The Magnificent 7!

We live by the 7 and we’ll die by the 7 if they can’t pull off their numbers this week and next. Expectations are high and multiples are high with META still at 32x last year’s earnings, TSLA 34x, MSFT 36x, GOOG/L 27x, AMZN 60x, NVDA 63x and even AAPL is at 25x earnings.

Money in the bank is paying 5% and 5% is 20x earnings with (technically) NO RISK. Unless the growth is SPECTACULAR. How spectacular? Well, we’d need to see a path to 20x and let’s say we’re generous and giving it 3 years…

32x would be a $1.2Tn company making $38Bn so getting to $60Bn (20x) means they have to be growing at 17% annually. If you’re not seeing that kind of growth, you’re simply not going to get to 20x, are you? META made $38Bn last year and, historically, has grown 12% but this year they expect to LEAP to $52Bn and on to $60Bn in 2025 – 50% is A LOT of growth to expect in one year and last year, their Q1 earnings were $5.7Bn so they’ll need to be closer to $10Bn to be on track for $52Bn – that’s the kind of pressure the Magnificent 7 are under.

-

Meta Platforms (META):

-

Tesla (TSLA):

- Tesla is expected to report its first-quarter 2024 earnings on April 23, 20241.

- The electric vehicle giant’s performance will be closely watched by investors and analysts.

-

Microsoft (MSFT):

- Microsoft recently reported its fiscal year 2024 third-quarter financial results on April 25, 20241.

- The next earnings release for Microsoft is expected to be in the fourth quarter of 2024. Keep an eye out for updates as the company announces the actual date23.

-

Alphabet (GOOGL):

- Alphabet (Google’s parent company) is set to report its earnings on April 25, 2024 after market close4.

- The company’s last quarter earnings beat estimates, reflecting a positive surprise of 2.50%. For the upcoming release, analysts expect earnings of $1.49 per share, a 27.35% year-over-year increase4.

-

Amazon (AMZN):

- Amazon.com is expected to release its earnings on April 30, 2024 after the market closes6.

- In the previous quarter, Amazon reported earnings of $1.01 per share, surpassing the consensus estimate by 24.69%. For the upcoming release, stay tuned for further details7.

-

Nvidia (NVDA):

- Nvidia’s earnings report is scheduled for May 22, 20241.

- As a leading semiconductor company, Nvidia’s results will provide insights into the tech sector’s health.

-

Apple (AAPL):

- Apple’s next quarterly earnings report is scheduled for May 2, 20248.

- In the last quarter, Apple beat estimates with earnings of $1.64 per share. For the upcoming release, analysts expect earnings of $1.49 per share9.

Will they deliver? No one seems to think they won’t so we’ll have to wait and see what actually happens and, aside from those usual suspects – we have over 100 S&P 500 companies reporting their earnings this week.

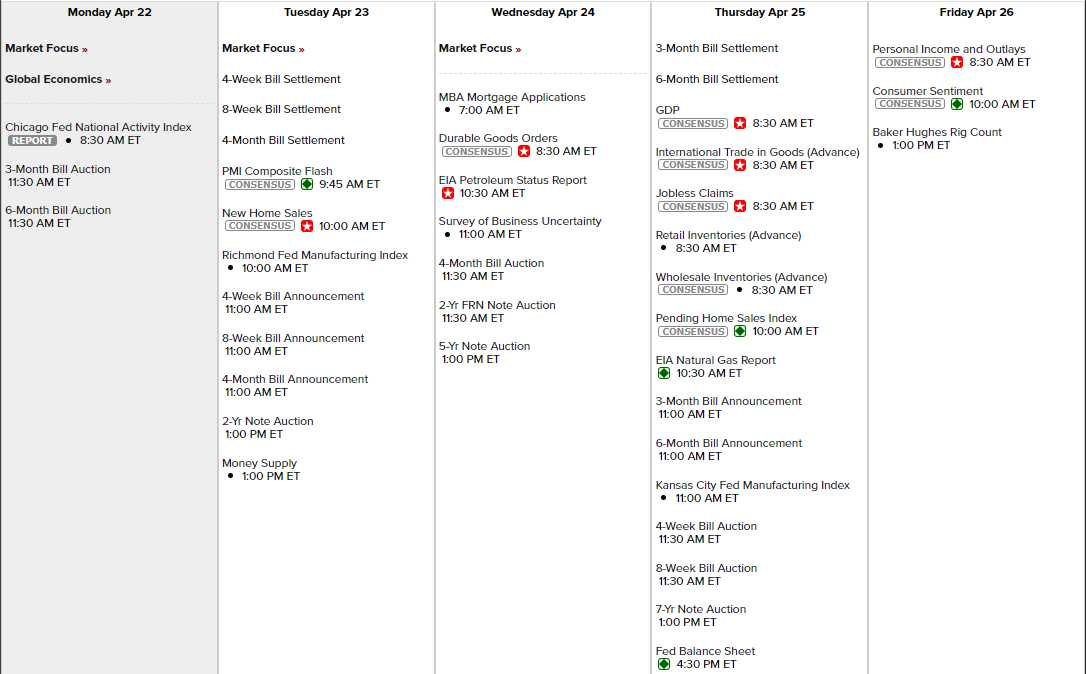

On the Data front, it’s a busy week and we kicked it off well with the Chicago Fed National Activity Index up 0.15 vs 0.09 expected. The 3-month average is still -0.19 so nothing to celebrate – especially as Personal Consumption is still down. We are STILL holding note auctions. This week it’s the 4-week, 8-week, 4-month, 6-month, 2-year (2 types), 5-year and 7-year for another $300Bn as the insanity continues.

Tomorrow we get Home Sales, PMI and the Richmond Fed, Wednesday is Durable Goods and Business Uncertainty. Thursday is GDP for Q1 (first look – 2.7% expected) along with Inventories and Home Sales again. Friday is Personal Income and Outlays along with Consumer Sentiment – both very important indicators as to how stressed out Consumers are.

And that’s it, April is pretty much in the bag and then we have a holiday in May and then the year is half over – wow! So we’ll take this meaningless Monday to relax and we’ll see how things look tomorrow but, unless we get some truly magnificent earnings – today is just the pause before the pullback continues.

Be careful out there,

-

- Phil