“I don’t ask for much, I only want trust

“I don’t ask for much, I only want trust

And you know it don’t come easy” – Ringo

WTF is wrong with “investors” these days?

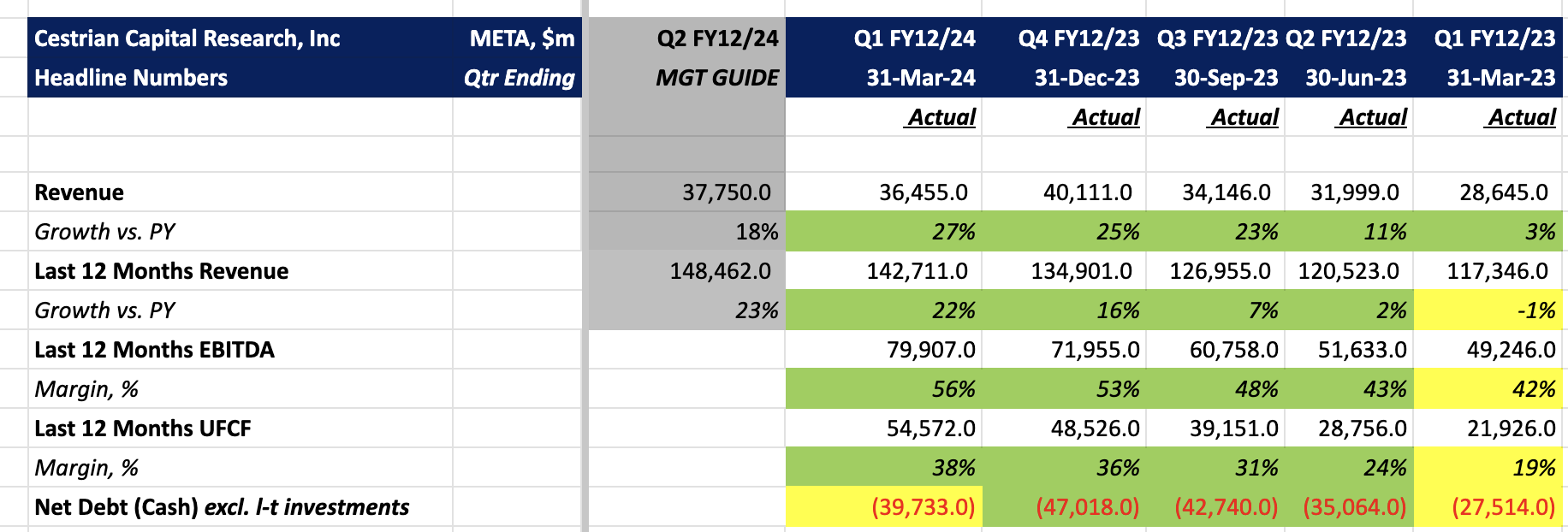

These are fantastic numbers from META – Revenues are up 27% (y/y) and that is MORE than they’ve been up all year. Profits are up 56% vs last year AND the company paid down $7Bn worth of debt AND they launched an AI initiative that will generate more revenues in the future but Zuckerberg made the cardinal sin of investing in the future and the stock goes down 18% – MADNESS!!!

Perhaps META is a bit ahead of itself at 33x last year’s earnings but $423 is $1.07Tn and Meta is in danger of losing that 4th comma if they fail $400 but they are well on track to make more than $50 BILLION in 2024 and dividing that by less than $1Tn in market cap gives us an earnings multiple of (pauses to run it through top-level AI math processors…) less than 20x! That’s not too bad, is it?

So cheer up META shareholders, there’s nothing wrong with your company – you and your fellow shareholders are just impatient idiots who let yourselves get spooked out of your position by click-bait headlines.

Unlike Uncle Elon, Mark Zuckerberg doesn’t pre-announce vaporware but who do you think is more likely to have a basement full of functioning prototypes, Elon Musk or Mark Zuckerberg?

Unlike Uncle Elon, Mark Zuckerberg doesn’t pre-announce vaporware but who do you think is more likely to have a basement full of functioning prototypes, Elon Musk or Mark Zuckerberg?

Last time META traders got spooked about spending plans was 2022, when they took the stock down from $350 to $100 – only to find out in 2023 that it all worked out perfectly and the company shot up to $500. But it’s not just META… So many companies – especially cyclical ones – get sold off by impatient traders, who only want to see profits NOW!!! – not later.

This is fantastic for us at PhilStockWorld because we are value investors and we’re always happy to take companies who invest in the future off the hands of people who panic out of positions based on a disappointing quarter (and META’s quarter isn’t even disappointing – just their CapEx got raised). Meanwhile, who else is investing in AI this Q? Apple (AAPL) – get ready to run away, lemmings!

This is fantastic for us at PhilStockWorld because we are value investors and we’re always happy to take companies who invest in the future off the hands of people who panic out of positions based on a disappointing quarter (and META’s quarter isn’t even disappointing – just their CapEx got raised). Meanwhile, who else is investing in AI this Q? Apple (AAPL) – get ready to run away, lemmings!

AAPL is already trading 15% off the top and $169 is “only” $2.6Tn with earnings on May 2nd. Last year, AAPL made $97Bn and this year they expect to make $107Bn so let’s call it 24x – so it’s more expensive than META and we can only HOPE it gets sold back to $140 – so we can back up the truck and buy more of it.

Rounding out the Magnificent 7, TSLA just popped on yesterday’s earnings, GOOG/L and MSFT go this evening, AMZN will release on the 30th and we have to wait for May 22nd for NVDA to justify their $2Tn market cap ($797). NVDA is expected to DOUBLE earnings this year – so that will be interesting.

Meanwhile, it’s Thursday and the indexes keep getting REJECTED at their strong bounce lines and if that’s the end result of the first big week of earnings – then it’s more likely we’re consolidating for a move down than recovering. As we discussed in yesterday’s Webinar, the Magnificent 7 are responsible for 77% of the S&P 500s earnings growth so – if they can’t support us on their reports – what hope do we have from the other 493 companies?

Meanwhile, it’s Thursday and the indexes keep getting REJECTED at their strong bounce lines and if that’s the end result of the first big week of earnings – then it’s more likely we’re consolidating for a move down than recovering. As we discussed in yesterday’s Webinar, the Magnificent 7 are responsible for 77% of the S&P 500s earnings growth so – if they can’t support us on their reports – what hope do we have from the other 493 companies?

We have GDP coming up at 8:30 and a few more BIG stocks this evening so we’ll see what happens. So far this morning (7:50), we have significant beats from AZN, CAT, CMCSA, DOW, EME, F, FCN, HOG, HES, IMAX, KDP, NEM, NOW, OSK, PGC, PDS, RCL, SLM, SPGI, URI, VLO, WHR and XEL and significant misses from AAL, BFH, CHE, ETD, FAF, IP, HZO, KNX, NBR, RS, LUV, PFSI, STM, and TXT

👬 Positive Trends

- Industrials: Strong performance from Caterpillar (CAT), Dow (DOW), Emerson Electric (EME), and Oshkosh (OSK) indicates a healthy industrial sector. This could signal robust manufacturing activity, infrastructure spending, and overall economic growth.

- Basic Materials: Newmont (NEM) in the mining sector suggests potential strength in commodities, especially precious metals, which can act as a hedge against inflation or market uncertainty.

- Healthcare: AstraZeneca’s (AZN) beat could be a sign of positive developments in pharmaceuticals and innovation in drug research and development.

- Consumer Staples: Keurig Dr. Pepper’s (KDP) performance may point to continued consumer spending on staples even in potentially uncertain economic times.

- Utilities: Shares in Xcel Energy (XEL) performing well suggest a stable or growing demand for essential utilities like electricity.

Negative Trends

- Airlines: Significant misses by American Airlines (AAL) and Southwest (LUV) reflect a potentially troubled air travel sector. This could be due to factors like rising fuel costs, ongoing economic concerns, or reduced travel demand.

- Real Estate: Misses by companies like Weyerhaeuser (WY) and St. Joe Company (JOE) might indicate slowing activity in the housing market or broader real estate sector. This can be tied to rising interest rates or a downturn in the economy.

- Financials: Notable misses within the financial sector (BFH, PFSI) could suggest challenges for financial institutions, potentially due to changing economic conditions or lending markets.

8:30 Update: GDP was way off at 1.6% vs 2.4% expected. Lack of consumption is the big culprit – something we also talked about yesterday as I warned that consumer pessimism is getting extreme and can send us down into a Recession. The good news is that gives the Fed room to start cutting but the markets aren’t seeing it that way and the early losses are doubling down as an initial reaction.

Not a problem for us, we planned on falling to S&P 4,800 and we’re simply on the way. Our hedges are perfect so far and our portfolios are holding up well so this should, if anything, be a perfect buying opportunity – if we’re PATIENT!

Would you like to get market insights like these every day? Become a Member and join us inside!

You will gain access to our 6 Member Portfolios as well as Trade Ideas, Our Legendary Live Chat Room, Live Trading Webinars, Trading Education and other exclusive perks.

Find out why Forbes called Phil “The Most Influential Stock Market Professional on Twitter” (in 2016, before Elon ruined it!).

Email Maddie – Admin@philstockworld.com – for a 7-day FREE trial at sign up.