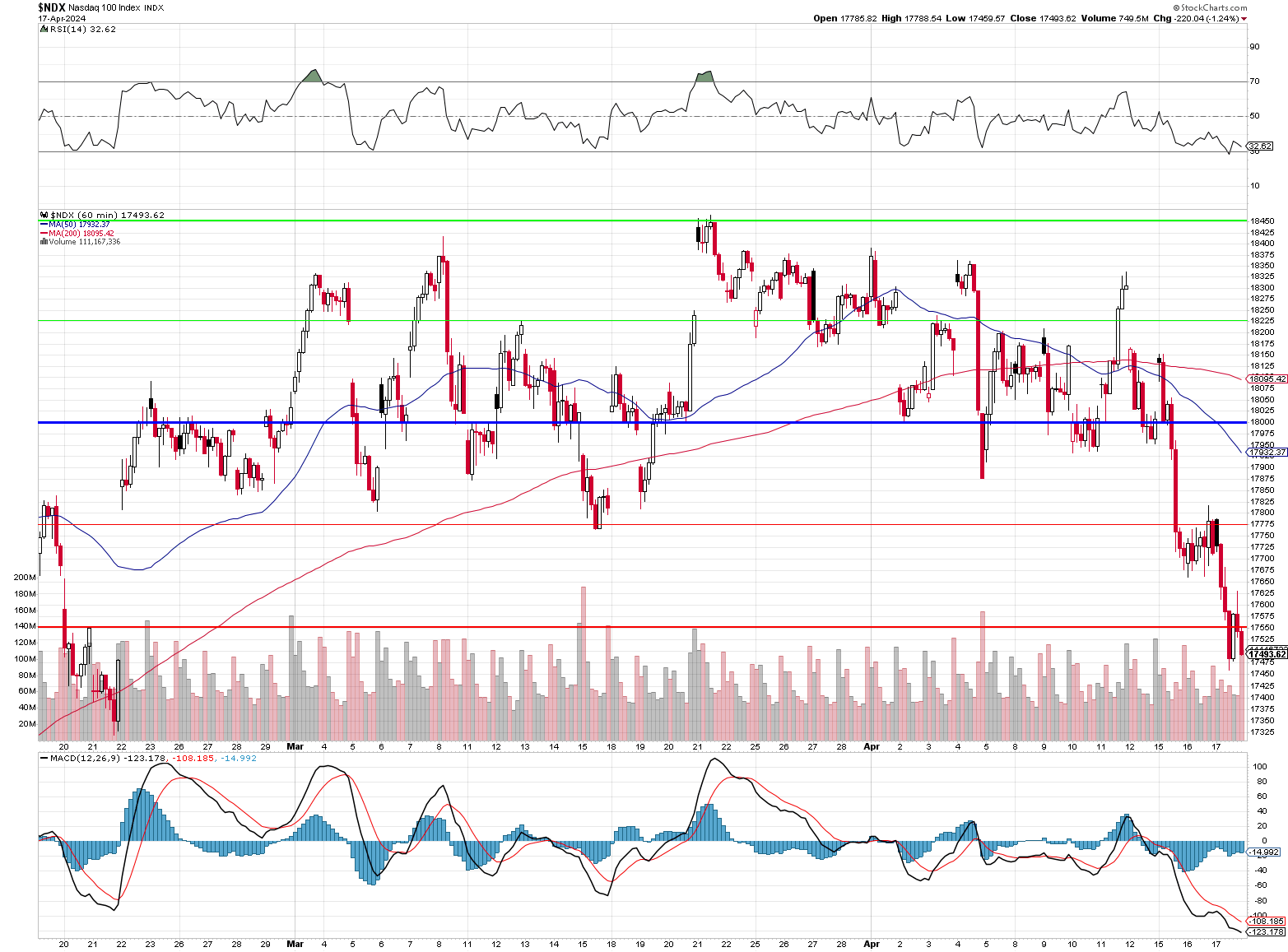

We’ve been using this chart since February and all the Nasdaq 100 has done since then is move within our predicted range – already giving up all the gains. This has “just” been a 1,000-point (5.4%) pullback but there’s another 1,000-point (5.7%) drop just to get us back to our January open, which was still 2,000 points (13.7%) above the November lows:

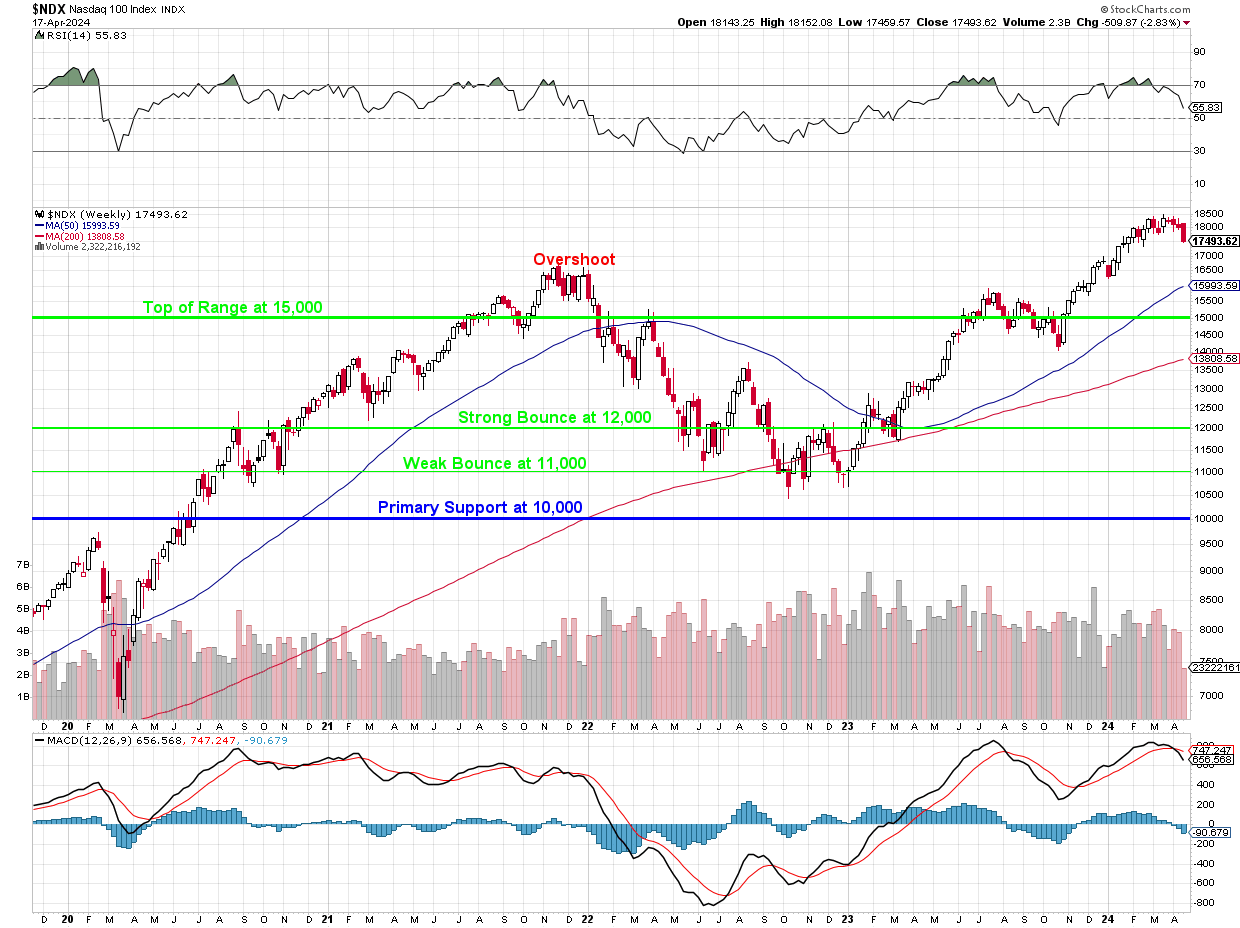

The AI bubble of 2023 (11,000 to 17,500 was up 59%), like the Dot Com bubble of 1999 was indeed led by some very profitable companies but one company’s profit is another company’s expense and investors tend to lose sight of that fact. NVDA, for example, sold $26Bn worth of chips in 2023 and project to sell $60Bn in 2024 and profits are expected to grow from $4.3Bn to $29.7Bn. Of the $34Bn increase in sales, $25.4Bn is increased profits.

While that’s great for NVDA, it indicates they are not transferring $25.4Bn in VALUE to their customers but merely extracting more money for essentially the same chips – profiteering from the temporary shortage. Meanwhile, competitors like INTC, AMD and TSM are forced to spend money to catch up – and they get punished by traders for investing in the future.

As I warned on Bloomberg back in March of last year, there are only 11 companies who SELL AI services and components in the S&P and the other 489 companies in the index are CONSUMERS of AI and they are currently overpaying for constrained supplies – that is NOT a recipe for a profitable market.

Case in point, this week so far, we have had 18 (43%) earnings misses out of 41 reports. Several notable companies missed expectations, including CSX, Discover Financial Services (DFS), Ericsson (ERIC), J&J (JNJ) (by a narrow margin), Kinder Morgan (KMI) Travelers (TRV), SL Green (SLG), Synovus (SNV) and US Bancorp (USB). Charles Schwab (SCHW) was a disappointment in-line, as was Prologis (PLD).

Beats came from United Airlines (UAL), United Health (UNH), Goldman Sachs (GS), Morgan Stanley (MS), Las Vegas Sands (LVS) and Wintrust (WTFC).

It’s a small sample (10% of the S&P) but not a very good start and we’re certainly not ready to jump in and buy the dip into this weekend. Oil prices have cooled off to $81.71 – so that’s nice but not nice enough to cool inflation and the Fed on pause means inflation can go up and damage Corporate Profits and put further pressure on Consumer Spending as they, like our Government, are massively in debt trying to maintain an unrealistic, unaffordable, unsustainable lifestyle.

It’s a small sample (10% of the S&P) but not a very good start and we’re certainly not ready to jump in and buy the dip into this weekend. Oil prices have cooled off to $81.71 – so that’s nice but not nice enough to cool inflation and the Fed on pause means inflation can go up and damage Corporate Profits and put further pressure on Consumer Spending as they, like our Government, are massively in debt trying to maintain an unrealistic, unaffordable, unsustainable lifestyle.

That’s right, I said it: UNSUSTAINABLE! The planet is on fire people and, even though we are doing an amazing job of completely ignoring it in the US (thanks Corporate Media!) – other countries are actively cutting back on consumption and being mindful of ways they can do something to at least slow the path to self-destruction. Just look at the kind of commie propaganda they are subjected to in the UK:

MADNESS!!! What will they come after next? Did you even know the United Nations has a Global Corporate Sustainability Initiative? Probably not if you live in America, where your news consumption is controlled by a dozen Billionaires who, in turn, control 90% of the information you receive. These are the same people who tell you the United Nations is “useless” and NATO is “ineffective” and unfair to American interests. We used to make fun of Russia with Izvestia and Pravda but we’re honestly no better off here…

MADNESS!!! What will they come after next? Did you even know the United Nations has a Global Corporate Sustainability Initiative? Probably not if you live in America, where your news consumption is controlled by a dozen Billionaires who, in turn, control 90% of the information you receive. These are the same people who tell you the United Nations is “useless” and NATO is “ineffective” and unfair to American interests. We used to make fun of Russia with Izvestia and Pravda but we’re honestly no better off here…

The difference is the US Corporate Media promotes Capitalism and we like Capitalism – even when Capitalism starts to mean having the wealthy pay no taxes (their primary reason for controlling the narrative) and even when Capitalism begins to destroy the planet and then refuses to do anything to stop it because – that would not be in the Capitalists’ interests, would it?

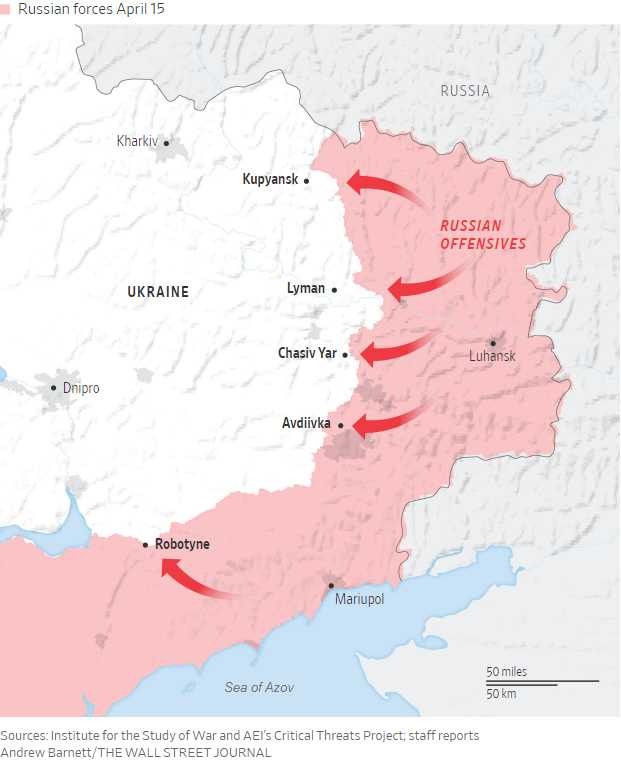

Even as we speak, an entire party in the US Congress is about to sell out one of our allies to Russia as geopolitical maneuvering takes center stage, highlighting a troubling disconnection between short-term political strategies and long-term global stability. This abandonment not only jeopardizes Ukraine’s sovereignty but also sends a precarious signal to other nations under threat, suggesting a wavering commitment from traditional powers that have long stood as pillars of international order.

The situation in Ukraine, with its military stretched thin against an aggressive Russian expansion, underscores a broader narrative of unsustainable global practices. The aid delay being caused by “Republicans” is not merely a logistical hiccup; it is emblematic of a deeper, more systemic issue of faltering international alliances and support systems. As U.S. aid stalls, the echoes of these delays reverberate, signaling a potential shift in how global powers engage with beleaguered states.

The situation in Ukraine, with its military stretched thin against an aggressive Russian expansion, underscores a broader narrative of unsustainable global practices. The aid delay being caused by “Republicans” is not merely a logistical hiccup; it is emblematic of a deeper, more systemic issue of faltering international alliances and support systems. As U.S. aid stalls, the echoes of these delays reverberate, signaling a potential shift in how global powers engage with beleaguered states.

In this context, the unfolding drama in Ukraine is not an isolated event but a part of a larger mosaic of global instability driven by economic pressures, shifting political alliances, and environmental neglect. As the planet faces unprecedented challenges from climate change to geopolitical tensions, the cost of inaction grows. The narrative unfolding in Ukraine could very well be a preview of what other regions might face as resources become scarcer and global temperatures (and tempers) continue to rise.

The distressing part of this narrative is not just the immediate suffering and instability it causes but the long-term implications for global governance. As nations become more inward-looking, the collective action needed to address global crises like climate change becomes harder to achieve. This shift towards nationalism and isolationism, as seen through the lens of U.S. policy shifts and media coverage, can potentially lead to a more fragmented, less cooperative world.

The events unfolding in Ukraine and the broader geopolitical maneuvers reflect a troubling trend towards a more divided and unstable global order. This not only challenges our current understanding of international relations but also calls into question the sustainability of a global system that seems increasingly incapable of responding effectively to the pressing issues of our time.