This is fun!

Any time the market needs a boost (and we were dipping in the Futures against another strong job report), all someone has to do is make a comment about cutting rates and suddenly trader sentiment shifts more bullish.

In a surprising turn of events, the Bank of England’s Monetary Policy Committee (MPC) has kept interest rates steady at 5.25%, BUT the vote split has caught the attention of market participants. Deputy Governor Dave Ramsden joined Swati Dhingra in voting for a rate cut, resulting in a 7-2 split. This shift in sentiment within the MPC has reignited hopes for future rate cuts, causing a stir in the financial markets.

BOE Governor Andrew Bailey, in his post-meeting press conference, acknowledged the encouraging news on inflation but maintained a cautious stance, stating, “We need to see more evidence that inflation will stay low before we can cut interest rates.” This statement, while not an outright commitment to rate cuts, has left the door open for potential easing in the coming months BUT, on the whole, it’s not really different than the Fed’s statement – the difference is just two votes.

BOE Governor Andrew Bailey, in his post-meeting press conference, acknowledged the encouraging news on inflation but maintained a cautious stance, stating, “We need to see more evidence that inflation will stay low before we can cut interest rates.” This statement, while not an outright commitment to rate cuts, has left the door open for potential easing in the coming months BUT, on the whole, it’s not really different than the Fed’s statement – the difference is just two votes.

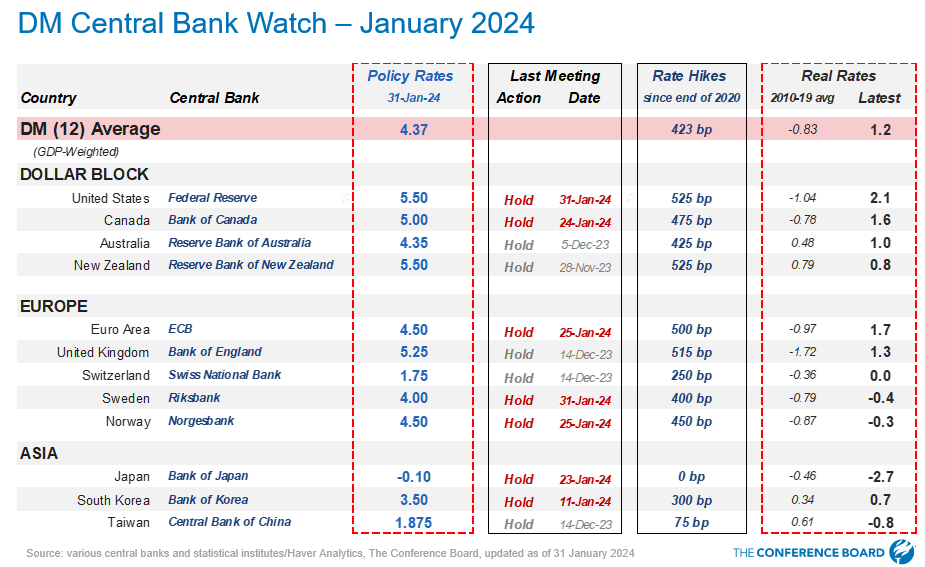

The BOE’s decision to keep rates steady comes amidst a backdrop of diverging global central bank policies. While the Federal Reserve has remained steadfast in its commitment to higher rates, the European Central Bank (ECB) is expected to start cutting rates as early as June. This divergence has led to speculation about the potential impact on currency markets, particularly the pound sterling.

Interestingly, the BOE’s Chief Economist, Huw Pill, recently noted that the UK’s inflation story is more aligned with the Euro area’s than the US’s. This suggests that the BOE may be more inclined to follow the ECB’s lead in cutting rates, potentially limiting the pound’s weakness against the Euro.

While the pound initially fell against the Dollar, it later pared some of its losses because, as I said, 7-2 is not 6-3 or 5-4. Gilt yields have seen some volatility, with shorter-dated bonds experiencing a slight decline in yields. The FTSE 100 and FTSE 250 have both seen modest gains, with interest rate-sensitive sectors such as property companies and homebuilders benefiting from the prospect of future rate cuts.

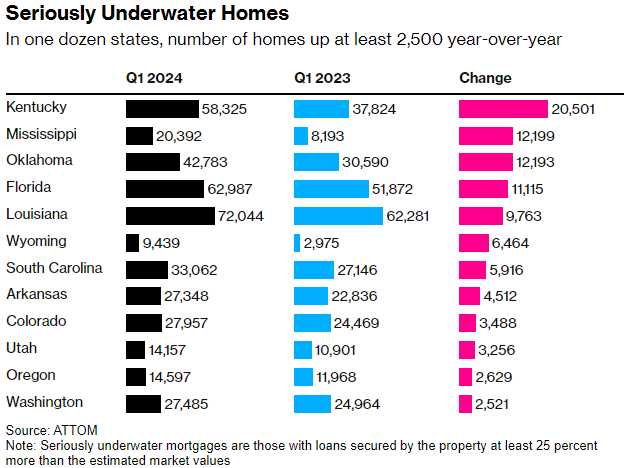

The BOE’s decision to keep rates steady, with a hint of potential rate cuts in the future, comes at a time when both the US and UK housing markets are facing a growing number of seriously underwater homes. According to data from ATTOM, a real estate data firm, roughly one in 37 homes in the US are now considered seriously underwater, meaning the loan balances are at least 25% more than their market value. This share is even higher in several southern states, such as Kentucky, West Virginia, Oklahoma, and Arkansas.

The pandemic-era government stimulus and rising property prices initially provided a buffer for homeowners, but the higher interest rates implemented to curb inflation are now starting to cool the housing market. This cooling effect, combined with the fact that many homes were purchased with small down payments, has led to an increase in seriously underwater mortgages, already approaching half of the pandemic highs again.

In the UK, the housing market faces a similar situation. The prospect of future rate cuts by the BOE may provide some relief to homeowners, as it could potentially lower mortgage rates and make it easier for borrowers to keep up with their payments. However, the uncertainty surrounding the timing and magnitude of these rate cuts may also lead to some hesitation among potential buyers, as they wait for more clarity on the direction of the housing market.

This potential divergence in Central Bank policies could have significant implications for the housing market and the broader economy. If the BOE does indeed cut rates while the Fed maintains its hawkish stance, it could lead to a widening interest rate differential between the two countries, which may impact currency markets and international investment flows.

As we navigate these uncertain times, it’s crucial for policymakers and market participants to closely monitor the developments in both the US and UK housing markets, as well as the actions of their respective Banksters. The delicate balance between managing inflation, supporting economic growth, and ensuring the stability of the housing market will be a key focus in the coming months.

In the words of former BOE Governor Mervyn King, “A successful central bank should be boring.” However, in the current economic landscape, it seems that Central Banks are anything but boring, as they grapple with the complexities of diverging global policies and the ever-present threat of inflation.